-

Holders of Bitcoin might accumulate more, prompting suggestions of a price increase.

A crucial indicator revealed that BTC might plunge again before it hits another all-time high.

As a seasoned crypto investor with several years of experience under my belt, I’ve seen firsthand how volatile yet rewarding Bitcoin (BTC) can be. While the coin’s all-time performance is nothing short of impressive, with an increase of over 103,942,579% since its inception, it’s important to remember that investing in crypto comes with risks.

The investment in crypto carries risks. However, Bitcoin (BTC), being the cryptocurrency with the largest market capitalization, has demonstrated the potential for significant returns that only a few assets can rival.

But don’t take AMBCrypto’s word as advice.

An examination of Bitcoin’s historical price trend on CoinMarketCap uncovered a stunning revelation: Bitcoin’s value has skyrocketed by an astounding 103,942,579% since its creation.

Investors want to emphasize that Bitcoin is not all flashy exterior without substance. Instead, it offers significant value.

The market collapse in 2022 demonstrated that the notion of “up only” is merely a myth when it comes to Bitcoin investments. During a bear market, the value can just as easily decrease.

Watch out! The direction is not always north

In the year 2021, Bitcoin reached its peak price (APT) of $69,000. However, just a year prior, the cryptocurrency plummeted to under $16,000 due to specific occurrences, serving as a reminder of the unpredictable nature of Bitcoin investments and their potential risks.

In the year 2024, I observed an intriguing development with the digital currency I’ve been tracking. On March 14th, it set a new record, soaring to an astounding price of $73,750. However, this growth was not sustainable and the coin experienced a correction. Currently, its value hovers around $64,298.

The value decreased by 5.58% over the past thirty days. However, whether Bitcoin is a wise investment for you depends on various factors influencing its price.

As a crypto investor, I’ve witnessed firsthand how the approval of spot Bitcoin ETFs earlier this year significantly contributed to the recent surge in Bitcoin prices, reaching new all-time highs. Yet, the impressive inflows that were commonplace during the first quarter have seemingly disappeared.

From an analytical standpoint, I find it essential to focus on the core financials and crucial indicators when evaluating investment opportunities in the cryptocurrency market. For instance, in my recent analysis for AMBCrypto, I examined Bitcoin’s potential profitability utilizing on-chain metrics.

