-

ETH has struggled to initiate an uptrend on the charts

Most market indicators and metrics looked bearish

As an experienced analyst, I have closely monitored Ethereum’s [ETH] price movements and market indicators in the recent past. ETH has struggled to initiate a sustainable uptrend, with most market metrics and sentiment data pointing towards bearish conditions.

💥 Trump Tariff Shockwave: EUR/USD in Crisis Mode?

Find out what experts predict for the euro-dollar pair this week!

View Urgent ForecastAs a researcher studying the cryptocurrency market, I’ve observed that Ethereum‘s [ETH] daily and weekly price charts showed positive trends at the time of my analysis. However, there was a possibility that this uptrend could be temporary. In fact, recent market analysis suggested that ETH could drop to a price as low as $2,700 before experiencing any significant bull rally. Therefore, I decided to delve deeper into Ethereum’s current state to gain a clearer perspective on what to anticipate in the near future.

Bears v. Bulls for Ethereum

As a researcher, I’ve observed an uptick in Ethereum’s price within the last 24 hours, resulting in a gain of approximately 1%. Based on data from CoinMarketCap, Ethereum was then trading at a price of $3,035.04 and boasted a market capitalization surpassing $364 billion.

I’ve conducted an analysis and identified a potential downside for Ethereum (ETH). According to my assessment, ETH may dip to around $2,700 in the near future. This view is shared by Crypto Tony, a well-known crypto analyst, who recently expressed this projection on his social media platform. Based on his tweet, ETH’s price will initially hit its support level at $2,700 before starting a potential rally that could take it up to $5,400.

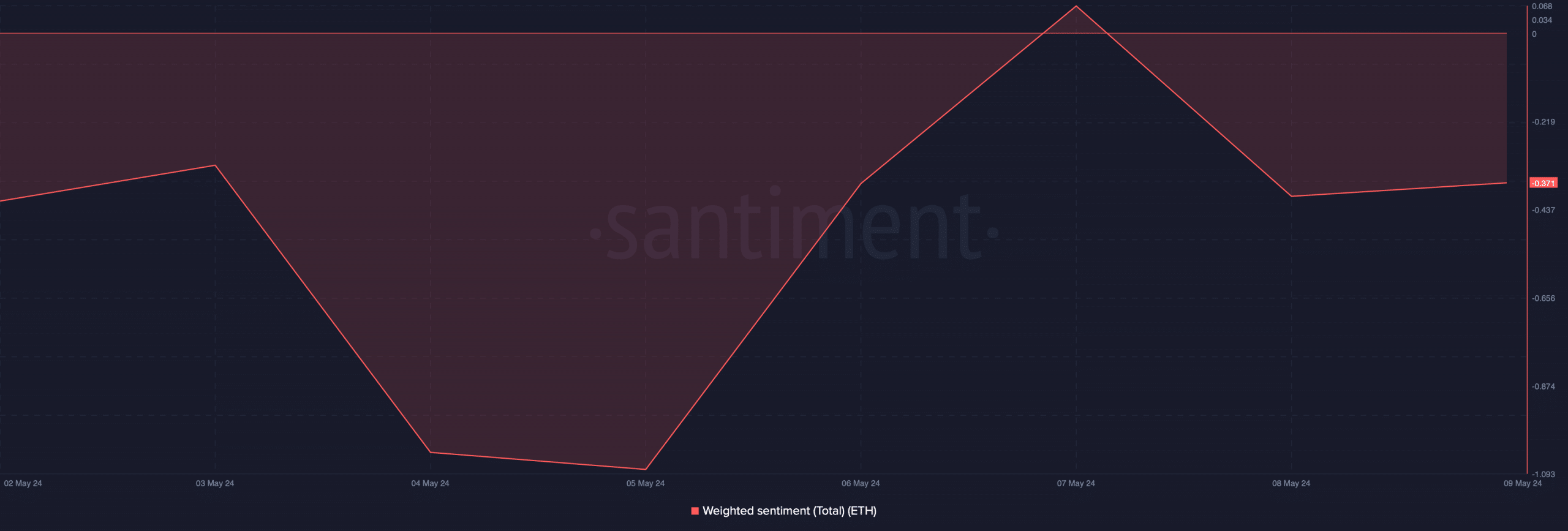

It’s plausible that Ethereum (ETH) could reach a price as low as $2,700 due to decreased investor confidence. According to AMBCrypto’s interpretation of Santiment’s data, the sentiment towards ETH is heavily negative, which suggests that bearish sentiment continues to prevail in the cryptocurrency market.

