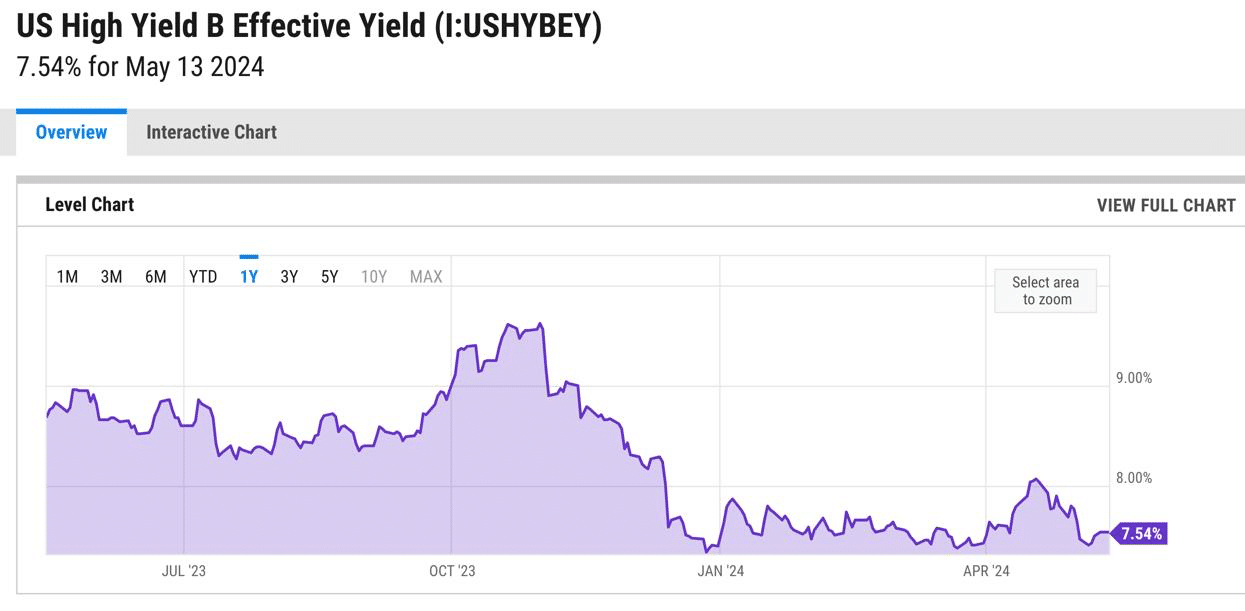

- Bitcoin needs the U.S. high yield rate to drop below 6% or 7% for a sustainable rally.

