- Bitcoin miners might sell as decreased mining rewards and transaction fees lower revenues.

- A potential sell-off by miners could dramatically impact the cryptocurrency market.

As a long-term crypto investor with experience in the market, I’m closely monitoring the current state of Bitcoin and its miners. The recent halving event and subsequent decrease in mining rewards and transaction fees have put immense pressure on miners to sell their holdings, which could potentially lead to a sell-off. This sell-off could significantly impact the cryptocurrency market, especially given the current low liquidity.

Despite a minor 2.3% dip, Bitcoin’s value remains robust, with prices hovering above $60,000.

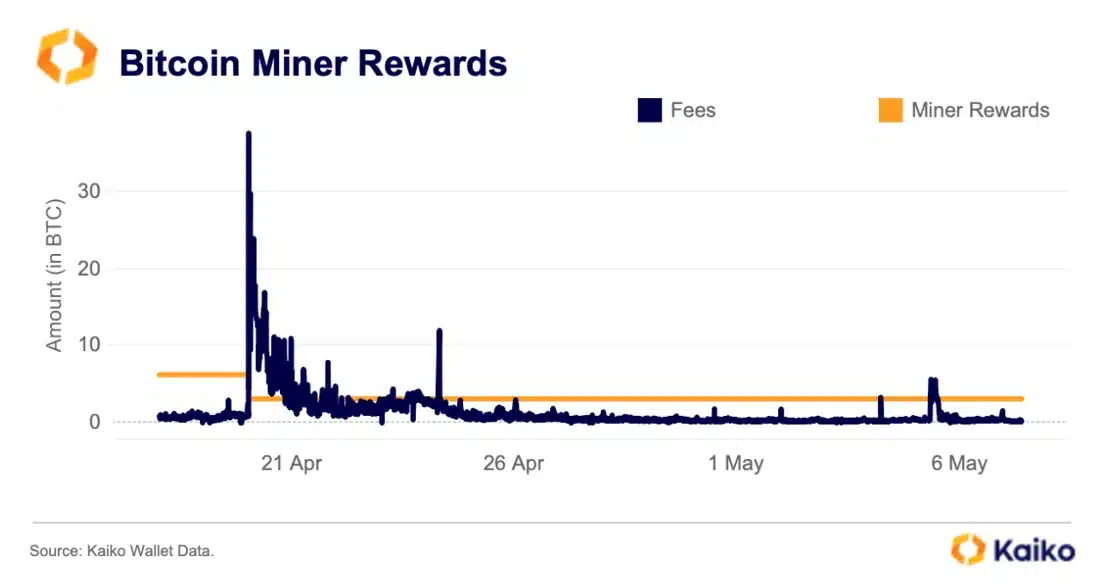

Amidst tough times for Bitcoin miners, this price stability emerges despite a significant drop in their income post the latest Bitcoin halving, as indicated by data from Kaiko.

Pressures on Bitcoin miners intensify

Bitcoin miners are experiencing growing incentives to offload their cryptocurrency stash due to decreasing income derived from mining activities.

The latest reduction in mining rewards, from 6.25 Bitcoins to 3.125 Bitcoins following the recent halving event, has noticeably affected their earnings.

The decrease in income is further aggravated by the declining transaction fees, which have yet to bounce back to their previous levels following the halving event.

In simpler terms, Kaiko’s findings indicate that miners are earning less from both their mining rewards and transaction fees.

As a researcher studying the Bitcoin mining industry, I’ve observed that rising operational costs are compelling miners to sell some of their Bitcoins to meet their expenses. According to Kaiko’s analysis, this trend is becoming more prevalent.

Miners of Bitcoin often sell their newly mined coins when the block reward is cut in half. This is because the expense of generating new blocks is substantial, compelling miners to offload their tokens to recoup costs.

Miners holding large amounts of Bitcoin could trigger significant price drops in the market due to their selling, with potentially severe consequences considering the present limited capacity for buyers and sellers to trade.

As a financial analyst, I can assert that major Bitcoin mining companies, such as Marathon Digital Holdings, with a substantial Bitcoin hoard valued at approximately $1.1 billion, possess the power to instigate considerable market fluctuations should they choose to liquidate even a modest portion of their holdings.

Kaiko’s report explains.

Bitcoin miners generally categorize their Bitcoins as current assets because they can sell these cryptocurrencies to cover operational costs when needed.

