- Ethereum showed a bearish market structure and could be headed for $2.5k.

- The OBV slipped below a key level as selling pressure increased.

As an experienced analyst, I have closely monitored Ethereum’s [ETH] market structure and trends, and based on the current data, I believe that Ethereum could be headed for $2.5k in the near term. The bearish sentiment was further reinforced by reports of potential rejections for spot Ethereum exchange-traded funds (ETFs) in the US.

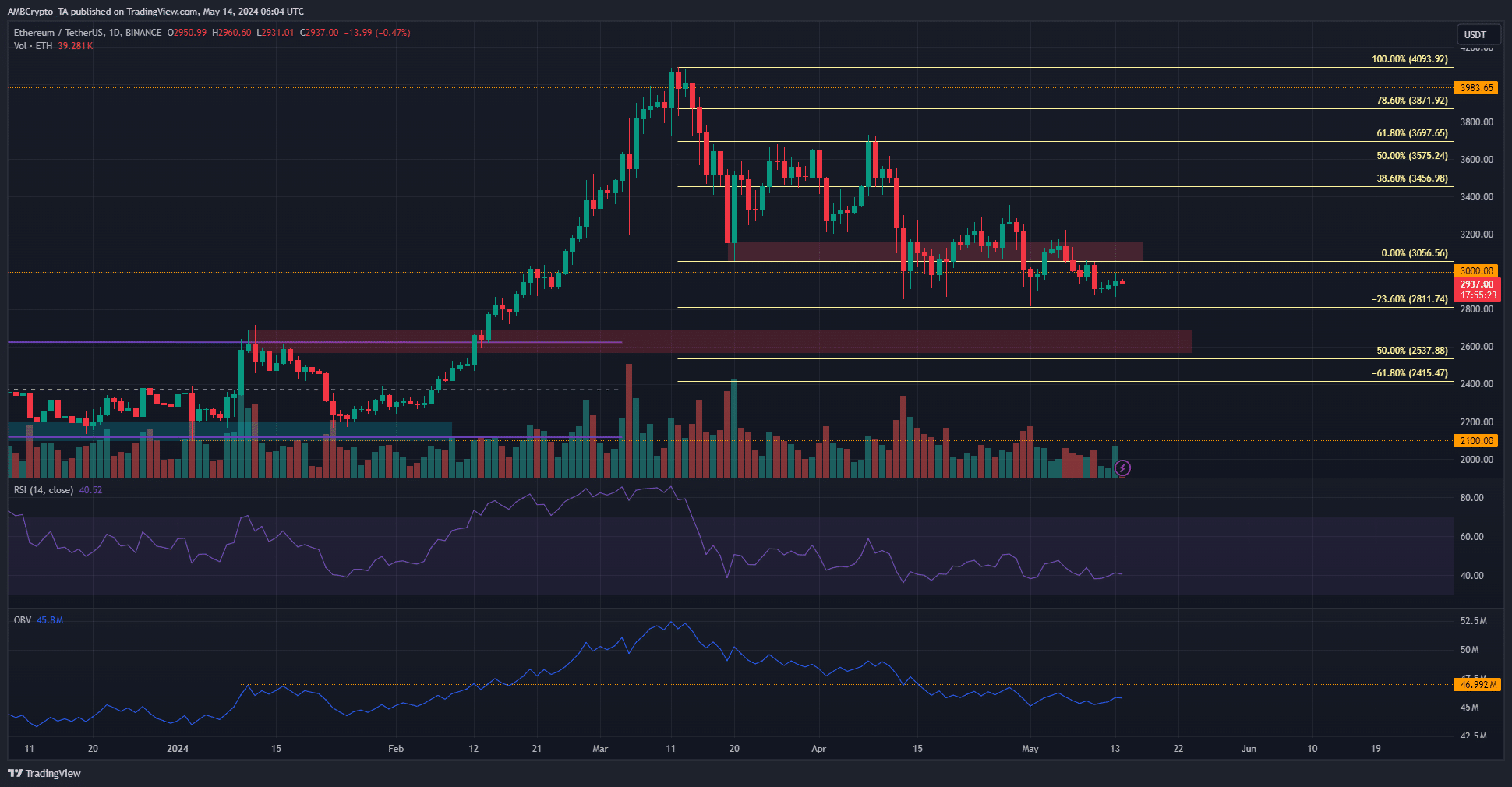

Six weeks ago, Ethereum [ETH] shifted into a downward trend on the daily chart as it dipped beneath the $3,000 threshold.

If news emerges that applications for Ethereum-based ETFs to trade on U.S. exchanges are expected to be denied, this information could strengthen the pessimistic outlook among investors.

Experts predicted significantly lower Ethereum prices in the near future if the market rejected it. According to technical analysis, this was a possibility. However, it remained uncertain how long this downward trend would last.

The bearish market structure continued to hold sway

A set of Fibonacci retracement levels were plotted based on ETH’s drop from $4093 to $3056.

In the middle of April, Ethereum dropped beneath the $3,000 threshold, although it didn’t change the overall bearish trend in the longer-term market.

