- Bitcoin’s price uptick contrasted with traders closing positions, indicating market caution.

- Analysis suggested a short-term surge to $65K before a potential downtrend.

As a seasoned crypto investor with a deep understanding of the market dynamics, I find the recent Bitcoin price action intriguing. While the 2.8% daily increase and 6.8% weekly surge are undoubtedly positive signs, they come amidst cautious behavior from traders.

The price of Bitcoin (BTC) has experienced a significant surge in recent days. In just the last 24 hours, there was a 2.8% price hike, and over the past week, the cryptocurrency has seen a remarkable 6.8% growth. As a result, Bitcoin is currently trading above the $63,000 threshold.

As an analyst, I’ve noticed an uptick in prices recently, but the market conditions surrounding this trend are more intricate than just a simple bull run.

Bitcoin: Strategic movements

As a diligent researcher, I’ve noticed the upbeat price trends in the market, but upon closer examination, I discovered some noteworthy shifts in trader behavior that warrant further investigation.

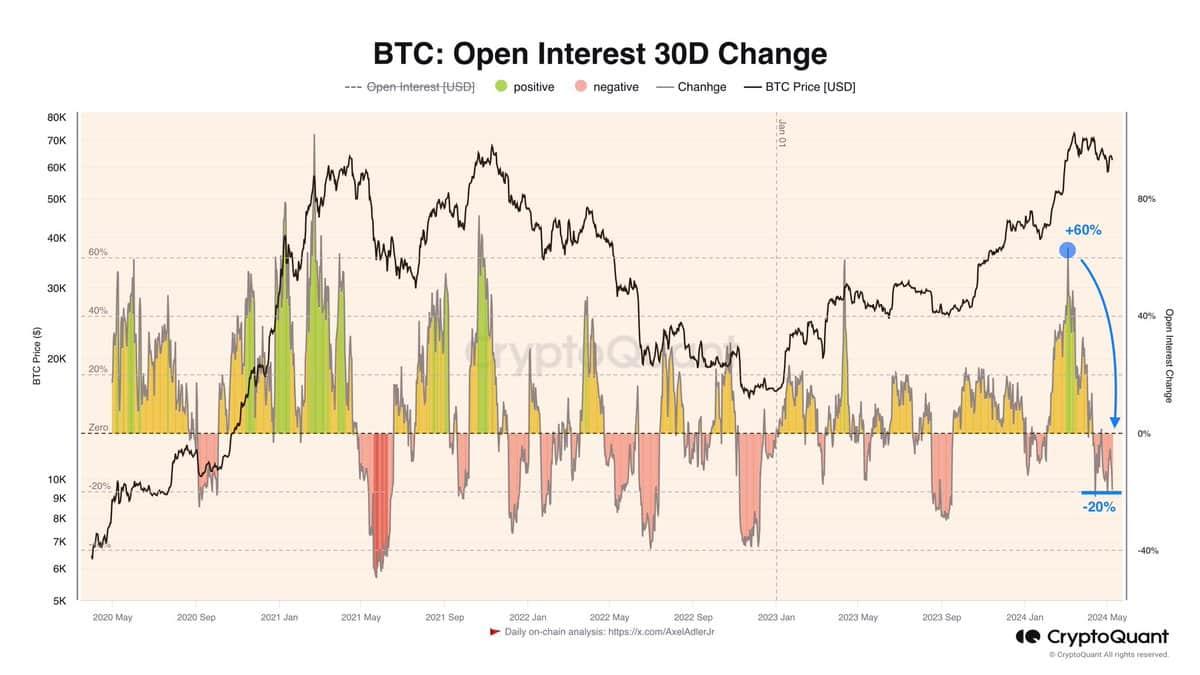

As a social media analyst on the X platform, formerly known as Twitter, I’ve noticed an intriguing trend based on CryptoQuant data. Specifically, I’ve observed that leveraged traders on perpetual trading platforms like Binance (BNB) have been actively closing their positions in recent times.

A decrease of 20% in Open Interest over the past month signifies that traders are adopting a cautious stance, choosing to exit their positions as they wait for price developments to unfold.