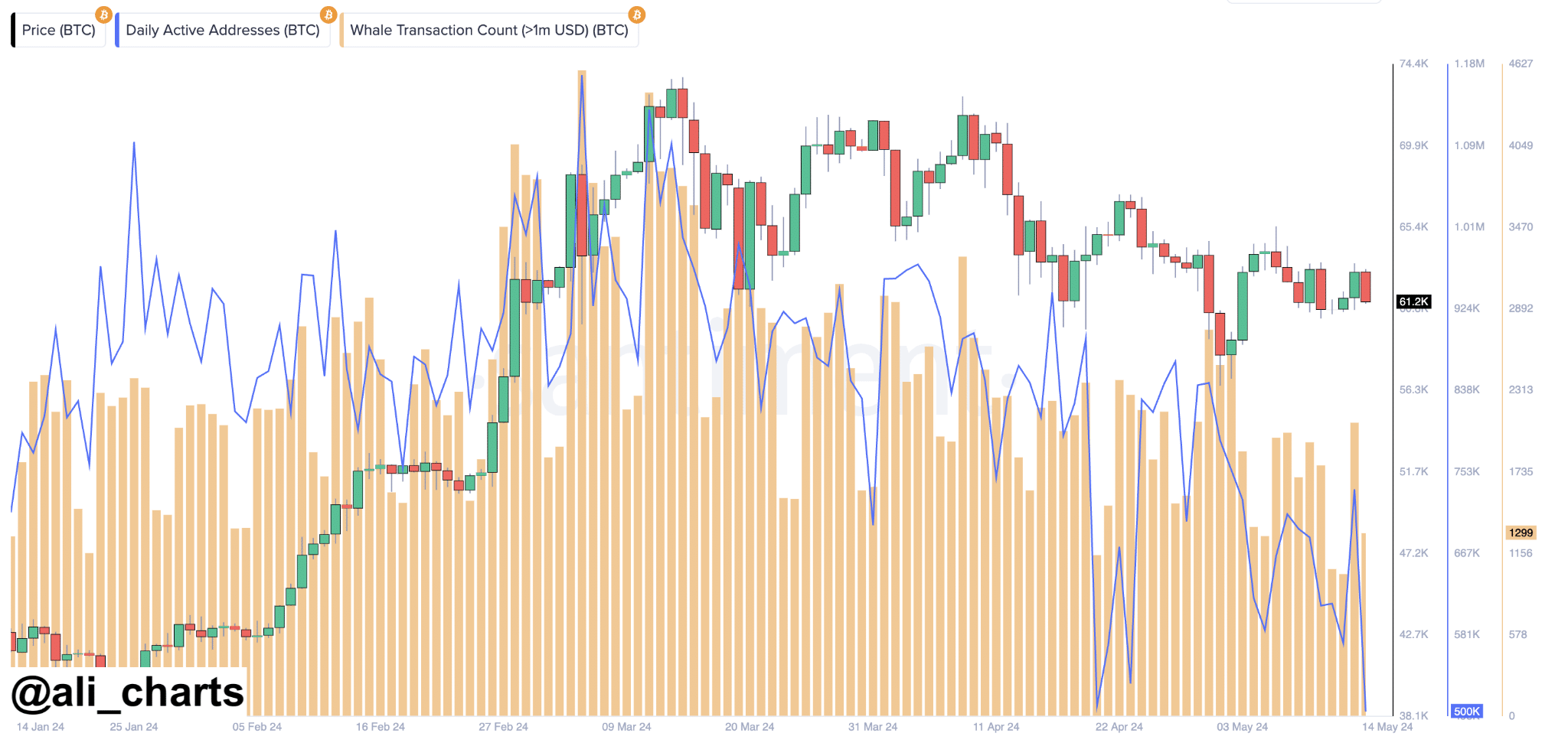

- Network activity is decreasing, and big investors are currently inactive.

As an experienced financial analyst, I believe that the current state of Bitcoin’s price is influenced significantly by economic indicators such as the U.S. high yield rate. The persistently high yields have kept investors cautious and reluctant to invest heavily in alternative assets like Bitcoin. For a sustainable rally, we need to see this rate drop below 6% or 7%.

Bitcoin’s current price is approximately $10,000 less than its peak value achieved earlier in 2021. Despite efforts to surpass the $65,000 threshold, it has yet to succeed thus far.

Financial analyst Timothy Peterson highlighted the significance of the U.S. high yield rate in relation to the cryptocurrency market. He underscored the importance of this rate dipping below 6% or 7% for Bitcoin to maintain its record-breaking prices consistently.

Economic indicators and Bitcoin’s price

At the current moment, the U.S. high yield rate was reportedly 7.54%. This figure indicated a firm grip on prospective economic expansion and financial commitments, such as those related to the cryptocurrency sector.

Historically, a decrease in high yield rates has tended to be followed by an increase in Bitcoin prices. The reason being, when yields are low, investors may find attractive the potential returns of non-traditional assets like Bitcoin.

As a crypto investor, I’m always on the lookout for lucrative opportunities, especially in today’s low-interest environment. Cryptocurrencies have the potential to deliver impressive returns, making them an attractive alternative investment option for me.

As an analyst, I would interpret this situation from a Bitcoin investor’s perspective as follows: The U.S. economy holds significant importance for Bitcoin investors due to several interconnected factors. Recently, the U.S. Treasury Department conducted an auction for 30-year bonds, which experienced robust demand. This surge in demand led to a decrease in yields. From my analysis, this trend could potentially signal confidence in the long-term growth of the U.S. economy, which historically has had a positive correlation with Bitcoin’s price movement. Consequently, Bitcoin investors might perceive this as a favorable sign for the cryptocurrency market.

