- Short positions increase following Grayscale’s decision to pull its Ethereum futures ETF application.

- Market sentiment grows bearish with potential further declines.

As a researcher with extensive experience in the cryptocurrency market, I cannot help but feel a sense of unease regarding Ethereum’s current state. The recent decision by Grayscale to withdraw its Ethereum futures ETF application has led to a surge in short positions and a growing bearish sentiment.

The second largest digital currency, Ethereum [ETH], has recently failed to demonstrate substantial growth in value, unlike Bitcoin [BTC] which has experienced a notable increase in price lately.

As an analyst, I’ve observed that despite Ethereum surpassing $4,000 in value during March, it didn’t establish a fresh record high – a feat Bitcoin achieved as it hit a new peak within the same timeframe.

Over the past two weeks, I’ve noticed a nearly 10% decrease in Ethereum’s value. Sadly, this downtrend hasn’t stopped, as there’s been a further 2.2% decline in the last 24 hours.

The pessimistic outlook towards Ethereum is evident in the trading activities of investors, as they’ve been progressively adding to their short positions, notably following a notable move by Grayscale Investments.

Grayscale’s strategic withdrawal

Recently, Grayscale Investments decided to withdraw its request for an Ethereum futures exchange-traded fund (ETF) from the Securities and Exchange Commission (SEC). This action has noticeably influenced traders’ outlook towards Ethereum and related investments.

Three weeks prior to the SEC’s ruling, this decision caused a surge in short bets against Ethereum.

