- Arbitrum active addresses registered figures of 900,000 for consecutive days

- ARB’s market trend has continued to fall though

As a crypto investor with some experience in the market, I’m keeping a close eye on Arbitrum (ARB) after its recent achievements in the Layer 2 ecosystem. The network set a new record for daily active addresses, which surpassed 900,000 for consecutive days, and maintained an average of over 900,000 active addresses in the last seven days. This is quite impressive, as it solidified Arbitrum’s position within the L2 space.

As an analyst, I’d put it this way: Today, Arbitrum has made headlines by reinforcing its stance in the Layer 2 space. This achievement was marked by consistently maintaining a significant number of active addresses, which reached a new peak and established a record for daily active addresses.

Lately, there has been a significant rise in the number of transactions for this platform. Moreover, this trend is accompanied by an uptick in activity. Nevertheless, the value and trading volume of its associated token have remained fairly constant on the price charts.

Arbitrum sets record for active addresses

On May 15th, a thorough examination of active addresses on Growthepie uncovered a new milestone for Arbitrum with a staggering number exceeding 972,000. This figure shattered the previous record not only for Arbitrum but also for all Layer 2 networks in terms of daily active addresses. Furthermore, during the preceding seven-day period, Arbitrum consistently averaged over 900,000 active addresses – yet another unprecedented achievement.

As a data analyst, I’ve observed that during the time of my analysis, Arbitrum had recorded approximately 786,000 active addresses in the previous 24-hour period. In contrast, Base, its closest rival in Layer 2, reported around 299,000 active addresses. This indicates a substantial impact and influence that Arbitrum holds within this space.

At the current moment, Arbitrum stood out among other layer 2 (L2) networks with around 2.1 million recorded transactions. The surge in transaction activity was mirrored by an increase in active addresses, reinforcing its leading position within the L2 market.

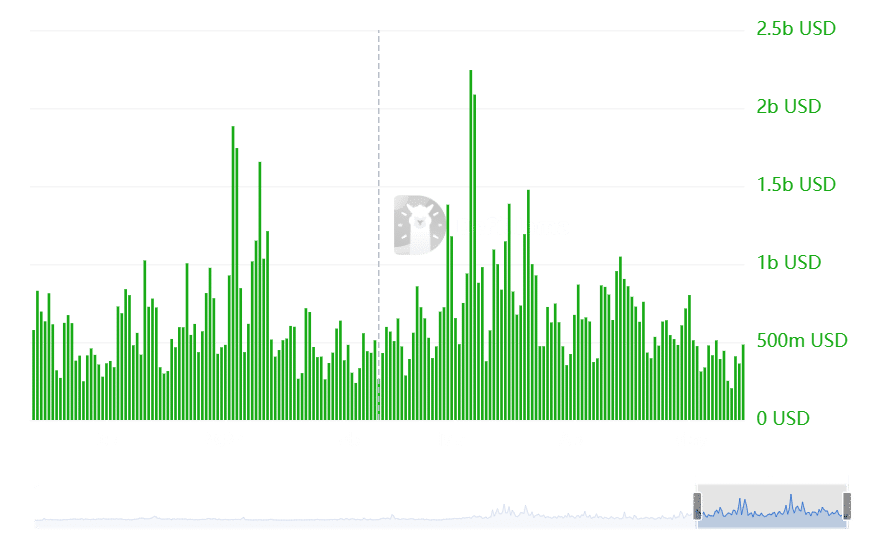

Arbitrum volume remains steady

As an analyst, I’ve noticed a surge in the number of active addresses on Arbitrum within the last few days. However, upon closer examination of its transaction volume, I didn’t find any substantial shifts or spikes. Interestingly enough, according to DefiLama’s data, there were no remarkable changes in L2 (Layer 2) volumes over the past week.

Despite hitting a new record high in the past 24 hours, the network processed approximately $483 million worth of transactions.

An increase of more than 1% has occurred in Arbitrum’s Total Value Locked (TVL) within the past 24 hours.

