-

Dogecoin saw negative sentiment but steady social media engagements.

Liquidity clusters could be key for a DOGE reversal.

As a researcher with experience in analyzing cryptocurrency markets, I have been closely monitoring Dogecoin’s [DOGE] recent price action and market sentiment. Based on my analysis of the data provided by AMBCrypto and Santiment, I believe that Dogecoin may be experiencing a period of negative sentiment but steady social media engagements.

As a market analyst, I’ve observed that Dogecoin [DOGE] encountered resistance during its recent price advance at the $0.165 mark. Notably, this price level represents the peak where DOGE was previously trading back in April.

Since the high of Monday the 6th of May, DOGE has registered losses of 12%.

According to a recent analysis by AMBCrypto, a significant number of Dogecoin investors continue to see a positive return on their investment despite the recent price dip. This setback, which occurred over the past few weeks, erased all the progress made during the second half of March.

Yet, the selling pressure from these holders was not as heavy as feared.

Does this mean investors are confident that Dogecoin would outperform the market?

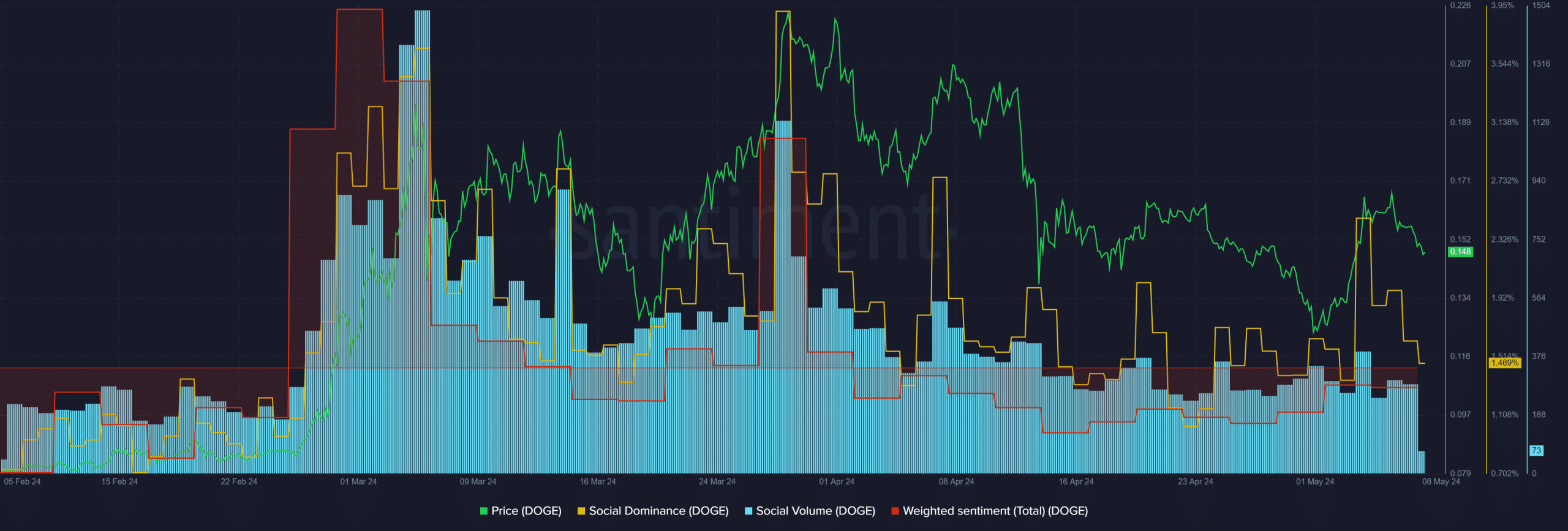

To answer this question, AMBCrypto analyzed the social metrics from Santiment.

The faith of investors appeared thin. This sentiment had been unfavorable since April, with prices dropping beneath the $0.2 mark and subsequently transforming it into a barrier for further advancement.

