-

Over the past 48 hours, Bitcoin’s liquidation has been below $50 million.

BTC has held the $60,000 price range.

As a crypto investor with some experience under my belt, I’ve seen my fair share of market volatility and liquidation events. Over the past 48 hours, Bitcoin’s liquidation has been below $50 million, which is a relief after the significant surge we witnessed just a few days ago. The fact that BTC has held the $60,000 price range is also promising.

Over the past week, Bitcoin’s [BTC] value dropped noticeably, dipping beneath the $60,000 mark.

During this economic downturn, there was a significant increase in the number of both short-term and long-term liquidations. Consequently, certain positions were eliminated entirely.

As a researcher observing market trends, I’ve noticed an intriguing balance emerging between price fluctuations and liquidation events. This equilibrium indicates that the market may be experiencing a degree of stability.

Bitcoin liquidation declines

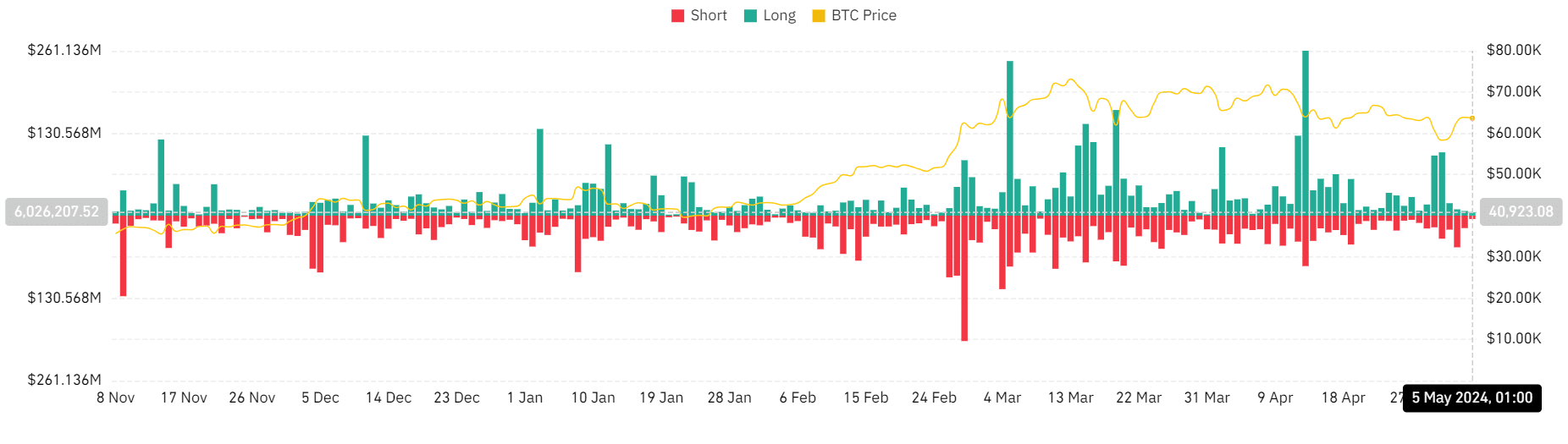

An examination of the Bitcoin liquidation data from Coinglass, conducted by AMBCrypto, uncovered significant spikes in this process occurring on the 30th of April and 1st of May.

On April 30th, the liquidation volume exceeded $113 million, and long positions represented more than $95 million of this amount.

On the first day of May, this trend persisted, with the total liquidation amount reaching over $136 million and long positions holding more than $100 million in value.

As BTC‘s price recovered and surpassed the $60,000 mark once more, the amount of liquidated trades decreased.

As a researcher studying market trends, I’ve observed that the liquidation volume, which had surpassed $50 million on the 2nd of May, has not exceeded this threshold since then. The most recent data indicates that the liquidation volume currently hovers around $10 million.

