- Bitcoin’s price now has a strong correlation to macro events, including Fed rate decisions

- Analysts expect a range breakout, but they disagree on when it might happen

As an experienced financial analyst, I believe that Bitcoin’s price behavior is increasingly influenced by macroeconomic events, particularly those impacting liquidity, such as Fed rate decisions. The recent rally following the release of lower-than-expected U.S inflation data is a prime example of this correlation.

Bitcoin’s price surged by 7.5%, reaching a new high of $66,000 on the charts, in response to the unanticipated drop in crucial US inflation figures. This upbeat market reaction is consistent with Bitcoin’s historical trend of reacting strongly to significant macroeconomic events, such as revised Federal Reserve interest rate predictions.

I, Rob Hadick, General Partner at Dragonfly, have expressed my perspective regarding Bitcoin. In my viewpoint, Bitcoin functions as a significant or large-scale investment asset, often referred to as a ‘macro’ asset.

“In my opinion, Bitcoin functions as a large-scale investment asset. Its price movements appear to mirror the amount of liquidity present in the financial markets.”

He further stated that market reactions can be anticipated when there are changes affecting market fluidity, such as quantitative easing programs, adjustments in balances, or Federal Reserve interest rate determinations.

Will ‘better’ macro conditions help Bitcoin in 2024?

As a crypto investor, I’ve noticed that the connection between Bitcoin (BTC) and significant economic events, such as Federal Reserve rate decisions, has grown stronger in recent times. This correlation became more pronounced when investments into new US spot Bitcoin Exchange-Traded Funds (ETFs) began to decrease.

Many market observers have pointed out that the overall market liquidity has been low, leading to subdued price movements in Bitcoin over the past few weeks. Notably, crypto-analyst Jamie Coutts observed that although global liquidity is increasing, the momentum has stalled.

As a researcher closely following the cryptocurrency market and Bitcoin in particular, I’ve observed the recent “sluggish” pace of liquidity. However, I remain optimistic and anticipate a significant breakthrough around October 2024.

As a researcher studying global financial markets, I’ve identified a developing trend in liquidity that resembles a bullish ascending triangle formation. Based on historical patterns and current market conditions, I anticipate this triangle could potentially break out before October 2024. For Bitcoin enthusiasts, the year 2025 is predicted to be quite remarkable.