As a crypto investor, I’ve noticed that the market structure has taken a turn for the worse lately. The On-Balance Volume (OBV) has dipped below a significant threshold as well. Currently, at the present moment, the $3k resistance area is proving to be quite robust. Additionally, the momentum is tilting towards bears with an RSI reading of 40.5.

Based on the Ethereum price analysis using Fibonacci extensions, it seems probable that the price will fall below the $2,800 mark.

It’s possible that the Extension Levels of 50% and 61.8% in Ethereum could be put to the test. However, it remains uncertain whether Ethereum will experience a V-shaped reversal or instead undergo consolidation at those levels.

The liquidity chart showed the short-term bounce was over

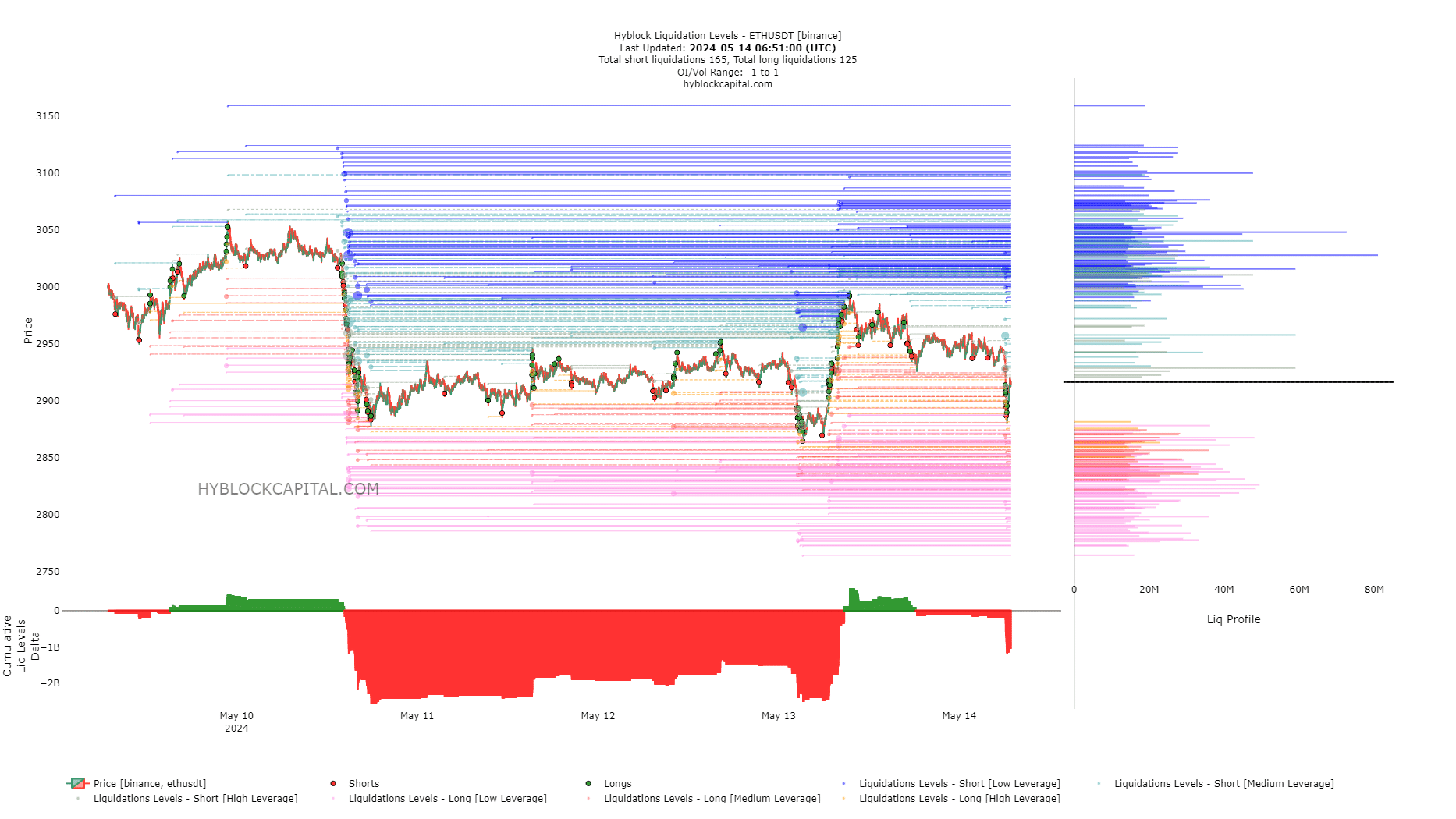

Approximately 25 hours ago, the total liquidated amounts exceeded the accumulated positions significantly, suggesting a higher volume of short trades compared to long ones.

Read Ethereum’s [ETH] Price Prediction 2024-25

A few hours later, the price bounced from $2870 to $2990 to take out the late short sellers.

As of now, the total liquidated amounts have accumulated to an amount below zero, indicating only slightly severe conditions. Consequently, Ethereum prices may still have room to decrease, potentially reaching the $2840 mark as a near-term forecast.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-05-14 16:07