-

XRP has massively underperformed BTC for a while.

XRP hit a key demand zone, but an analyst downplayed a strong bullish reversal for the altcoin.

As a seasoned crypto investor with a keen interest in XRP, I’ve witnessed its underperformance against Bitcoin (BTC) for quite some time now. The recent optimism surrounding the potential end of the SEC lawsuit and bullish targets set by some XRP enthusiasts have certainly added positivity to the market sentiment. However, it’s important to consider expert opinions like that of Peter Brandt.

Market players involved with Ripple (XRP) have expressed optimism following recent reports suggesting that the ongoing SEC lawsuit may reach a resolution soon. The general mood towards XRP in the financial market was favorable during the past week as well.

Some XRP bulls even set conservative targets at $3 at the end of this cycle.

Instead of “However, Peter Brandt, a classical price chart analyst, downplayed bulls’ optimism, especially when comparing XRP‘s performance to Bitcoin‘s,” you could say:

Based on the XRP/BTC chart, Brandt noted,

As a crypto investor, I’ve been observing the market closely, focusing on the comparisons between different cryptocurrencies and their performance against Bitcoin (BTC), rather than the US Dollar (USD). This perspective raises some questions for me. Why are XRP bulls so adamant about XRP being close to its all-time lows relative to BTC, while it has only managed to finish above its current price in just six of the past 126 months?

Is XRP headed to ‘zero’?

The XRP/BTC chart illustrates how XRP fares in relation to Bitcoin. When the value drops or trends downward, this signifies that XRP is not keeping pace with BTC’s performance.

On the other hand, a positive value, or rising XRP/BTC, translates to XRP outperforming BTC.

According to the data presented in the graph, Brandt asserted that XRP was on a downward trend and approaching no value, signifying a significant discrepancy between XRP’s performance and Bitcoin’s. Consequently, investors holding XRP might consider selling their XRP holdings and investing in Bitcoin instead.

In response to being queried if the reduced value of XRP indicated greater upward possibility compared to Bitcoin for the remainder of the market cycle, Brandt playfully remarked:

It’s plausible, but the responsibility lies with XRP rather than Bitcoin. Moreover, if the current trend favors alternative coins, why not consider other options besides XRP?

