-

Ethereum’s exchange reserves hiked over the past week

Most metrics suggested that ETH might continue to rally

As a seasoned crypto investor with several years of experience under my belt, I’m always keeping an eye on Ethereum’s price movements and market trends. The recent surge in ETH‘s price and the buy signal flashing on its chart are certainly worth noting.

Over the past 36 hours, the cryptocurrency market has seen a bullish trend, resulting in most cryptos displaying upward trends on their charts. This shift was also reflected in Ethereum [ETH], whose price rose and triggered a buy signal on its chart, suggesting potential price growth in the near future.

Ethereum’s bullish turn

Based on CMC’s report, ETH experienced a significant price drop last week, reaching a low of $2,860. However, the buying force regained control in the past day, causing a surge of more than 3.5%, with the token currently trading at $3,007.64. Its market capitalization was valued above $361 billion as of press time.

While analyzing crypto markets, renowned figure Ali identified a potential buying opportunity for Ethereum (ETH). Based on his assessment, ETH might experience a bounce-back, ranging from one to four price candles.

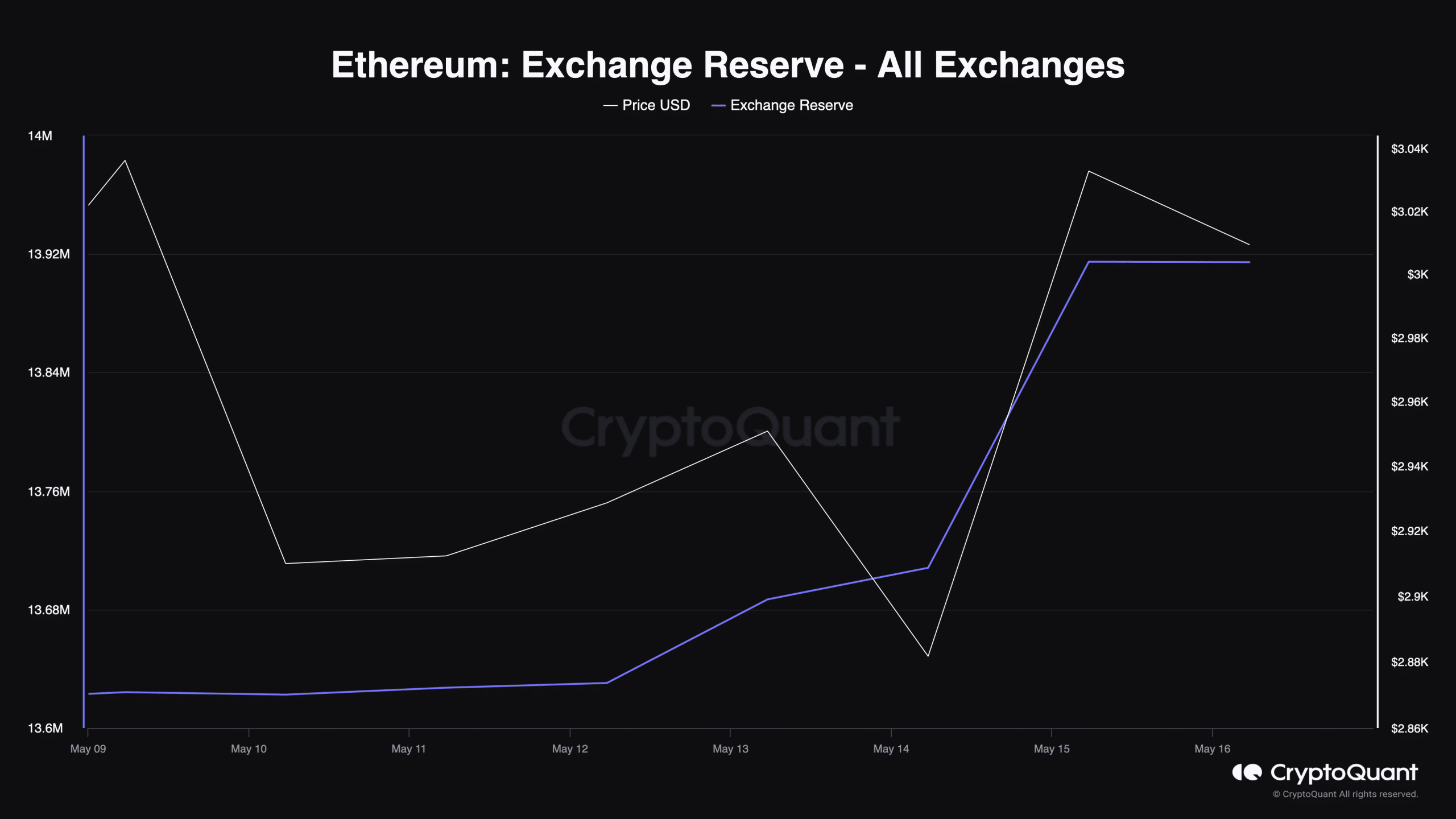

AMDCrypt0 examined Ethereum’s statistics to determine if investors seized the chance to acquire additional Ethereum. A review of CryptoQuant’s figures indicated a significant increase in Ethereum’s exchange reserves, suggesting heightened selling activity.

As a researcher investigating recent investor activity in Ethereum (ETH), I turned to Santiment’s data for insights. Notably, I discovered that the amount of ETH held on exchanges had increased over the past week. This could suggest that some investors may have sold their ETH holdings during this period.

The amount of Ethereum held by leading addresses showed little change, implying that whales had not engaged in significant transactions. A plausible explanation for this pattern could be that investors were anticipating a market peak and therefore chose to cash out their Ethereum holdings and secure their gains.

Will Ethereum’s bull rally continue?

