-

Despite the accumulation, DOGE’s price might face resistance at $0.15.

Traders looking to short the coin might get burnt as a recovery might happen quickly.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned to read between the lines when it comes to market trends and price movements. And based on the latest developments with Dogecoin (DOGE), I believe that despite the accumulation by large addresses, there might be some resistance at $0.15.

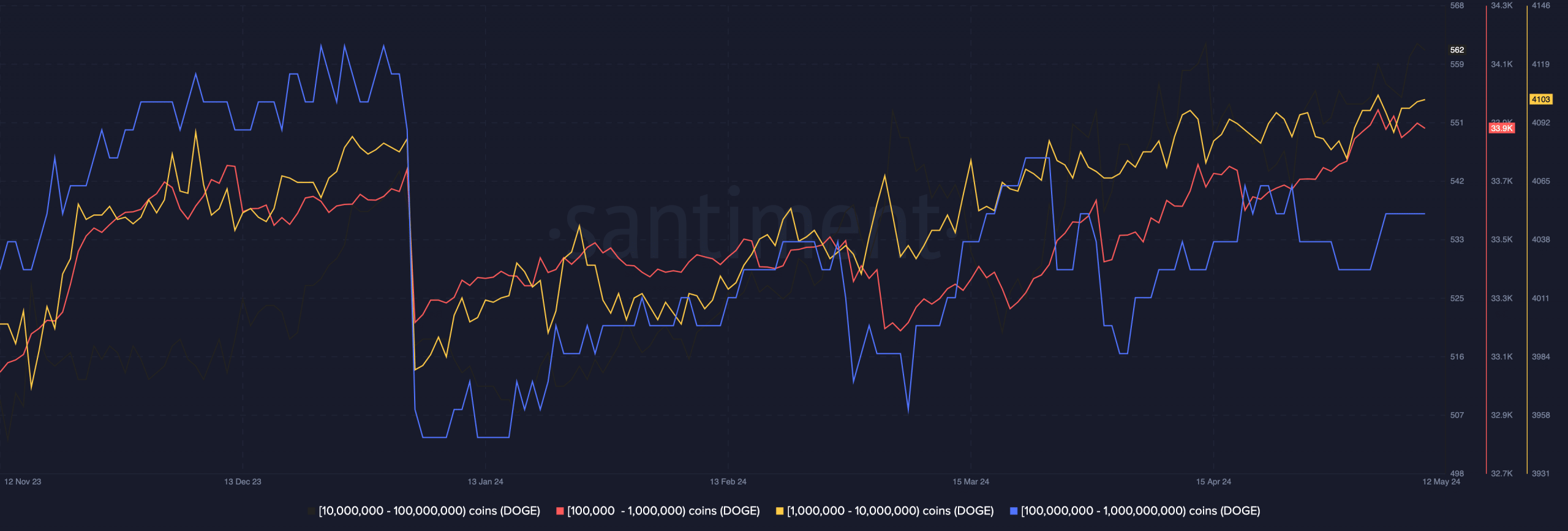

As a researcher, I’ve uncovered some intriguing data regarding Dogecoin [DOGE] addresses holding a significant amount of coins. Specifically, the number of these addresses, which contain between 100,000 and 1 billion DOGE, has seen a notable rise. This information is confirmed by my current findings with AMBCrypto.

Employing data from Santiment, we noticed that the accumulation started around the 2nd of April.

As a crypto investor, I’ve observed that an uptick in the number of active Dogecoin (DOGE) wallets is often an indicator of heightened demand for the coin. In turn, increased demand can lead to a potential price hike for DOGE.

DOGE plans to win

In the majority of situations, an anticipated price rise doesn’t occur right away. This is due to the fact that transactions may be taking place at other points in the market.

As of this writing, DOGE’s price was $0.14— a 28.18% correction in the last 30 days.

If the quantity of larger investors buying Dogecoin at reduced prices continues to rise, there’s a good chance that Dogecoin will experience another price surge and reach around $0.18 once more.

