- SEC issued a Wells Notice to Robinhood for potential securities violations.

- Robinhood responds proactively to regulatory challenges by adjusting operations.

As an analyst with a background in financial regulation and experience following the crypto space, I find the recent development between Robinhood and the SEC to be a pivotal moment in the regulatory landscape for cryptocurrencies.

The SEC, or United States Securities and Exchange Commission, has once more sent a notice to Robinhood Markets, Inc. This notice is known as a Wells Notice.

What’s the matter?

Over the weekend, Robinhood revealed in a filing for Form 8-K that they had been notified by the Securities and Exchange Commission (SEC) staff about receiving a Wells Notice.

The SEC might initiate proceedings against the trading platform for alleged securities infringements, according to the announcement.

In my recent blog post, I, Dan Gallagher, the chief legal, compliance, and corporate affairs officer at Robinhood, provided insights into the matter at hand.

“Confidently, we maintain the stance that the cryptocurrencies traded on our platform do not classify as securities. We eagerly anticipate collaborating with the SEC to elucidate the minimal grounds for a potential case against Robinhood Crypto.”

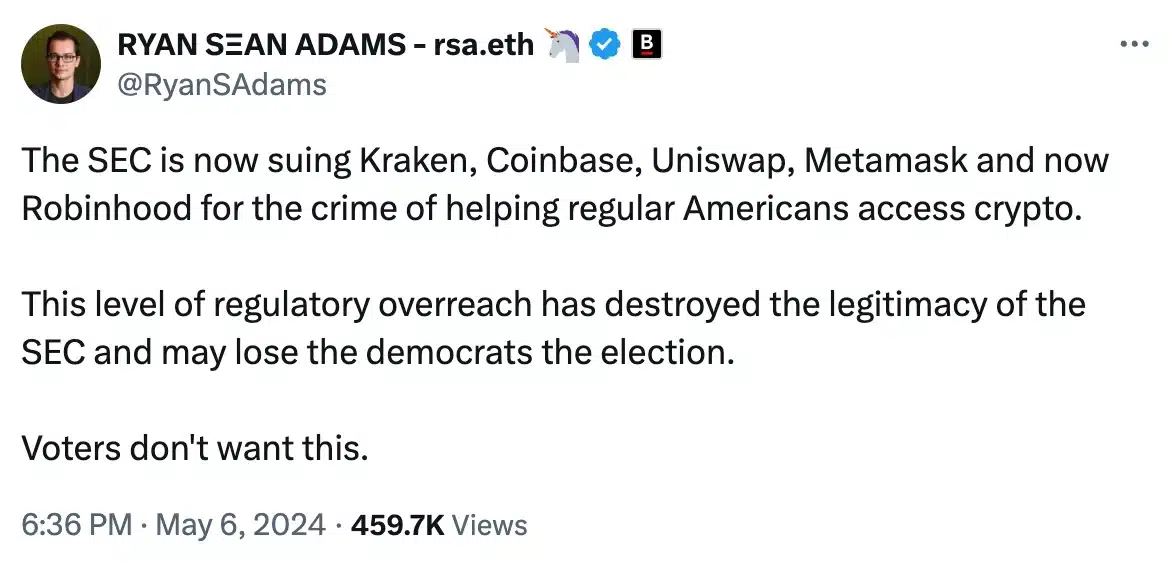

Ryan S. Adams, a prominent figure in cryptocurrency investing, shared his distinct viewpoint regarding the likely influence of upcoming US elections.

In alignment with previous expressions, Hayden Adams, the CEO of Uniswap, shared his thoughts during an interview on the “Bankless” podcast.

“The SEC is essentially taking very aggressive stances and basically trying to shut down crypto.”

The potential impact

The impact of the Wells Notice sent to Robinhood was immediately felt in the market.

As an analyst, I’ve observed that Robinhood’s stock, represented by the ticker symbol HOOD, underwent a notable decline of around 10% during the pre-market trading session on May 6th.

As of the latest update, Robinhood’s stock has declined by 0.95% within the past 24 hours.

Highlighting his disappointment on the issue, Gallagher, added,

“Despite our long-standing efforts to collaborate with the SEC towards gaining regulatory guidance, such as our initiative to register our US cryptocurrency business, we are dismayed by the SEC’s decision to send us a Wells Notice.”

Interestingly, Wick, a cryptocurrency influencer noted,

In the realm of bull markets, it is a frequent occurrence that unfavorable news does little to dampen the strength of asset prices. Instead, they demonstrate remarkable robustness and resilience in the face of adversity.

The uncertain fate of Robinhood

In the face of regulatory hurdles and an ongoing SEC legal action, Robinhood has initiated several preventative measures. For instance, they have removed certain cryptocurrencies like Solana [SOL], Cardano [ADA], and Polygon [MATIC] from their trading platform. Additionally, they have made adjustments to their trading fees.

In summary, falling behind other exchanges in the SEC’s regulatory timeline may provide advantages for Robinhood in terms of making strategic adjustments and preparing legally.

However, the immediate influence stems mainly from market trends and investors’ attitudes towards digital currencies.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-05-07 14:15