- Bitcoin is predicted to stay within the $55K-$75K range.

- Mike Novogratz of Galaxy Digital suggested developments could significantly impact Bitcoin’s price.

As a researcher with experience in cryptocurrency markets, I find the current stability of Bitcoin within the $55K-$75K range intriguing. Mike Novogratz’s insights during Galaxy Digital’s Q1 earnings call have provided valuable context to this trend. The crypto markets are indeed in a consolidation phase, and Novogratz’s prediction of continued trading within this range over the next month is plausible based on market behavior and historical data.

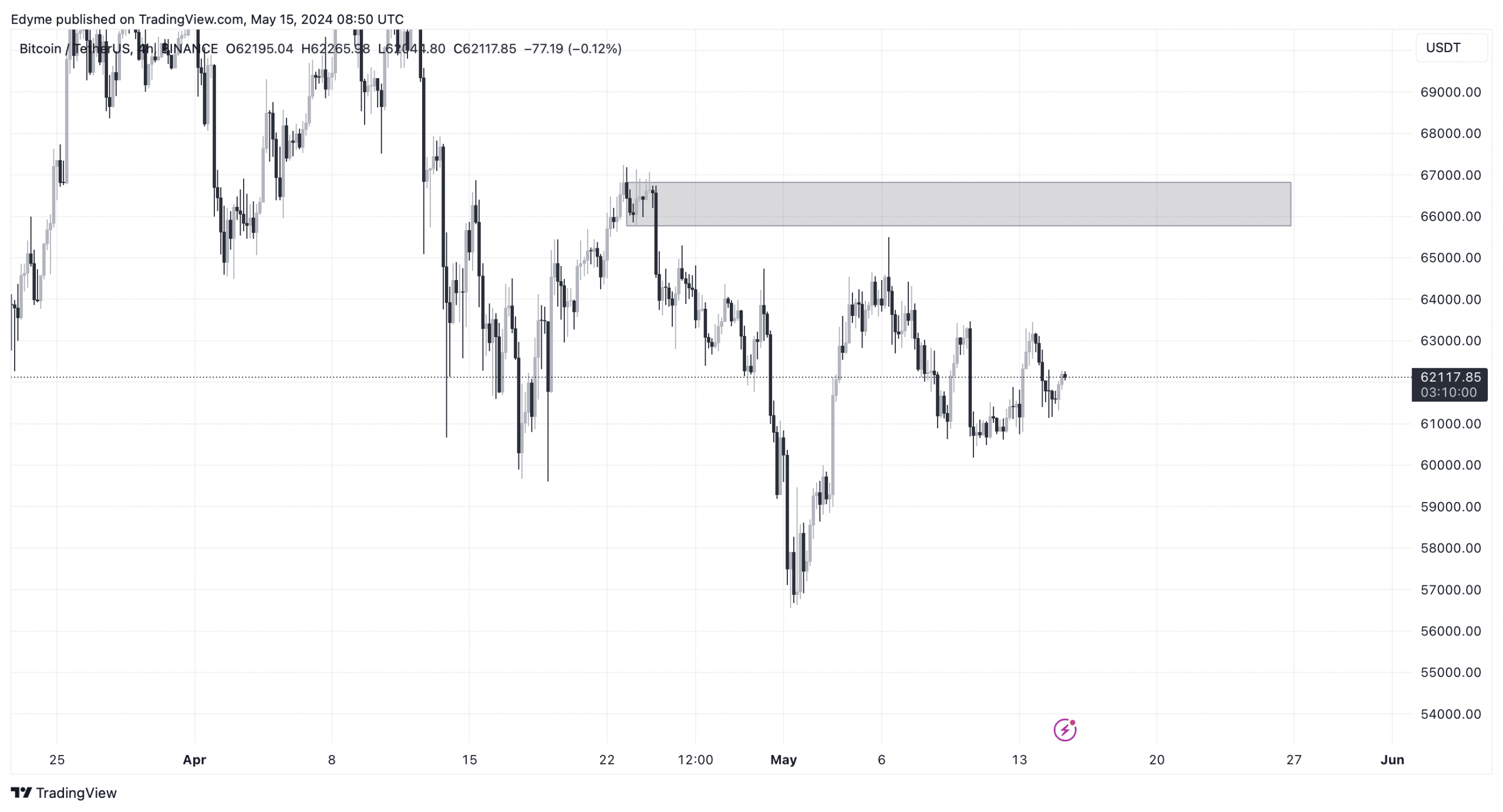

Bitcoin’s value has shown remarkable consistency, hovering around the $60,000 level following its peak at over $73,000 in March.

So far, the premier digital currency has seen a slight increase of 0.4%, trading at $62,167.

As an analyst, I can tell you that this degree of consistency isn’t merely a fleeting occurrence, but rather a significant aspect of a larger pattern that we’re keeping a close eye on within the industry expert community.

In the face of unstable market scenarios, Mike Novogratz, Galaxy Digital’s founder and CEO, offered his perspectives during the organization’s first-quarter financial update.

As a successful crypto investor and follower of market trends, I’ve been thrilled to witness Galaxy Digital’s impressive run with substantial quarterly revenues. However, it was Mike Novogratz’s insightful predictions regarding Bitcoin that truly piqued my interest and resonated within the industry.

