- Legendary trader Peter Brandt believes Ethereum’s price chart is ‘intriguing’

- Ethereum’s price showed signs of recovery, with an increase in new addresses

As a crypto investor with some experience under my belt, I’m keeping a close eye on Ethereum’s price movements and market sentiment. The recent volatility has been intriguing, to say the least, with the asset initially dipping below the $3,000-threshold before rallying back above it.

Ethereum has seen erratic price fluctuations, falling under the $3,000 mark in the past few days but then rebounding to surpass this level once more.

Traders and investors have been drawn to Ethereum’s price action lately, as the asset experienced a 1.4% increase at the onset of Friday. This uptick marks an important turning point for Ethereum, signifying its efforts to preserve its progress above this significant price threshold.

Analyzing Ethereum’s chart patterns and broader market sentiment

In the midst of market volatility, experienced trader Peter Brandt, with decades under his belt in financial markets, shared his thoughts on Ethereum’s price chart via social media platform X. He found the chart “intriguing.” This analysis ignited lively debates within the trading community.

As an analyst examining Ethereum’s price chart, I identified two distinct patterns: a flag and a channel. At first glance, I believed the flag to be a continuation pattern commonly observed during momentary pauses within active market trends.

However, upon further analysis, Brandt suggested that the pattern might better resemble a channel.

This structure is characterized by two equally slanted lines serving as its boundaries, with Ethereum’s price touching these levels at least twice. Though it’s debatable to pinpoint the precise design, Brandt emphasized the possibility of a price surge beyond either boundary, signaling an impartial stance towards Ethereum’s near-term price trends.

This neutrality is mirrored in the broader market sentiment.

The sentiment analysis by Santiment revealed a continuing “bearish” attitude towards leading cryptocurrencies, which has been ongoing since the Bitcoin halving on April 19. Despite this event, there was no substantial boost in market capitalizations across the crypto sector.

The prevailing atmosphere indicates that there may be short-term rewards, but the market approaches the future with apprehension regarding long-term possibilities.

Signs of recovery and technical outlook

As a analyst, I’ve noticed that despite the current pessimistic outlook, there are encouraging indications pointing towards a possible market recovery in the near future.

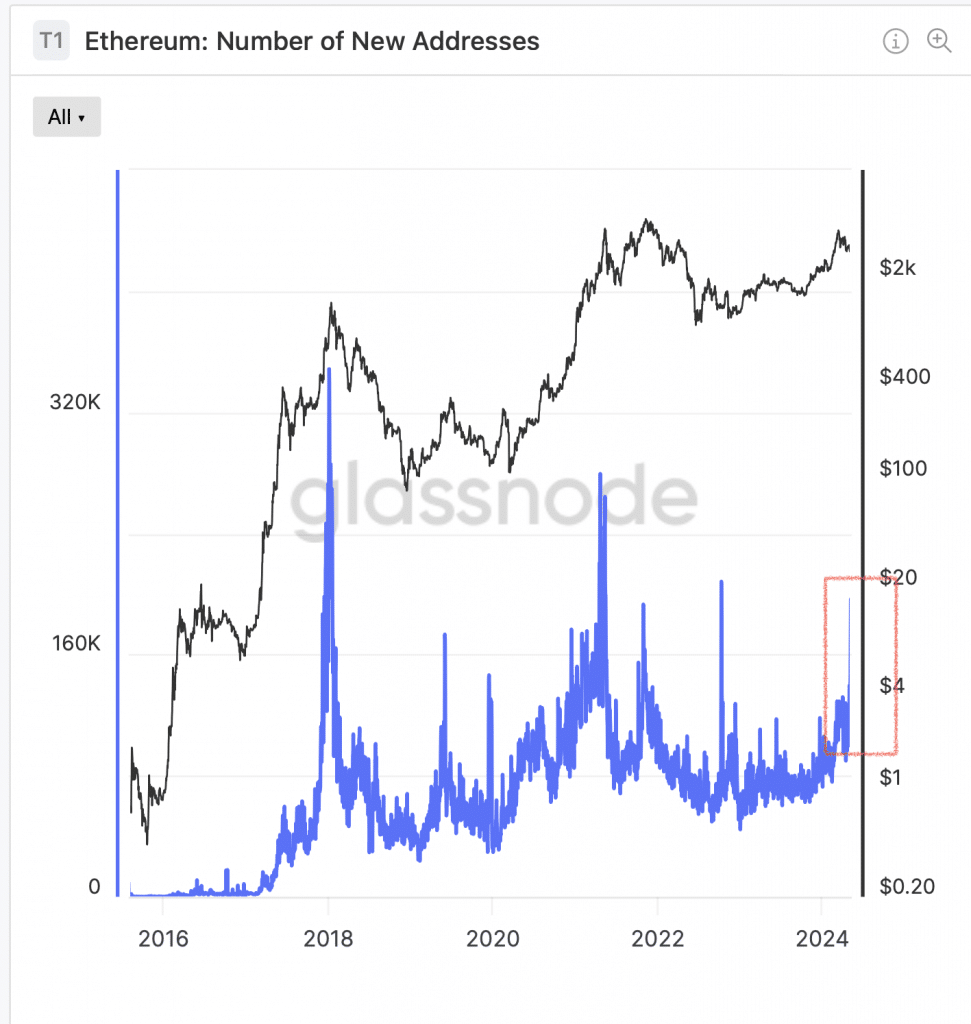

Based on Glassnode’s latest report, there has been a significant increase in the creation of new Ethereum addresses. The figure has risen from under 100,000 during the early part of January to over 160,000 currently.

An increase in the number of new Ethereum addresses might serve as a positive sign, suggesting growing curiosity and possible future investments in the cryptocurrency, notwithstanding its recent setbacks.

From a technical standpoint, the daily Ethereum chart showed a bearish pattern as of now, with consistent declines below key support levels. However, a more detailed examination of the 4-hour chart indicated that Ethereum might experience brief price rises. These upticks could represent market manipulations aimed at extracting liquidity at elevated prices before resuming the predominant downward trend.

According to AMBCrypto’s further examination, Ethereum’s price fluctuations became more erratic, as suggested by the expanding Bollinger Bands.

The RSI reading finished at 40, adding weight to the prevailing bearish sentiment among investors.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-05-11 07:03