Apart from that, quite a few other metrics also looked somewhat bearish too.

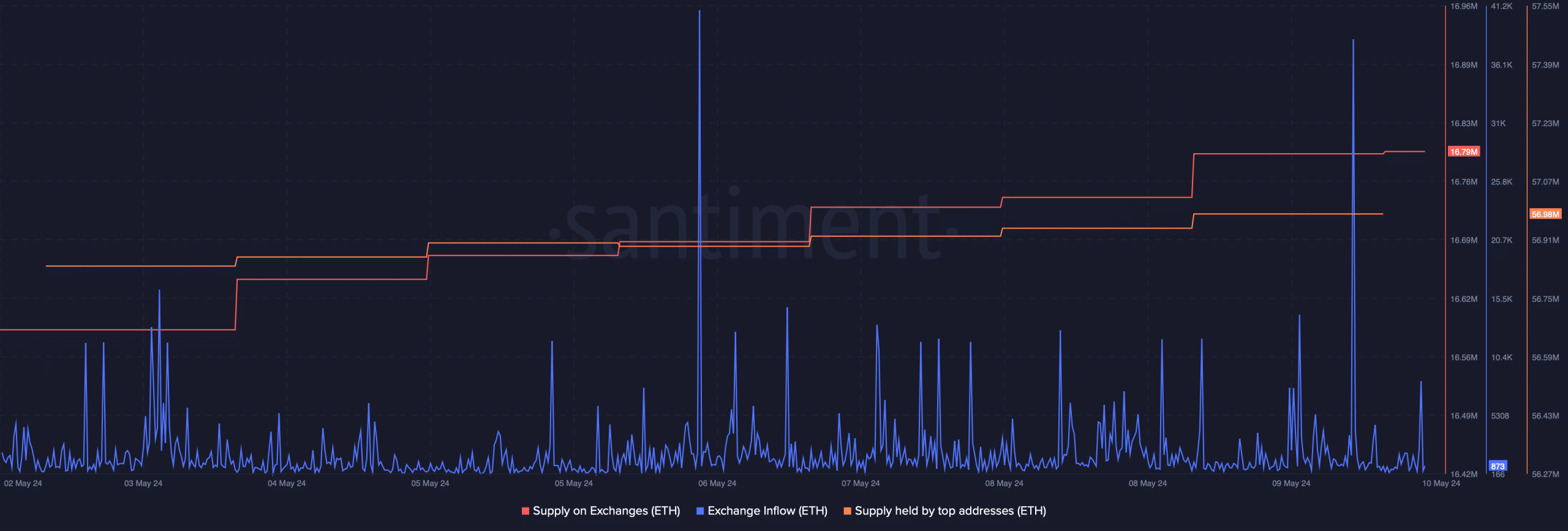

The amount of ETH being traded on exchanges significantly rose, indicating a surge in sellers. This trend was also corroborated by the rise in the cryptocurrency’s supply held on these platforms during the previous week.

As a crypto investor, I’ve noticed an intriguing trend: while some investors were selling off their holdings, the so-called “whales” took the opposite approach and continued to buy more. This is indicated by a slight uptick in the amount of cryptocurrency held by the largest wallets.

