-

BOME’s price has risen by double digits in the last 24 hours

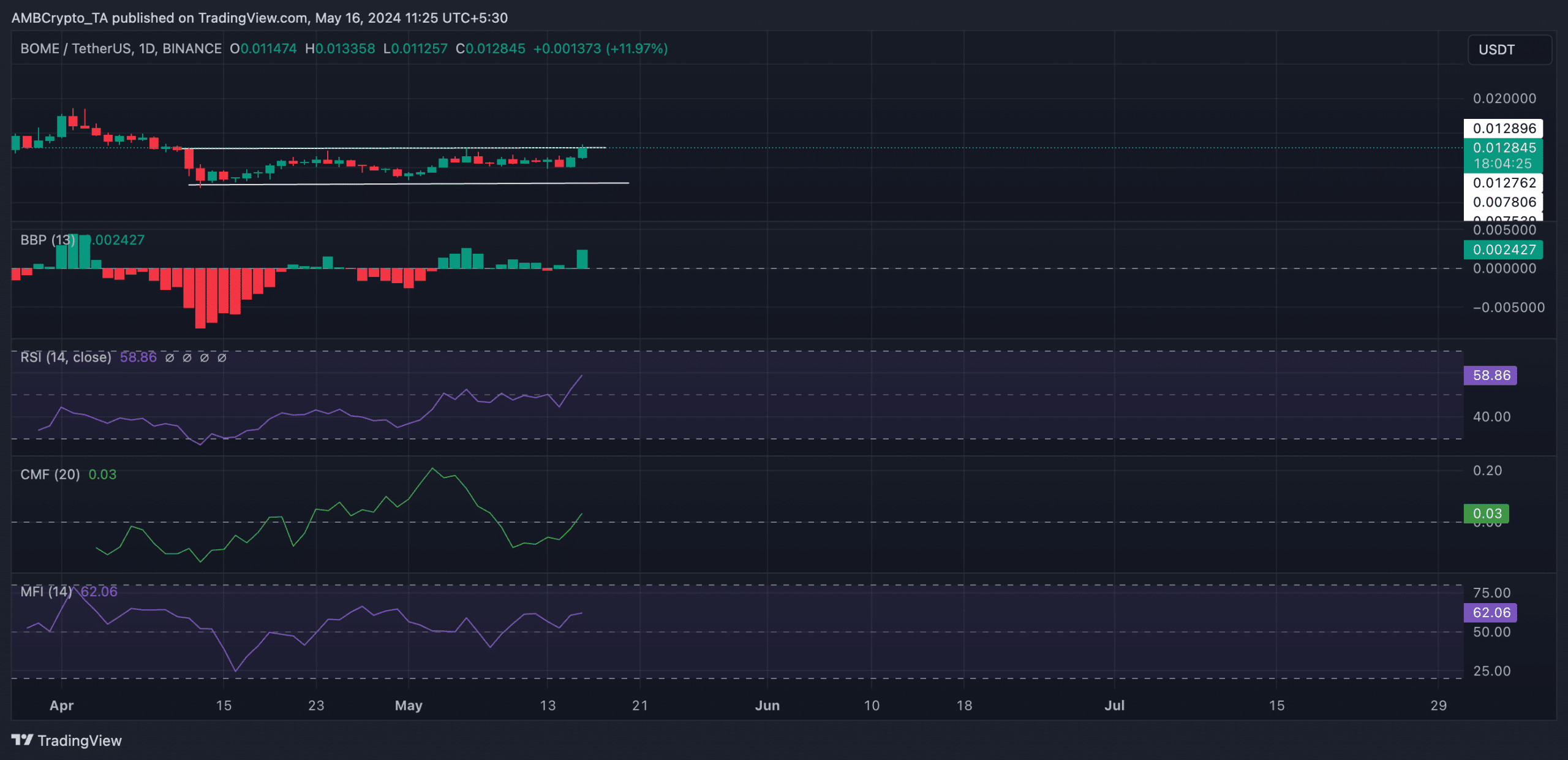

Last few weeks have seen it consolidate within a horizontal channel too

As an experienced analyst, I believe that BOME‘s recent price surge is a result of the broader trend in the memecoin market. However, it’s important to note that this token has been trading within a horizontal channel for the past few weeks.

In the past day, the price of the meme-focused cryptocurrency Book of Meme (BOME) has experienced a notable increase of approximately 21%, likely fueled by the current buzz and growth in the memecoin sector.

At the moment of publication, the value of BOME‘s altcoin was at $0.0125 based on market charts. On May 16th, early in the trading day, BOME’s price surged to a one-month peak of $0.13, subsequently experiencing a minor retreat and returning to its current value as per CoinMarketCap.

BOME makes an attempt

Before the latest surge in the cryptocurrency market, BOME‘s price moved quietly within a restricted band, shaping a flat trendline pattern referred to as a horizontal channel.

When an asset exhibits sideways trading within a defined price range over a certain duration, it can be described as following a consolidation pattern. During such periods, neither the buyers nor sellers manage to exert enough power to cause substantial price movements in the asset. Consequently, a price corridor emerges where the asset’s value oscillates between its resistance and support levels.

In BOME’s case, it has faced resistance at $0.0127, while finding support at $0.007.

As a researcher observing the market at this moment, I notice that BOME seems ready for a potential increase in value as it hovers above its resistance level. When the price of an asset surpasses the upper trendline acting as resistance, a buy signal emerges.

As a crypto investor, I closely monitor AMBCrypto’s analysis of various technical indicators. Their assessment that a resistance level could be breached provided significant insight into potential price movements in the market.

At the present moment, I’ve noticed some promising trends in BOME‘s key momentum indicators. Specifically, its Relative Strength Index (RSI) stood at 58.38, and its Money Flow Index (MFI) was reading 61.95.

At these values, these indicators revealed that buying pressure exceeded profit-taking activity.

Additionally, the Chaikin Money Flow (CMF) of BOME has surpassed its zero line, registering a level of 0.03 currently. This technical indicator signifies the inflow of money into the asset, enhancing the market’s liquidity and supporting its price movement.

As a researcher studying the cryptocurrency market, I’ve found that the Elder-Ray Index for BOME has shown a positive value. This signifies the persisting bullish trend for this altcoin. The Elder-Ray Index is my go-to indicator to gauge the balance of power between buyers and sellers in the market. A positive value implies that the buying pressure is stronger than the selling pressure, reinforcing the upward trend.

When the market is favorable as it currently is, bullish influence holds the upper hand for BOME‘s Elder-Ray Index, which stood at 0.0024 at the time of reporting.

Read Book of MEME’s [BOME] Price Prediction 2024-25

What next for BOME?

If the price of BOME surpasses its current resistance level, it could potentially reach a new price of $0.015. On the other hand, should the bears regain control and invalidate this projection, the memecoin’s value may be pulled back towards its support at $0.009.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-05-16 12:07