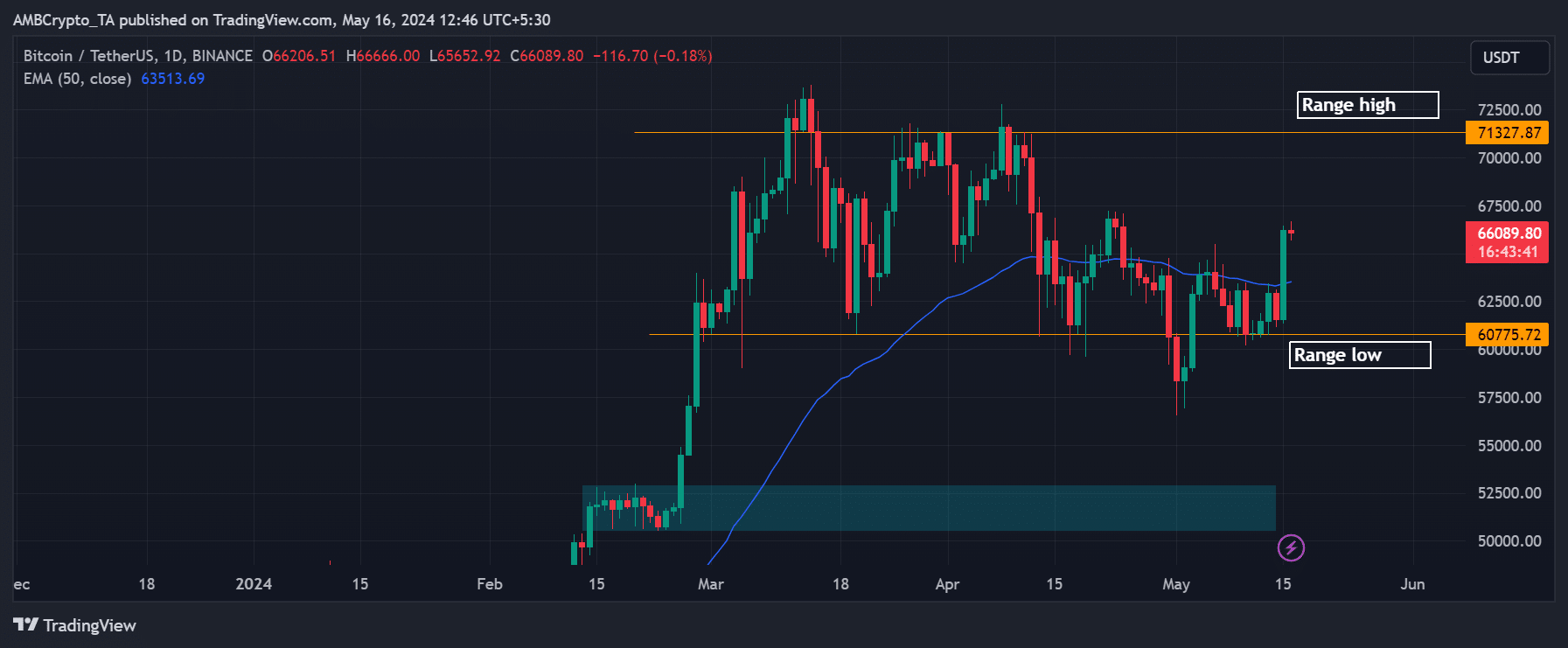

As a researcher examining global liquidity trends and their potential impact on Bitcoin’s price action, I find that current projections suggest Bitcoin could continue its consolidation phase between $60,000 and $72,000 well into the early quarter of 2024. This forecast slightly deviates from Mike Novogratz’s predictions.

Mike Novogratz, Founder of Galaxy Digital, projected a possible range breakout by the end of Q2.