Bitcoin maintains trend above $60,000

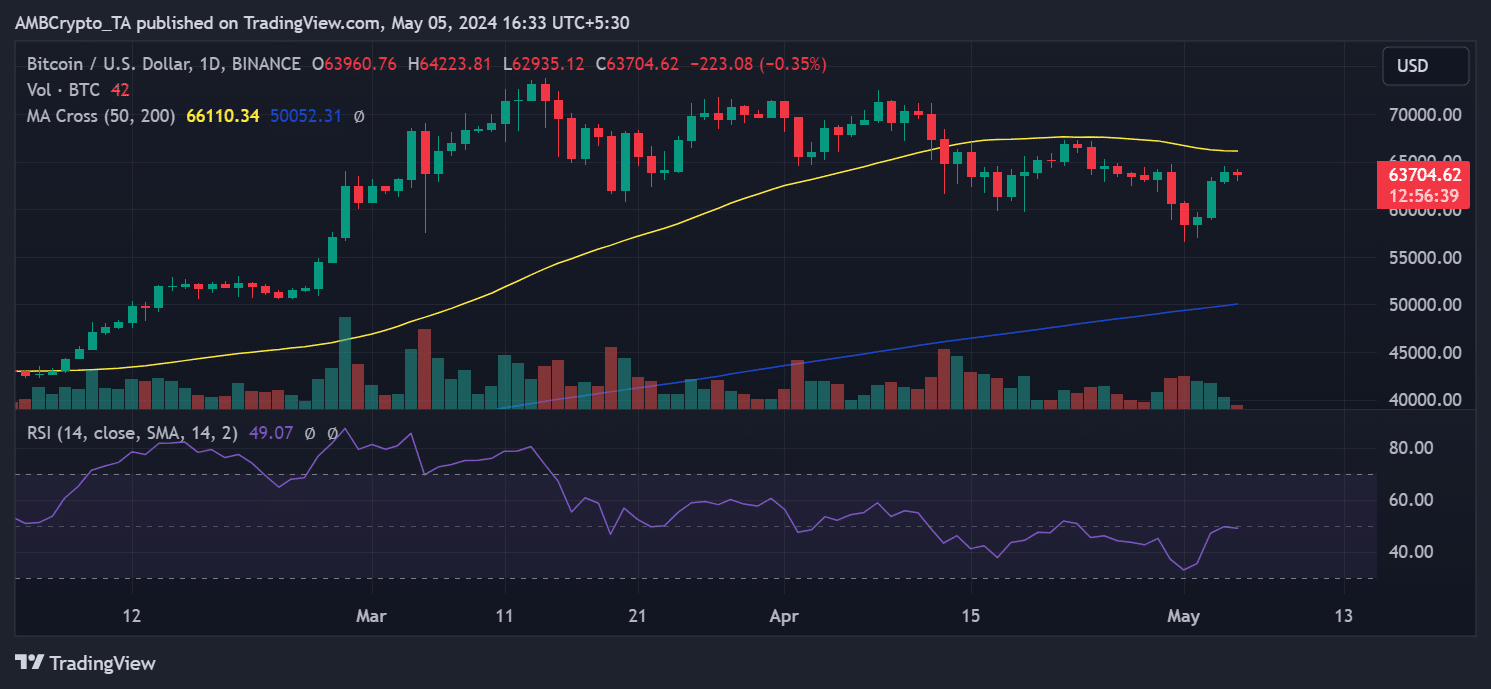

According to AMBCrypto’s analysis, Bitcoin’s price displayed a significant bounce back on the daily chart after suffering a 8% decrease over a 2-day period ending on the 1st of May.

According to AMBCrypto’s analysis, there have been successive upward trends in the market starting from the 2nd of May. On the 3rd of May, there was a significant surge of more than 6%.

Bitcoin’s price climbed past the $63,900 mark, registering a gain of more than 1% by the close of trading on the 4th of May.

At present, the price was dipping by under 1% yet held steady within the $63,000 bracket.

Although the price bounced back, the short-term moving average (represented by the yellow line) remained a barrier for further advancement, holding strong around $66,000.

Strained profit for 30-days holders

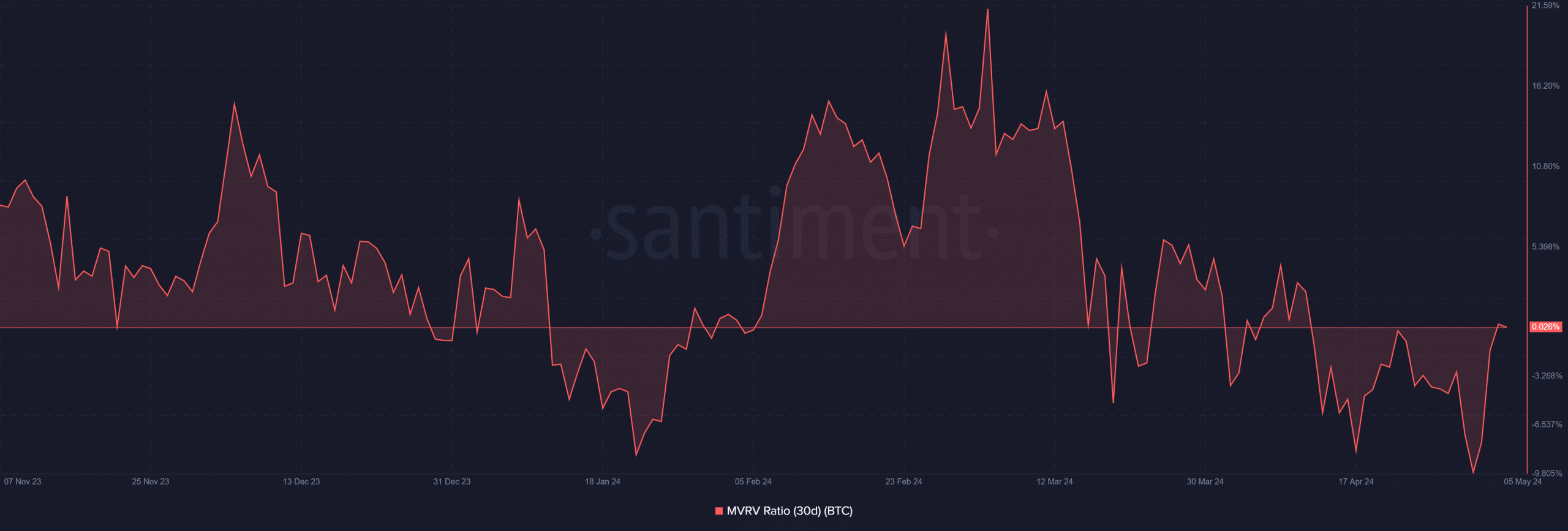

In simpler terms, the ratio of Bitcoin’s 30-day market value to its realized value showed that many investors had bought their coins at higher prices than the current market price during the month of April.

The graph indicated that Bitcoin dipped below the zero mark and hit its lowest point in several months, plunging to a level of 9.71% in the red.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a researcher analyzing the market value realization (MVR) ratio, I’ve noticed that it currently hovers slightly above the breakeven point at approximately 0.026%.

Within this timeframe, those holding Bitcoin have been making a profit, possibly as a result of its recent modest price rise.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Bobby’s Shocking Demise

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

2024-05-06 05:11