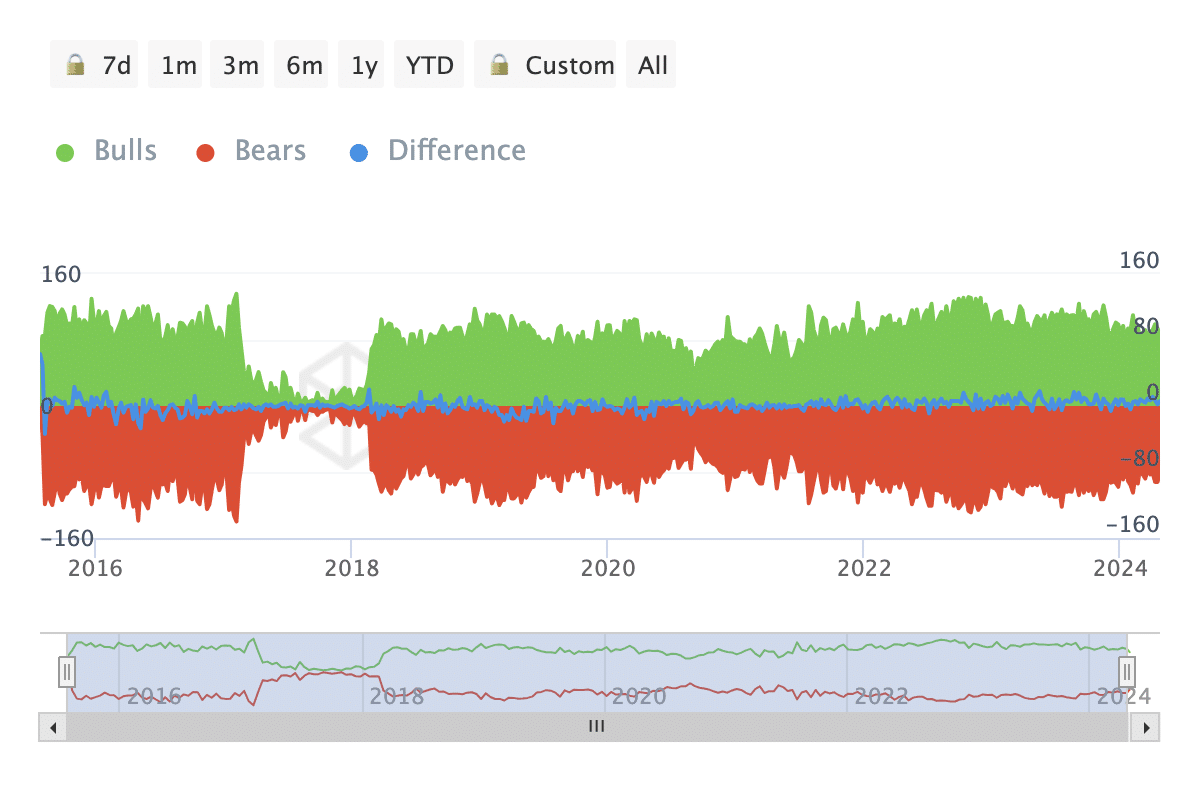

- The positive reading of the bulls and bears indicator suggests that the price might increase.

