- Bitcoin’s 200-day moving average reached an all-time high, suggesting a bullish outlook.

- Short-term challenges persisted, with some metrics showing potential bearish signals.

As a seasoned crypto investor with years of experience in this volatile yet promising market, I’ve grown accustomed to the intricate dance between bullish and bearish signals that characterizes Bitcoin’s price movements.

Bitcoin [BTC] has bounced back strongly after experiencing a downturn, regaining ground lost at earlier prices.

The price of Bitcoin, which had dropped by almost 14% since its peak above $73,000 in March, is showing signs of potential rebound based on its recent market behavior.

As a crypto investor, I’ve noticed an exciting development over the last week. Bitcoin momentarily broke through the $64,000 mark, reaching new heights. However, it has since pulled back slightly and currently hovers around $63,635 at the time of my writing this.

The 0.9% decrease over the past day hasn’t diminished the lingering positivity towards Bitcoin’s future prospects.

Bitcoin: Bullish signals amid price fluctuations

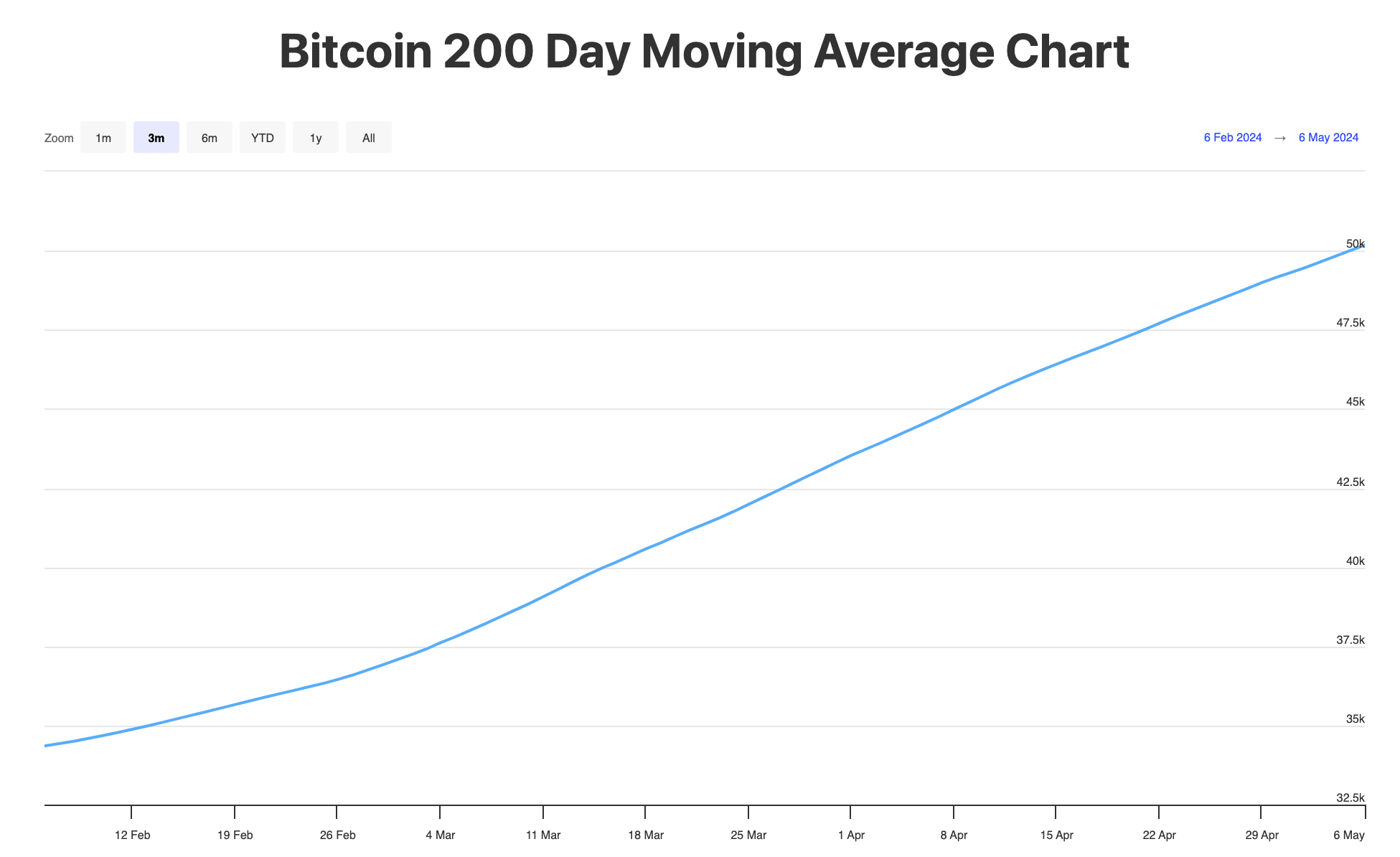

As a crypto investor, I’m closely monitoring the current market volatility. One key metric I regularly check is the Bitcoin 200-day moving average, which plays a significant role in identifying long-term trends. Remarkably, this average has hit an all-time high of $50,178.

Analyzing data from BuyBitcoinWorldwide, AMBCrypto identified this significant marker, implying a promisingly optimistic perspective for Bitcoin’s future growth.

The 200-day moving average (M Average) filters out short-term market fluctuations, providing a more accurate representation of the market trend’s direction.

As of now, the price of Bitcoin was holding above a significant threshold, implying a positive long-term trend.

