-

Bitcoin’s market structure revealed it was close to a re-accumulation zone.

A bounce to $65,065 could be BTC’s target once the coin recovers.

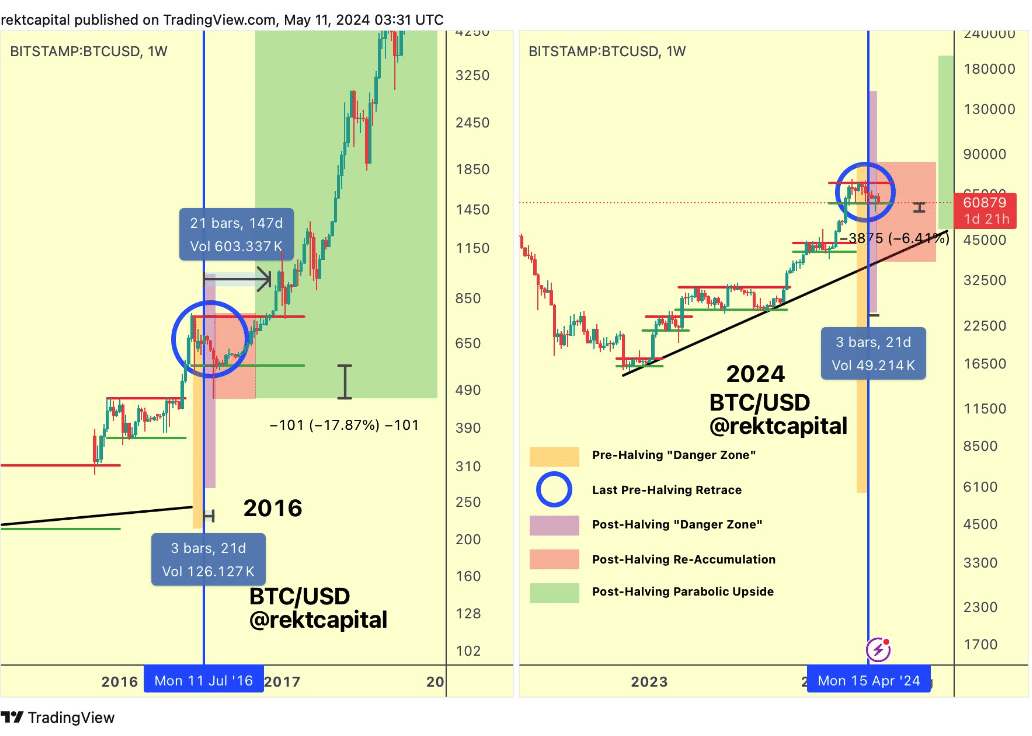

As a seasoned crypto investor with several years of experience in the market, I’m keeping a close eye on Bitcoin’s [BTC] current market structure. According to Rekt Capital’s analysis, Bitcoin seems to have left the danger zone and is now in the re-accumulation area. This means that the coin has satisfied the post-halving correction, and a bounce to $65,065 could be BTC’s target once it recovers.

Based on the analysis of cryptocurrency trader Rekt Capital, Bitcoin (BTC) has moved beyond the risk zone and now resides in the region for collecting more supplies. This insight was shared by the trader through a post on X, previously known as Twitter, on the 11th of May.

As a researcher examining the data presented by Rekt Capital in the chart, I can observe that Bitcoin appears to be fulfilling the typical corrective phase following its halving event. In approximately two days, it seems possible that Bitcoin may have completely exited the potentially risky zone.

The red days are almost over

To support his argument, he looked back at the cryptocurrency market in 2016. During that period, there were three successive bearish engulfing candlesticks identified within a 21-day span. Subsequently, Bitcoin experienced significant growth and surpassed $4,250 within several months.

In the 2024 price chart, a new sequence of red candlesticks emerged, implying that Bitcoin’s price correction might be nearing its conclusion. Currently, Bitcoin is priced at $60,509.

I observed a decline of 5.61% over the past week in Bitcoin’s value. Consequently, numerous Bitcoin contracts in the market had to be closed due to this significant drop.

According to information obtained from Hyblock, AMBCrypto identified areas with significant magnetic pull surrounding liquidation thresholds. This marker signifies prices at which traders may face compulsory sale of their positions.

In simpler terms, the magnetic field represented by the blue zone signifies a significant amount of buying and selling activity, potentially causing Bitcoin’s price to trend towards $65,065 in the near future.

As a researcher studying the cryptocurrency market, I’ve observed that if Bitcoin (BTC) fails to bounce back, it could lead to a deeper price decrease. Additionally, the Cumulative Liquidation Level Delta (CLLD), which is a measure of the total amount of long and short contracts being liquidated, was showing a negative value during this period.

When negative values prevail in the CLLD (Composite Length of Delayed) indicator, it suggests that the length of time between short positions being opened and liquidated is decreasing. In other words, shorts are experiencing more frequent liquidations. If this trend continues, it could potentially be a bullish sign for Bitcoin’s price as it may indicate increased buying pressure in the market.

HODLers are in on the exit

Another metric on Glassnode indicated a possible price rise that we discovered. Specifically, it was the Hodler Net Position Change.

Long-term Bitcoin investors’ monthly net position change indicates whether they’re buying or selling more than previously. A negative value signifies these investors have sold more Bitcoins than bought during the month, potentially cashing in on profits or exiting their positions.

The Hodler Net Position Change, when interpreted positively, suggests that investors have been purchasing or accumulating cryptocurrencies up to the last week of April. Prior to this period, a negative reading of the metric indicated that investors were selling or realizing their profits.

Starting from the first week of May, I’ve noticed a shift in the market dynamics. More precisely, on the 10th of May, long-term investors purchased approximately 26,990 Bitcoins. Currently, there are signs suggesting that this trend could persist.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Maintaining this pace could result in Bitcoin staying above $60,000 in the near future. In the bigger picture, this consistency could play a significant role in driving further upward price movements.

Traders should exercise caution as Bitcoin may continue to decline according to Rekt Capital’s analysis. It is possible that Bitcoin could experience a couple more days of price decreases before potentially starting to recover gradually.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-12 09:11