As a crypto investor, I can tell you that with significant holders like Marathon Digital and Riot Platforms hoarding large quantities of Bitcoin, any compulsory sales from their end could result in considerable price movements within the market.

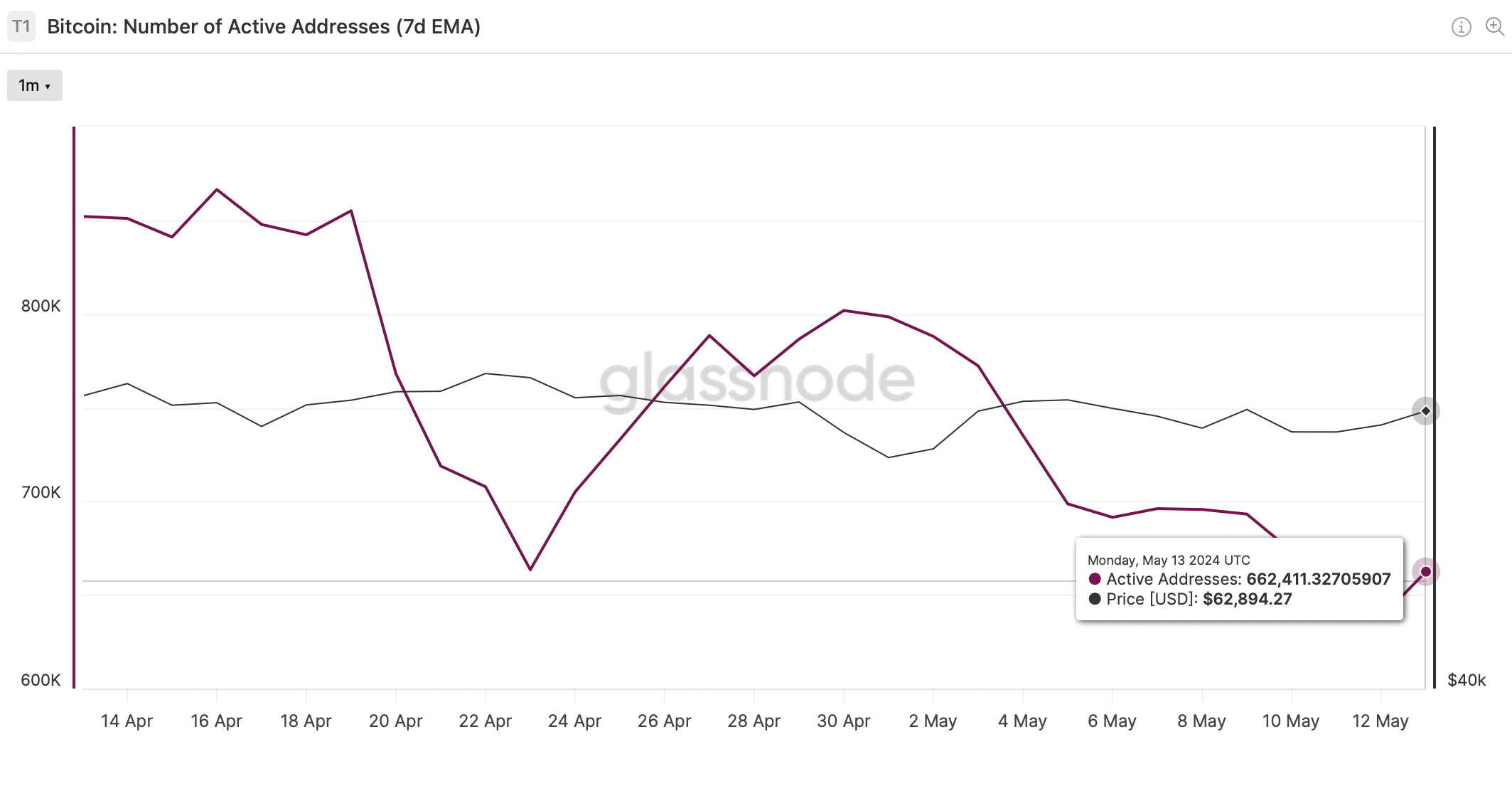

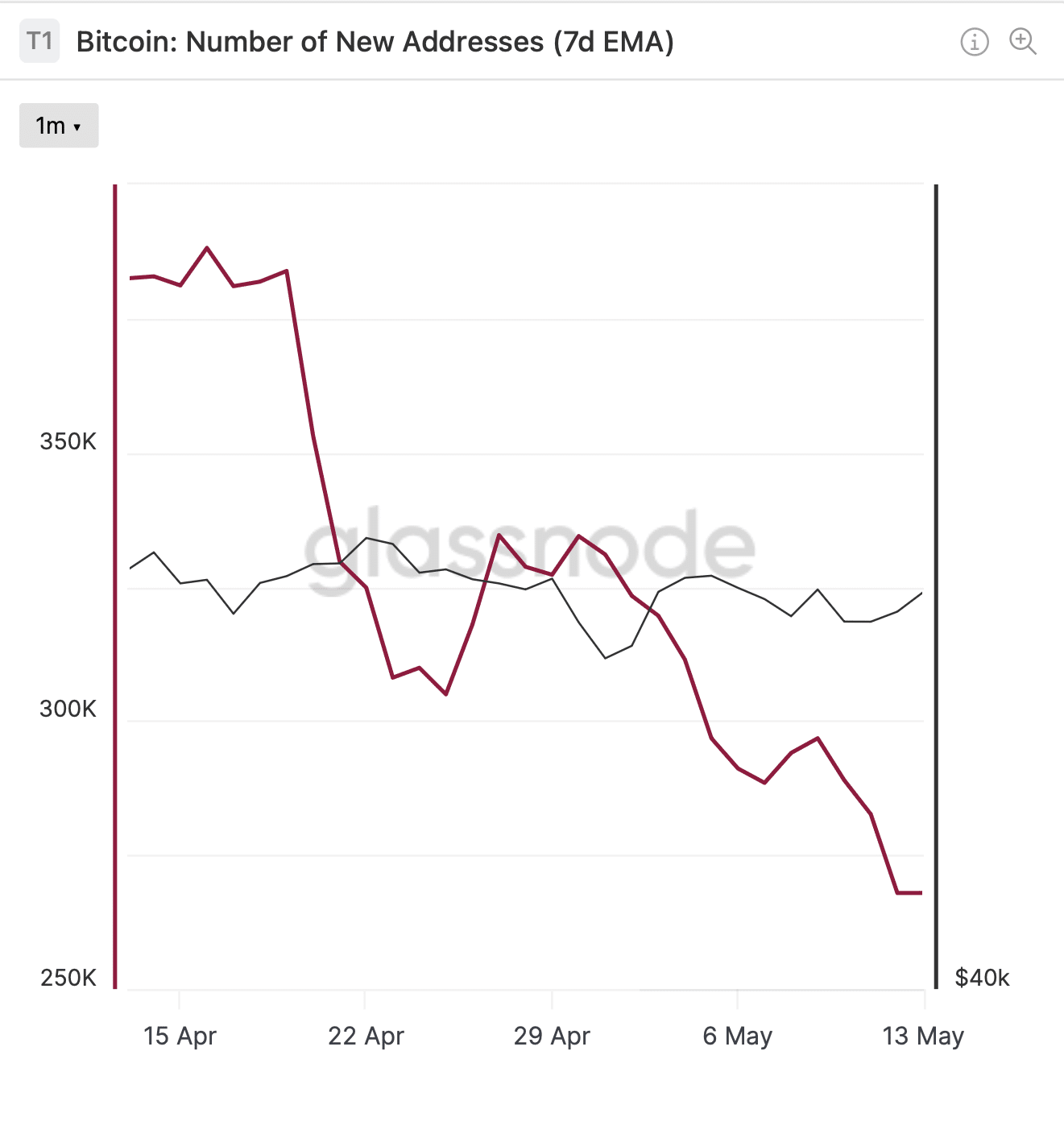

Bitcoin’s network activity declines

Meanwhile, Bitcoin’s network activity is showing signs of slowing down.

According to Glassnode’s latest findings, the number of actively used Bitcoin addresses, as indicated by the 7-day moving average, has dropped from approximately 800,000 to around 700,000 within the past few weeks.

As a researcher observing the data, I’ve noticed that the seven-day exponential moving average (EMA) of new addresses has dropped from approximately 388,158 to 267,925 over the past period. This potential decrease could signal waning user engagement and interest in the given context.

