-

Some PEPE whales bagged billions of tokens, suggesting a price increase in the near term.

The NVT ratio indicated that PEPE’s price might decrease before the potential pump.

As an experienced analyst, I have seen my fair share of memecoin market trends, and this PEPE situation seems intriguing. Based on the recent developments, I believe there is potential for a price increase in the near term due to whale accumulation. However, it’s essential to consider other metrics before making a definitive call.

As a crypto investor, I recently came across some intriguing news on Lookonchain. According to their latest post, no less than four investors have purchased substantial amounts of PEPE within the past 24 hours.

Based on the post and evidence from Etherscan, it appears that a specific user transferred 350 billion PEPE tokens out of Binance (BNB)

The confirmation of keeping the token rather than selling it right away was underscored by this withdrawal. Meanwhile, another purchaser withdrew 101 billion tokens, equivalent to a value of $885,000, during the same time frame.

The other two purchases include a massive 123.66 billion and a 74.5 billion accumulation.

As a market analyst, I’ve observed numerous instances where substantial purchases of memecoins have transpired in the cryptocurrency market, according to AMBCrypto’s reports.

Big players are getting ready

As a crypto investor, I believe that such events suggest preparation among market participants for a potential price surge.

Past events have also shown that this sort of accumulation foreshadows a rise in PEPE’s value.

As of the current moment, PEPE was being traded for approximately $0.00000875 per token, marking a moderate 1.32% growth within the past 24 hours. Nevertheless, this figure might not be its final price surge.

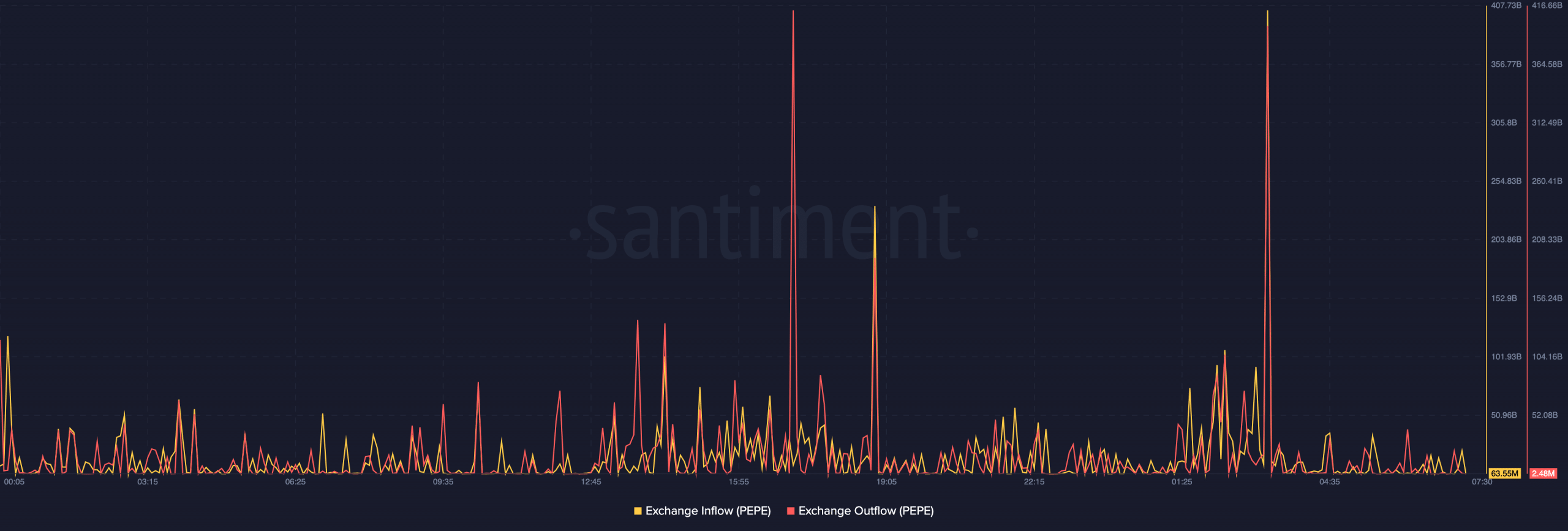

As a crypto investor, I believe it’s important to examine various on-chain metrics before making any bullish predictions. So, let me walk you through one of the metrics AMBCrypto considered: exchange flow. By analyzing the volume and direction of coins moving in and out of exchanges, we can assess whether there is an influx or outflow of tokens. This information helps us determine if investors are accumulating or distributing their holdings, which can provide insights into potential price movements.