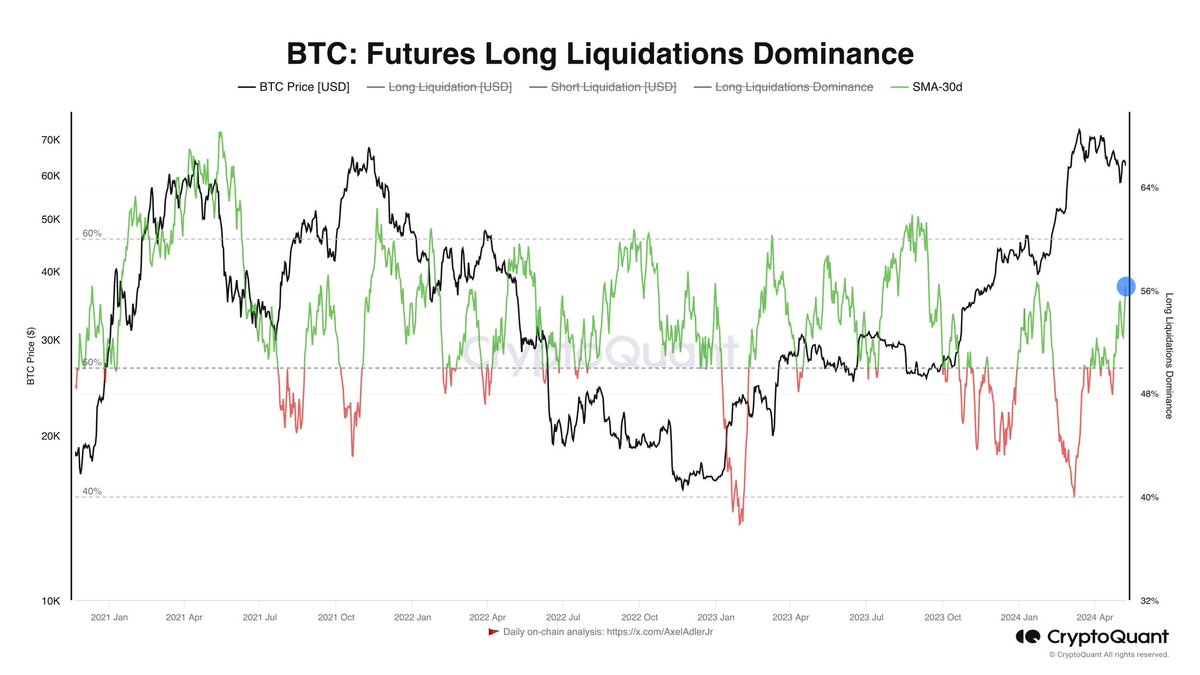

Traders exhibiting caution with Bitcoin transactions may not automatically signify a pessimistic perspective towards its market value.

As an analyst, I would interpret Adler’s observation differently. Instead of viewing the shrinking number of open positions as a sign of fear or hesitation, I believe traders are adopting a calculated and optimistic approach. They are not rushing to exit the market but rather biding their time, anticipating clearer indicators before making their next move.

The analyst noted,

“Perhaps it’s important for the market to experience this pessimism so that investors can build up short positions. Subsequently, these positions might be utilized to fuel a potential price increase.”