As a financial analyst, I’m closely monitoring the recent unemployment figures alongside other economic indicators. These data points have intensified investors’ expectations for interest rate reductions in the coming months. Consequently, should central banks deliver on these expectations, it could lead to a decrease in high yield rates. In turn, such an occurrence might encourage Bitcoin’s price to rebound and regain its previously held higher value levels.

Based on current Bitcoin trends, there are some noteworthy shifts occurring. As per recent reports by Santiment, the level of activity on the Bitcoin network has decreased.

This includes a decrease in the number of massive transactions, also known as whale movements.

The whales may be holding back their actions, potentially biding their time for better market circumstances before executing significant transactions, resulting in increased market instability.

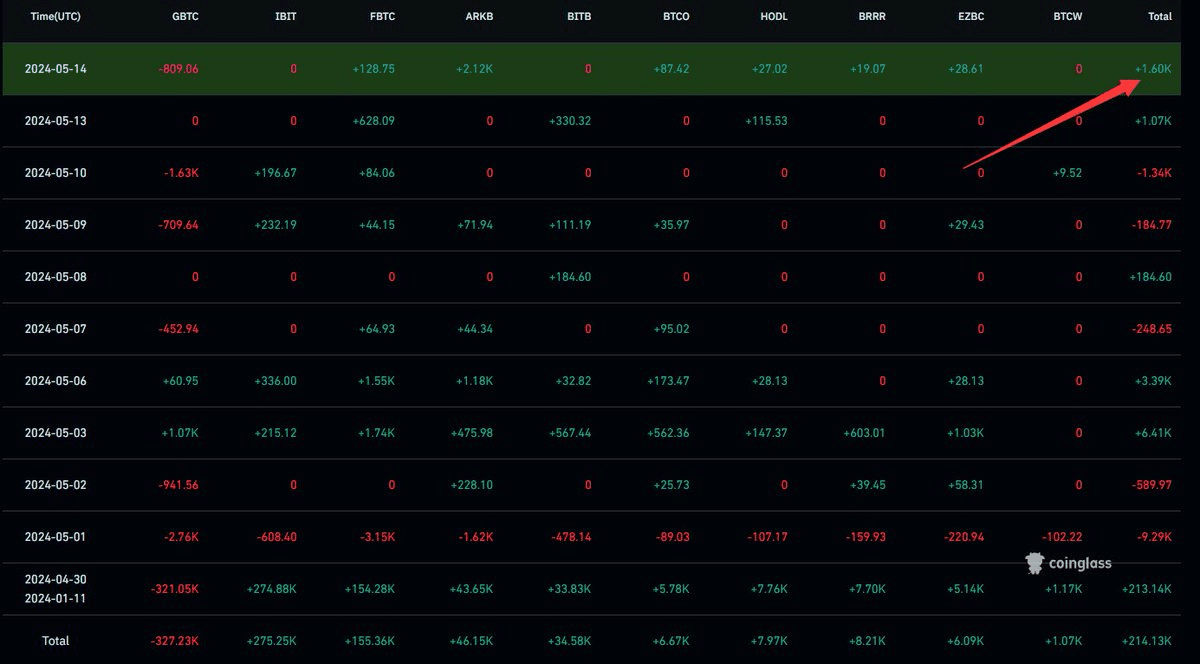

Meanwhile, Bitcoin ETFs are also showing some notable trends.

In the past 24 hours, there was an inflow of around 1,600 Bitcoin, equivalent to roughly $100.5 million based on current market prices, according to information from Coinglass.

