-

TON’s price surged significantly over the last 24 hours

Activity on the network grew, while the revenue generated by the protocol fell

As a researcher with experience in analyzing cryptocurrency markets, I find TON‘s recent price surge intriguing. While the price has rallied significantly, there are some concerning signs that could impact its future performance.

“To everyone’s surprise, Toncoin (TON) has emerged as a strong performer in the cryptocurrency market during the past few months. Compared to many other crypto-assets, TON has shown impressive gains.”

TON’s latest rally

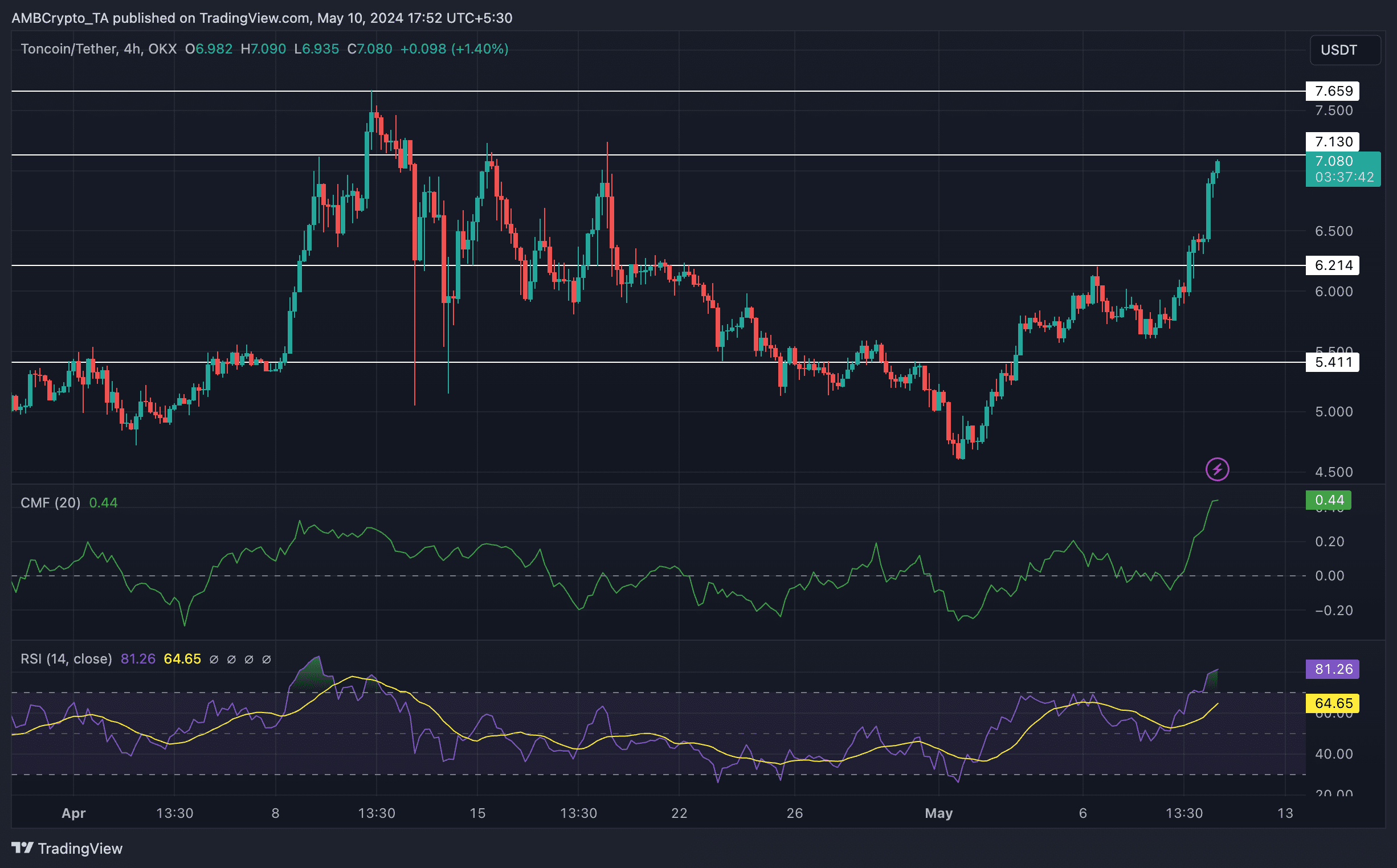

Over the past 24 hours, I’ve noticed an impressive 17.74% increase in TON‘s price. Previously, its chart showed a bearish trend since the 11th of April. Yet, this recent surge is substantial enough to potentially