- Solana’s price appreciated by more than 11% in the last 7 days

- Most market indicators were bullish, but the CMF flashed bearish signs

As an experienced analyst, I have seen my fair share of bull markets and bear markets in the crypto space. While Solana’s [SOL] price action has been impressive lately with more than 11% appreciation in just seven days, it is essential to consider all possible factors that could impact its future price movement.

As a Solana (SOL) investor, I’ve noticed an uptrend in the cryptocurrency’s price over the past few days. The bullish market seems to be driving this growth, and if conditions remain favorable, we could potentially see SOL surpassing $200 by May. However, it’s important to acknowledge certain concerns that might impact Solana’s price movement on the charts.

What’s going on with Solana?

Last week, Solana’s price soared past bears, registering an increase of over 11%. Notably, in just the previous 24 hours, as per CoinMarketCap data, SOL experienced a significant gain of approximately 7%. Currently, the token is being traded at $155.10 and boasts a market capitalization exceeding $69.5 billion.

A well-known cryptocurrency analyst, Crypto Tony, has shared his insights in a recent tweet regarding Solana (SOL). He indicated that the positive trend for SOL’s price could potentially continue and reach greater heights based on current market conditions.

The price of Solana (SOL) is nearing a significant resistance point at around $160. If SOL manages to surpass this barrier, it could potentially reach the $200 mark by May.

To gain a clearer perspective on this matter, we delved into Santiment’s data at AMBCrypto. Based on our examination, there was a significant surge in optimistic sentiment towards SOL on May 9th. This upward trend suggests that investors hold a positive outlook on SOL.

The open interest level rose in tandem with the price increase. An uptick in open interest often signifies a strong likelihood that the current pricing trend will persist.

The funding rate for SOL has decreased on the graphs, but historically, price movements have tended to go in the opposite direction. This could be an indicator of an upcoming price increase.

Concerns galore?

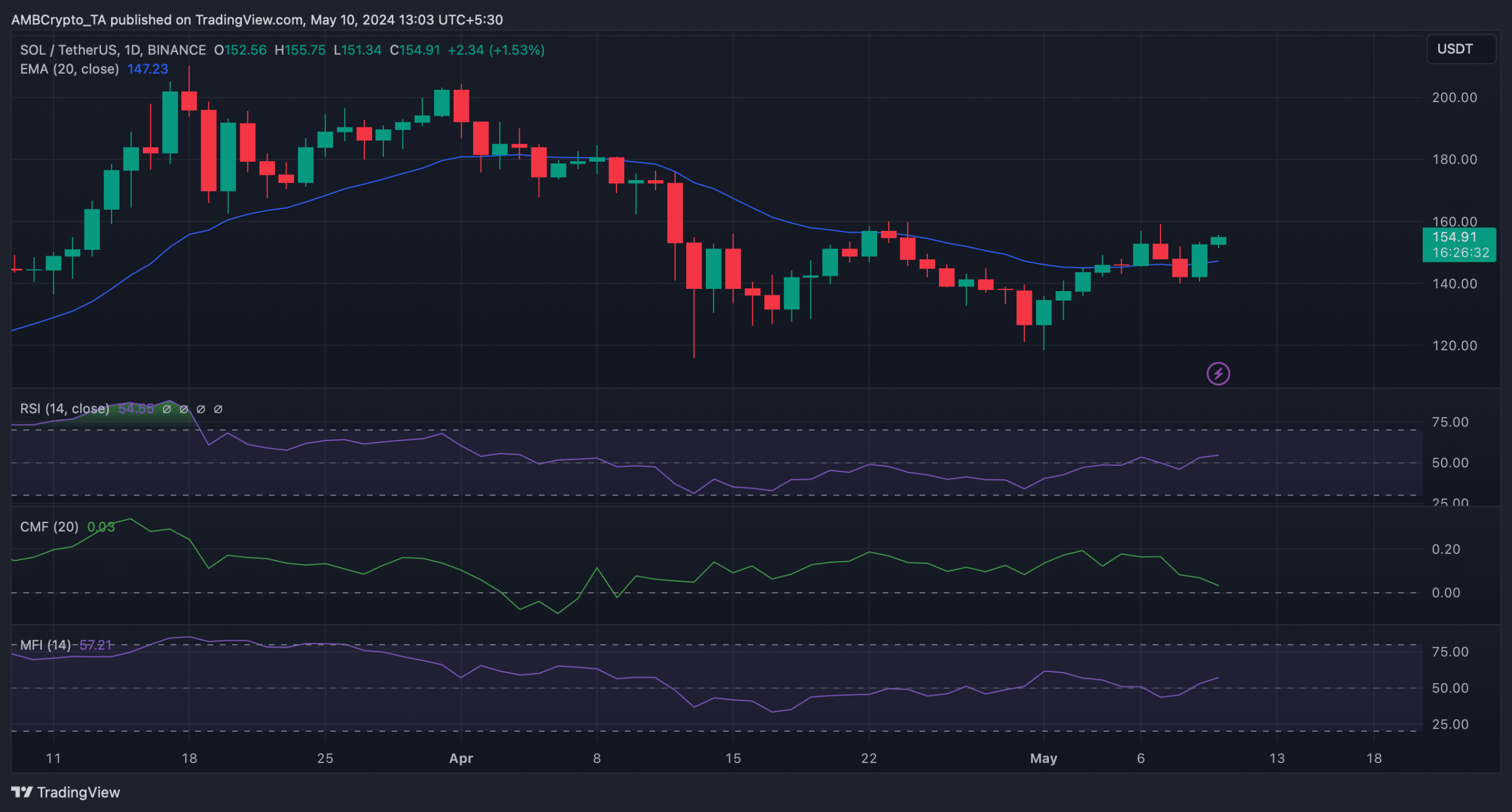

As a crypto investor, I turned to AMBCrypto for insights into Solana’s (SOL) price action. They examined SOL’s daily chart to determine if technical indicators suggested a potential move above $160. Based on their analysis, I noticed that the SOL price was comfortably sitting above its 20-day Exponential Moving Average (EMA).

The Relative Strength Index (RSI) displayed a significant surge, with a reading of 54.6 at the current market update. Similarly, the Money Flow Index (MFI) for Solana exhibited an upward trend. These technical signals implied that the bullish momentum for SOL might persist.

As a researcher studying market trends, I’ve noticed that the Chaikin Money Flow (CMF) has been declining lately, which aligns with the bearish sentiment among investors.

AMBCrypto had previously reported that SOL was forced to retreat from its $160-level on 7 May.

Realistic or not, here’s SOL’s market cap in BTC’s terms

As a crypto investor closely monitoring Solana (SOL), I’ve noticed the significant resistance level that the Chaikin Money Flow (CMF) indicator suggests. If this resistance holds strong and the CMF indication proves accurate, it may hinder SOL from advancing past this point yet again. A rejection from this zone could potentially trigger a trend reversal, leading the token’s price to plummet towards $120 in the upcoming days.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-10 18:16