- Grayscale’s Bitcoin ETF recorded a negative outflow of over $43M, triggering outflows for the other products

- However, Bitcoin’s market wasn’t particularly affected by it

As a seasoned crypto investor with a keen eye on market trends, I find the recent developments in U.S. spot Bitcoin ETFs intriguing. The negative outflow of over $43M from Grayscale’s GBTC and other products has raised concerns about changing investor sentiment. However, it seems that Bitcoin itself was not significantly affected by this news, as it continues to hold above the $63,000 mark.

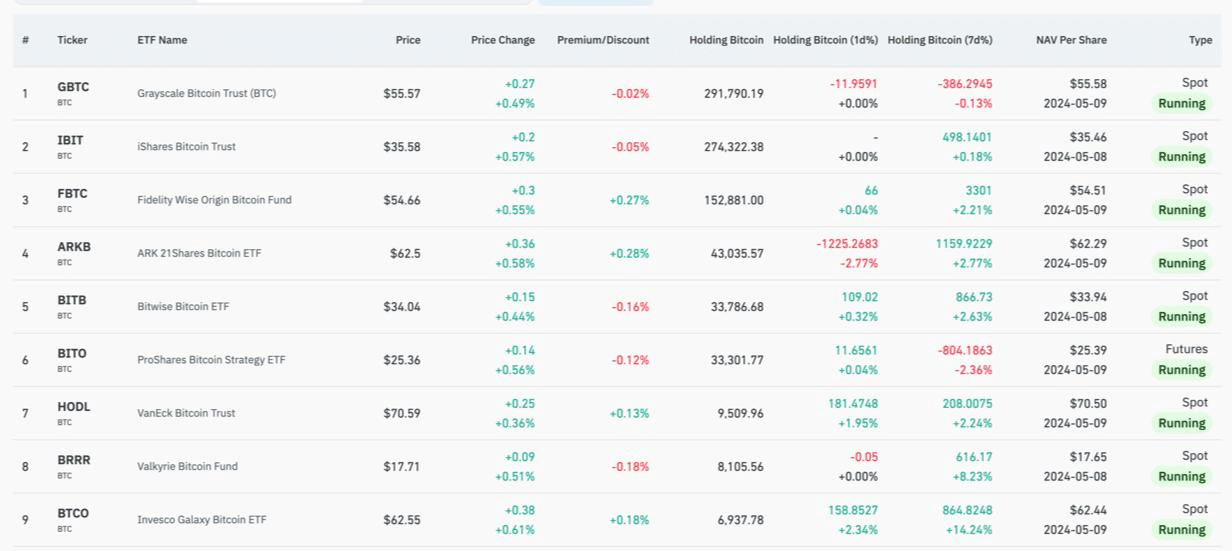

U.S. spot Bitcoin ETFs, previously anticipated to be a significant driver for Bitcoin’s bull run reaching $100,000 by 2024, have experienced sluggish activity this month. Yesterday alone, these products recorded approximately $11.3 million in withdrawals, instigated by Grayscale.

Change in investor sentiment?

The data from Coinglass uncovered concerning news for Grayscale’s GBTC as it experienced an outflow of approximately $43.4 million. However, there was a brief reprieve last Friday when the fund received an unexpected inflow of around $60 million, suggesting its lingering market influence.

In contrast, BlackRock’s IBIT Bitcoin ETF experienced a noteworthy inflow of $14.2 million, indicating increasing optimism among investors. Fidelity’s Wise Bitcoin ETF also saw a smaller but significant gain of $2.7 million.

The BITB ETF from Bitwise attracted $6.8 million in investments on Thursday, making it the preferred choice among ETFs with an impressive $11.5 million in total inflows. In contrast, other ETFs like Ark 21shares (ARKB), WisdomTree’s BTCO, and Franklin Templeton’s EZBC Bitcoin saw more modest gains with inflows of $4.4 million, $2.2 million, and $1.8 million, respectively.

Today saw fewer transactions for Bitcoin ETFs from Hashdex, VanEck, Valkyrie, and Invesco Galaxy, with no new investments recorded. This could indicate a decreased appetite amongst institutional investors for these specific Bitcoin ETF offerings.

As a crypto investor, I’ve observed that since their inception, these funds have attracted an impressive collective inflow of approximately $12.1 billion. Notable players like BlackRock’s iShares and Fidelity have dominated this space, contributing substantial investments. Interestingly, despite comparable performance with returns averaging around 28%, the responses from investors have shown striking differences.