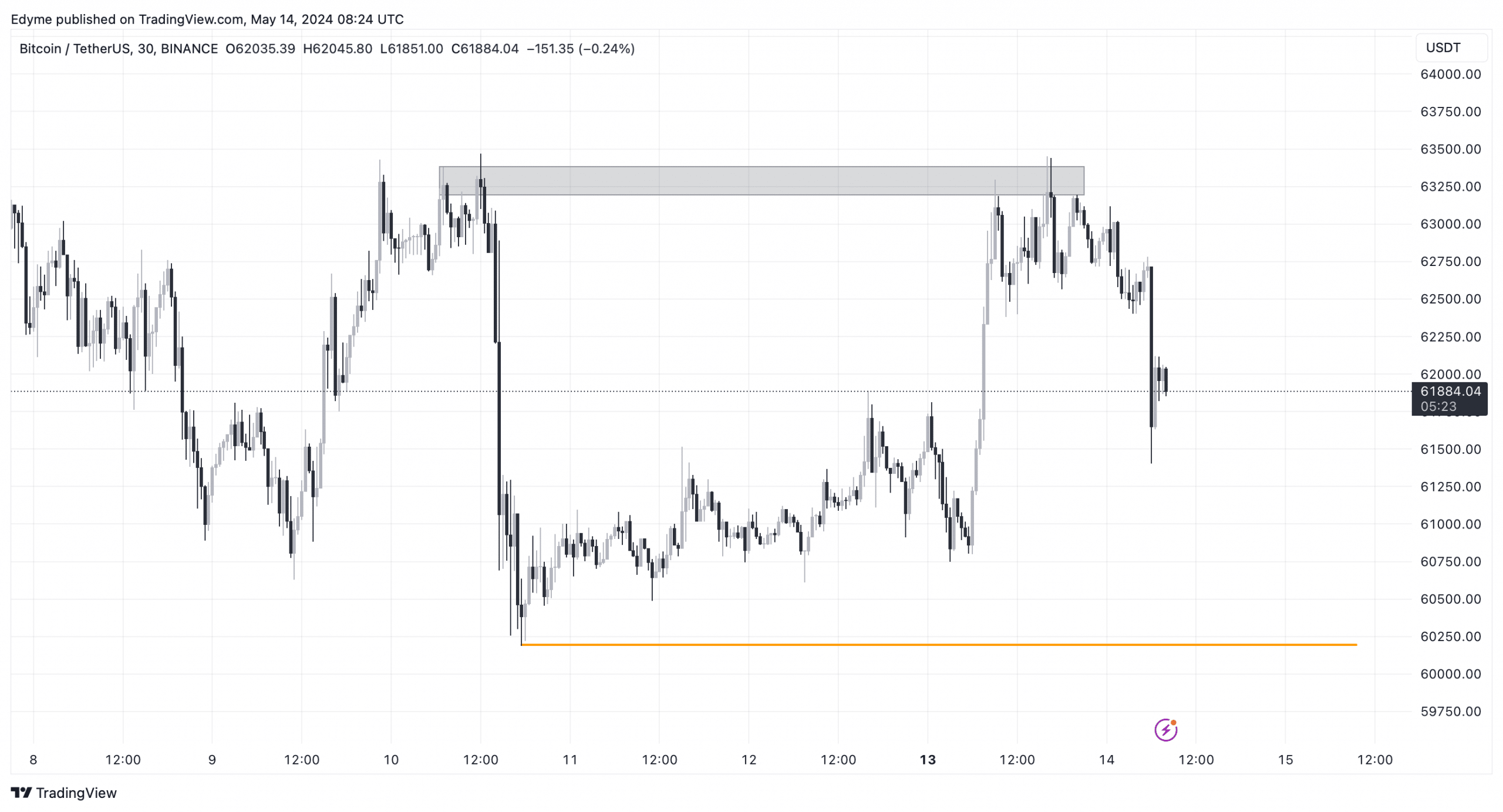

“According to short-term tech analysis, Bitcoin removed significant market liquidity from the 30-minute chart on May 14th.”

As an analyst, I would interpret this as indicating a potential trend for the asset’s value to decline further towards the $60,000 mark, possibly reaching a swing low, before any noteworthy price increase transpires.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a researcher studying the Bitcoin market, I’ve noticed that recent pressures on miners and the potential decline in the market could lead to increased volatility.

As a crypto investor, I’ve been keeping an eye on AMBCrypto’s latest update. They mentioned that renowned analyst Ali Martinez has predicted some potential price movements for Bitcoin. If Bitcoin manages to bounce back and hold the $64,290 level as support, there’s a possibility of witnessing a bullish trend pushing the price up toward an exciting target of $76,610.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Gayle King, Katy Perry & More Embark on Historic All-Women Space Mission

- Flight Lands Safely After Dodging Departing Plane at Same Runway

2024-05-15 06:15