- U.S. spot Bitcoin ETFs see net inflows, signaling growing confidence.

- Hong Kong ETFs experience outflows, U.S. spot Bitcoin ETF trading volume declines globally.

As a researcher with extensive experience in the cryptocurrency market, I find this recent trend of U.S. spot Bitcoin ETFs experiencing net inflows while Hong Kong ETFs face outflows and global trading volume declines an intriguing development.

For Bitcoin [BTC] supporters, today brings exciting news as American spot Bitcoin ETFs have once again started seeing more investments than withdrawals.

After four straight weeks of investors withdrawing their funds, there was an inflow of $116.8 million last week. This renewed interest from investors occurs following a 1.98% decrease in the primary cryptocurrency’s price within the previous day.

Increased investor interest

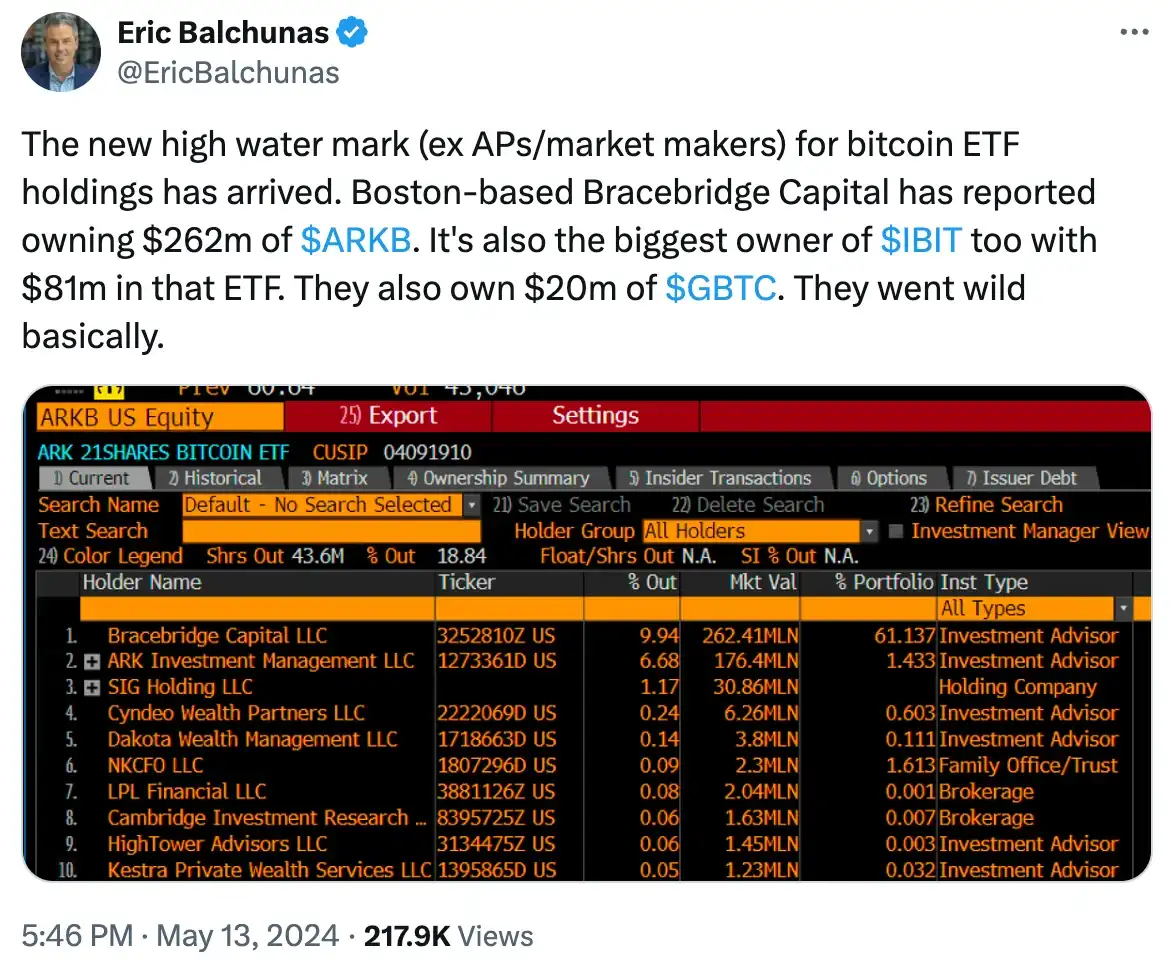

In spite of the unclear pricing situation, there’s been a significant surge in investor enthusiasm, as demonstrated by recent occurrences. For instance, Bracebridge Capital revealed a $363 million commitment to Bitcoin ETFs in a Securities and Exchange Commission (SEC) filing.

In addition, it was disclosed on May 14th that J.P. Morgan’s customers have recently poured $731,246 into Bitcoin spot ETFs.