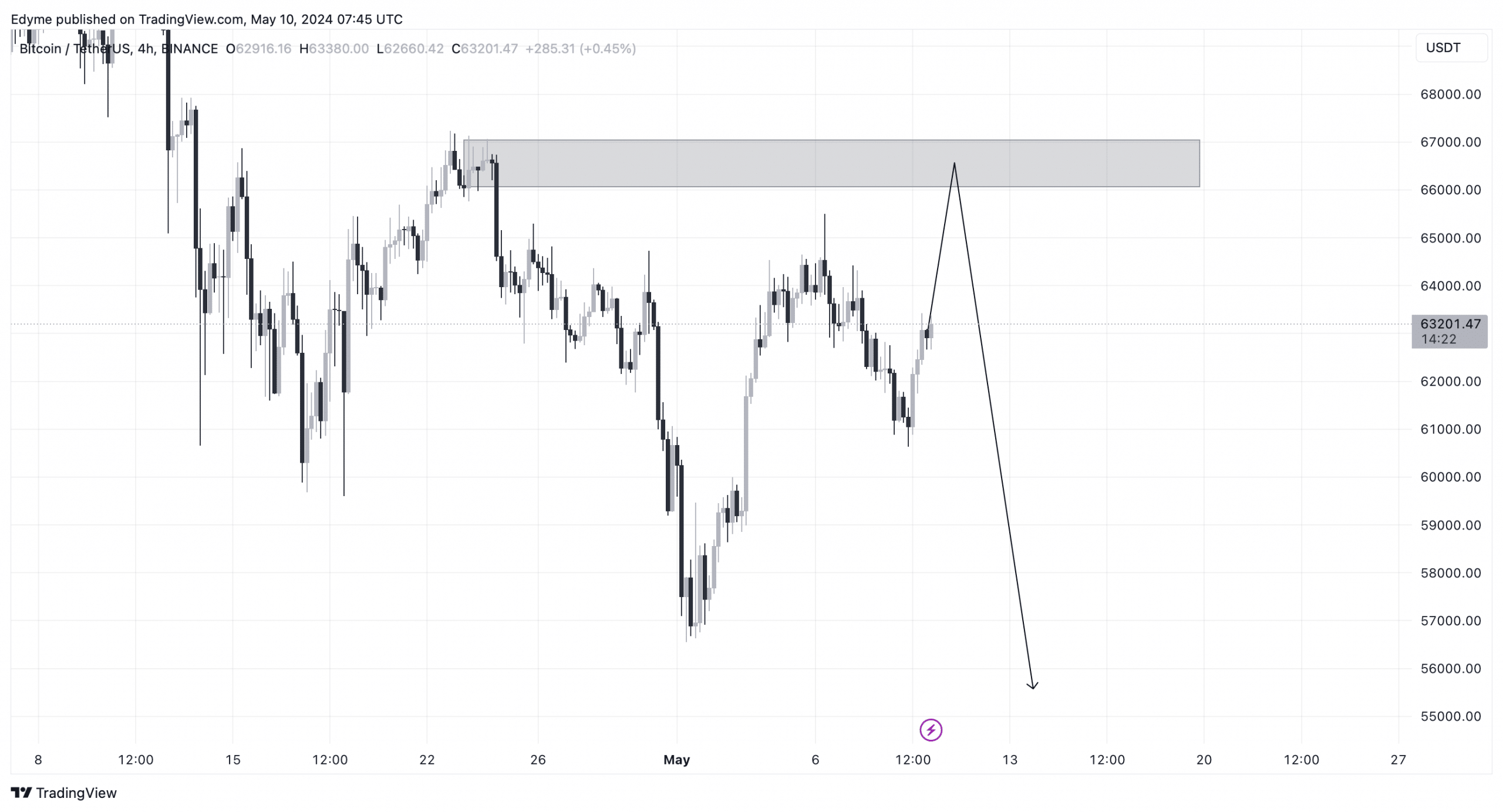

According to AMBCrypto’s analysis of Bitcoin’s market sentiment, the cryptocurrency displayed bearish signs on the daily chart. However, there could be a brief price surge towards approximately $65,000 in the short term before the overall trend continues.

As an analyst, I believe the current uptrend could be a deliberate move by market players to extract maximum liquidity at elevated prices prior to a potential deeper correction. This decline might push the price below the $56,000 mark.

What do liquidation patterns suggest?

The market’s current state is also reflected in the liquidation patterns observed.

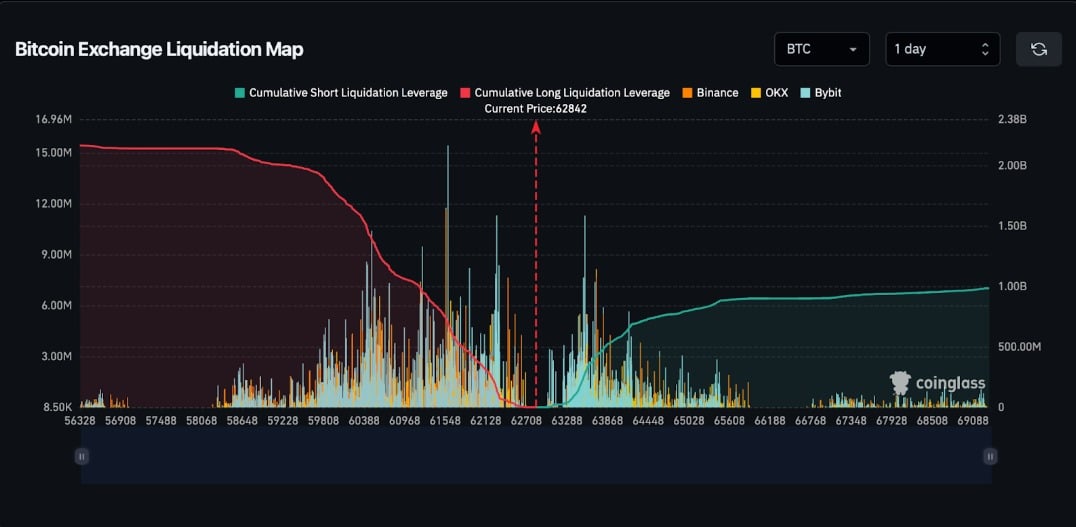

As a crypto investor, I’ve noticed an interesting trend based on data from Coinglass. At the moment, there are more Bitcoin short traders than long traders in the market. The total value of short liquidations reached a significant $2.16 billion, while long liquidations amounted to only $984.31 million. This means that a larger number of investors have bet against Bitcoin’s price increase than those who have bet on it.