More gains may be coming

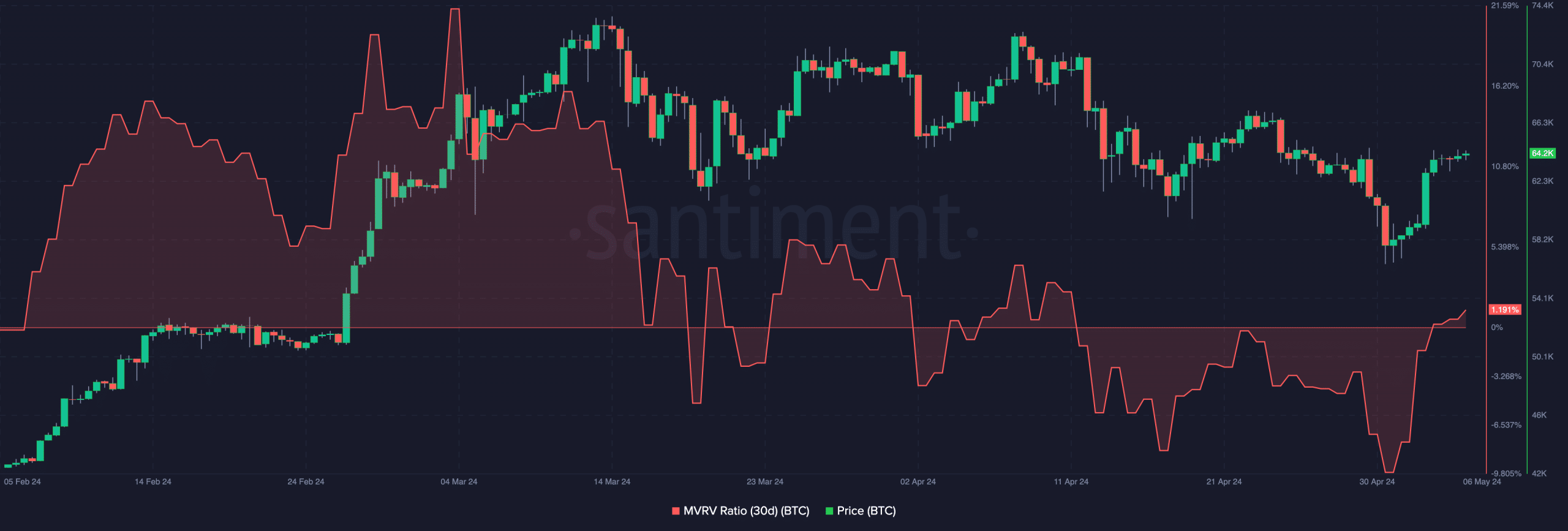

One metric we examined was the Market Value to Realized Value (MVRV) ratio for Bitcoin (BTC). This ratio indicates the profitability level of Bitcoin holders by comparing their current market value to the value they paid to acquire the coins.

Currently, the 30-day MVRV ratio for Bitcoin stands at 1.19%. In simpler terms, this figure represents the average profit or loss for investors who bought and held Bitcoin over the past month. If these investors decide to sell their assets now, they can expect to realize returns close to this percentage.

As a crypto investor, I wouldn’t count on a significant sell-off based on the current state of unrealized gains. These potential profits don’t seem enticing enough to prompt mass selling. Thus, it makes more sense for us to hang on to our coins and remain patient.

Additionally, when the Miners’ Realized Value to Price (MVRV) ratio reached 21.30%, Bitcoin’s price surpassed $71,000. This information implies that further accumulation may occur, potentially pushing BTC back towards more lucrative levels.

Will Bitcoin add an extra 40% increase?

As a researcher studying the current trends in cryptocurrency markets, I’ve come across predictions suggesting that the value of a particular coin could reach up to $100,000 during this market cycle. However, it’s important to note that not everyone agrees with this forecast. Some analysts hold more cautious views and prefer a more conservative approach.

For those with optimistic outlooks, the pre-halving peak of Bitcoin’s ETF and all-time high provided signs that its price could potentially increase by an additional 40% prior to reaching its maximum point.

In an interview with AMBCrypto, Ben Cousens, the Chief Strategy Officer at ZBD, discussed the topic. ZBD is a business that leverages the Bitcoin Lightning Network for processing transactions.

The ZBD chief refrained from providing a definite price forecast but expressed positivity in his statement instead.

In the broader context of Bitcoin, it’s worth noting that historically, the occurrence of a halving has been followed by rising fiat prices. This is due to the supply shock caused by the reduction in new Bitcoins being mined. Moreover, during this halving event, institutional adoption was gaining momentum through ETFs, making a more significant impact on the market. The heightened anticipation surrounding the halving also attracted a fresh wave of users eager to learn and utilize Bitcoin.

According to Cousens’ perspective, there’s a possibility that a fresh influx of new investors will join the crypto market, particularly Bitcoin. If this happens, the ensuing demand may boost prices significantly. As a result, investing in Bitcoin now could potentially yield substantial returns.

A short-term outlook may not cut it

For brief-term investors, it’s important to exercise caution. While Bitcoin (BTC) could potentially yield profits, it’s essential to recognize that its value may experience fluctuations, leading to potential corrections.