signal a reversal in the trend. Moreover, the Chaikin Money Flow (CMF) has been on an upward spree lately, suggesting that there’s been a steady influx of buying pressure for TON.

“Despite being above neutral, the RSI (Relative Strength Index) for TON indicates that it might be overbought, potentially leading to a minor price correction in the future.”

The introduction of Notcoin, a community token with a tap-to-mine mechanism, partially explains this phenomenon.

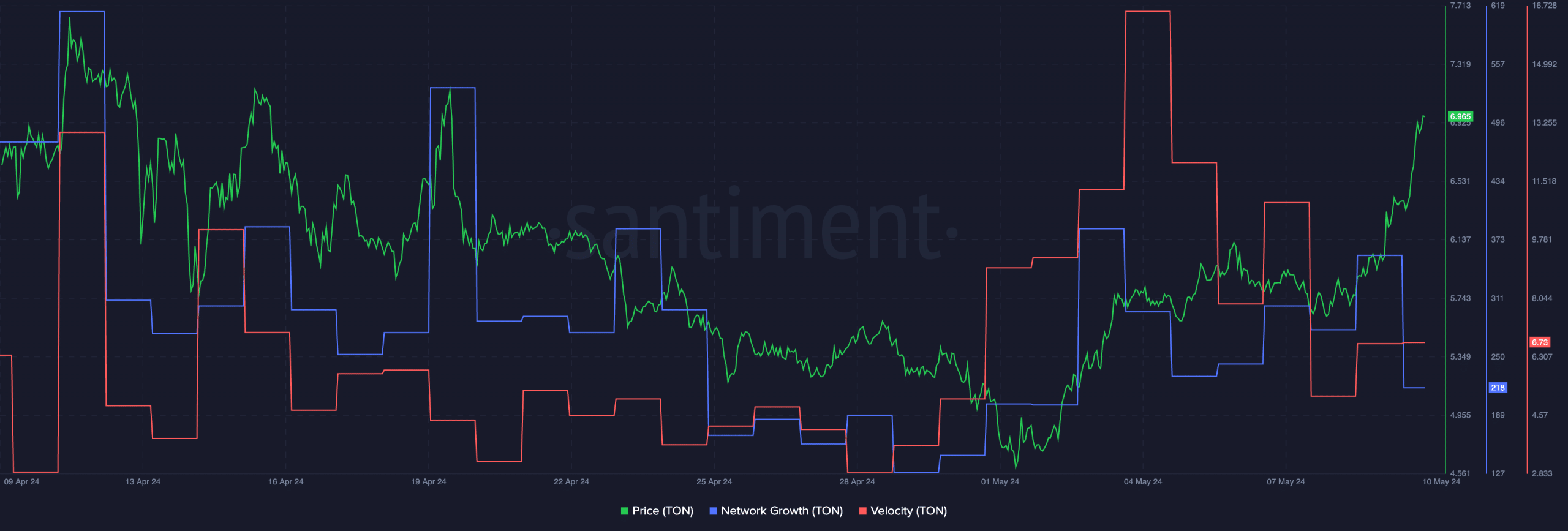

As an analyst, I’ve noticed some concerns despite the recent price increase for TON. One such issue is the decline in network growth. Specifically, the number of new addresses on the TON network has decreased noticeably over the past few days. This trend implies that the interest in the TON token may be waning among potential investors.