A significant number of market players anticipated more price decreases based on the noticeable disparity.

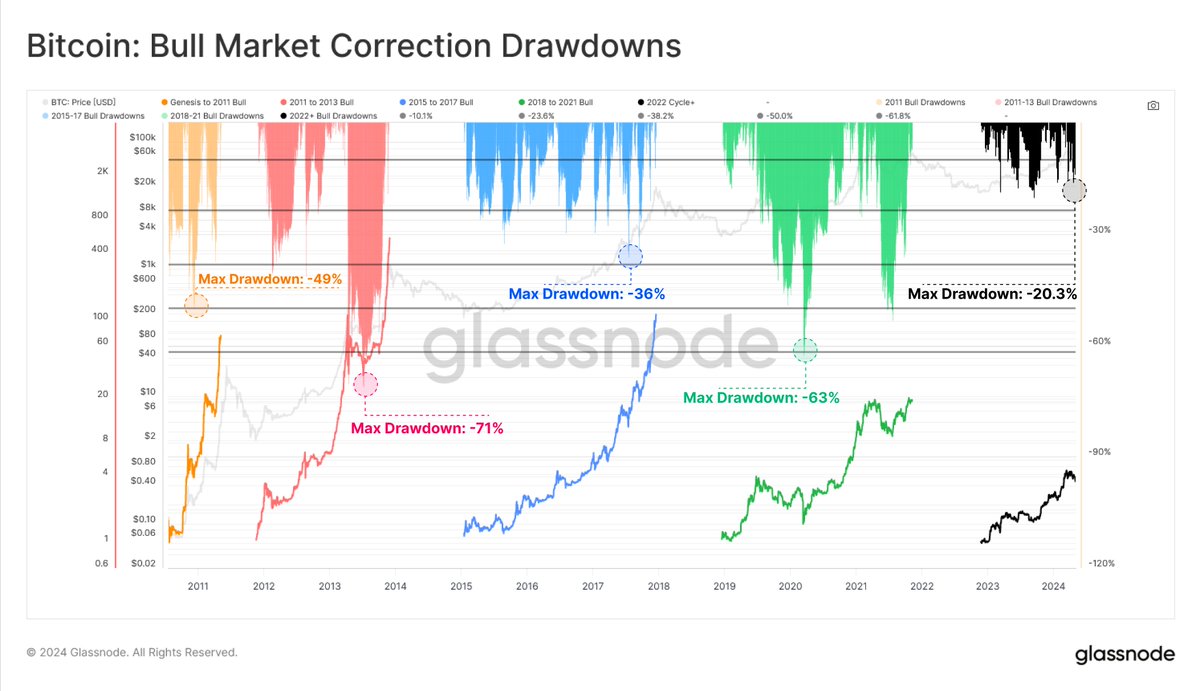

According to AMBCrypto’s analysis of Glassnode’s findings, Bitcoin has experienced a correction of approximately 20.3% since reaching its record peak of $73,000.

Read Bitcoin’s [BTC] Price Prediction 2024-25

As a crypto investor, I’ve noticed that the recent correction we’re experiencing is the most significant one on a closing basis since the turbulence caused by the FTX crisis back in November 2022.

As a crypto investor, I’ve been closely monitoring the market trends based on Glassnode’s analysis. Despite the occasional short-term corrections, the current macro uptrend shows signs of resilience with shallower corrections compared to previous cycles. This suggests that the underlying market strength remains solid, even in the face of temporary price fluctuations.

Read More

- Gold Rate Forecast

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- OM PREDICTION. OM cryptocurrency

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- Meet the Stars of The Wheel of Time!

- Why Gabriel Macht Says Life Abroad Saved His Relationship With Family

- Where Teen Mom’s Catelynn Stands With Daughter’s Adoptive Parents Revealed

- EUR PKR PREDICTION

2024-05-11 11:03