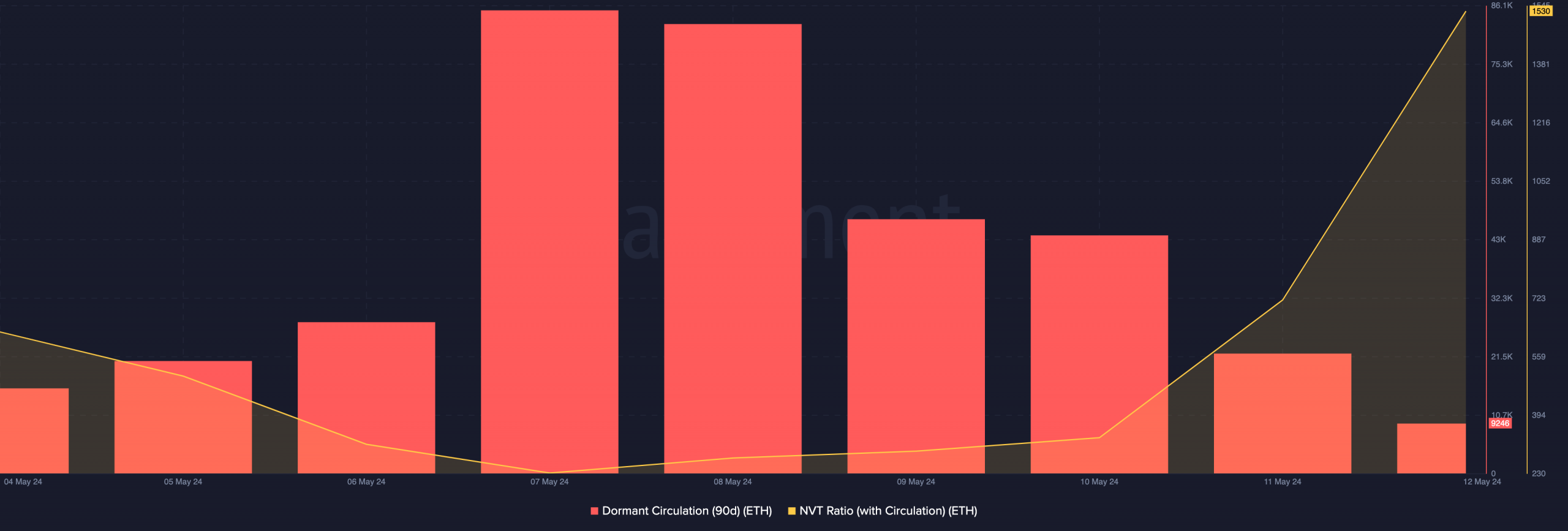

- Ethereum’s network was overvalued and could hinder the potential upswing.

As a seasoned crypto investor with several years of experience under my belt, I closely follow various indicators and metrics to make informed decisions about my investments. The recent bullish signal from Ethereum’s Bulls and Bears indicator is an encouraging sign, suggesting that the price might increase in the near term. However, I remain cautious as Ethereum’s network valuation, as indicated by the Network Value to Transaction (NVT) ratio, seems overvalued at the moment.

In the past 24 hours, Ethereum’s [ETH] price has dropped by 7.30%. However, based on a crucial signal, it seems that this downturn could be coming to an end shortly.

The metric under discussion is referred to as the Bulls and Bears indicator from IntoTheBlock. This measurable value can be calculated based on either the number of addresses or the transaction volume.

Instead, let me note that while much attention is often given to major purchasers or vendors due to their significant impact on price fluctuations.

The 1% want to keep the faith

As an analyst, I would interpret a net negative reading on the Bulls and Bears indicator to mean that there are more significant sell orders in the market than buy orders. Consequently, the price of the underlying asset could potentially experience a downward trend due to this imbalance.

As a researcher studying Ethereum’s market trends, I have observed some encouraging data. The metric in question has shown positive readings, suggesting a bullish sentiment among investors regarding the price trend. If this trend persists over the coming days, Ethereum could potentially reach new heights and approach the $3,100 mark.