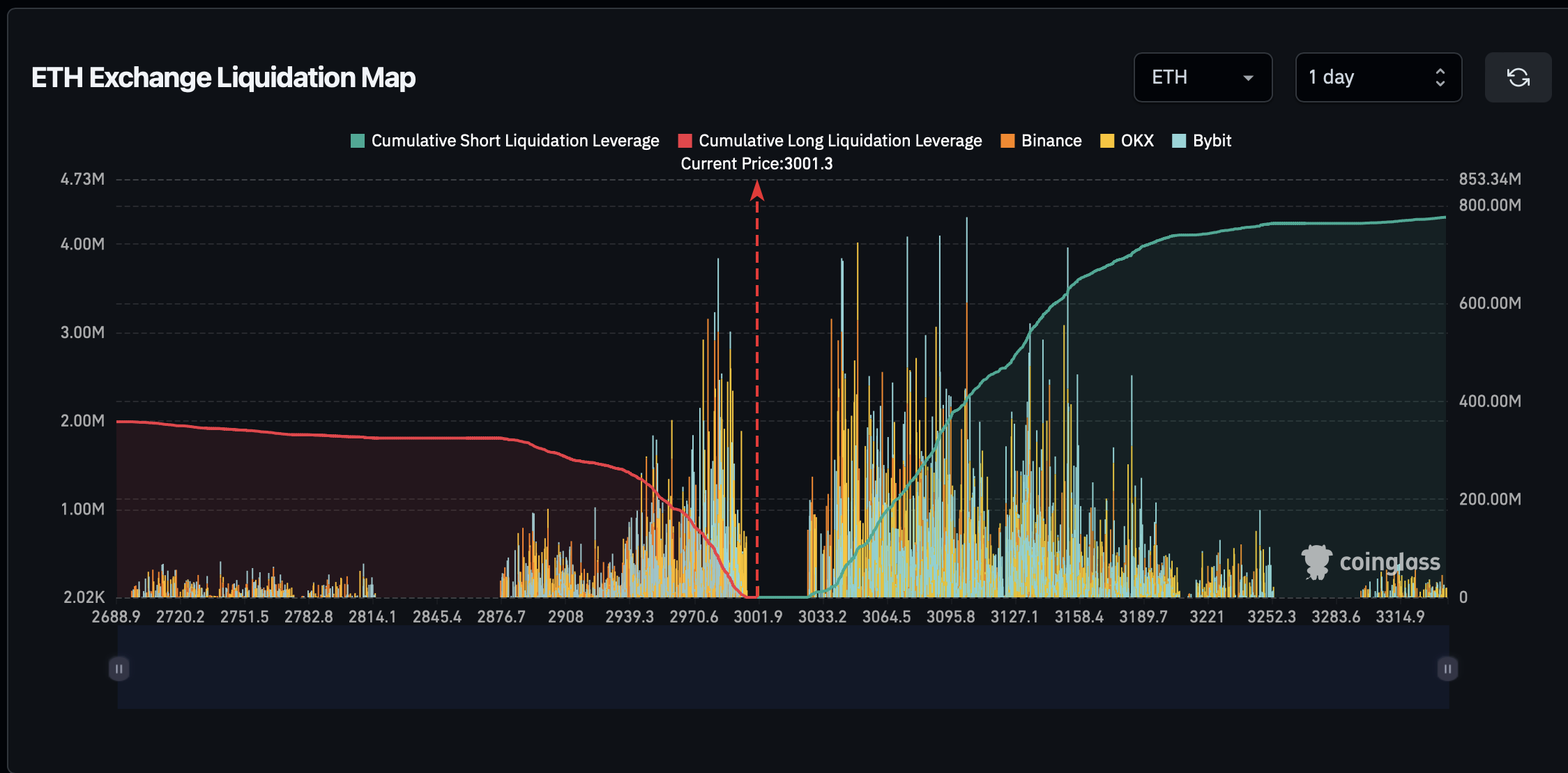

Traders have taken a large wager that prices will drop even more, with over $358 million worth of bets ready to be closed if the market rises by only 4%.

Conversely, a 4% drop would only eliminate $237 million in long positions.

As a crypto investor, I’m choosing to withdraw my Ethereum funds due to growing uncertainties around its regulatory standing. The classification of Ethereum as a security and the potential approval or rejection of spot Ethereum ETFs are key concerns that could significantly impact the platform’s future.

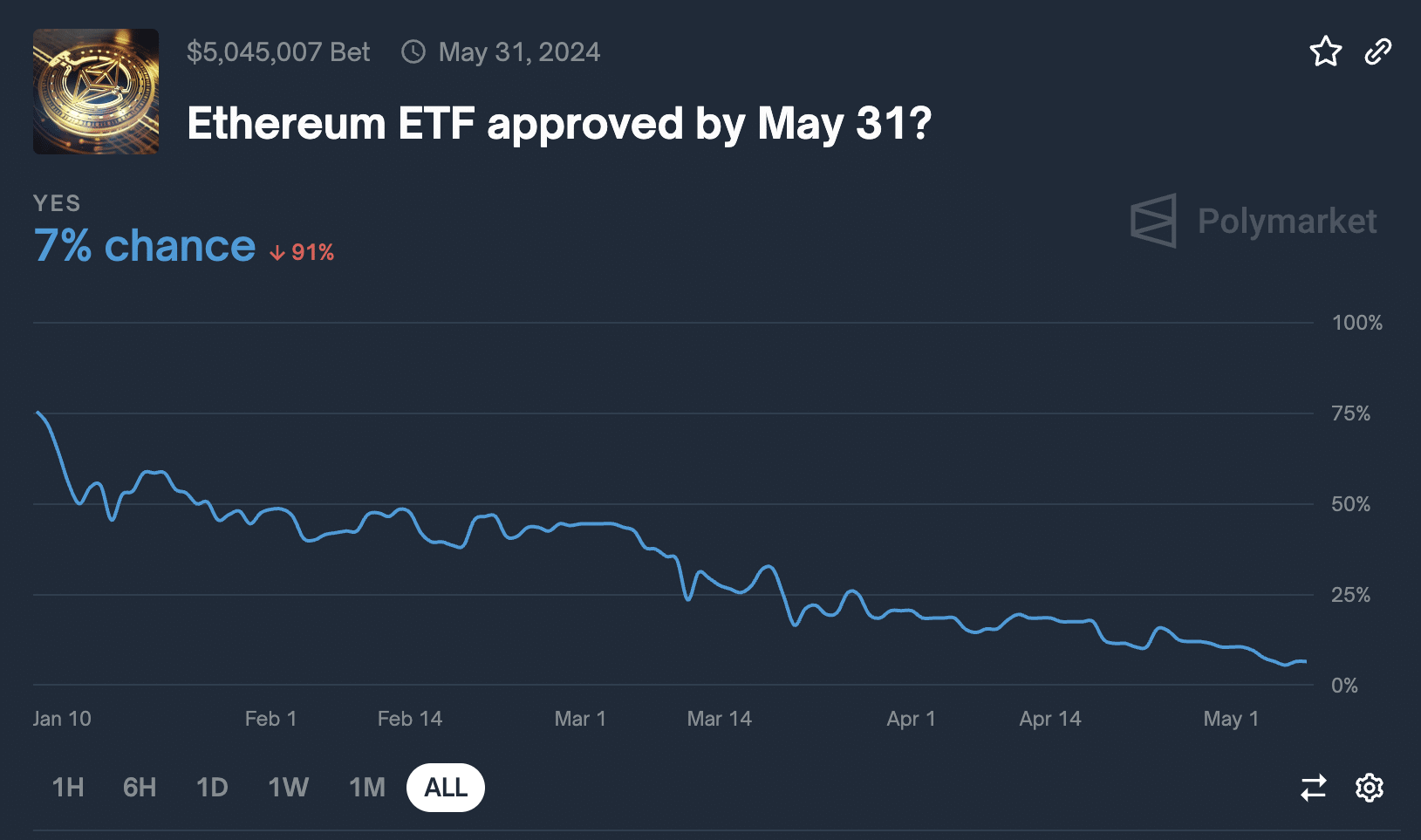

As the approval decision for these ETFs draws near on the 23rd of May, there’s growing uncertainty among financial analysts and market players.

