- Bitcoin’s miner revenue has fallen to its lowest in the last year.

- This is due to the recent decline in network activity.

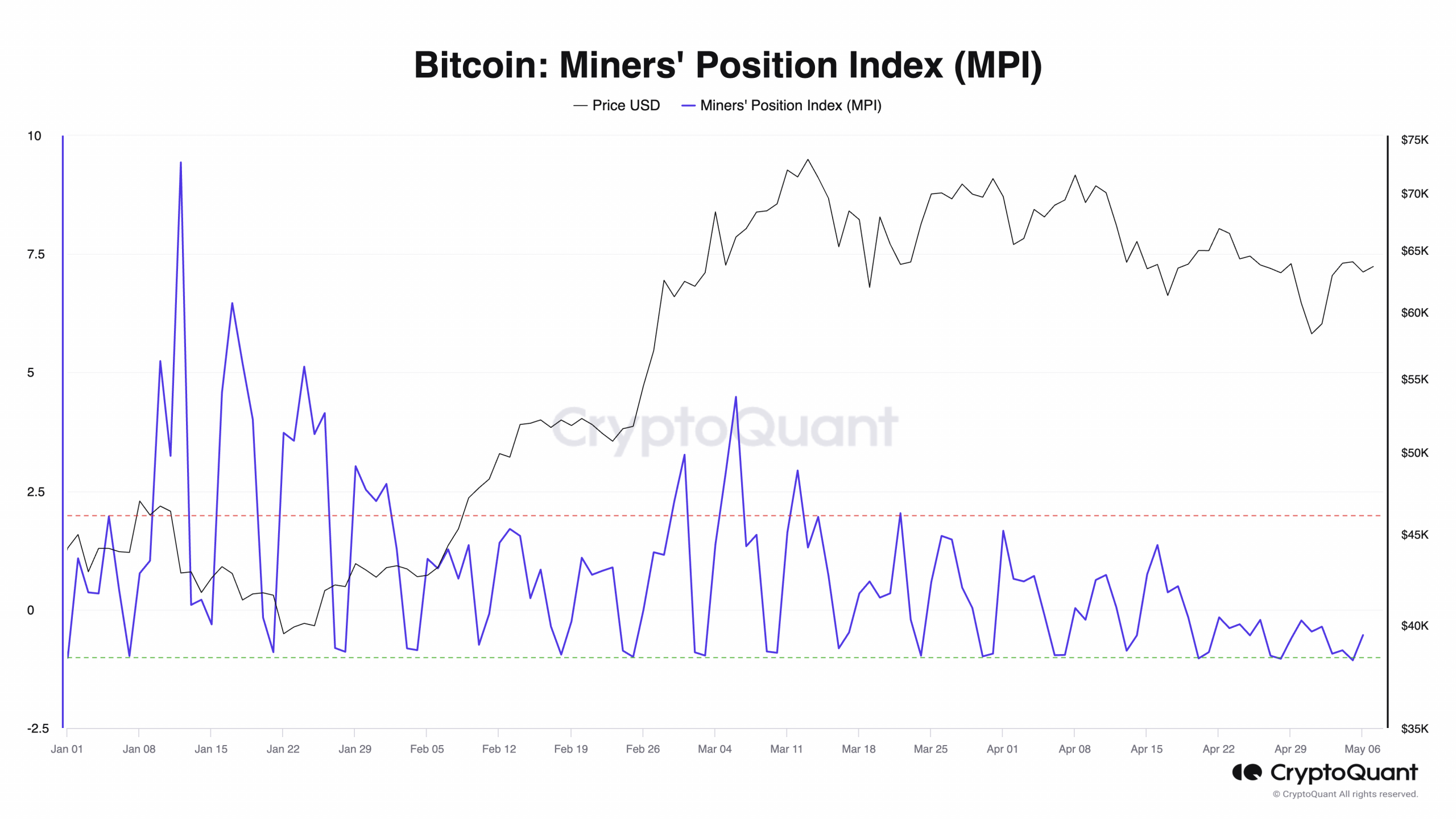

As a researcher with a background in cryptocurrency and blockchain analysis, I find the current state of Bitcoin’s miner revenue concerning. According to recent data from CryptoQuant, Bitcoin’s miner revenue has fallen to its lowest level in the last year due to a decline in network activity. This is evident in the falling Miner Position Index (MPI) and Puell Multiple metrics.

According to an analysis by pseudonymous crypto expert “Papi” in a recent report, Bitcoin’s [BTC] Miner Position Index (MPI) indicates that the leading cryptocurrency is currently experiencing its longest post-halving event period of decreased miner selling pressure.