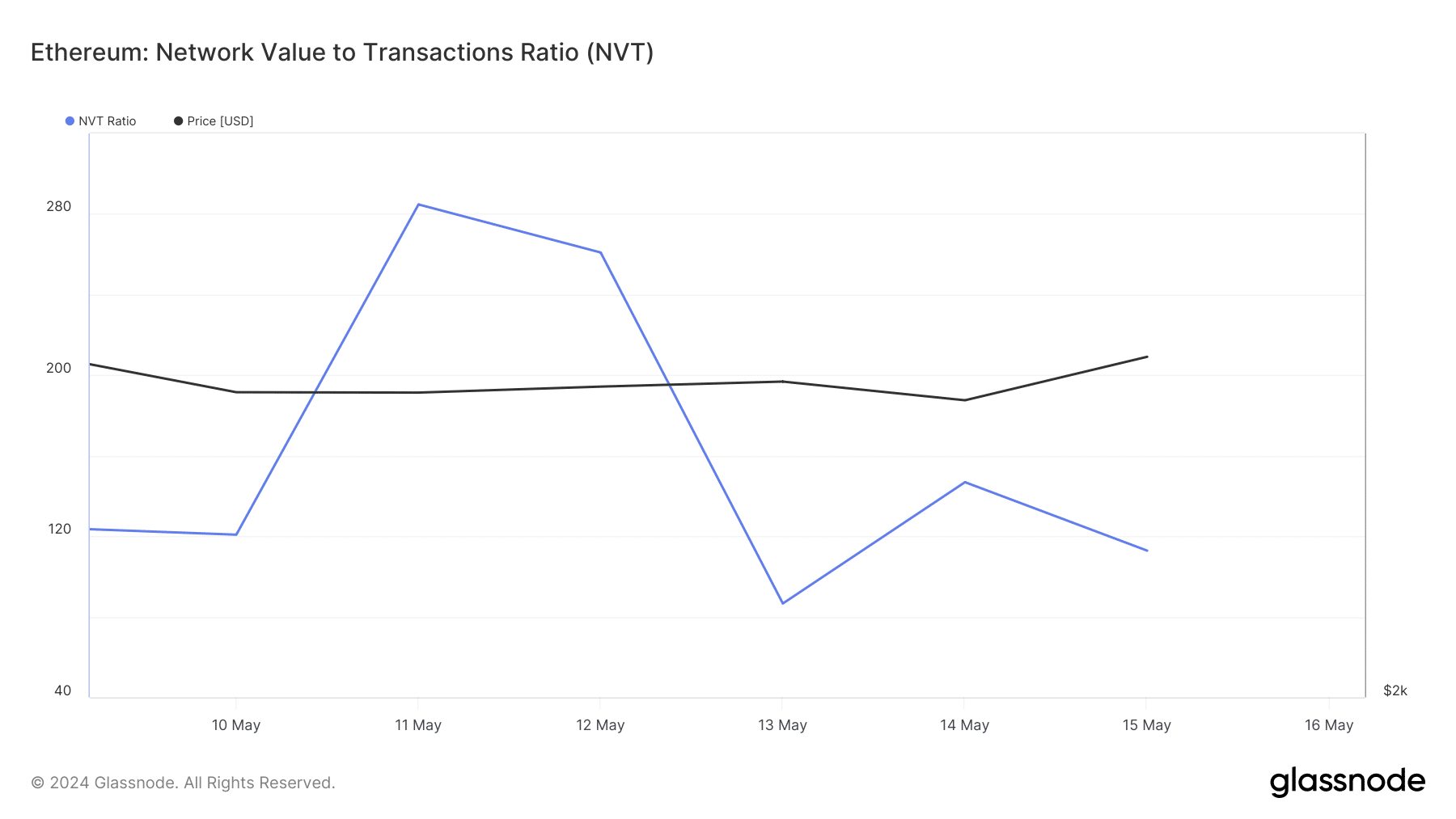

To see whether this bull rally would last longer, AMBCrypto then analyzed Glassnode’s data.

Based on our examination, Ethereum’s Network Value to Transactions (NVT) ratio has decreased in the last week. This decrease implies that the asset may be underpriced, increasing the likelihood of a price surge.

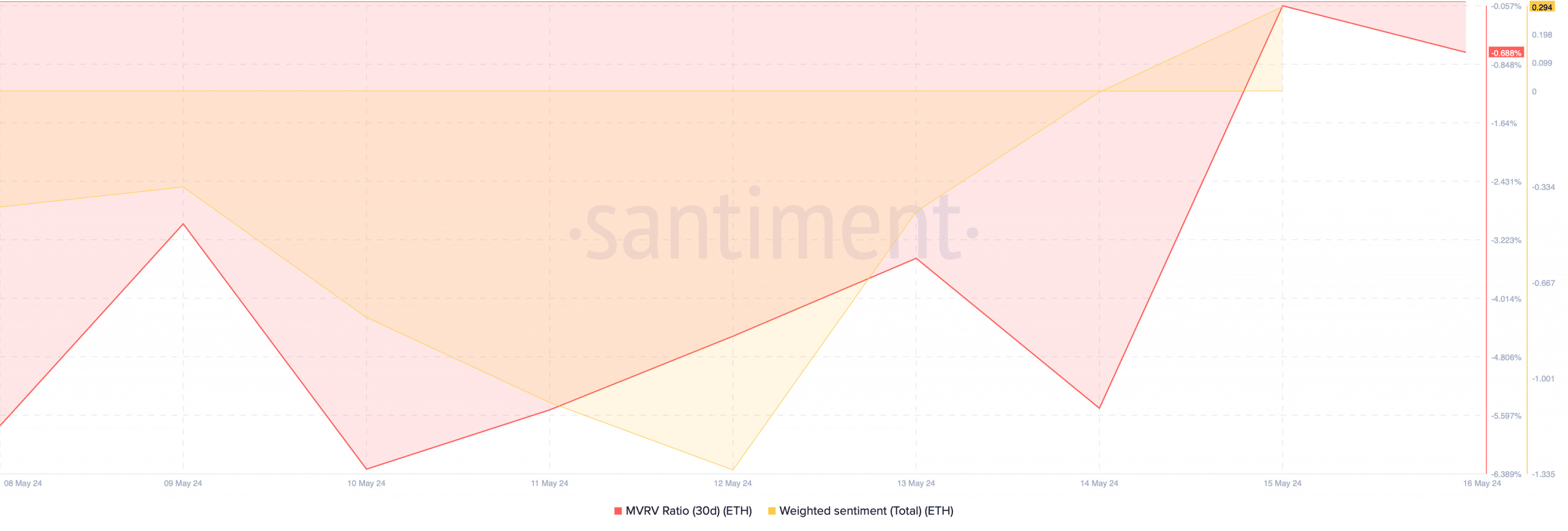

The MVRV ratio for the token has significantly increased in the past few days, indicating a potential buying opportunity based on this metric.

At the moment of publication, Ethereum’s MVRV (Maker’s Value Realized vs Maker’s Value) ratio stood at a level of -0.68%. Simultaneously, investors’ attitude towards Ethereum became more optimistic, as indicated by an increase in its weighted sentiment.

