-

BTC’s price has appreciated by over 6% as it approached $63k on the charts

Most metrics and indicators flashed green too

As an experienced market analyst, I’ve seen my fair share of Bitcoin price movements over the years. And based on the current trends and metrics, I believe that Bitcoin’s price action is looking quite promising.

The price of Bitcoin (BTC) exhibited renewed volatility, rapidly approaching the $63,000 mark on the charts. Notably, a discernible pattern emerged in its price movement, potentially indicating that Bitcoin could reach a new height of around $75,000 within the upcoming weeks.

Bitcoin’s price action looks promising

I’ve analyzed the data from CoinMarketCap and found that Bitcoin (BTC) has experienced significant growth over the past week, increasing by more than 6%. This upward trend continued in the last 24 hours, with BTC appreciating by approximately 3%. At present, the price of one Bitcoin is at $62,998.95, and its market capitalization exceeds $1.24 trillion.

As a crypto investor, I’ve observed the recent dip in the price of Bitcoin from its all-time high (ATH). However, despite this setback, many market analysts remain optimistic about its future price action. In fact, according to AMBCrypto’s previous report, the CEO of analytics firm CryptoQuant, Ki Young Ju, stated that Bitcoin’s network fundamentals could potentially support a market valuation “three times larger than its current size.”

As I analyzed the recent price action of Bitcoin (BTC), I noticed an intriguing development: an inverse head-and-shoulders pattern was emerging on the chart. This technical formation, as highlighted by the renowned crypto analyst known as “Titan of Cryptos” in a tweet, implies that BTC’s price could be primed for a significant upward move. In fact, this bullish signal suggests that Bitcoin might surpass its all-time high (ATH) and potentially reach new heights, around $75k, within the upcoming weeks.

As an analyst, I’d advise that we consider the potential implications of the tweet’s mention of an adverse scenario. If certain unfavorable circumstances materialize, Bitcoin (BTC) could potentially slide back down to the $56k mark. Therefore, it would be prudent to closely examine Bitcoin’s current situation to assess which outcome is more probable.

What to expect from Bitcoin?

As an analyst examining the data from CryptoQuant, I’ve observed a noteworthy decrease in Bitcoin’s exchange reserves according to AMBCrypto’s findings. This observation carries significant implications – a diminishing supply of Bitcoins on exchanges signifies strong buying pressure. In other words, this trend is indicative of a bullish market sentiment.

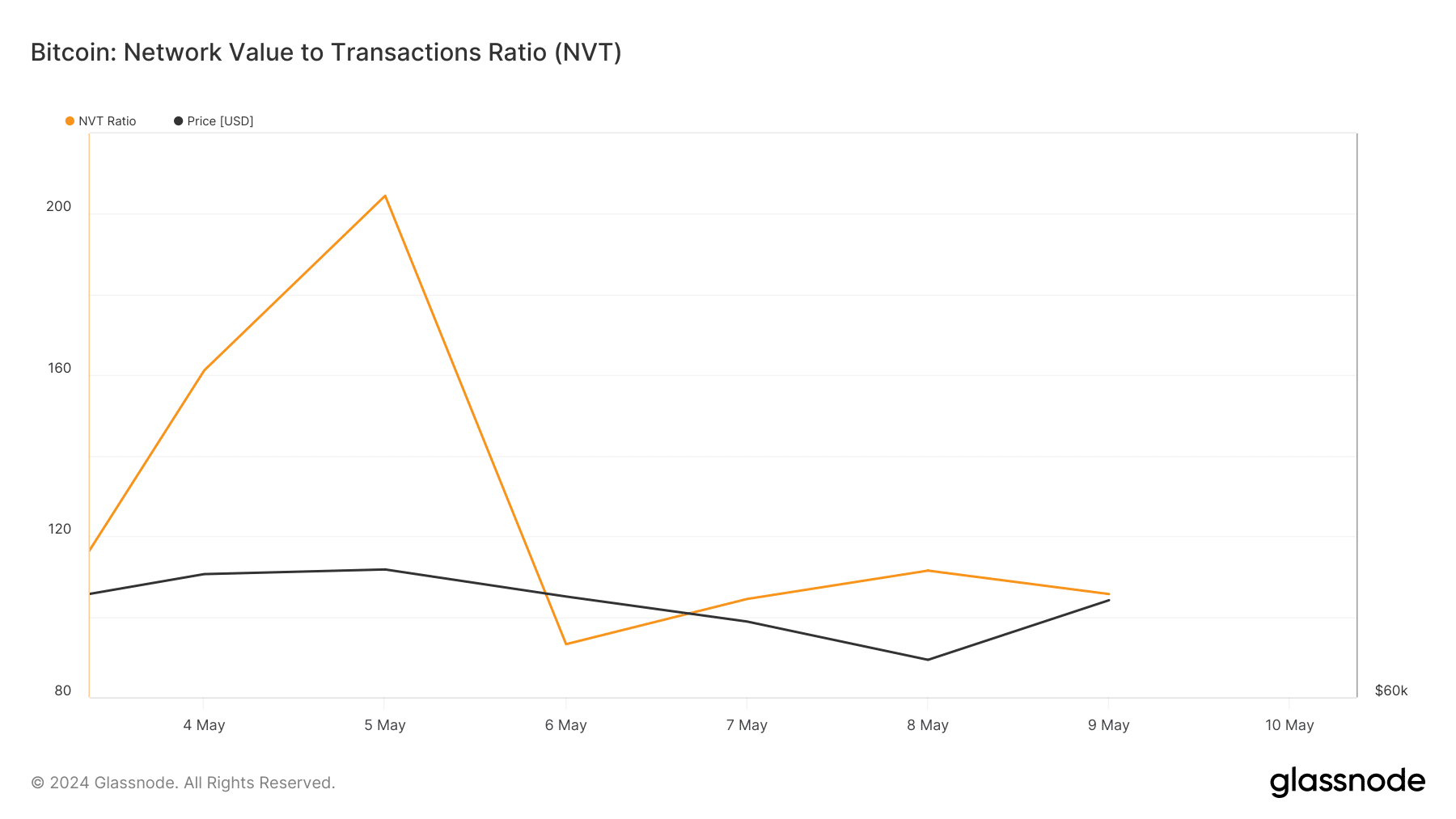

Based on the findings from its binary CDD analysis, it appears that investors holding Bitcoin for the long term have been less active than usual over the past week. This could indicate that they are planning to hold onto their coins for a longer period, increasing the potential for an uptrend. Moreover, Bitcoin’s NVT ratio decreased last week, suggesting that the cryptocurrency is currently undervalued relative to its network value. Collectively, these metrics strengthen the argument that Bitcoin may reach or surpass its all-time high.

However, its aSORP flashed opposing signals.

Currently, the average school return on investment (ASROP) for Bitcoin (BTC) is showing a red figure at the present moment. This signifies that a greater number of investors have been cashing out their profits in the midst of this bull market. Such a trend could potentially signal the approaching peak of the market.

To determine if the market has peaked, AMBCrypto examined Bitcoin’s daily chart for signs. At that point, Bitcoin was attempting to surpass its 20-day exponential moving average (EMA). If it managed to break through this barrier, it would likely signal a prolonged bullish trend.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Its Money Flow Index (MFI) also registered a sharp uptick.

Contrary to what the Chaikin Money Flow (CMF) indicated, Bitcoin’s price seemed bullish. However, the bearish signal from CMF suggested a possible reversal, potentially leading to a decline in BTC‘s value down to $56k on the charts.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-10 23:03