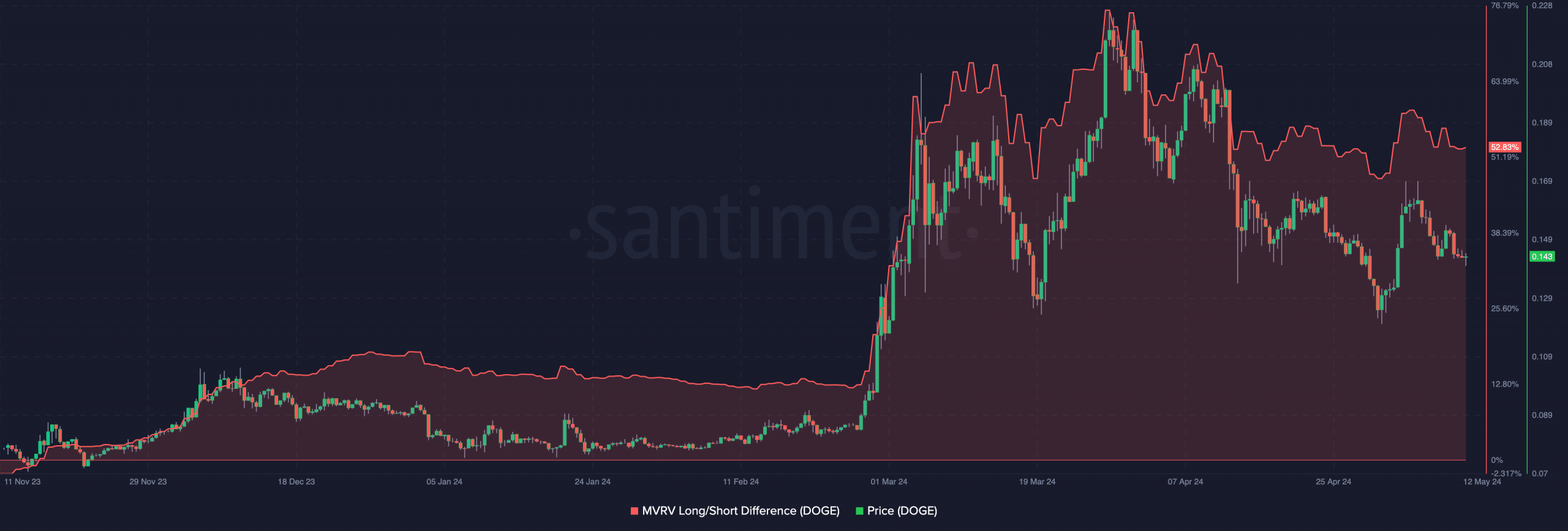

Additionally, AMBCrypto examined the Market Value to Realized Value (MVRV) Ratio’s Z-Score. This indicator helps determine whether a particular cryptocurrency is experiencing a bearish or bullish market trend.

As an analyst, I would interpret a negative MVRRealized Value Z Score as a sign of a bear market. However, when it comes to Dogecoin, with an MVRV Z Score of 52.83%, I would say that this cryptocurrency has managed to keep its bullish momentum despite the broader market trending bearish.

If the metric continues to decrease, implying a possible further drop in price, Dogecoin could potentially reach a trading value of $0.12.

For a trader, considering entering a position as this price is dropping could present an opportunity. Nevertheless, examining additional metrics is crucial before making a definitive investment decision.

