-

Metrics revealed that selling pressure on PORK increased.

Most indicators hinted at a further price drop.

As a researcher with experience in analyzing cryptocurrency markets, I’m concerned about the recent developments surrounding PepeFork (PORK). Despite its surging social metrics and weekly rally, PORK has seen a significant price correction, leading to increased selling pressure. Based on the data from various metrics, it appears that fewer investors were in profit, and the meme coin’s active deposits and supply on exchanges have increased. These trends suggest that selling pressure is currently high for PORK.

Pepe’s unique digital token, PepeFork (PORK), experienced significant growth in recognition within the cryptocurrency sphere, reflected by surging social statistics. Simultaneously, despite this heightened popularity, PORK’s price trend headed in an opposite direction.

To examine the present situation and compare the performances of PEPE and PORK, AMBCrypto intended to conduct a thorough analysis.

PORK’s latest bloodbath

In simpler terms, Pork-related news mentioned in the recent tweet from LunarCrush gained significant attention on social media, as indicated by a surge in associated metrics.

One explanation for the growing interest in this meme coin might be its impressive weekly surge of more than 12%.

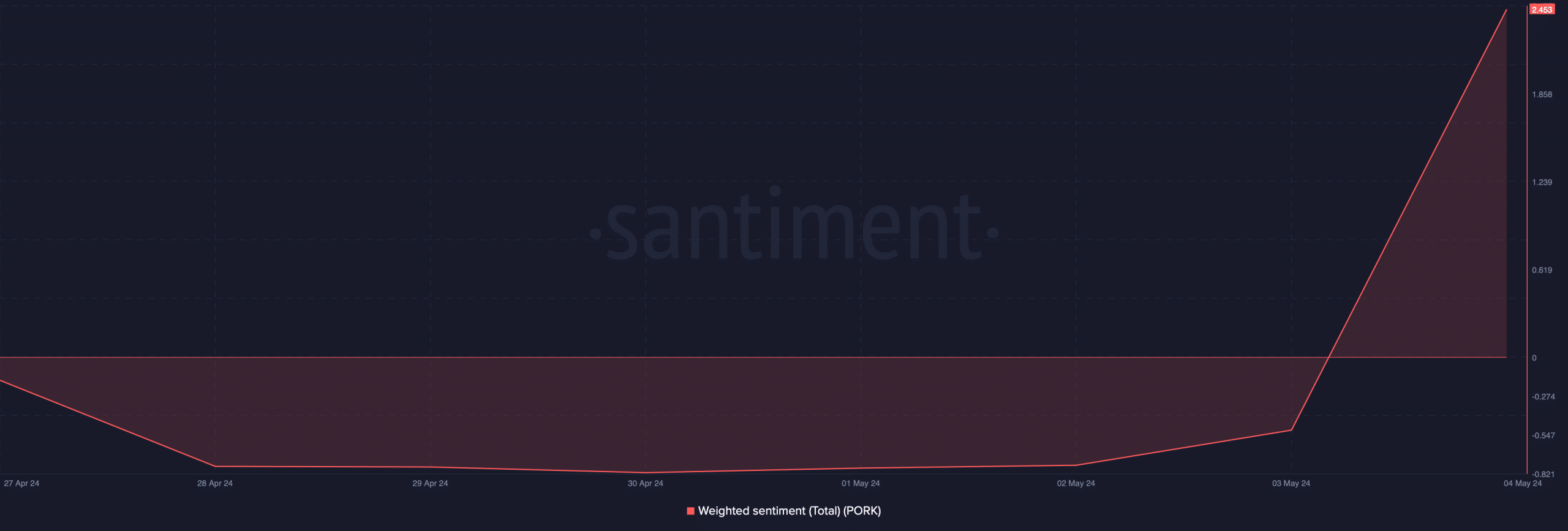

Due to the price increase, there was a positive outlook towards the meme coin based on its favorable Weighted Sentiment.

