As a seasoned crypto investor, I’ve witnessed the Ethereum [ETH] ecosystem evolve and mature over the years. The recent milestone of Ethereum Layer 2 platforms in terms of Ether locked is an exciting development that could potentially lead to improved scalability and lower transaction fees.

New information shows that Ethereum’s [ETH] Layer 2 solutions have reached a noteworthy threshold by holding a large amount of Ether.

What is the comparison of the impact of various Layer 2 Ethereum solutions, and how does the total value locked in these Layer 2 platforms influence the overall Ethereum Total Value Locked (TVL) trend?

Ethereum on Layer 2s hit milestone

According to AMBCrypto’s examination of Ethereum Layer 2 platforms’ Total Value Locked (TVL), an impressive new benchmark has been reached in the amount of Ether (ETH) secured on these systems.

The data revealed that over 12.7 million units of Ethereum are currently secured on these Layer 2 platforms.

Despite hitting a record high in terms of dollars tied up on these platforms earlier, the amount of Ethereum locked within them has only recently achieved a new peak.

At present, more than 12.734 million units of Ethereum are being held on these Layer 2 platforms.

The value of Ethereum (ETH) tokens locked in various contracts is determined by their volume, yet this value is subject to change based on fluctuations in the market price of ETH.

As a crypto investor, I’ve noticed that the amount of Ethereum (ETH) being locked in smart contracts keeps rising consistently. However, the value of this ETH in US dollars can fluctuate due to changes in the price of ETH itself.

Layer 2s with the highest TVL

A thorough analysis of the Ethereum Layer 2 Total Value Locked (TVL) uncovered that the combined share of three leading L2 platforms exceeded 73%.

As of the current data, the total TVL for Layer 2 solutions stands at approximately $40 billion.

As a researcher investigating the decentralized finance (DeFi) landscape, I’ve discovered that Arbitrum holds the leading position among other layer 2 (L2) platforms with an impressive $16.6 billion in total value locked (TVL), accounting for approximately 41.4% of the entire L2 TVL.

Furthermore, Optimism and Base Protocol account for substantial shares, holding around $7.33 billion and $5.55 billion in total value locked (TVL) respectively. These amounts correspond to over 18% and close to 14% of the entire L2 TVL (Layer 2 Total Value Locked).

Ethereum maintains a $50 billion TVL range

As an analyst, I’ve observed that Ethereum’s Total Value Locked (TVL) has shown a noticeable changeover the last several months according to AMBCrypto’s assessment.

Based on my examination of DefiLlama’s data, Ethereum’s Total Value Locked (TVL) has soared into the $50 billion range and has remained steady at this level. Currently, the TVL hovers around $56.7 billion.

The increase in Total Value Locked (TVL) in Layer 2 networks has played a role, but a major reason for this upward trend is the rise in value of Ethereum itself.

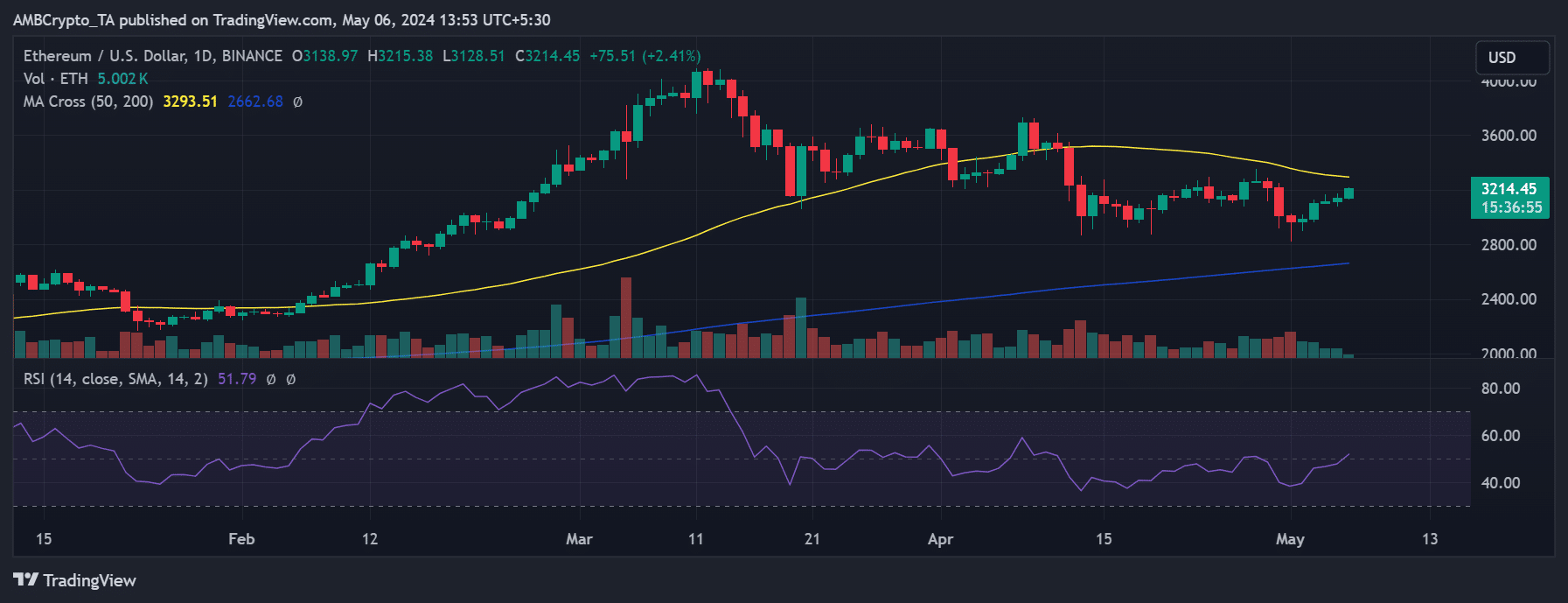

Ethereum shows weak bull trend

The chart for Ethereum’s daily performance shows an encouraging trend upward after a stretch of disheartening declines.

Read Ethereum’s [ETH] Price Prediction 2024-25

At the moment of writing this analysis, Ethereum was displaying a notable surge in value. The price had risen by more than 2%, reaching approximately $3,200 on the market.

The steady climb indicated a possible shift back to a bull market, a notion reinforced by its Relative Strength Index (RSI) suggesting optimism.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-05-06 16:08