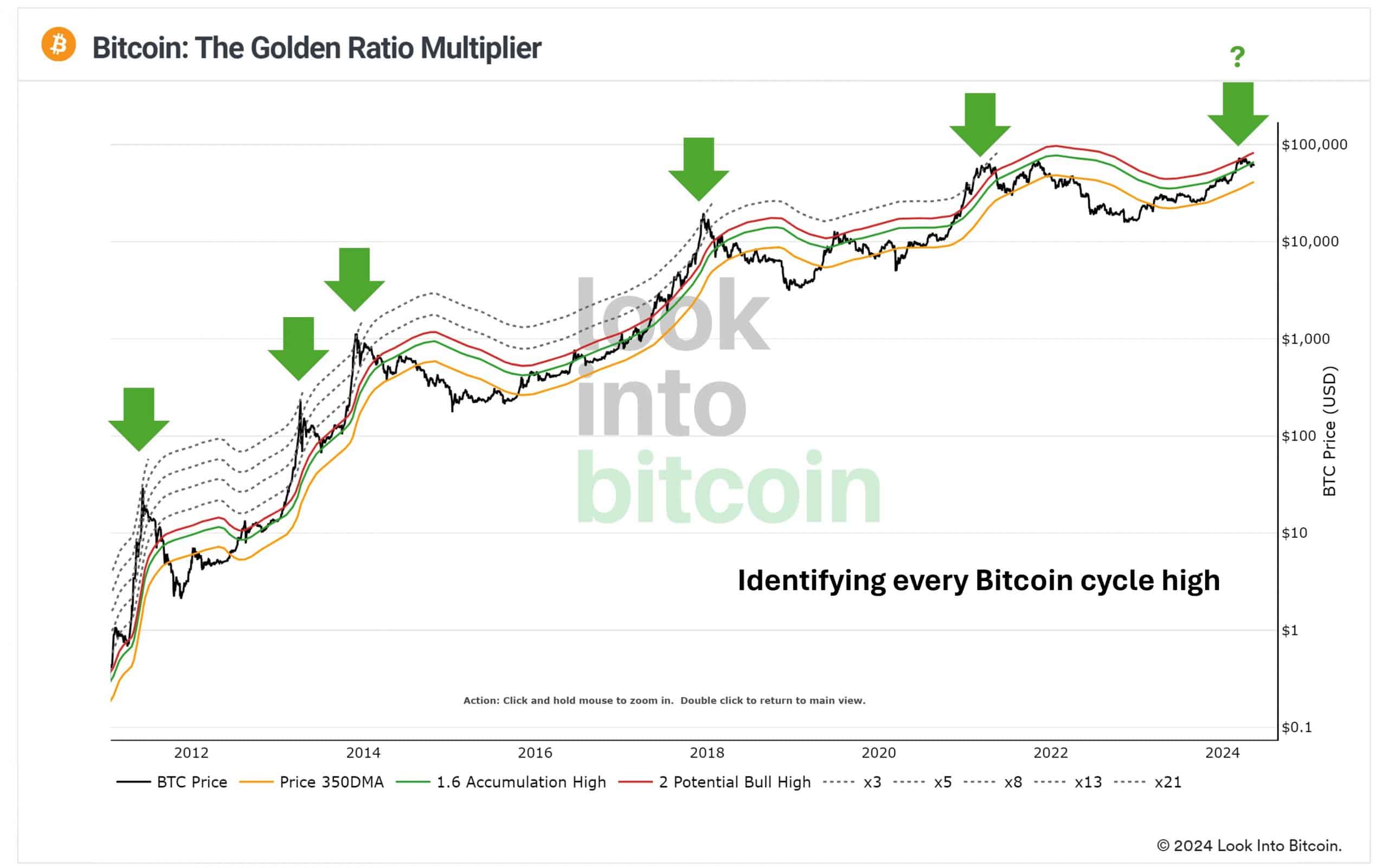

Another person isn’t the sole one making this observation. According to Philip Swift, the creator of Look Into Bitcoin, using the Golden Ratio Multiplier as a guide, Bitcoin’s value could potentially double or even triple its current worth.

As an analyst, I’ve observed that the GR Multiplier significantly contributed to the widespread adoption of Bitcoin during its formative years. Moving forward, we find ourselves transitioning into a fresh stage in Bitcoin’s development – some call it a supercycle.

As a researcher studying the dynamics of Bitcoin’s price movements, I employ the GR multiplier as a key tool to estimate both short-term and long-term price projections. This indicator takes into consideration Bitcoin’s adoption curve and historical market cycle patterns.

Swift holds that the recent peak indicated by the GR Multiplier aligns with the ending of Bitcoin’s adoption growth phase based on its past market cycle accuracy.

As an analyst, I would interpret this by saying: “I believe we’re approaching the maturity stage in Bitcoin’s adoption curve. The recent introduction of Bitcoin ETFs is a clear indication that it’s becoming increasingly integrated into global financial markets.”

As a crypto investor, I’ve noticed the predictions from analysts regarding Bitcoin (BTC). They anticipate a significant surge beyond our current price range. However, there’s a debate about when exactly this breakout will occur. Some believe it could happen soon, while others are more cautious and suggest a later timeline. Regardless, we should keep a close eye on BTC’s price movements.

As a market analyst, I would suggest that in the immediate future, Bitcoin (BTC) may target the resistance level at around $71,000. This projection stems from my observation of both shorter-term and longer-term market structures potentially shifting towards a bullish stance after recently displaying bearish tendencies.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-05-16 13:11