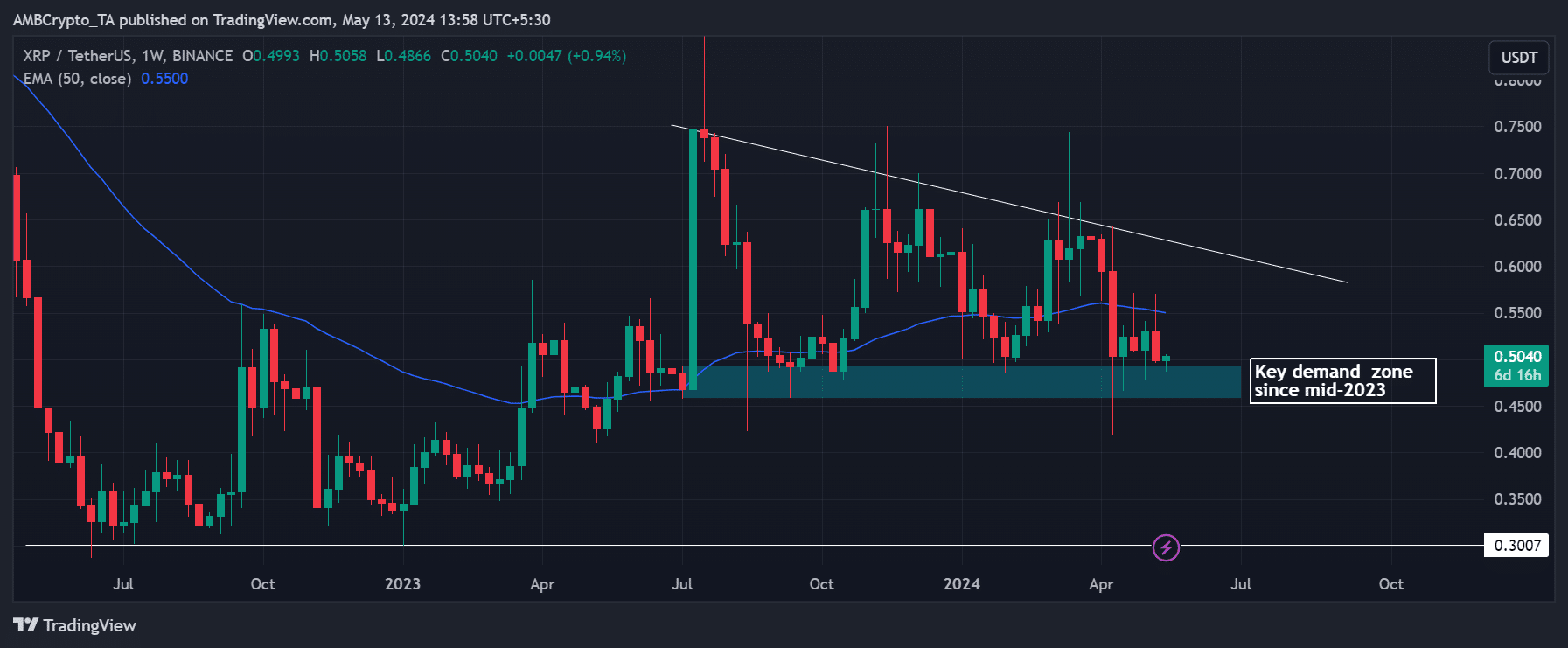

Examining XRP‘s weekly charts against USDT reveals that this altcoin has moved into a noteworthy demand area, which has maintained its strength since the middle of 2023.

As a crypto investor, I believe reaching a new high above the blue 50-day Exponential Moving Average (50-EMA) might give me confidence to target the resistance level represented by the white trendline.

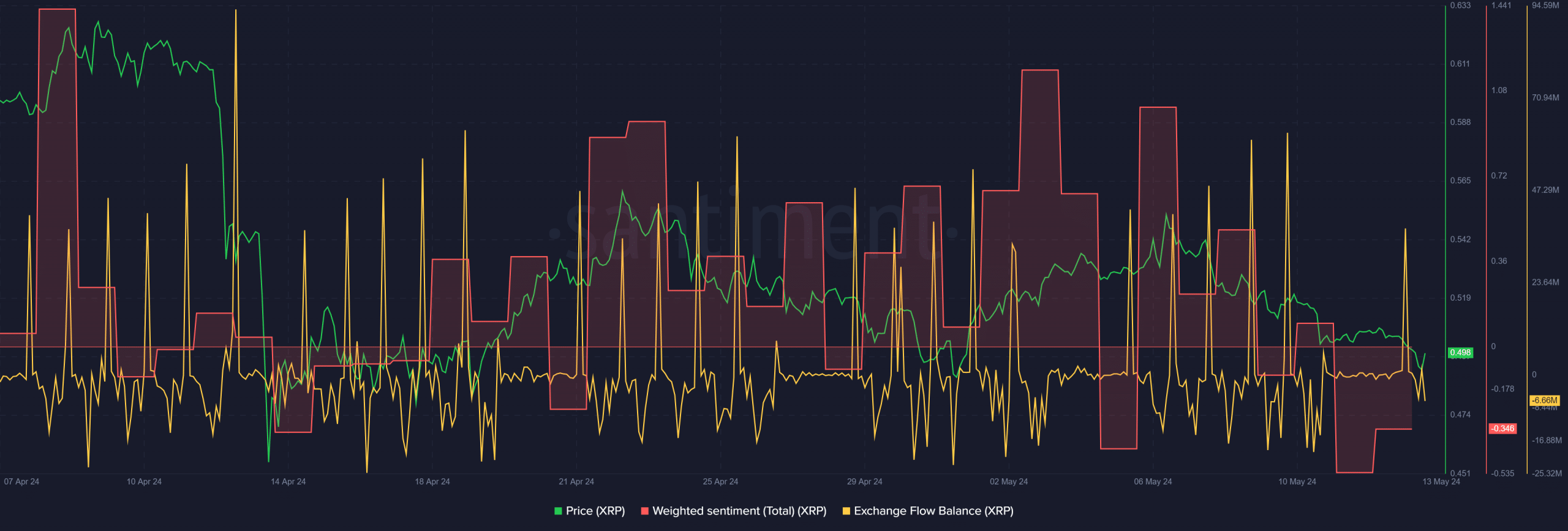

As a crypto investor, I’ve noticed an intriguing indicator based on on-chain data that hints at potential bullish momentum for this altcoin. Specifically, according to Santiment, the exchange flow balance for this cryptocurrency stood at a negative figure of approximately -6.66 million units at the time of my observation. This means that more coins were leaving exchanges and entering wallets than the opposite, suggesting reduced selling pressure and potentially increasing buying demand.

That meant 6.66 million XRP was withdrawn from exchanges—an accumulation trend.

When the value is negative in the context of XRP withdrawals from exchanges, it signifies that a greater amount of XRP has been taken out rather than added. This situation can be interpreted as a sign of accumulation.

As a researcher analyzing the cryptocurrency market, I’ve noticed a significant buildup of buying pressure around the crucial demand level at $0.05. However, the overall market sentiment remains somewhat pessimistic based on the bearish indicator reflected in the Weighted Sentiment metric.

In simpler terms, if we consider the data, XRP has lagged behind Bitcoin in terms of performance. However, it has recently reached a significant support level. If the ongoing SEC lawsuit resolves positively and the broader market trends improve, there’s a strong possibility for a bullish turnaround for XRP.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-13 21:12