- Altcoins have performed well in a six-month window, but it does not signal an altcoin season.

- The Bitcoin dominance chart could see accelerated gains for altcoin market capitalization.

As a crypto investor with some experience under my belt, I’ve seen how the market dynamics have played out during different cycles. Altcoins may have shown impressive gains in the past six months, but it doesn’t signal an altcoin season just yet. The Bitcoin dominance chart could be a more telling sign.

As an analyst, I’ve observed that despite over a month having passed since Bitcoin’s [BTC] halving event, the cryptocurrency has failed to shake off its post-halving blues. Market participants, including myself, are eagerly anticipating a bull run for both Bitcoin and altcoins.

The altcoin season started in September 2023 and saw a pullback in the past six weeks.

In the next phase, altcoins hold great potential for further growth. The past six months have seen a solid increase in value for them. But just imagine how explosive the altcoin market could become once Bitcoin reaches the peak of this current cycle!

Replicating the past cycle’s performance

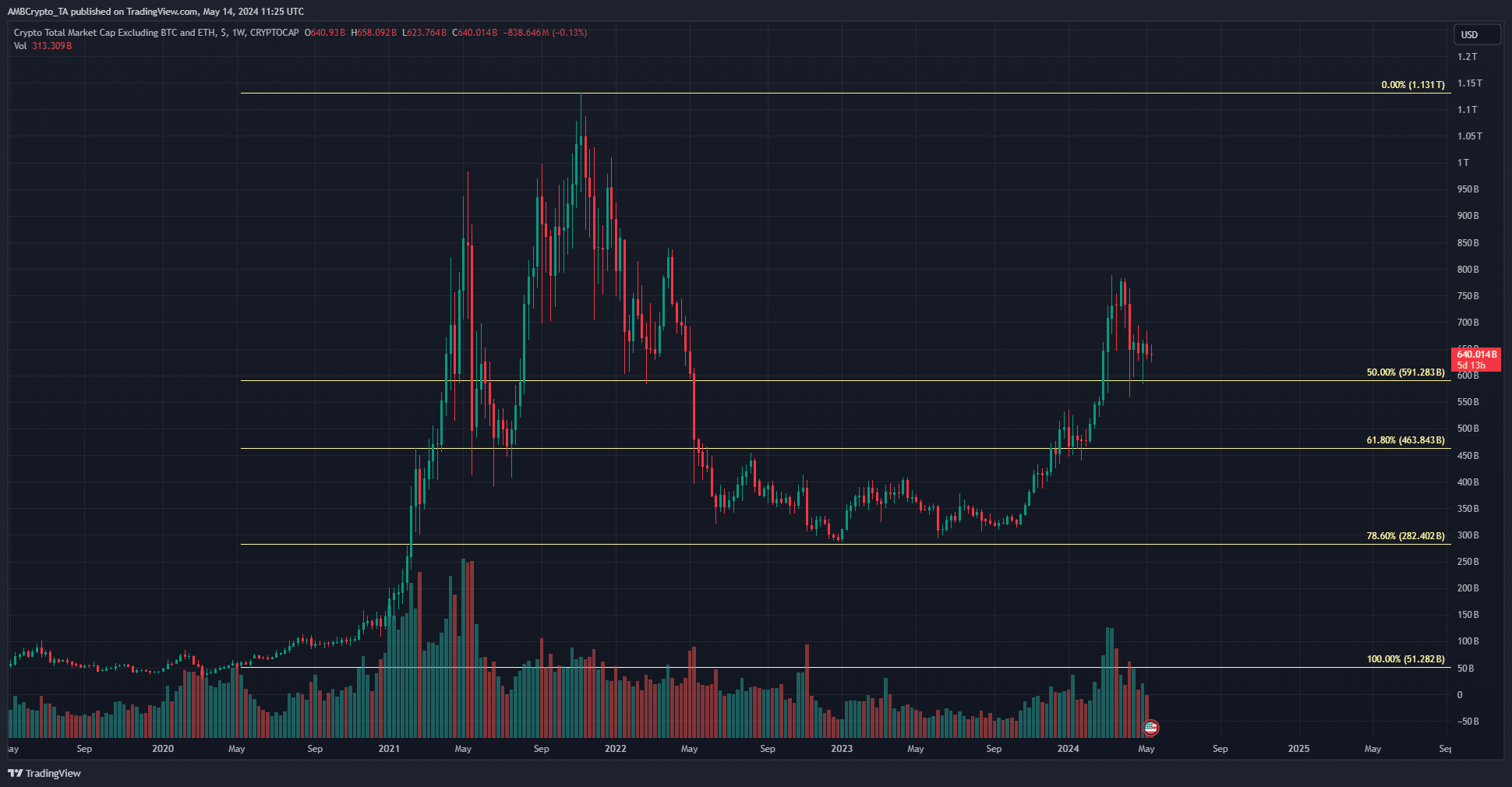

As a researcher studying the cryptocurrency market trends, I have observed an astonishing growth in the altcoin sector between May 2020 and November 2021. Initially, the total capitalization for altcoins stood at $51.2 billion. However, over the course of the next year and a few months, there was a significant surge in value. By November 2021, the altcoin market capitalization had reached an impressive milestone of approximately $1.13 trillion.

As a researcher studying market trends, I discovered an impressive 21.6-fold increase in certain metrics. If we observe a comparable outcome during the upcoming cycle, it could potentially elevate the market capitalization to an astounding $6 trillion.

