-

Bitcoin’s Open Interest grew materially as price of BTC declined.

Long term holders begin selling their holdings, interest in ETFs remained high.

As an experienced financial analyst, I’ve seen my fair share of market trends and volatility in the crypto space. The recent developments in Bitcoin (BTC) have been intriguing, to say the least.

Over the past several days, there has been a significant increase in open interest for Bitcoin [BTC], even as its price remains relatively stable within the $63,000 vicinity.

Open Interest on the rise

A larger volume of open interests in futures contracts usually signifies an increased number of traders joining the Bitcoin market. Consequently, this influx of participants may result in heightened price fluctuations as they make wagers on the anticipated future value of Bitcoin.

When larger sums of money are at stake, price fluctuations can grow more significant as investors with opposing views clash. This heightened volatility presents potential gains but also amplifies risks.

A rise in Open Interest for Bitcoin Futures contracts signifies a larger number of active contracts in the market. This leads to an expanded roster of potential buyers and sellers, thereby enhancing market liquidity. Consequently, entering and exiting positions becomes more facile due to the increased activity.

This can be beneficial for the overall market health for BTC.

ETF saga

Based on the information provided by Coinglass, I’ve noticed that there are more short positions than long ones for Bitcoin at the moment. This means that investors are betting against the price of Bitcoin, expecting it to decrease. However, only time will tell if these bears are correct with their predictions.

One significant influencing element on Bitcoin’s (BTC) price movement could be the current status of Bitcoin Exchange-Traded Funds (ETFs). As per SoSoValue’s recent report, a total net outflow of approximately $84.66 million was observed in Bitcoin spot ETFs on May 10th.

The GBTC ETF by Grayscale experienced a daily drain of $103 million, while the IBIT ETF from BlackRock attracted $12.4363 million, and Fidelity’s FBTC ETF gained $5.3039 million in investments.

The high amount of inflows could impact the price of BTC positively in the long run.

Long-term holders take a hike

At the moment of publication, the situation for Bitcoin (BTC) appeared grim. Its price dropped to $60,833.76, representing a 3.4% decrease over the previous 24 hours. Furthermore, the volume of BTC transactions decreased by 1.8%.

Read Bitcoin’s [BTC] Price Prediction 2024-25

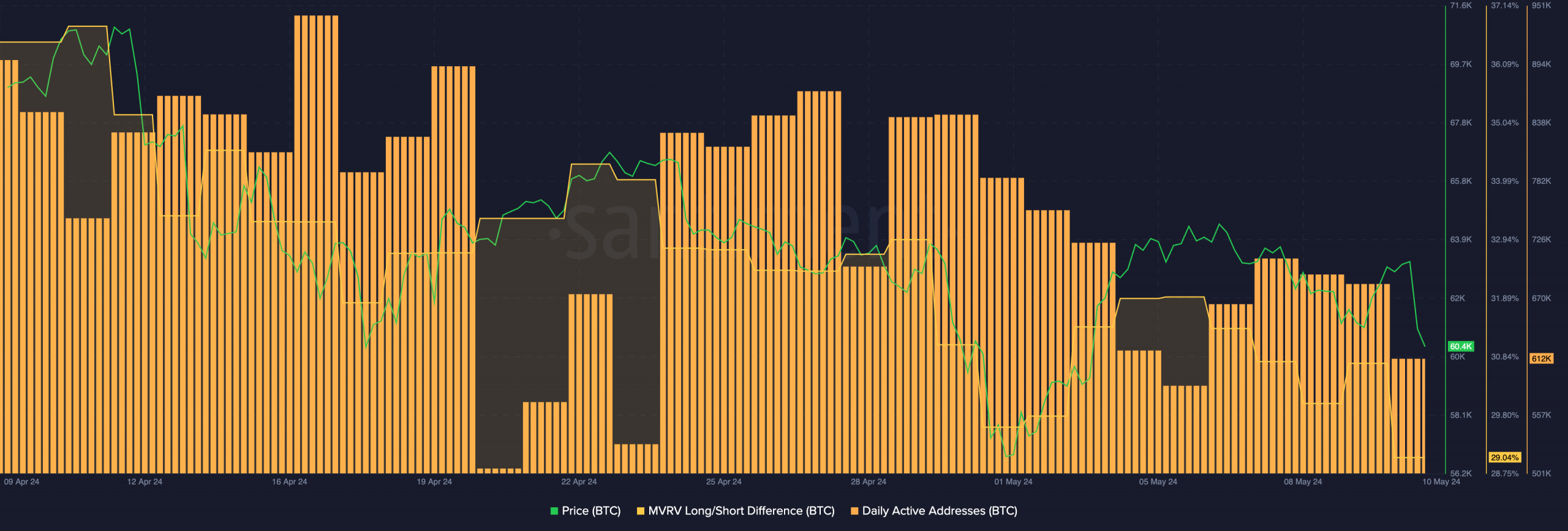

It’s unexpected that the gap between the number of long-term and short-term Bitcoin holders decreased, coinciding with the price drop. This implies that there has been a significant reduction in the number of long-term address holders for Bitcoin.

Over the past few days, the number of daily active addresses on the Bitcoin network has significantly decreased. This decline suggests that the overall engagement with the Bitcoin ecosystem is dwindling, which might have a negative influence on Bitcoin’s price.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-11 20:07