Read Ethereum (ETH) Price Prediction 2024-25

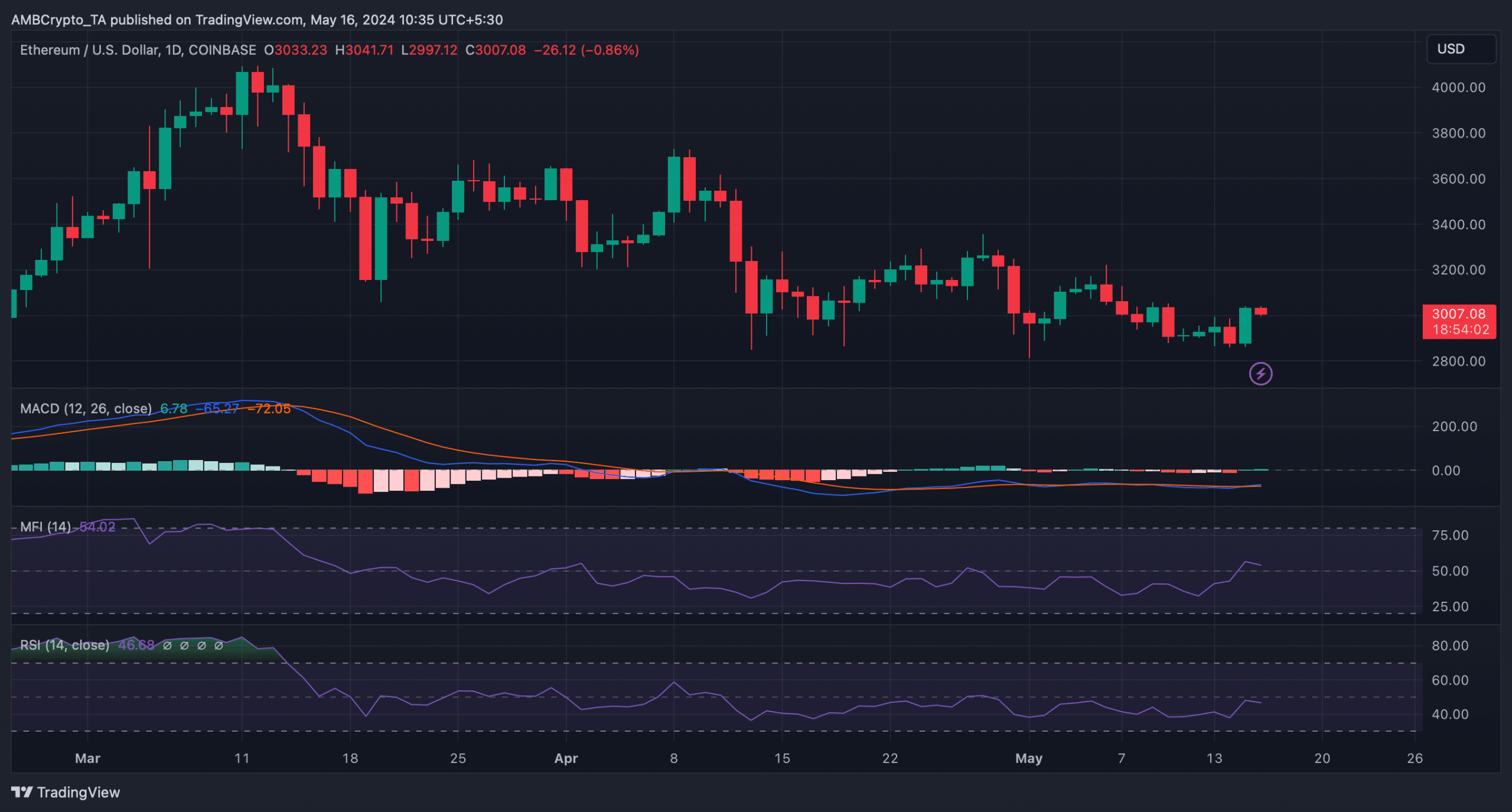

As a technical analyst, I’ve noticed an intriguing development in Ethereum’s price chart. The Moving Average Convergence Divergence (MACD) indicator has signaled a bullish crossover. This occurrence typically suggests a strong uptrend, implying that the bull market may persist for some time.

Contrary to some positive signals, the Relative Strength Index (RSI) and Money Flow Index (MFI) indicated a different outlook. Specifically, I noticed a downtick in the RSI values while the MFI followed a descending trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-05-16 11:03