Moreover, Wells Fargo joined the mix, owning 2,245 shares of GBTC worth approximately $121,207, with other participants following suit.

Eric Balchunas, a senior ETF analyst at Bloomberg, shared his insights on this matter through X (previously known as Twitter).

As a researcher studying the developments in the Bitcoin exchange-traded fund (ETF) market, I’m excited to note that the iShares Bitcoin Trust (IBIT) offered by BlackRock has recently achieved an impressive feat. With more corporations adopting this ETF as part of their investment portfolios, it now leads its competitors in terms of corporate holder count.

Since its inception till date, the BlackRock Bitcoin ETF has attracted 250 corporate holders.

As a researcher immersed in the dynamic world of cryptocurrencies, I’ve noticed an increasing buzz among investors. Extensive conversations have been taking place within our community regarding this trend.

In a recent tweet, an X user @SirJonasz shed light on the Bitcoin ETF exposure of leading banks

“They FUD #crypto in public and buy in private.”

On similar lines, @Vivek4real_ added,

“We are entering a new era.”

As an analyst examining on-chain metrics, I’ve noticed a significant shift in Grayscale’s Bitcoin Trust last week. Contrasting flows were observed, with $171.1 million leaving the trust compared to $63 million in inflows on May 3rd.

Inflows amounted to $111.3 million for Fidelity’s FBTC, making it the leader. ARKB followed closely with $82.8 million of investments. BlackRock’s IBIT recorded $48.1 million in inflows, which represents a decrease compared to its peak inflow figures in March.

Hold your horses

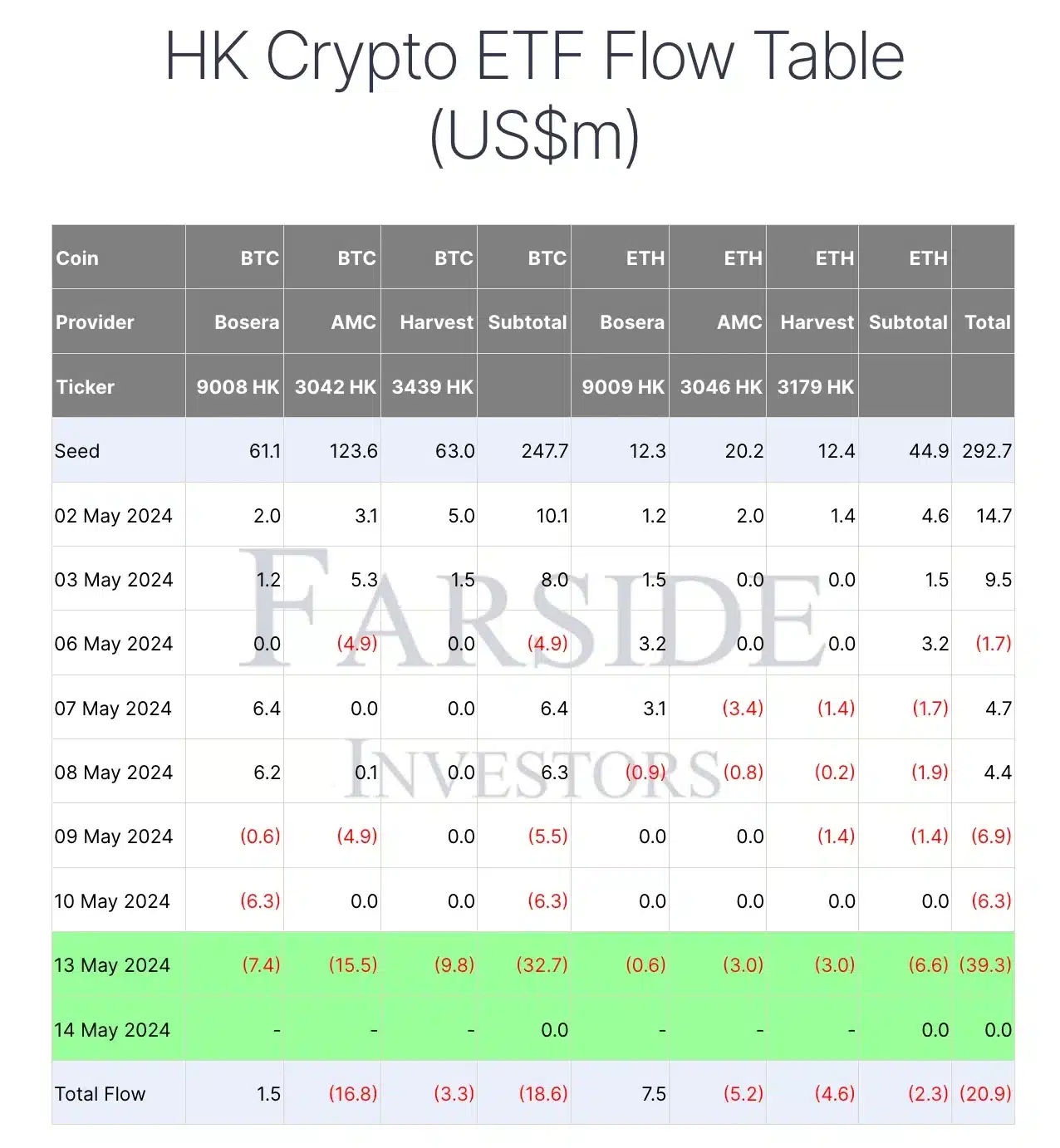

Despite the large volumes of money flowing in on the 13th of May, surprisingly, Hong Kong ETFs saw substantial outflows instead.