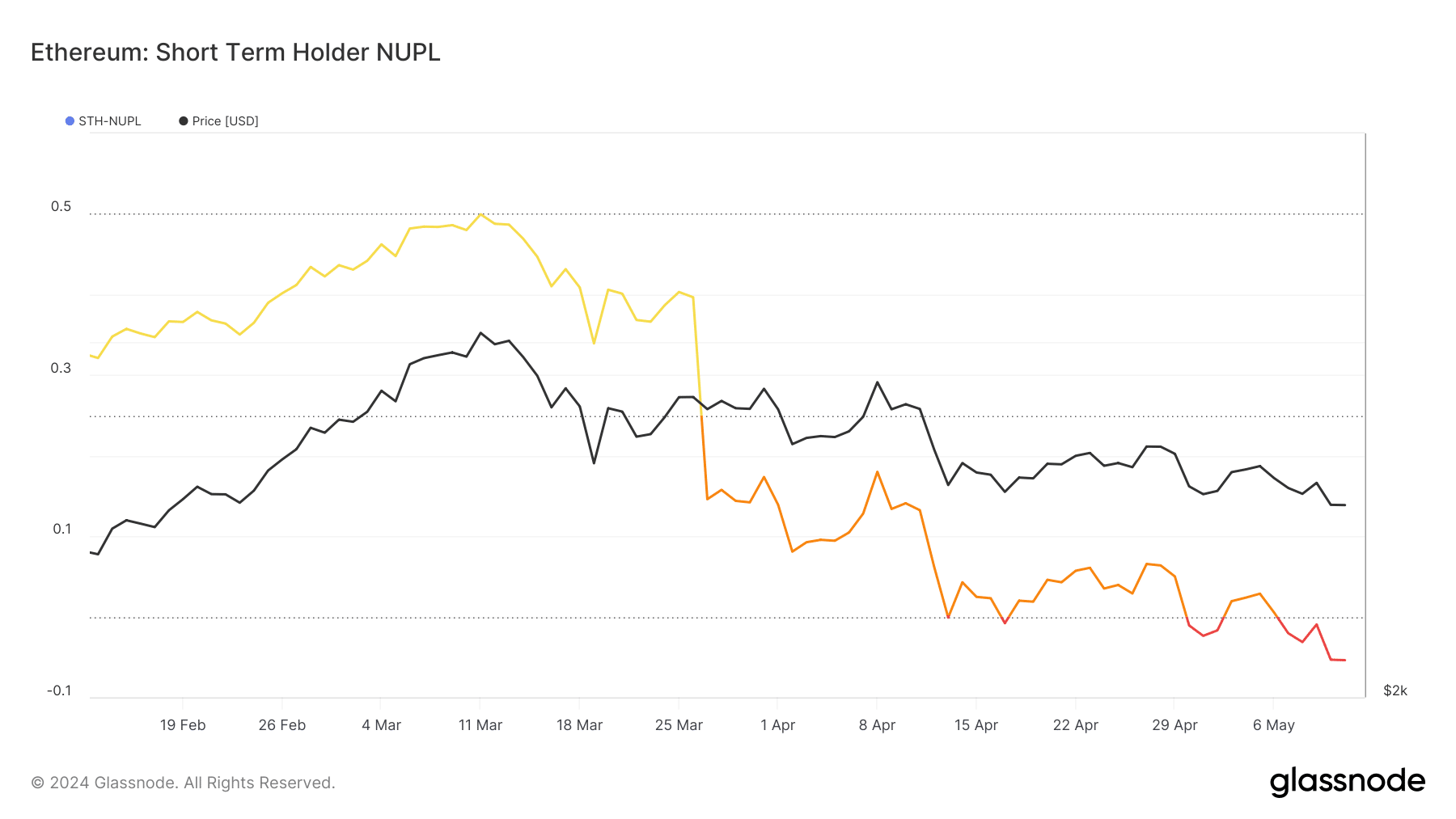

As a crypto investor, I’ve noticed that Ethereum’s current price level around $2,800 might not be enough to maintain its status quo or push it higher. Based on my analysis of Ethereum’s STH-NUPL indicator from AMBCrypto, I sense a lack of confidence among market participants regarding this cryptocurrency.

The acronym STH-NUPL represents “Short-Term Holders: Net Unrealized Profit/Loss.” By using this term, we gain insight into the actions of short-term investors in the market.

Investors panic, but ETH may come to their aid

Based on our examination, the lackluster performance of Ethereum’s price has shifted investor attitudes towards the cryptocurrency. Back in March, the sentiment indicator placed it in the optimistic zone.

At that time, Ethereum (ETH) investors were optimistic about its price trend. However, based on current developments, this outlook has shifted towards “capitulation” – a stage where sellers dominate the market, signaling widespread fear among traders.

Despite the fear that may arise, a decline in STH-NUPL could serve as an incentive for a rebound in Ethereum’s price. However, if STH-NUPL persists in its downward trend, Ethereum’s value might follow suit.

If fear intensifies, there could be a shift in direction with a stronger uptrend emerging if purchasing activity picks up.

In this instance, Ethereum might target a rise toward $3,500. Besides this metric, AMBCrypto found another indicator suggesting that ETH might soon recover.

This time around, we turned our attention to the circulation that had been inactive for 90 days. As per the data from Santiment’s on-chain analysis, the quantity of coins that had been dormant for this length of time had decreased to approximately 9246.

As an analyst, I would interpret an increase in the metric as a sign that coins which have been dormant for extended periods are now being transferred to new wallets. This shift could indicate that experienced holders are choosing to sell their assets.

In simpler terms, the decrease in Ethereum prices more recently suggests that long-term investors weren’t offloading their holdings as extensively as they did during the 7th and 8th of May.

Read Ethereum’s [ETH] Price Prediction 2024-25

Based on the Network Value to Transaction (NVT) ratio’s indication, Ethereum might still be considered overpriced. A low value for this ratio typically points towards an asset being underpriced.

For Ethereum, the given metric experienced a significant surge, implying that the network’s value may be disproportionately high compared to its transaction volume.

Read More

- OM/USD

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- ETH/USD

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-05-12 21:11