Supporting this belief, the strong performance of the 200-day Simple Moving Average (SMA) for Bitcoin was in line with the views expressed by influential figure and Bitcoin advocate Anthony Pompliano.

On CNBC’s Squawk Box, Pompliano underscored the importance of Bitcoin reaching a new milestone of $50,000. He emphasized the persistent upward trend of Bitcoin, acknowledging its well-known daily price fluctuations.

He noted in a post on X,

“Don’t get lulled to sleep by bitcoin going sideways. The long-term thesis is as strong as ever.”

The sentiment expressed by him was reflective of the wider perspective among Bitcoin specialists, who maintain its long-term worth despite market fluctuations and occasional price dips.

Complex dynamics are revealed

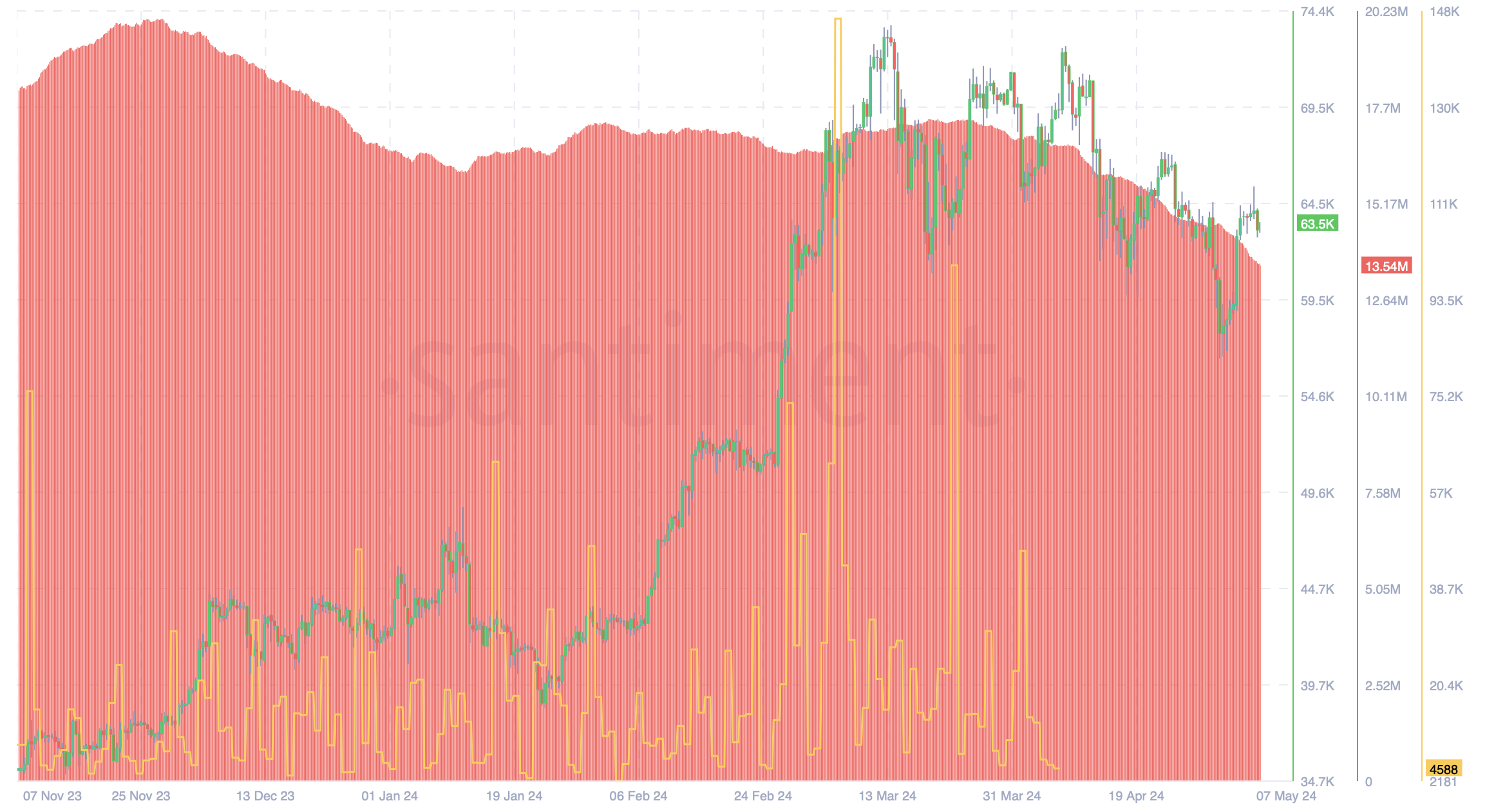

Based on Santiment’s data analysis, there has been a decline in Bitcoin’s dormant circulation and active addresses as per AMBCrypto’s assessment, despite the positive long-term signs.

The decrease in dormant Bitcoin circulation started around early March, preceding the cryptocurrency’s record highs. This could be an indication of long-term investors taking profits or reducing their enthusiasm.

Regarding the drop in active addresses, this indicates a reduction in network activity. These statistics serve as a warning sign among the otherwise optimistic context.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In a recent article on AMBCrypto, experienced trader Josh Olszewicz highlighted potential dangers even as Bitcoin experiences notable price increases.

Using the Ichimoku Cloud as his tool, his examination indicated that Bitcoin’s price could be continuing to traverse through market ambiguities, even though it had broken through the $64,000 resistance threshold.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-08 08:07