Based on Polymarket’s data, approximately 90% of the surveyed individuals anticipate that the Ethereum ETF application will be rejected.

How is Ethereum doing?

Ethereum encounters challenges beyond Exchange-Traded Fund (ETF) matters, primarily related to its widespread utilization and waning appeal among short-term investors.

James Check, a well-known crypto analyst focusing on on-chain data, highlighted that Ethereum’s current usage is insufficient to match the issuance to validators through its burn mechanism.

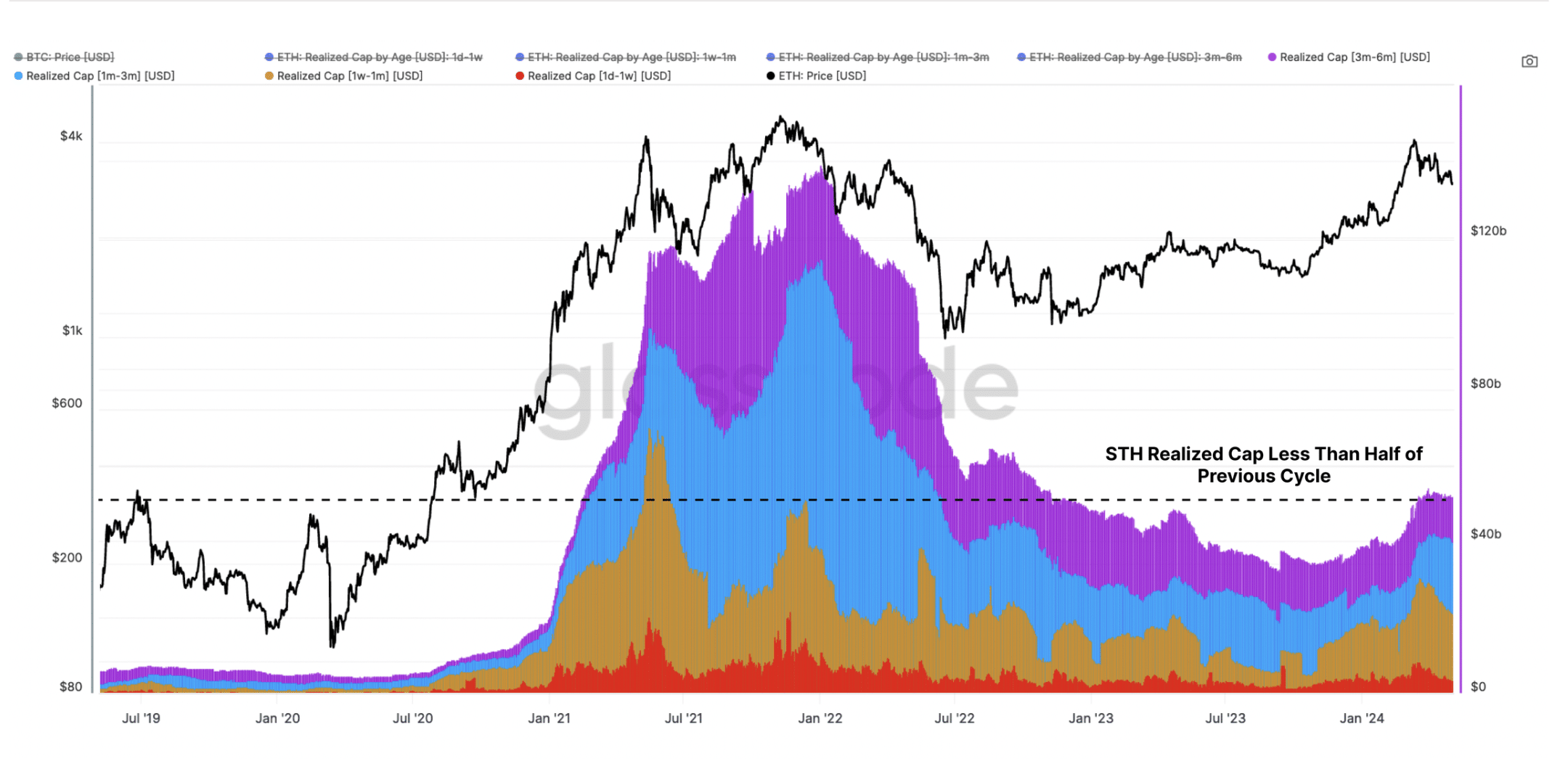

Glassnode made the observation that Ethereum has been trailing behind Bitcoin in terms of price growth, which they attributed to a slower build-up of speculative fervor among short-term investors.

