-

BONK has slim chances of a short-term bounce.

The technical and social indicators were not favorable to the buyers.

As a seasoned crypto investor with a keen eye for market trends and technical analysis, I believe that BONK has slim chances of a short-term bounce. The technical and social indicators were not favorable to the buyers.

In simpler terms, Bonk’s forecast for May indicated a higher probability of losses instead of a price increase based on the technical data. The indicators didn’t reveal strong buying power.

As a researcher, I’d like to share an observation based on a previous report from AMBCrypto. The piece highlighted potential risks for BONK, and unfortunately, since then, the meme coin has experienced a decline of approximately 13%.

Based on my analysis of the futures data, I’ve noticed a decline in excitement and hesitation among speculators regarding BONK‘s near-term bullish potential. Here are some crucial levels that traders need to keep an eye on:

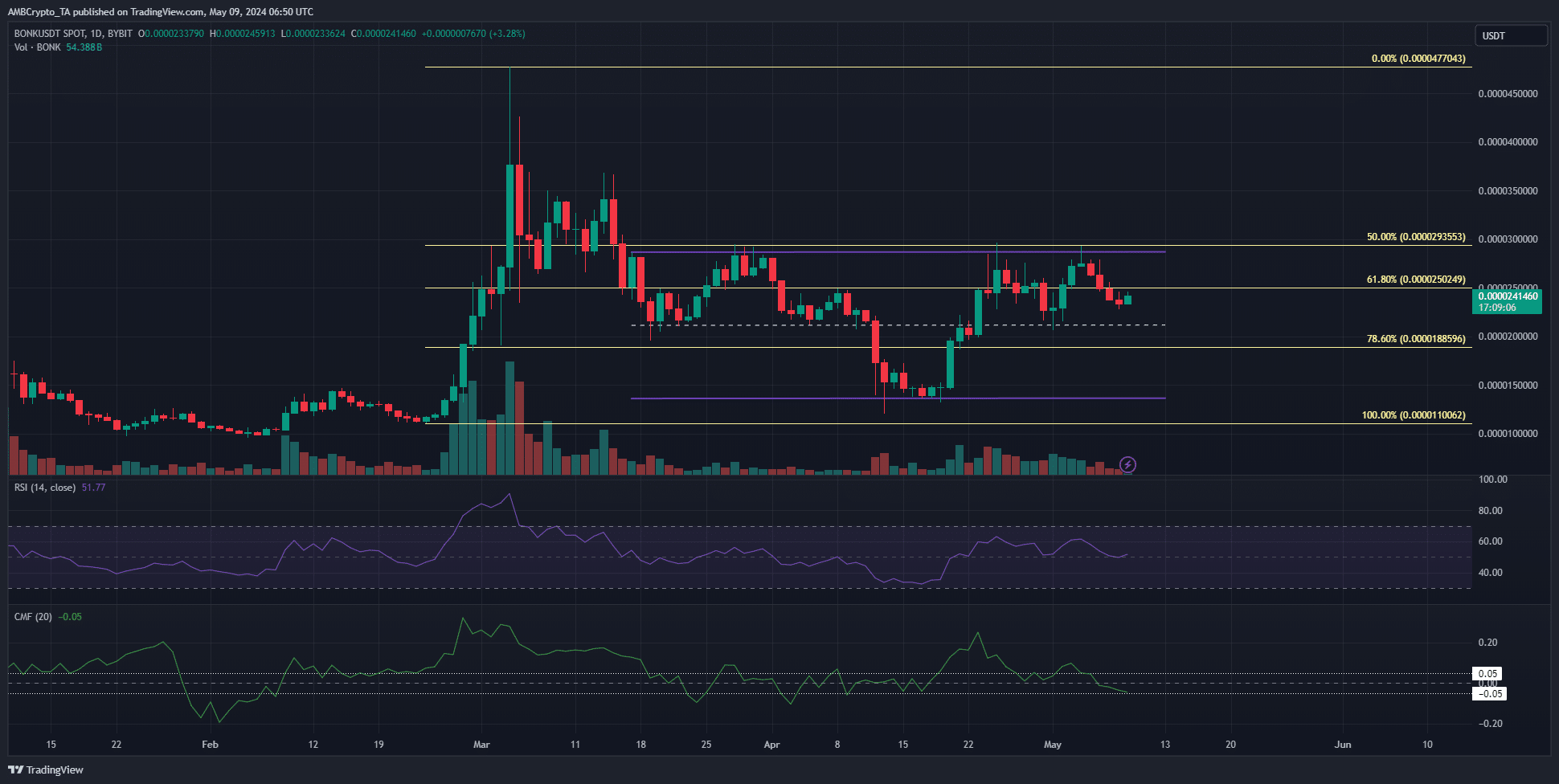

The range formation gave clues for the next trend

The two-month range was highlighted in purple and extended from $0.0000136 to $0.0000286.