Bitcoin is expected to remain between $55,000 and $75,000 in value during the next month according to his prediction. Towards the end of Q2, there may be an uptick in its price.

Bitcoin: Market dynamics

In my role as a researcher following the cryptocurrency market, I noted during the recent earnings call with Bloomberg that Novogratz described the current market situation as a “consolidation phase.”

As a cryptocurrency analyst, I would describe this phase as a time when the value of Bitcoin, alongside significant digital assets such as Ethereum [ETH] and Solana [SOL], is expected to remain relatively stable within their forecasted price ranges.

As a crypto investor, I believe Novogratz’s forecast isn’t solely reliant on current market trends. Instead, it takes into account historical price movements and anticipated future market developments that could significantly impact cryptocurrency prices.

Amidst fluctuating degrees of interest from institutional investors, there is a sense of steadiness with respect to Bitcoin ETFs, particularly those based on the spot market.

As an analyst, I’ve noticed that these ETFs experienced a surge in demand during their first week of trading, bringing in approximately $13.9 billion. However, my observations reveal that this initial excitement has subsided due to the broader downturn in cryptocurrency prices.

Nonetheless, Novogratz stays hopeful, pointing out the increasing acceptance of Bitcoin by conventional financial entities and the progressive incorporation of digital currencies into standard investment portfolios.

Future outlook

Technical analysts have also been closely observing Bitcoin’s price movements.

Based on AMBCrypto’s analysis, I believe Bitcoin has the potential to reach $65,000 in value before any possible correction sets in, as indicated by the daily chart trend.

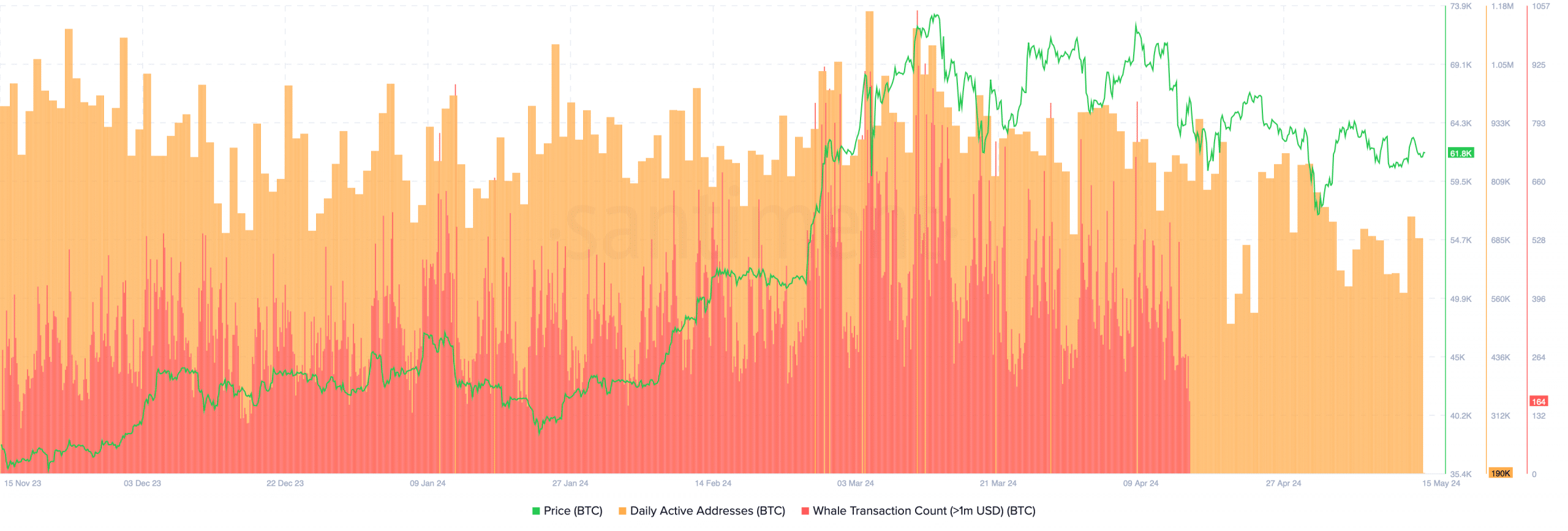

According to AMBCrypto’s latest findings, Bitcoin’s daily circulating supply has dropped to approximately 17,600 units, suggesting a decline in the number of transactions taking place within the last 24 hours.

As a crypto investor, I believe that several catalysts could have a substantial impact on the cryptocurrency market in the near future based on Novogratz’s analysis.

As a researcher studying economic trends, I would note that one significant influence on market conditions could be the U.S. Federal Reserve’s decision to lower interest rates should the economy exhibit signs of deceleration.

Read Bitcoin’s [BTC] Price Prediction 2024-25

The upcoming U.S. presidential election result, according to Novogratz, is expected to bring clearer regulations for cryptocurrencies into the picture.

Additionally, according to Santiment’s data, there was a noticeable reduction in Bitcoin network activity. The number of daily active addresses and large transactions saw a significant decrease.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-05-15 20:08