Based on Santiment’s data, approximately 63.55 million PEPE tokens were transferred out of exchanges over the past day, whereas about 2.48 million tokens entered the exchange platforms.

The significant disparity between the amount of memecoin flowing in through purchases and the amount going out through sales indicates a greater number of investors choosing to keep the asset rather than looking to offload it.

This update indicates that PEPE‘s price may not undergo a major decrease in the near future. On the contrary, it seems possible that the token could rebound and reach the price point of $0.000010 again.

Taking it one step at a time

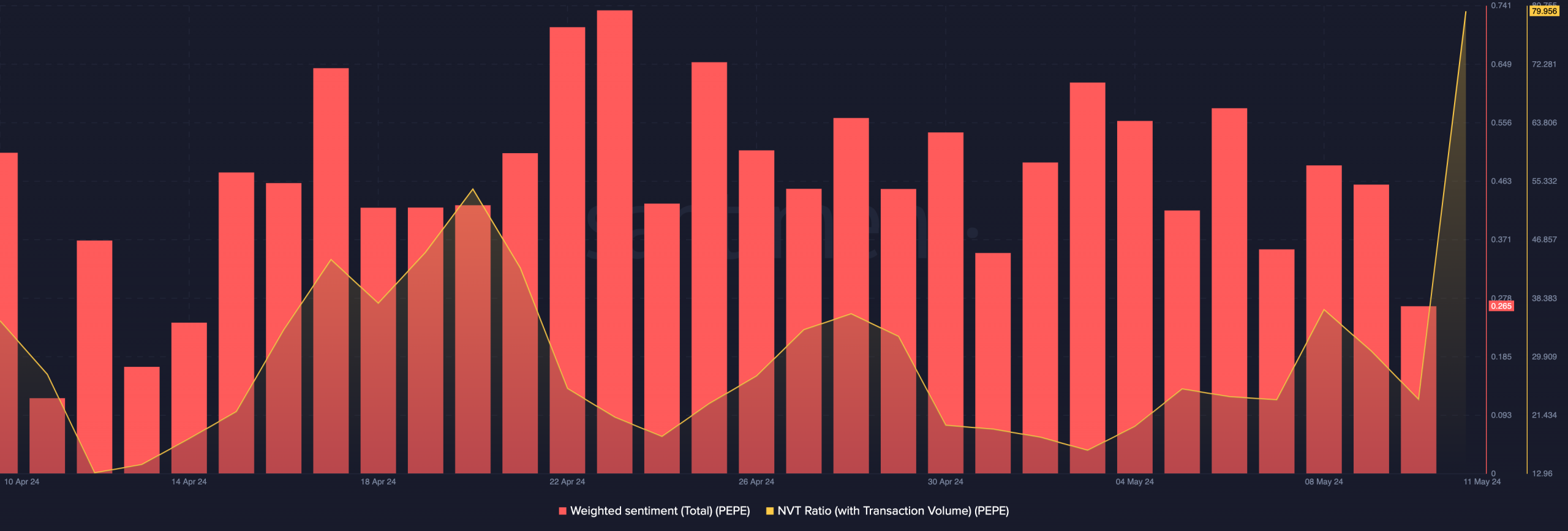

Although there was a suspicion of an impending price hike, Market players remained skeptical that PEPE‘s surge was imminent based on the analysis of the Weighted Sentiment by AMBCrypto.

The Weighted Sentiment score, which represents distinct opinions toward a particular project, stood at 0.265 as of the latest update.

As a researcher examining the discourse surrounding the memecoin, I’ve observed that the majority of comments have been positive in recent times. Nevertheless, there has been a noticeable decrease in positivity since the 9th of May. This suggests that while optimism was once high, it seems to be waning.

If the attitude towards PEPE remains positive, there’s still a possibility for it to rebound. Yet, its NVT ratio reached an elevated level of 79.95.

The acronym NVT represents Network Value to Transaction Ratio. This metric signifies whether a network’s market capitalization is in line with its transactional activity. When the NVT ratio is relatively low, it indicates that the network’s transaction volume is expanding at a faster pace than its market cap.

Is your portfolio green? Check the PEPE Profit Calculator

In this instance, the price could be ready for the next leg up.

Based on the information given, PEPE‘s NVT ratio rising suggests that the market capitalization is expanding more quickly than its trading volume. This could be an early sign that the price may experience a temporary decrease before experiencing a notable surge.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- MrBeast Slams Kotaku for Misquote, No Apology in Sight!

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

2024-05-11 16:07