Future targets

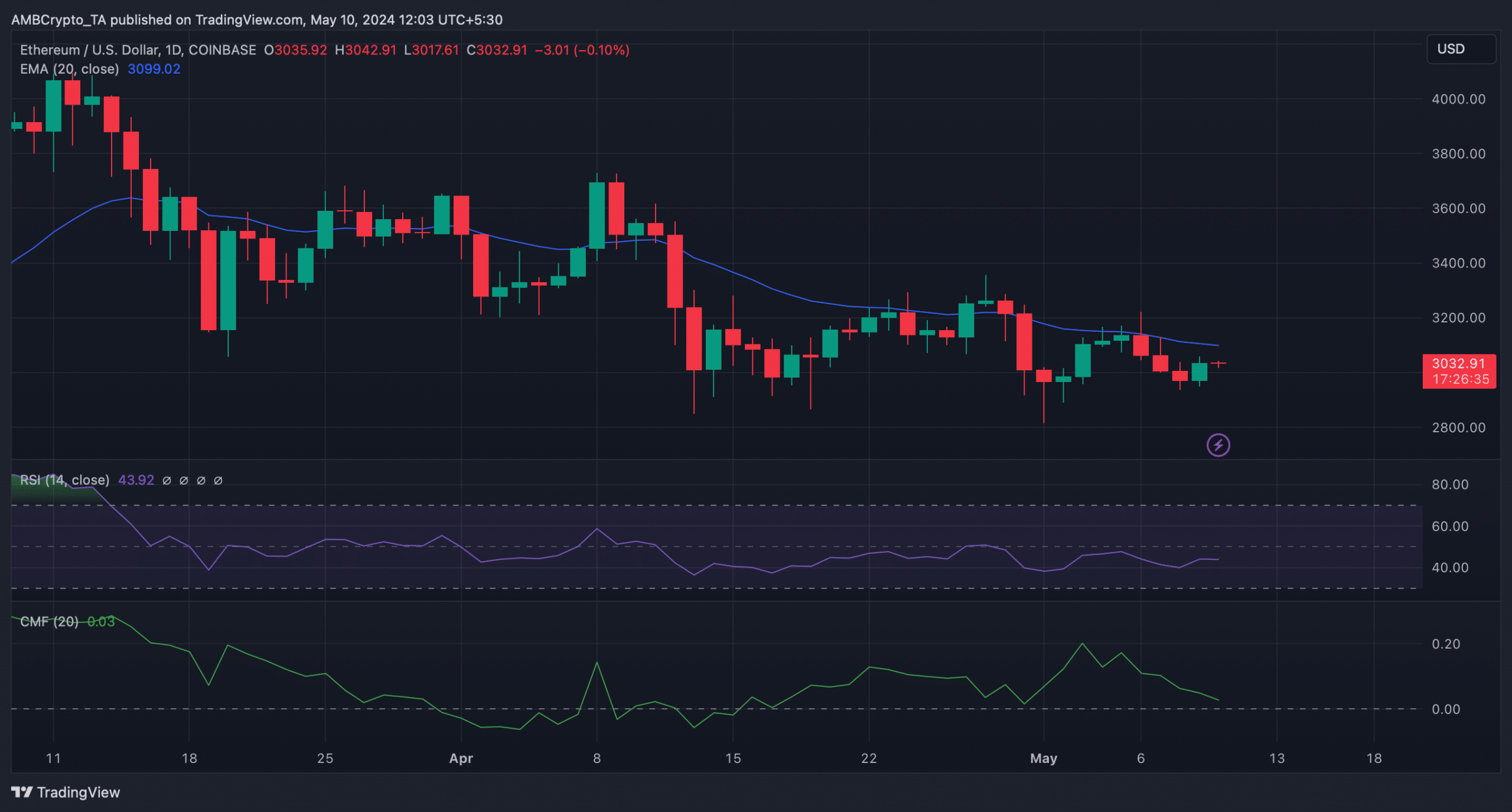

Previously, AMBCrypto reported a bearish sentiment towards Ethereum in the crypto-market. To verify this trend, we examined Ethereum’s daily chart for confirmation. Consistent with our assessment, the market signals persisted as bearish.

In simpler terms, the cost of the token was sitting below its 20-day Exponential Moving Average (EMA). The Relative Strength Index (RSI) was below the neutral mark. Furthermore, Ethereum’s Chaikin Money Flow (CMF) indicated a downward trend, increasing the likelihood that Ethereum could fall to $2.7k.

Investors need not be alarmed by ETH‘s downward price trend as there’s a chance for a turnaround prior to hitting the $2,700 mark.

If Ethereum reaches approximately $3,000 during its tests, the market could shift toward a bullish trend. On the contrary, a decline below this price point may cause Ethereum to encounter resistance around $2,920, depending on whether it recovers or not.

Read More

- OM PREDICTION. OM cryptocurrency

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Oblivion Remastered – Ring of Namira Quest Guide

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Lisa Rinna’s Jaw-Dropping Blonde Bombshell Takeover at Paris Fashion Week!

- Sophia Grace’s Baby Name Reveal: Meet Her Adorable Daughter Athena Rose!

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Quick Guide: Finding Garlic in Oblivion Remastered

- Oblivion Remastered: The Ultimate Race Guide & Tier List

2024-05-10 20:07