Additionally, the speed at which TON tokens were circulating decreased – Indicating a drop in their trading activity.

Read Toncoin’s [TON] Price Prediction 2024-25

As a analyst, I’ve identified several potential challenges that could negatively impact TON in the future and potentially impede its growth.

Looking at the data

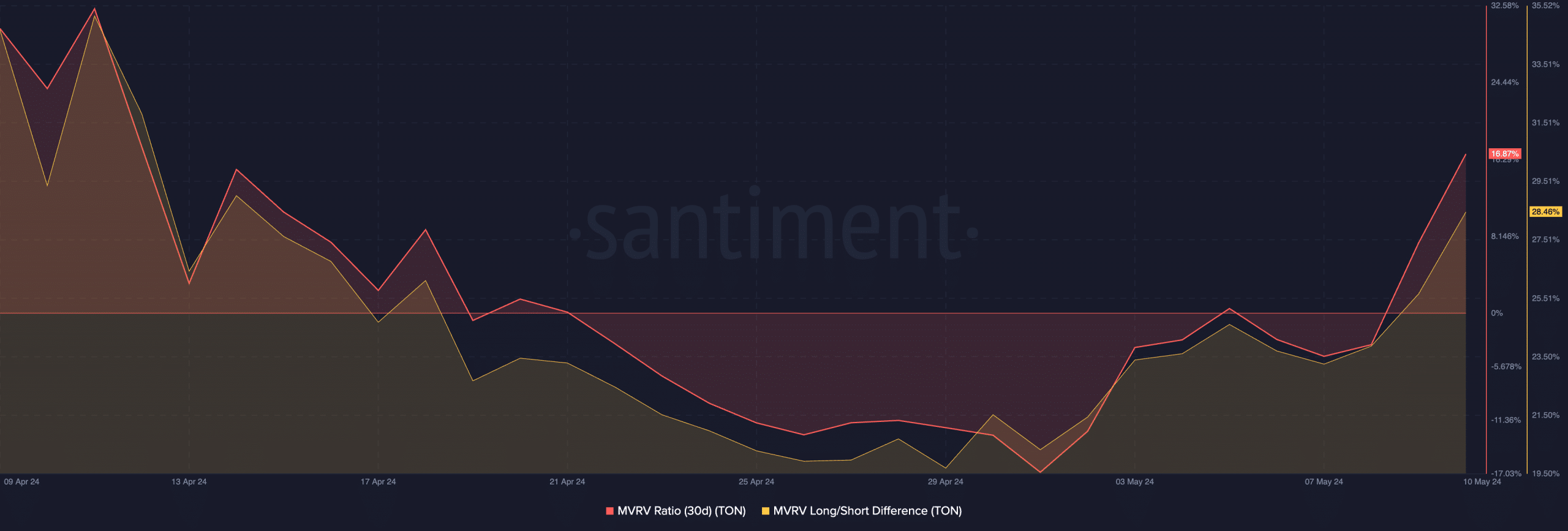

Additionally, the Multi-Vectored Risk Value (MVRV) ratio for TON has risen, signifying that many addresses have made a profit. This may encourage some of these addresses to sell their tokens, potentially leading to downward pressure on TON’s price.

During this time frame, the Long/Short ratio for TON increased significantly, suggesting a rise in the number of investors holding TON for the long term. It’s important to mention that these investors typically maintain a more stable and patient approach towards their investments, making them less likely to sell in response to market volatility.

In terms of overall activity too, the protocol did well.

Over the past few weeks, there was a remarkable increase in the number of daily active users on the network from 175,000 to 270,000. However, it came as a surprise that the network’s revenue took a downturn during this period.

Read Toncoin’s [TON] Price Prediction 2024-25

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-05-11 06:15