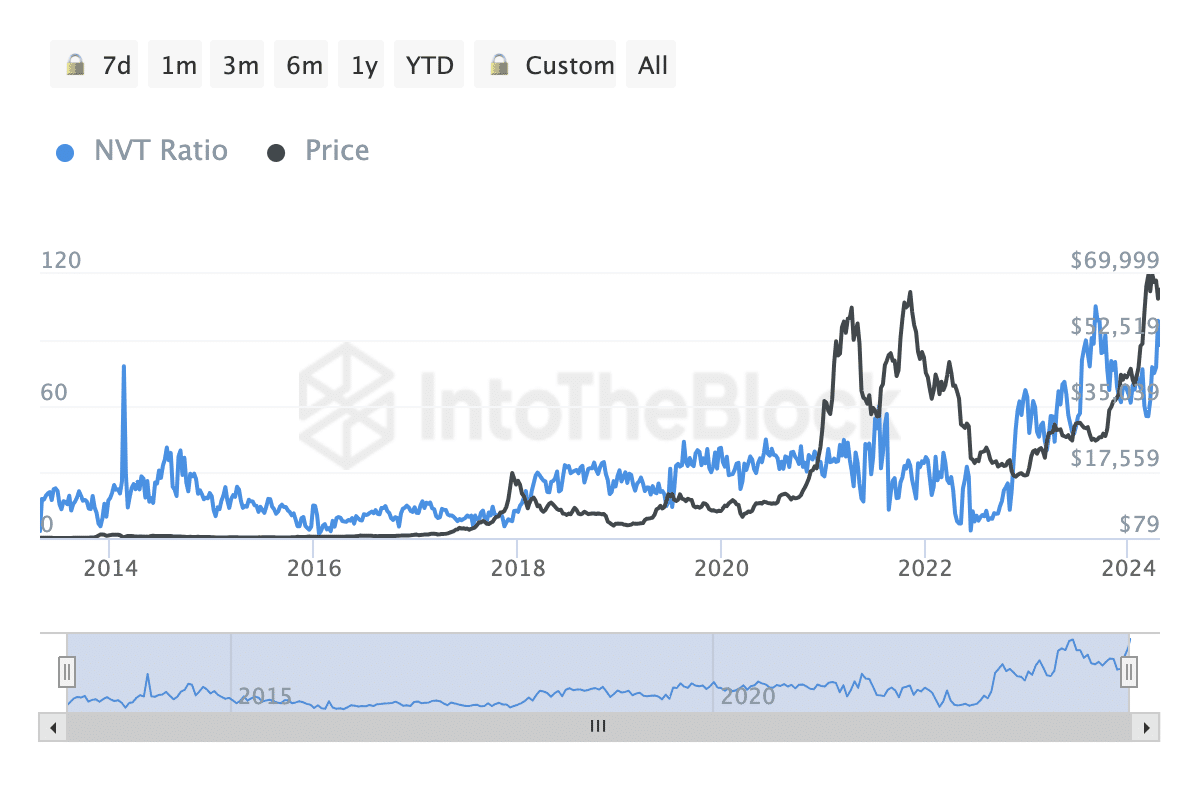

As a crypto investor, I closely monitor the Network Value to Transaction (NVT) ratio of coins in my portfolio. This important metric helps me gauge whether a coin’s current market price reflects its real-world usage and transaction activity. By comparing a coin’s market capitalization with its total trading volume, I can assess if the coin is undervalued or overvalued based on its underlying network activity.

As an analyst, I would interpret an increasing NVT (Net Value to Transactions) ratio as a potential sign of short-term overvaluation for the coin. Conversely, a lower NVT ratio could indicate an undervalued coin based on its current transaction activity.

Currently, according to IntoTheBlock’s data analysis, Bitcoin’s NVT ratio stood at 98.79 upon my writing this statement, potentially signaling an upcoming drop in price closer to $64,000.

If the current trend holds, I believe the value of Bitcoin could potentially fall back down to around $59,000. However, from a longer-term perspective, investing in Bitcoin may still prove beneficial, as long as the initial cost basis is taken into account.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

As a savvy crypto investor, I’ve been closely monitoring the market trends for this cycle. Based on my analysis, I anticipate that the coin’s price will reach anywhere between $87,000 and $92,000 before the cycle concludes. Given this forecast, purchasing at the current price or holding out for a further decline could potentially yield profitable returns.

Investors ought to remain vigilant regarding developments within the ecosystem, as a negative occurrence could potentially disprove this hypothesis.

Read More

- Best Race Tier List In Elder Scrolls Oblivion

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Gold Rate Forecast

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- OM PREDICTION. OM cryptocurrency

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- EUR PKR PREDICTION

2024-05-06 15:04