As a researcher observing the social media landscape of Dogecoin, I’ve noticed an uptick in dominance – meaning that Dogecoin is being mentioned more frequently relative to other cryptocurrencies in social media conversations. However, the overall volume of mentions has remained relatively stable. This trend doesn’t necessarily imply bullish sentiment but rather indicates a consistent level of interest and discussion surrounding Dogecoin on social media.

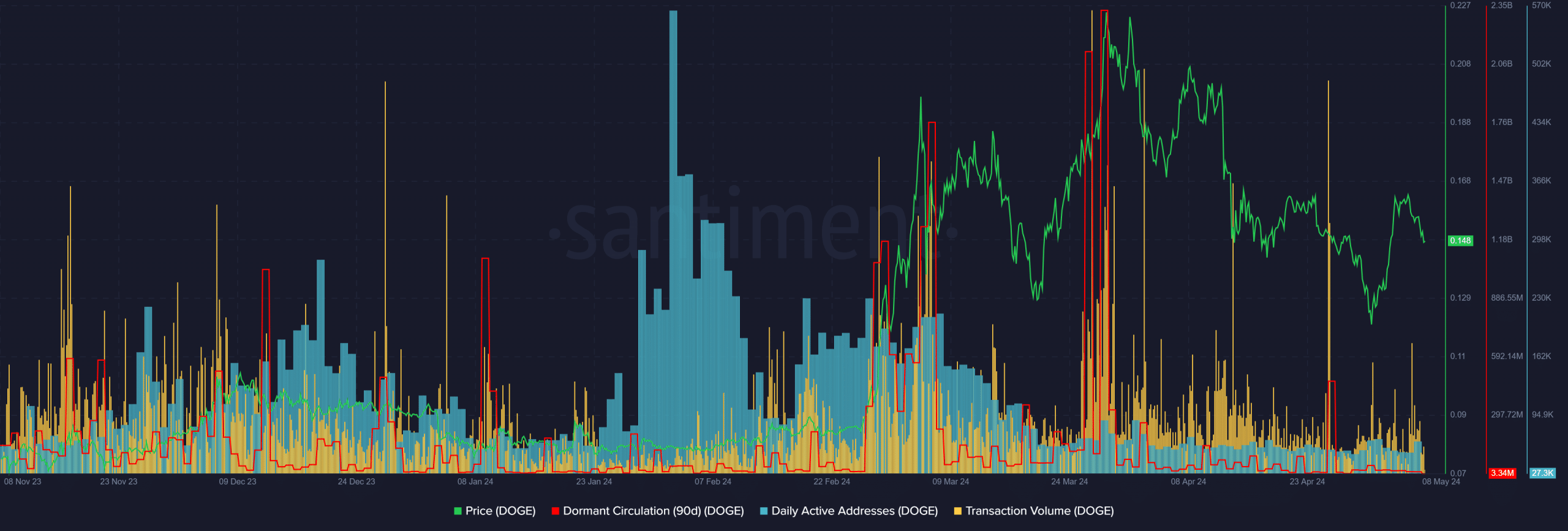

Based on the on-chain data, there’s been a significant drop in the number of daily active addresses compared to their peak in February. Over the last six weeks, this figure has remained relatively low.

Significantly, the absence of unique address involvement in transactions indicated a potential decrease in demand.

In the initial part of April, the transaction volume remained steady. However, there was a significant drop in transaction activity during the latter part of the month.

Over the last ten days, it has shown some signs of improvement, which is a positive development yet not definitively optimistic for the token’s price trend.

The dormant circulation saw a large spike on the 26th of April.

As a crypto investor, I’ve noticed a significant transfer of tokens from one wallet to another in the past few days. This could be an indication that a large seller is disposing of their holdings. However, since then, this metric has been relatively quiet. The absence of notable token transfers suggests that selling pressure may have subsided for now.