In the past two weeks, the price has been rejected twice as it approached the high end of its range, but it hasn’t fallen below the level of support that lies in the middle of the price range yet.

As a researcher analyzing financial data, I observed that the Relative Strength Index (RSI) on the daily chart stood at 51.7. This indicated that the momentum in the market was neither clearly favoring the buyers nor the sellers. Additionally, the Chaikin Money Flow (CMF) was recorded at -0.05. These readings suggested a balanced situation where neither buying pressure nor selling pressure had significant dominance.

As an analyst, I would interpret this level as a critical mark for investors. A reading below this point could be indicative of substantial capital withdrawal and heightened selling activity.

In simpler terms, the price movements at a shorter time frame indicated that the $0.0000209 mark functioned as a support level. Subsequently, another smaller price range developed within the upper portion of the bigger range.

Hence, scalp traders could look to buy a retest of this support with a tight stop-loss.

As a researcher studying the price trends of BONK, I’ve noticed that the current dip in price may experience a brief rebound around $0.0000209. However, this short-term recovery might not be sufficient to trigger a robust upward trend.

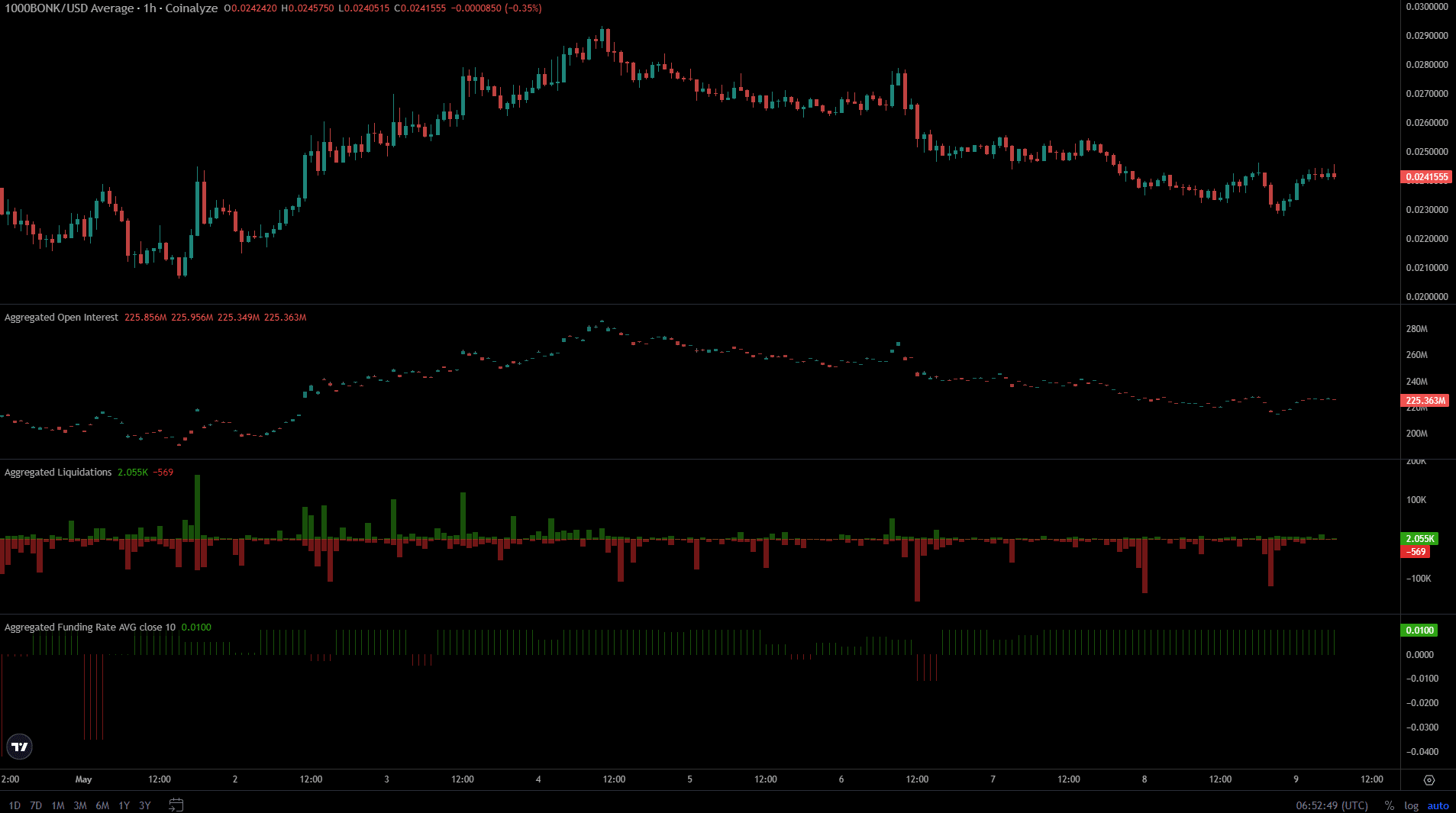