The Miner Payment Irregularity (MPI) metric for Bitcoin calculates the difference between the current value of total miner payments in US dollars and the moving average of the same figure over the past year, both expressed in US dollars.

When it increases, this signifies that miners are offloading more of their possessions for sale. On the other hand, a decrease implies they are either keeping their assets or acquiring additional ones.

Based on CryptoQuant’s latest data, the Money Flow Index (MFI) for Bitcoin stands at -0.23. This value represents a significant decrease from its year-to-date (YTD) peak of 9.43, which was reached on January 8th. Since then, the MFI has fallen by more than 100%.

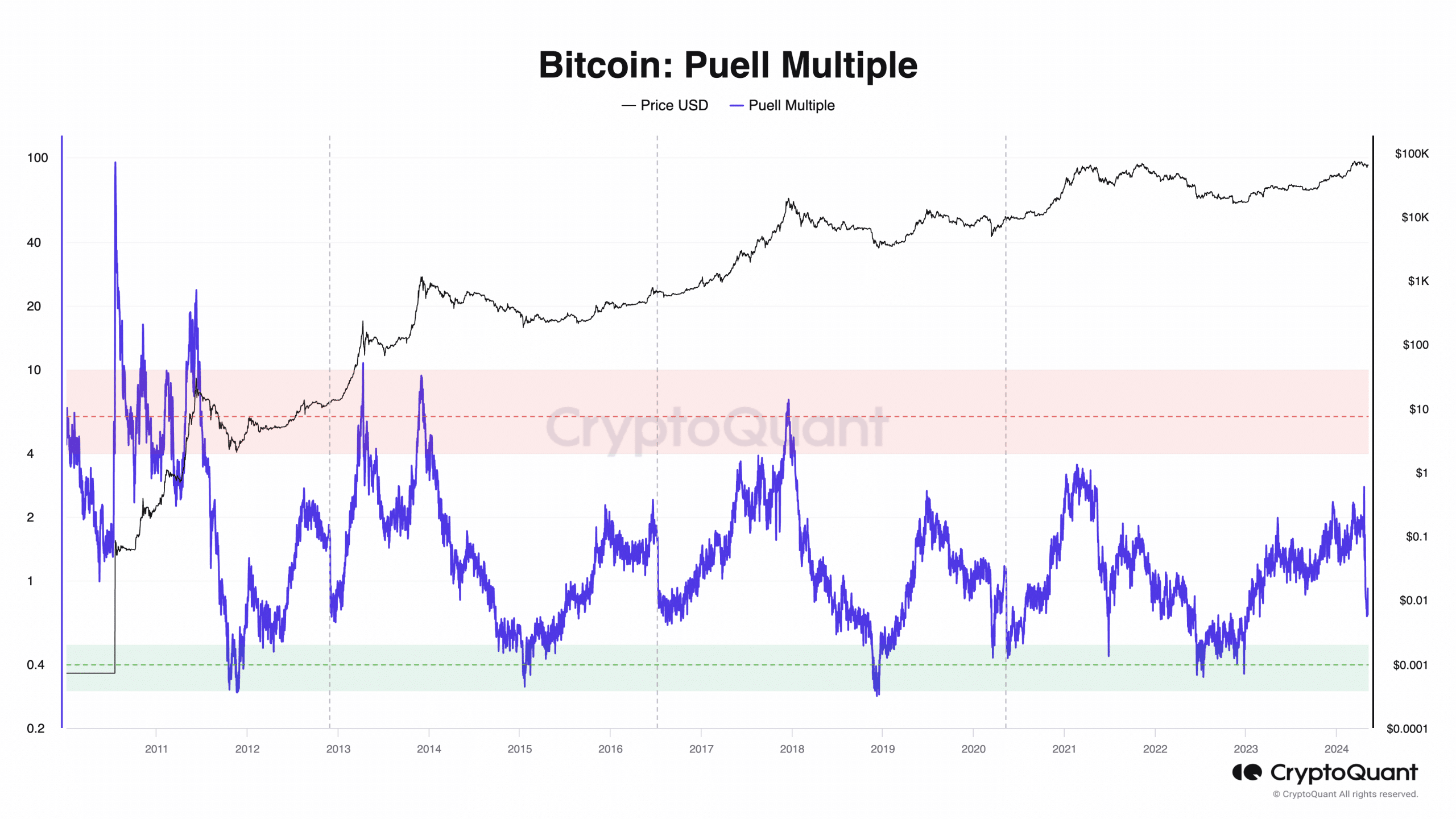

As an analyst, I observed in the recent report that both the Miners’ Price Index (MPI) and the Puell Multiple of Bitcoin have experienced a significant decline. Consequently, miner revenue has dropped to its lowest point in the past twelve months.