As a crypto investor following the market trends closely, I’ve noticed recent data from Farside Investors revealing that the combined bitcoin spot ETFs provided by ChinaAMC, Harvest Global, Bosera, and Hashkey experienced outflows totaling $32.7 million.

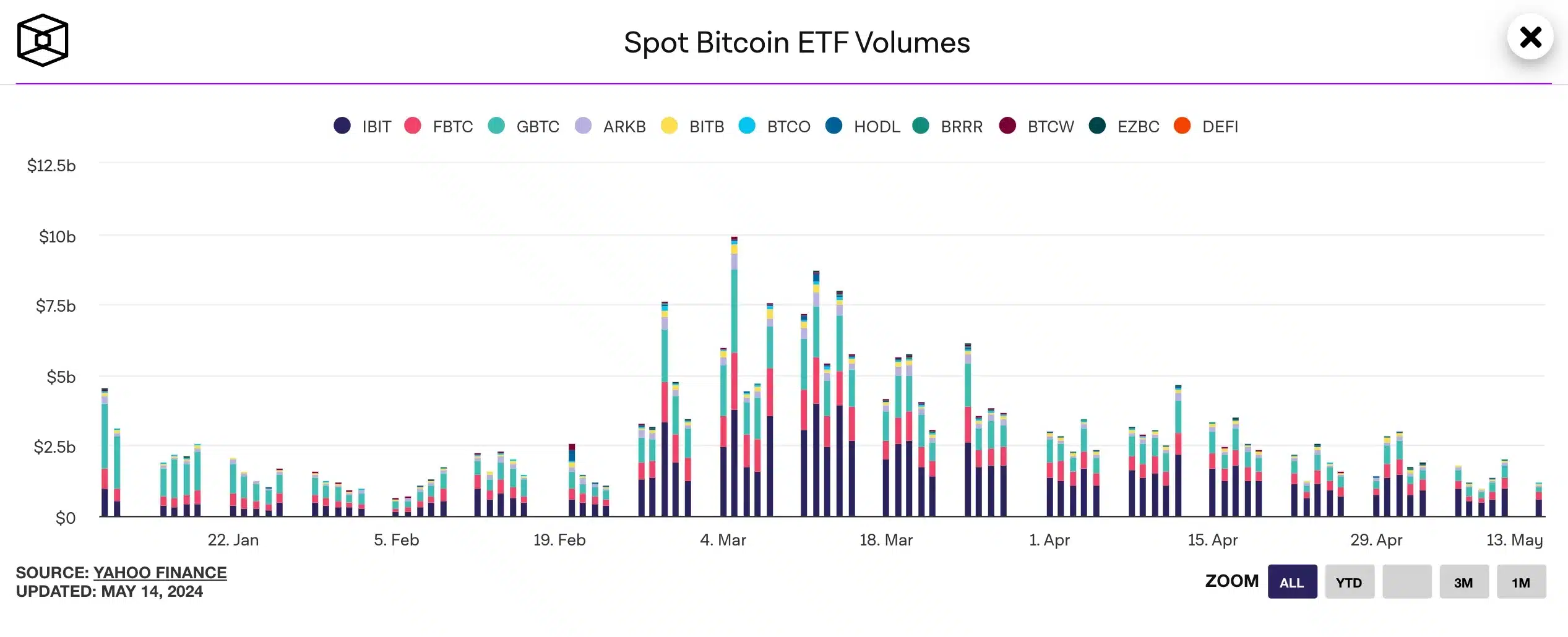

As an analyst, I’ve noticed that despite a change in direction, the trading volume for U.S. spot bitcoin ETFs saw a significant decrease last week, dropping from $11 billion to $7.4 billion according to The Block’s data dashboard.

As a crypto investor, I’ve noticed that the volume in the market has significantly dropped. This trend was also observed in the global crypto exchange-traded product market, where it decreased from $17 billion in weekly averages during April to just $8 billion.

To round up, the daily trading volume took a significant dip following its peak of $9.9 billion on March 5. This decline occurred concurrently with bitcoin surpassing its previous cycle high of approximately $69,000.

As the institutional investment in Bitcoin ETFs grows, it raises an intriguing question: Might this trend alter the way individuals access Bitcoin in the future?

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-05-15 07:04