Based on L2 Beats’ statistics, Arbitrum’s total value locked currently exceeds $16 billion, marking a rise of more than 1.2% in the data reported at the time of this writing.

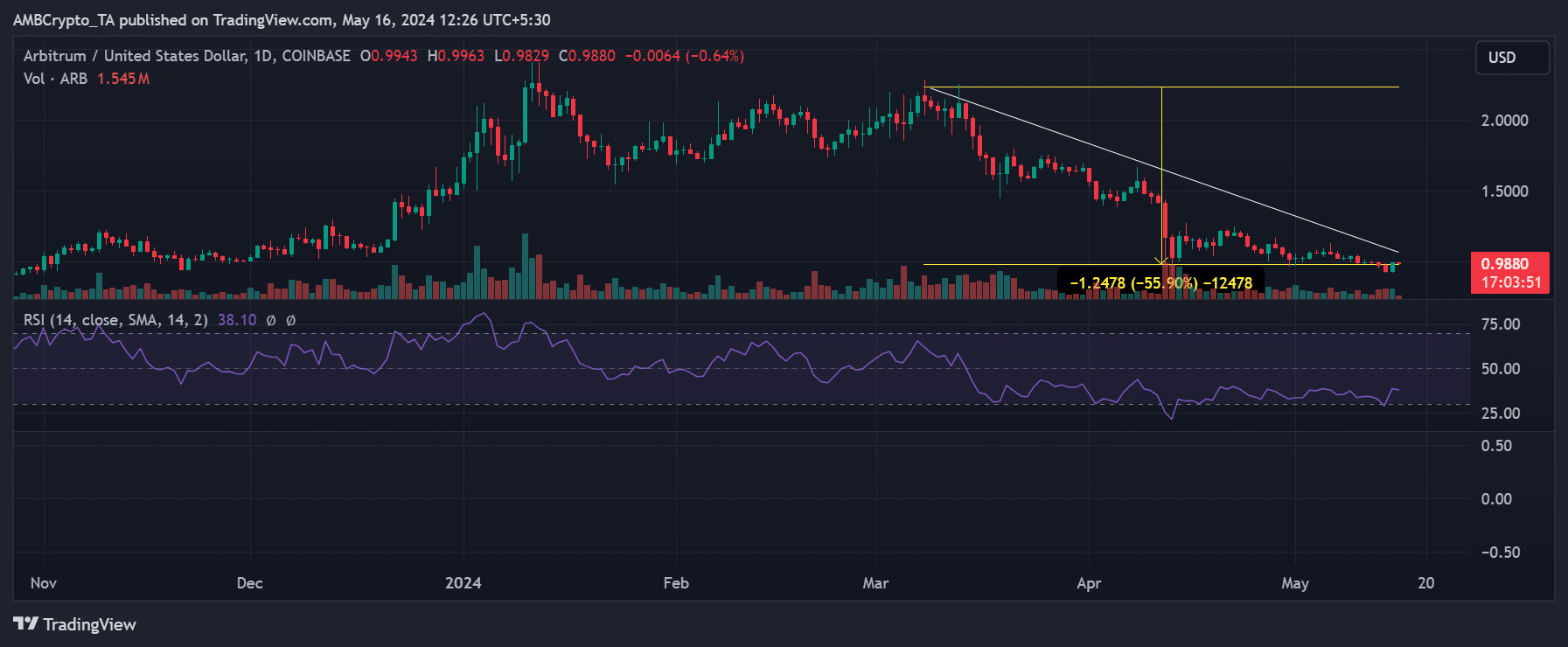

ARB remains bearish

Although Arbitrum has experienced significant growth in terms of active addresses and TVL, unfortunately, this positive trend hasn’t been reflected in its native token, ARB. A closer look at the daily chart reveals that ARB has been on a decline since March.

– Realistic or not, here’s ARB’s market cap in BTC’s terms

Based on our price range analysis, ARB has dropped around 55% in value since the downward trend initiated.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Solo Leveling Arise Tawata Kanae Guide

2024-05-16 19:04