Read Ethereum’s [ETH] Price Prediction 2024-2025

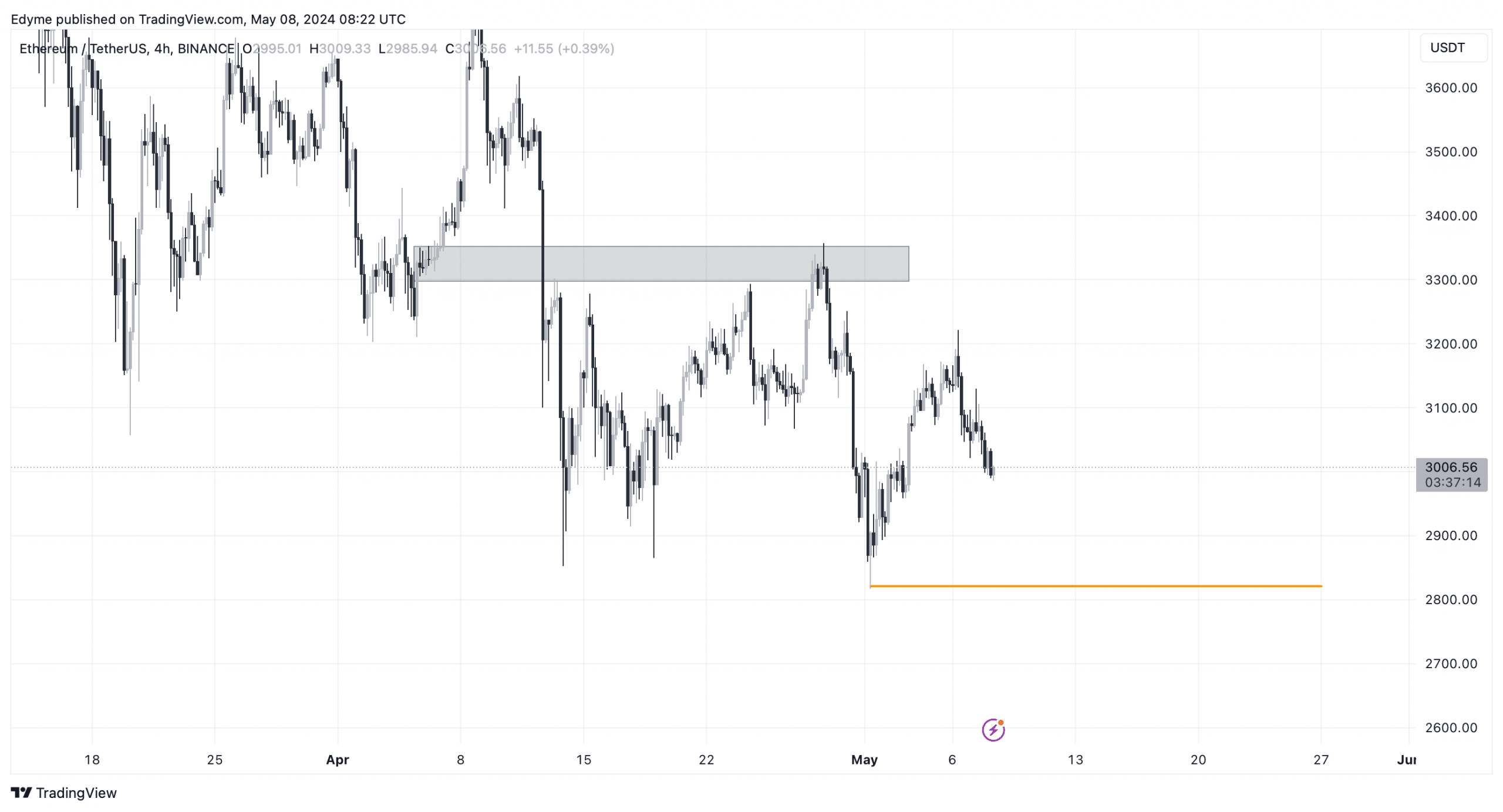

As an analyst, I would interpret the technical outlook for Ethereum’s price as follows: Based on current market trends, I anticipate that Ethereum’s price will likely continue to decrease, potentially reaching a support level around $2,800 where buying pressure may temporarily halt its decline.

The price of Ethereum has reached a significant resistance level lately, and if it continues to drop, the next goal could be hitting the major low point on the 4-hour chart.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Clarkson’s Farm Season 5: What We Know About the Release Date and More!

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

2024-05-08 20:07