Wait for a decline before placing the trade

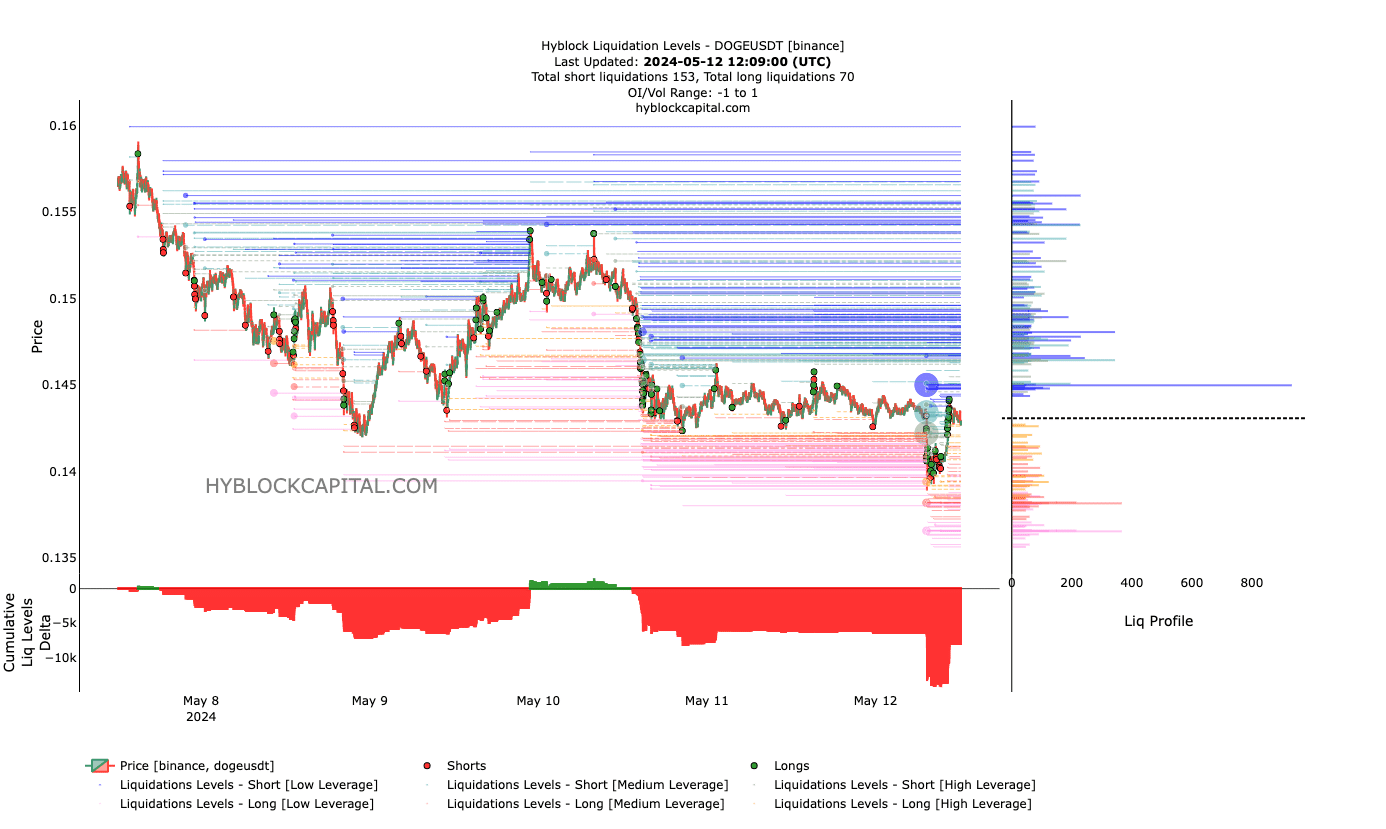

As a crypto investor, I closely examine the liquidation levels to gain insights into a digital asset’s potential price action. These levels provide valuable information about the market’s sentiment and the point at which automatic sell orders are triggered for margin positions. By analyzing these levels, I can make informed decisions and adjust my investment strategy accordingly.

The indicator signifies regions of significant market fluidity, potential areas where substantial price adjustments due to mass sell-offs could transpire.

Based on Hyblock’s analysis, a significant increase in liquidity for Dogecoin occurred at the $0.15 mark, making it potentially difficult for the cryptocurrency to attain this price level.

Should the current situation persist, it may be wiser to hold off on purchasing Dogecoin for now. However, if the price takes a downturn, it could present an attractive buying opportunity.

When it comes to predicting Dogecoin’s price trend, the Cumulative Liquidation Levels Delta (CLLD) provided valuable insights. At present, the CLLD indicator shows a negative value.

As a crypto investor, I’d interpret a high CLLD (Cumulative Liquidation Demand) value as an indication that there have been more long positions liquidated in the market. Conversely, a negative CLLD implies that short positions are experiencing significant liquidations, potentially leading to larger losses for those traders.

In addition, the negative CLLD confirmed the latter part of the statement above.

At this cost, a downward interpretation of this indicator warns that investors who have shorted Dogecoin may face consequences, as the cryptocurrency could unexpectedly surge and recover swiftly.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-13 02:15