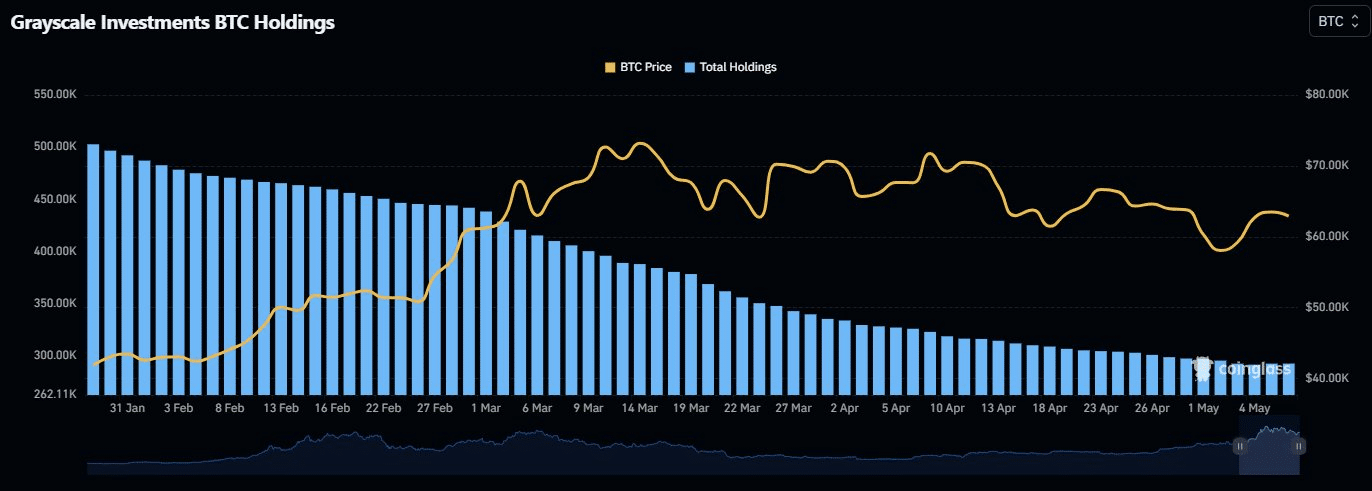

Grayscale suffered a massive setback, with over $17 billion in withdrawals since its conversion. Despite reducing fees, Grayscale’s charges remain substantially higher than most competitors, who typically charge between 0.2% and 0.25%.

As a crypto investor, I recently came across some interesting data from Coinglass. They indicated that Grayscale’s holdings include approximately 293 Bitcoins, currently valued at around $18.4 million.

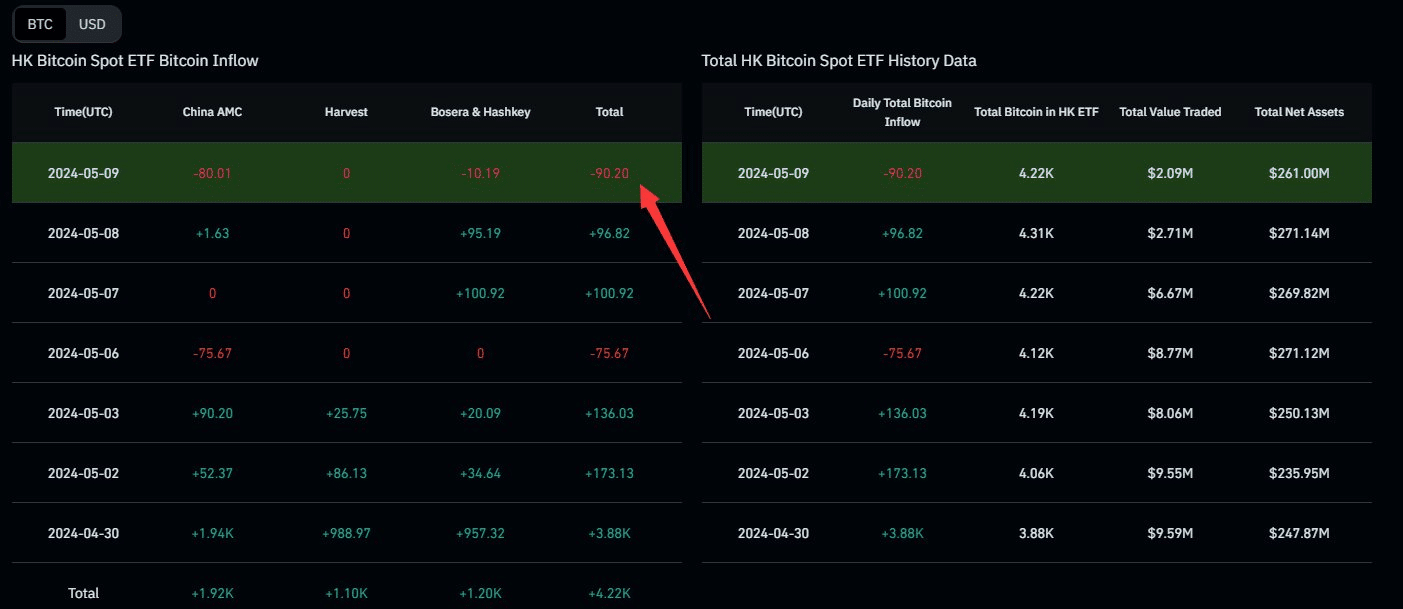

The outflows in crypto ETF products isn’t isolated to just the United States alone.

It’s worth noting that Bitcoin ETFs based in Hong Kong experienced withdrawals totaling over $5.5 million during the previous day, signaling a waning appetite for these financial instruments.

What about BTC?

Amidst the market turbulence, I, as an analyst, observe that Bitcoin has remained resilient and continues to maintain its position above $63,000 at present. A 4% increase in value within the past 24 hours underscores this strength. Additionally, data from CoinGecko indicates that a substantial 78% of the crypto community expresses bullish sentiment towards Bitcoin.

The Bitcoin halving failed to deliver the desired outcomes for many of us, yet investor and trader enthusiasm has predominantly remained bullish towards the top ten cryptocurrencies since then.

Despite growing uncertainties, the departure of smaller investors could unexpectedly pave the way for Bitcoin and other cryptocurrencies to rebound as summer nears, implying a possible restart in the erratic trends of the crypto market.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-05-11 08:07