It’s an astonishingly large sum contrasted to the $640 billion mark reported earlier, yet it’s important to remember that cryptocurrency markets can be unpredictable and may defy our expectations.

Despite the impressive gains of altcoins in recent months, they have faced competition from Bitcoin when it comes to attracting investment funds.

The current situation may shift when investors become more comfortable taking on greater risks, trusting in prolonged crypto market growth, and consequently broaden their portfolios with alternative cryptocurrencies.

Bitcoin dominance might hold the key

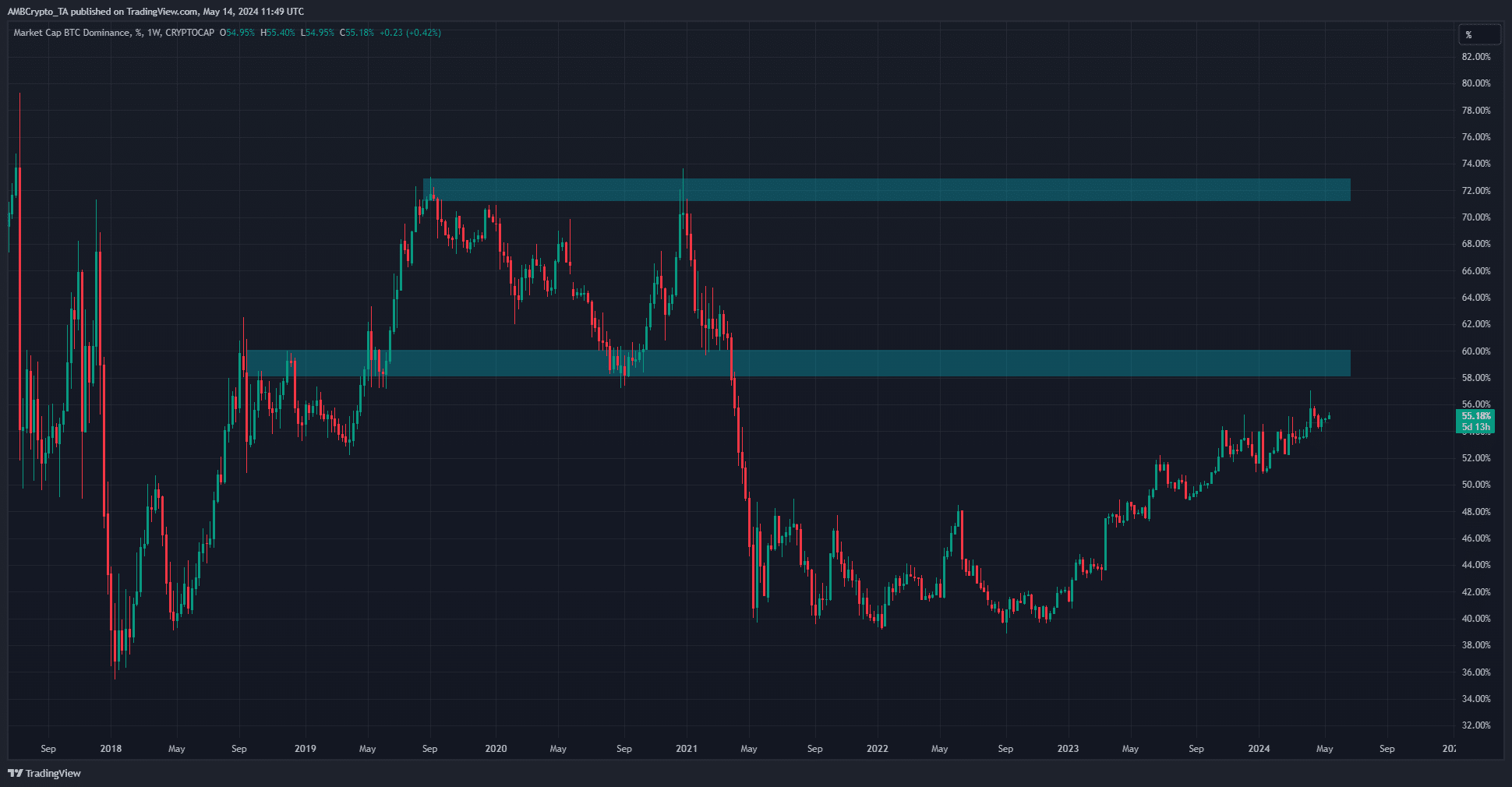

The proportion of the crypto market dominated by Bitcoin could decrease, leading to a significant increase in the bullish sentiment for altcoins as depicted in this chart.

When it starts showing a serious decline, this could signal that investors are more keen on purchasing altcoins rather than Bitcoin.

Over the past year, Bitcoin’s prominence has gradually risen. This trend is common during bear markets and often continues well into a bull market’s maturation.

The few months when this metric is in a free fall is when the altcoin season truly begins.

Read Ethereum’s [ETH] Price Prediction 2024-2025

As an analyst, I’ve noticed an intriguing pattern when examining the relationship between the altcoin market cap chart and the Bitcoin Dominance (BTC.D) chart. When Bitcoin dominance was on a downward trend, significant gains were made in the altcoin market.

As a crypto investor keeping an eye on altcoins, I would suggest monitoring Bitcoin’s dominance for potential drops during this market cycle. A decrease in Bitcoin’s dominance might signal the approach of an altcoin season.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-05-15 05:11