Despite the initial bullish momentum, the meme coin experienced a significant reversal. As reported by CoinMarketCap, over the past 24 hours, the meme coin’s price declined by over 10%.

At press time, it was trading at $0.0000002431 with a market capitalization of over $102 million.

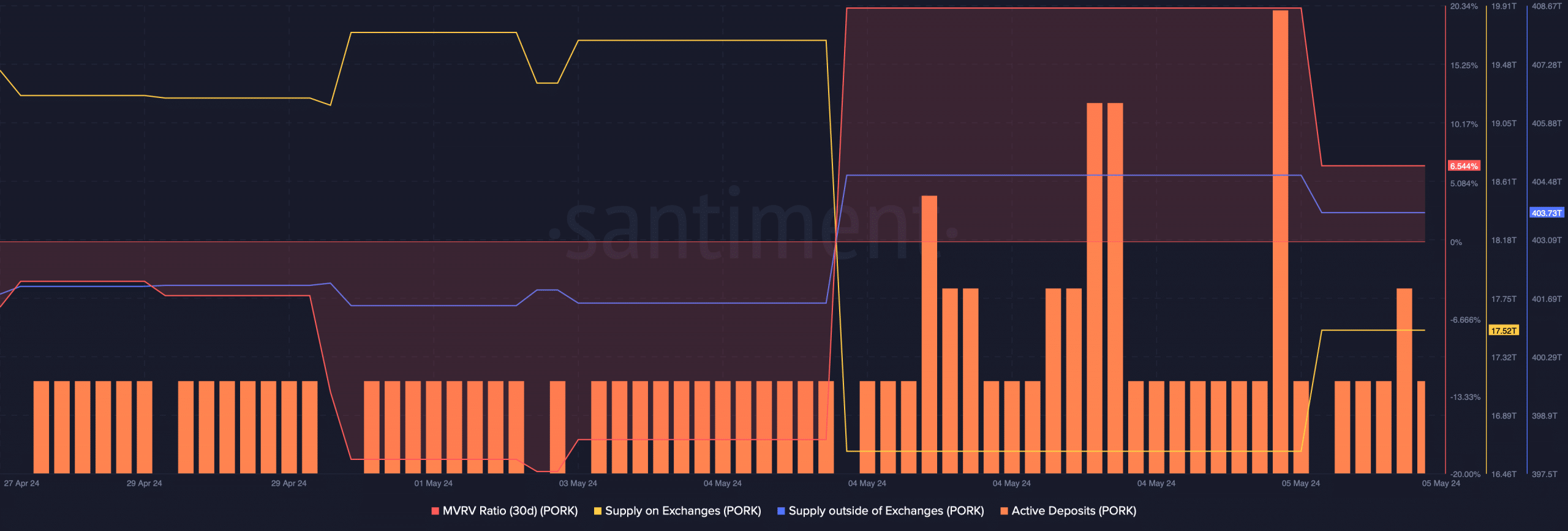

According to AMBCrypto’s interpretation of Santiment’s findings, the MVRV (Market Value to Realized Value) ratio for Pork coin decreased on May 5th. This signifies that a smaller number of investors were enjoying profits at that time.

When the price of the meme coin started to decline, I observed that many investors decided to dispose of their holdings. Simultaneously, there was a noticeable uptick in the number of active deposits associated with the meme coin.

On the fifth of May, there was a rise in the amount of the asset available on exchanges for trading, while the supply held by individual investors off the exchanges saw a decrease. Consequently, sellers were more active in the market at that moment.

PEPE is in a better position

In contrast to other cryptocurrencies that experienced significant declines, PEPE‘s price change, as reported by CoinMarketCap, was relatively mild at a decrease of merely 1.5 percent within the past 24 hours.