As a financial analyst specializing in cryptocurrencies, I would explain that the Puell Multiple for Bitcoin measures the ratio of newly minted coins, or block rewards, against their 365-day moving average. This indicator helps gauge miner profitability by revealing if recent daily issuance is above or below the average.

When the metric registers a value that’s significantly higher than typical, this indicates that miners are currently earning more than their historical average in revenues.

When the metric goes down, on the other hand, miners earn less in revenue than usual based on past records.

At present, the Puell Multiple for Bitcoin is 0.69. This figure hit its lowest point this year, at 0.67, on May 1st. Based on CryptoQuant’s information, this indicator last dipped into the 0.6 range back in February 2023.

Miners “pay” the price

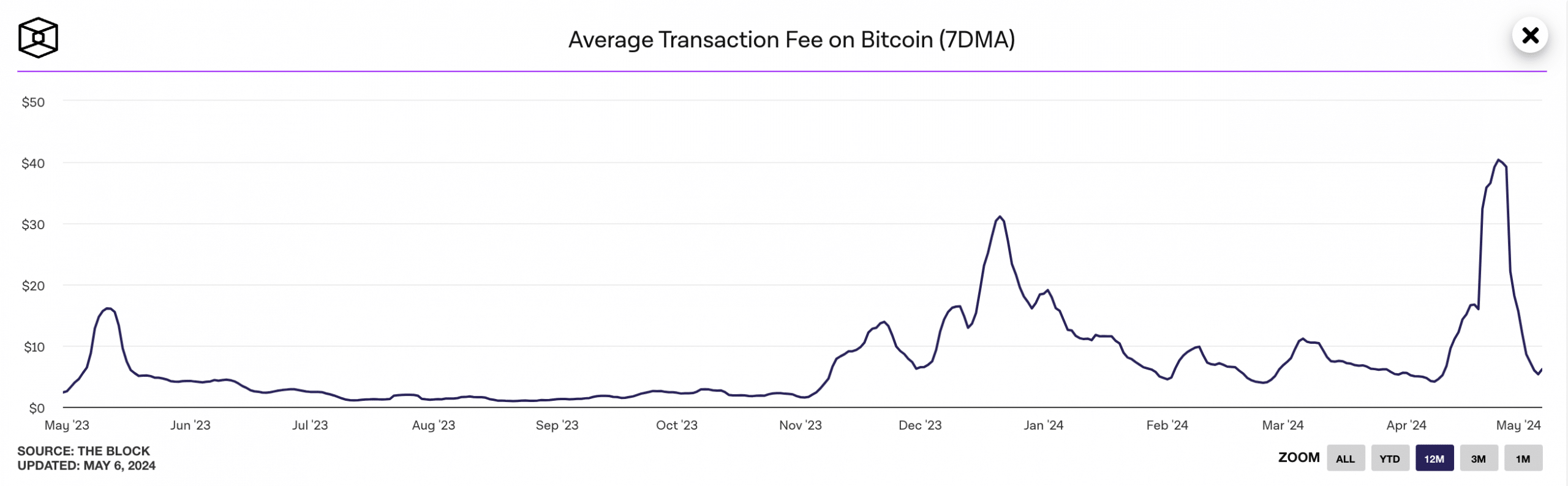

After the Bitcoin halving, the average transaction fees on the network significantly increased as a result of heightened activity surrounding Runes.

Despite the decreasing excitement surrounding the protocol, the number of transactions on the network has significantly dropped, resulting in reduced network fees.

The etching of Runes onto the Bitcoin network caused its average transaction fee, based on a weekly moving average, to reach a peak of $40 on the 24th of April, as indicated by data from The Block’s dashboard.

After the network activity stabilized, average transaction fees began to decrease. By the 5th of May, network participants were paying an average of only $6 in fees, marking an impressive 85% drop compared to the peak fee of $43 on the 24th of April.

As a data analyst, I’ve noticed that the decrease in certain market conditions has led to a shift in miner revenues. Based on Messari’s latest findings, up until the 20th of April, approximately 74% of miners’ earnings were coming from network fees.

On the 5th of May, just over a quarter (22%) of mining rewards came from transaction fees on the network, marking a significant decrease compared to previous levels due to reduced network activity.

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

- Moana 3: Release Date, Plot, and What to Expect

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- How to Get to Frostcrag Spire in Oblivion Remastered

- Doctor Doom’s Unexpected Foe: The Dark Dimension’s Ultimate Challenge Revealed!

2024-05-07 12:07