EA Lays Off Multiple Employees Amid Battlefield 6’s Current Woes – Rumor

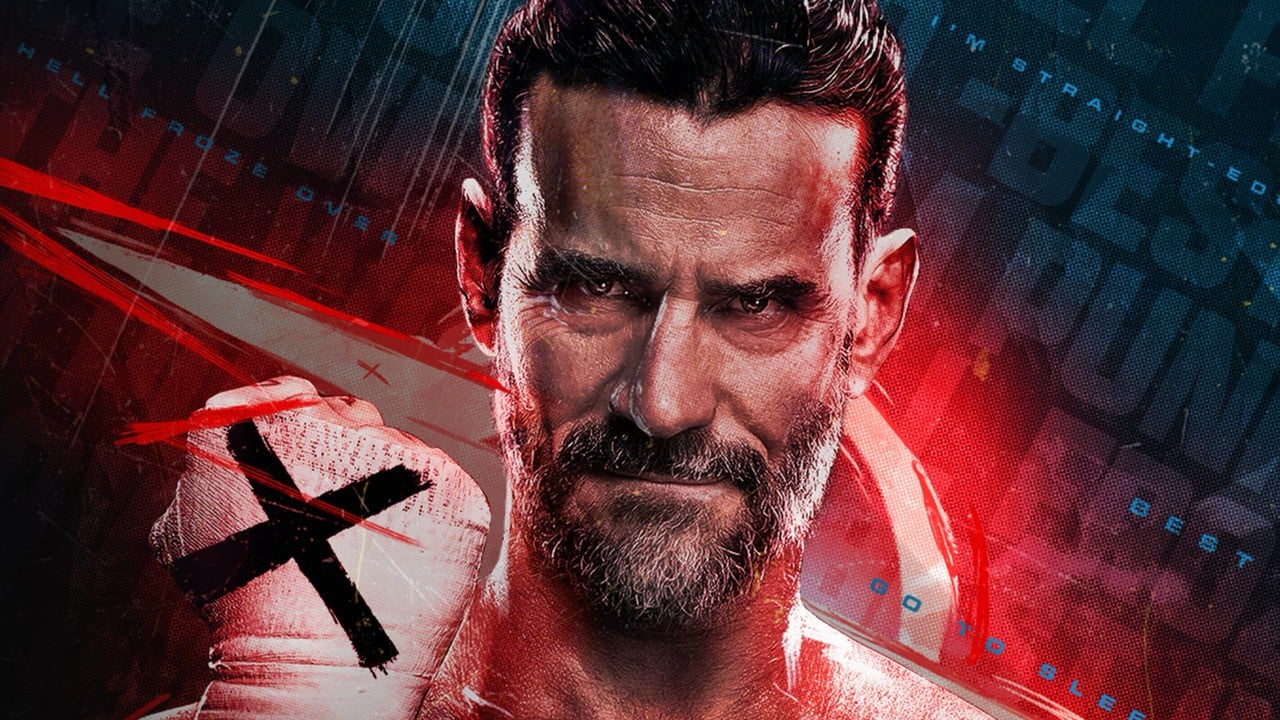

The game has faced criticism recently due to issues with updates, including too many ads, the use of AI-generated content, and a shortage of new material. EA has responded by postponing the Season 2 update to improve its quality and has shared a plan for upcoming content over the next three months.