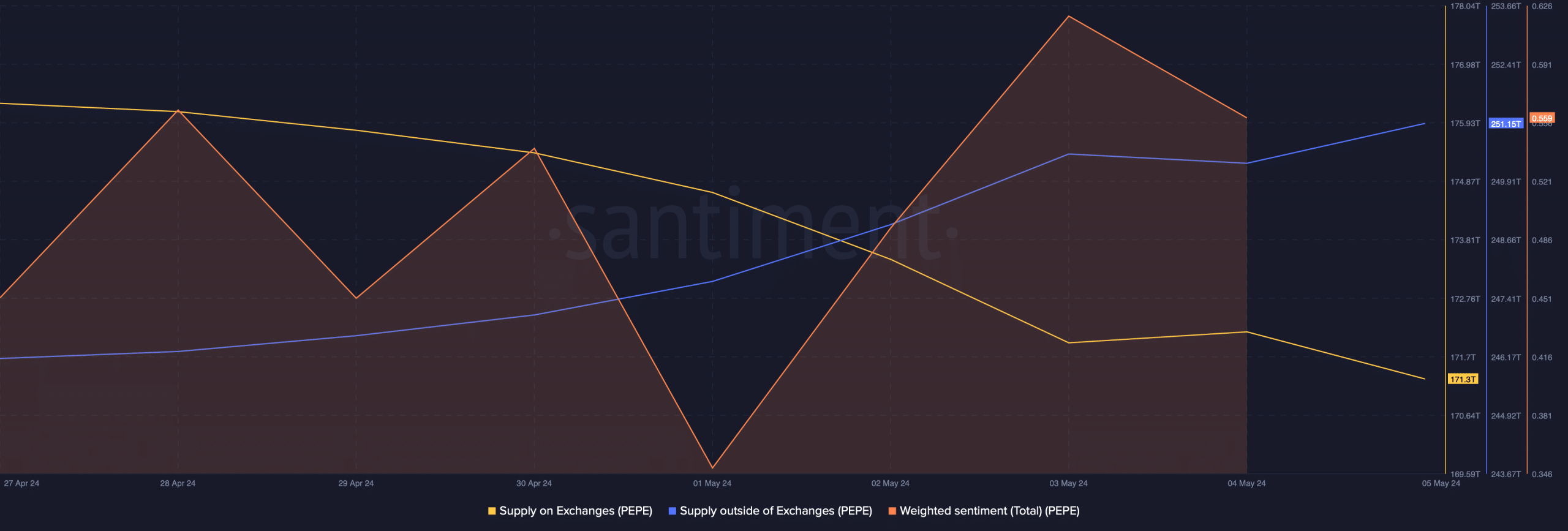

As a crypto investor, I’d say: At the current moment, PEPE was priced at $0.000008569 on the market. Its total market capitalization reached an impressive $3.6 billion. The overall feeling among traders towards PEPE remained optimistic, as indicated by its ascending Weighted Sentiment graph.

As a crypto investor, I’ve noticed that unlike Pork, Pepe has continued to experience significant buying demand. This is evident in the decrease of Pepe’s coin supply on exchanges during the past week, while its supply held outside of exchanges has grown.

According to a previous report by AMBCrypto, there’s a likelihood that the price of PEPE could reach $0.00001 within the near future.