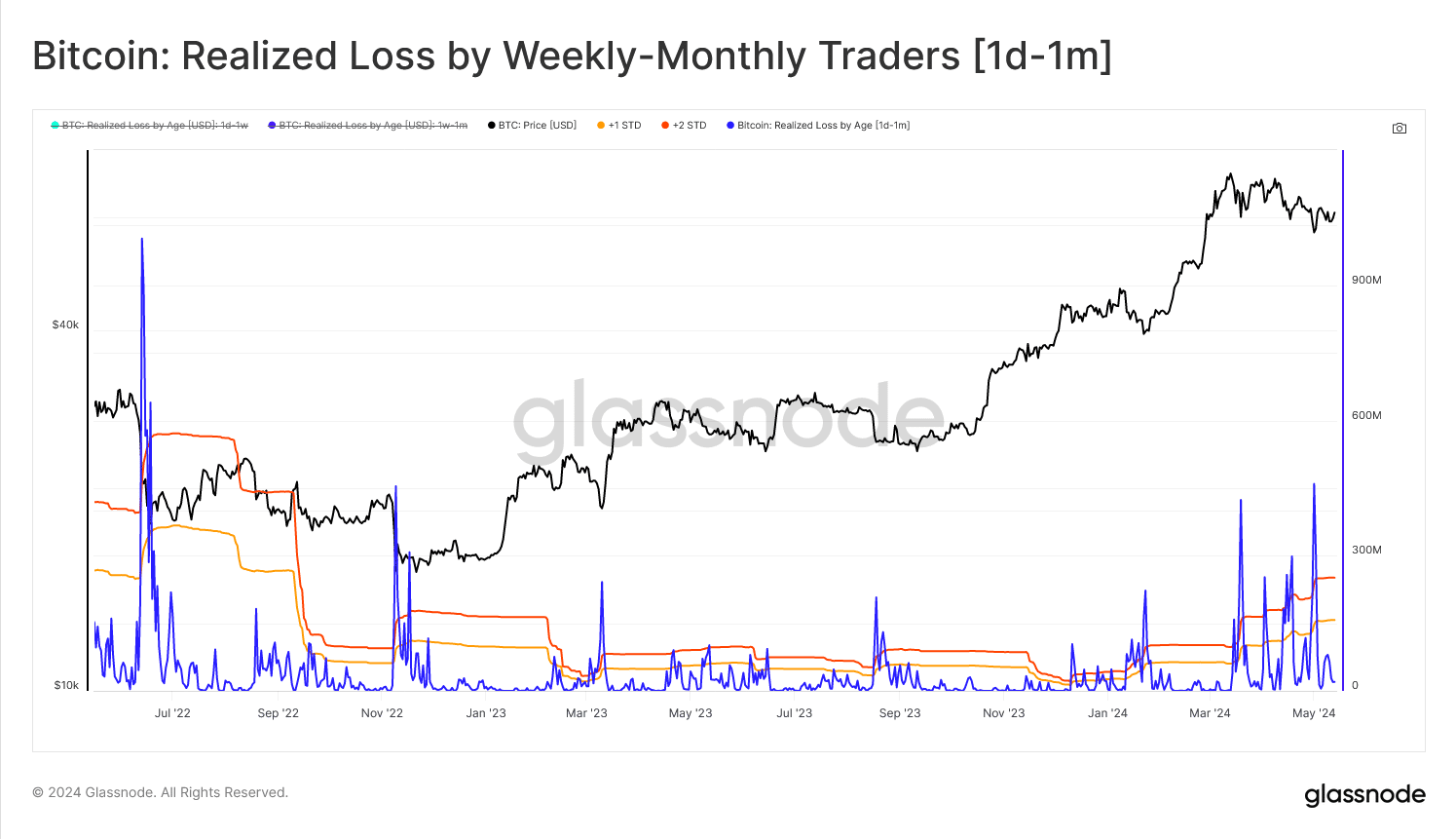

The latest metric introduced by Glassnode, named ‘Breakdown by Age,’ has provided valuable insights into the investing habits of individuals during the present market scenario.

As a researcher studying financial markets, I have observed that during a bull market, it is typically the long-term investors who reap substantial rewards. Conversely, those with shorter investment horizons may experience losses.

The brief setbacks experienced in the market towards the beginning of 2024 could be indicative of a shift in trend. Observe the chart below; it depicts a bullish market during this period.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin’s price makes no move

If Bitcoin holds its ground near the $62,700 mark with a favorable market outlook, there’s a good chance it will make another run for $63,000 and potentially even surpass that price.

If the price falls beneath the $62,700 mark of support, sellers may feel compelled to cash in their gains, triggering additional selling and potentially causing the price to drop further.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-16 02:15