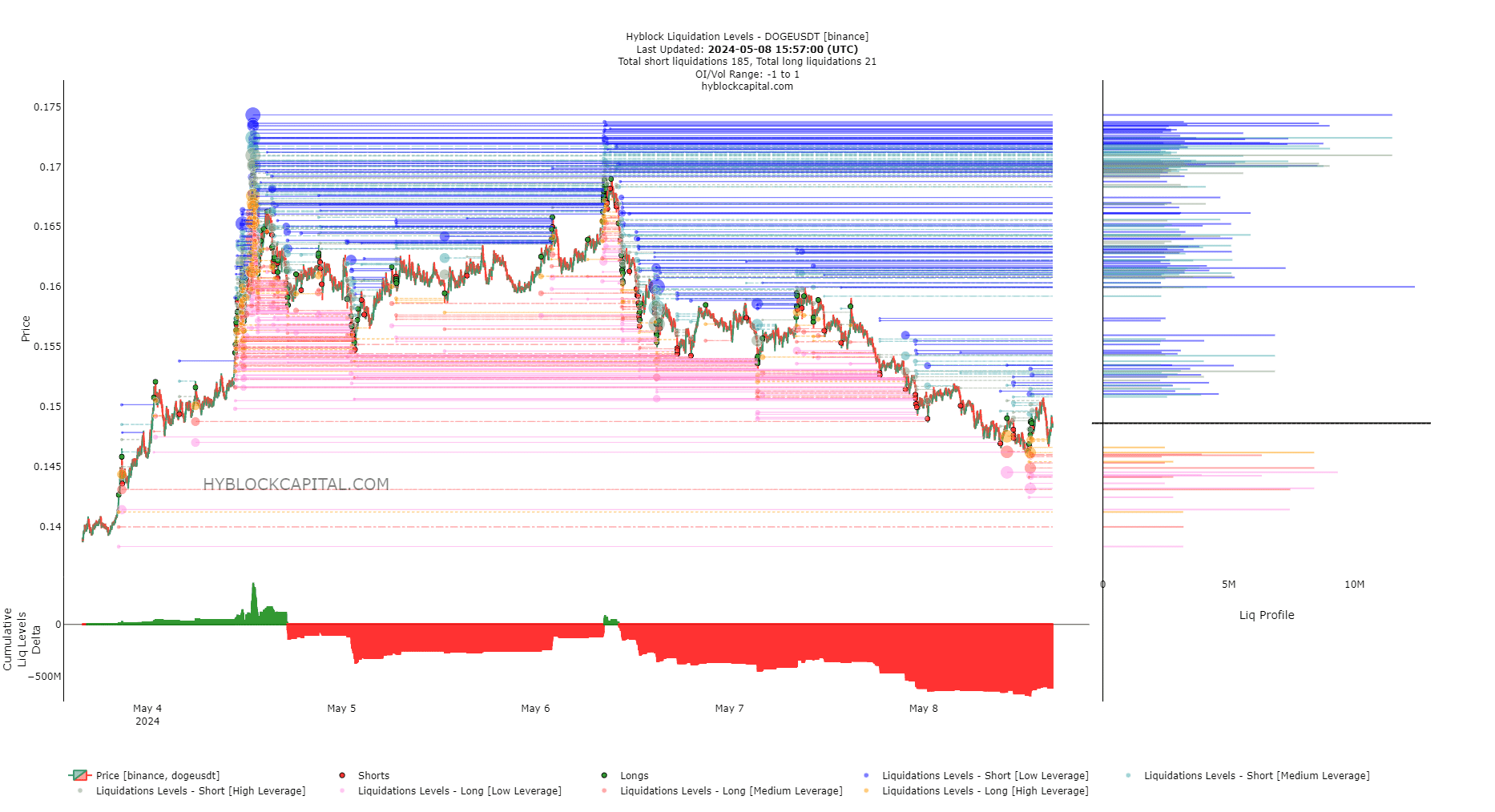

Analysis of the liquidity chart pointed to the next direction for DOGE

In simpler terms, the total difference between the amounts of positions being closed (liquidated) for shorts and longs was very large in magnitude, indicating that more short positions were being liquidated than long ones.

In turn, we can expect prices to climb higher to wipe out these liquidations.

This might come after the nearest pockets of liquidity at $0.147 and $0.144 are taken out.

Scalp traders should look for a price movement towards the $0.144 liquidity zone, which they believe will be followed by a quick turnaround and an uptrend towards the $0.155 to $0.16 range.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-05-09 10:15