What to expect from PORK

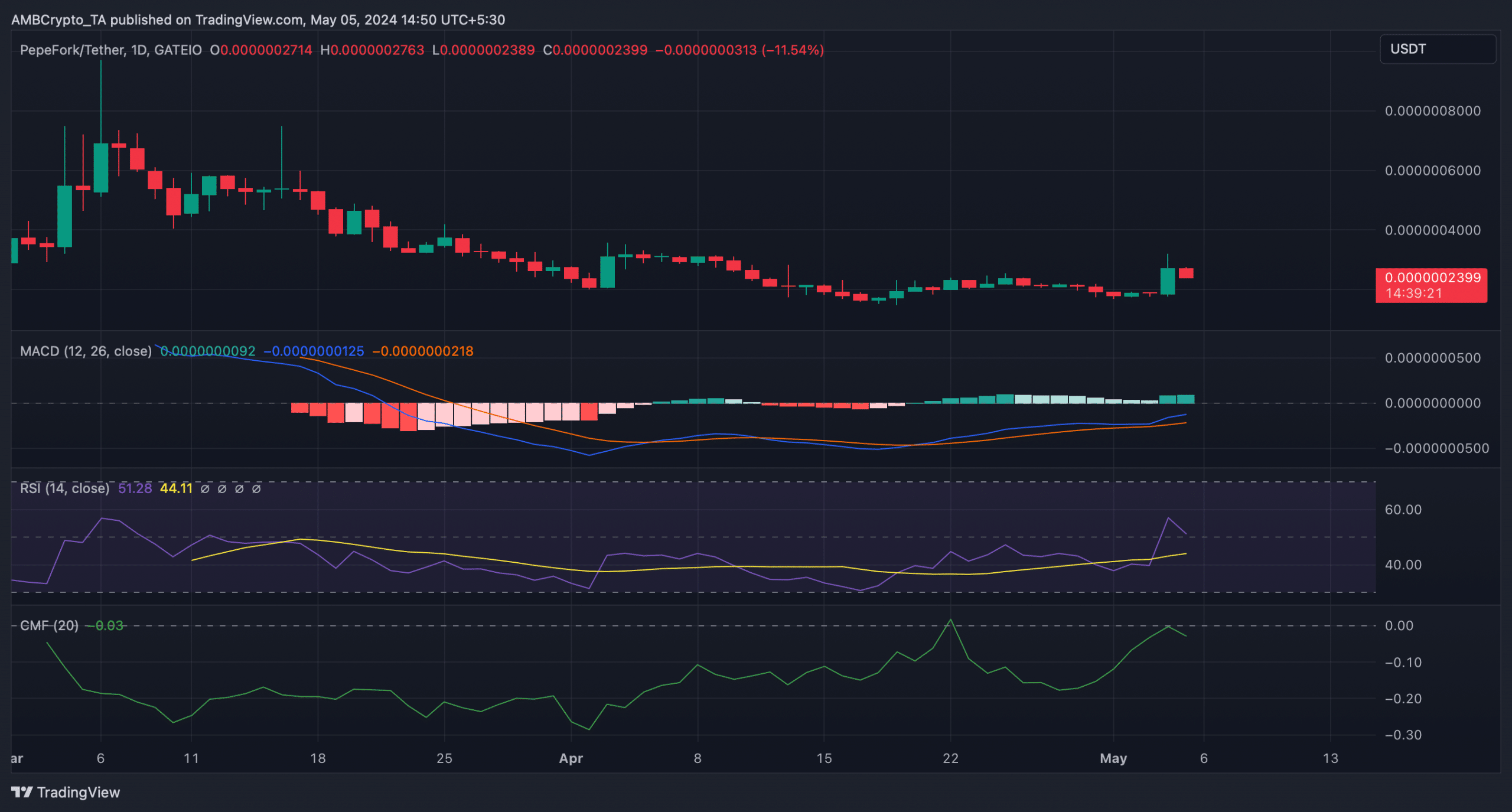

Due to PORK‘s worrying condition, AMBCrypto intended to examine its daily chart for a clearer perspective on potential reversals from the current downward trend.

We found that its Relative Strength Index (RSI) registered a sharp downtick.

Realistic or not, here’s PORK’s market cap in DOGE’s terms

As a crypto investor, I’ve been closely monitoring the price movements and using various technical indicators to help inform my investment decisions. One such indicator is the Chaikin Money Flow (CMF). Recently, I’ve noticed that the CMF has been following a similar downward trend as the price of the cryptocurrency I’m invested in. This observation suggests that the selling pressure in the market may be stronger than the buying pressure, increasing the likelihood of further price declines.

Nonetheless, the MACD remained in buyers’ favor as it displayed a bullish advantage in the market.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- tWitch’s Legacy Sparks Family Feud: Mom vs. Widow in Explosive Claims

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- OM PREDICTION. OM cryptocurrency

- Bobby’s Shocking Demise

- Gold Rate Forecast

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2024-05-06 03:03