As a crypto investor, I’ve noticed that the open interest in the market has been decreasing significantly over the past three weeks. This suggests that speculators have been taking a step back from the market, possibly due to uncertainty or profit-taking.

The investors showed no eagerness to buy more of the asset than they already had, yet they didn’t take a opposing position by selling short. This neutral stance was indicative of their attitude, as evidenced by the funding rate that barely exceeded the zero mark.

As a crypto investor observing recent market trends, I’ve noticed that each significant price decline over the past week seemed to be followed by a flock of long liquidations. These liquidations added downward pressure on the market and intensified the price drops.

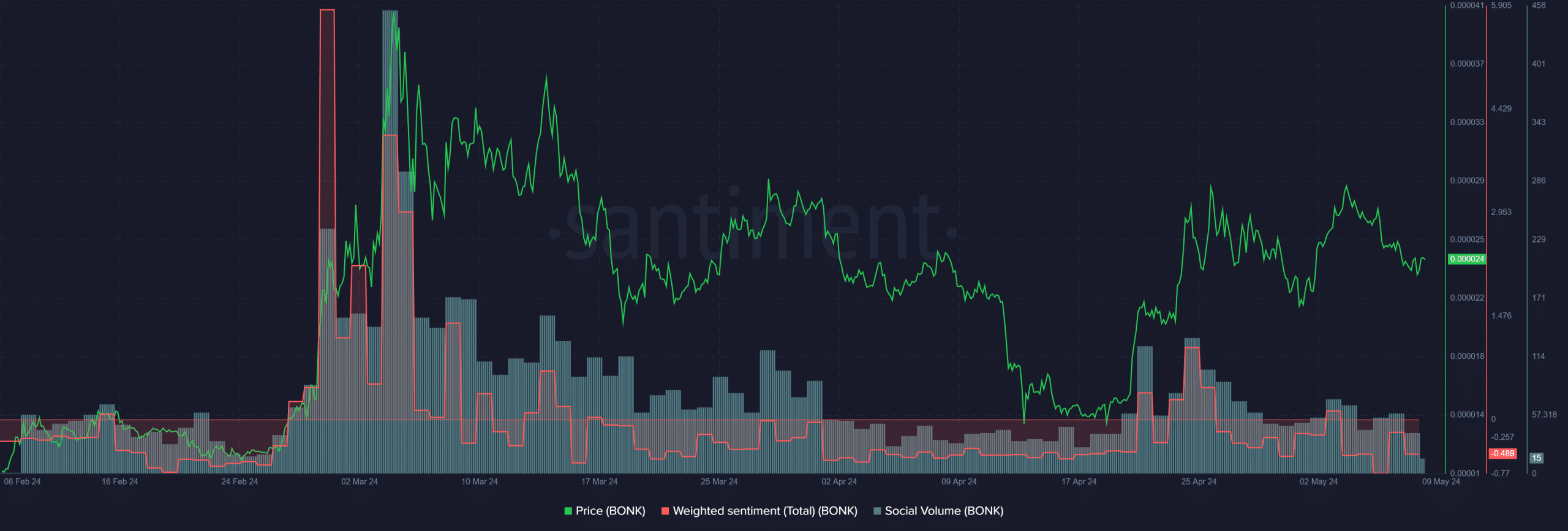

Do the social metrics signal a turnaround for BONK?

Since April 25th, there’s been a decrease in social activity. On that very day, the sentiment analysis, given in three-day intervals, showed positivity. However, it has mostly been negative since then.

Read Bonk’s [BONK] Price Prediction 2024-25

As a researcher examining the current market situation, I believed it was unlikely that BONK would break out of its short-term price range, given the low market interest and lackluster social media buzz surrounding the asset. The $0.0000209 level appeared to be a strong support for the token, making a bounce back from this price a plausible scenario.

However, selling pressure on Bitcoin [BTC] could propel BONK toward the range lows at $0.0000136.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-05-10 00:07