-

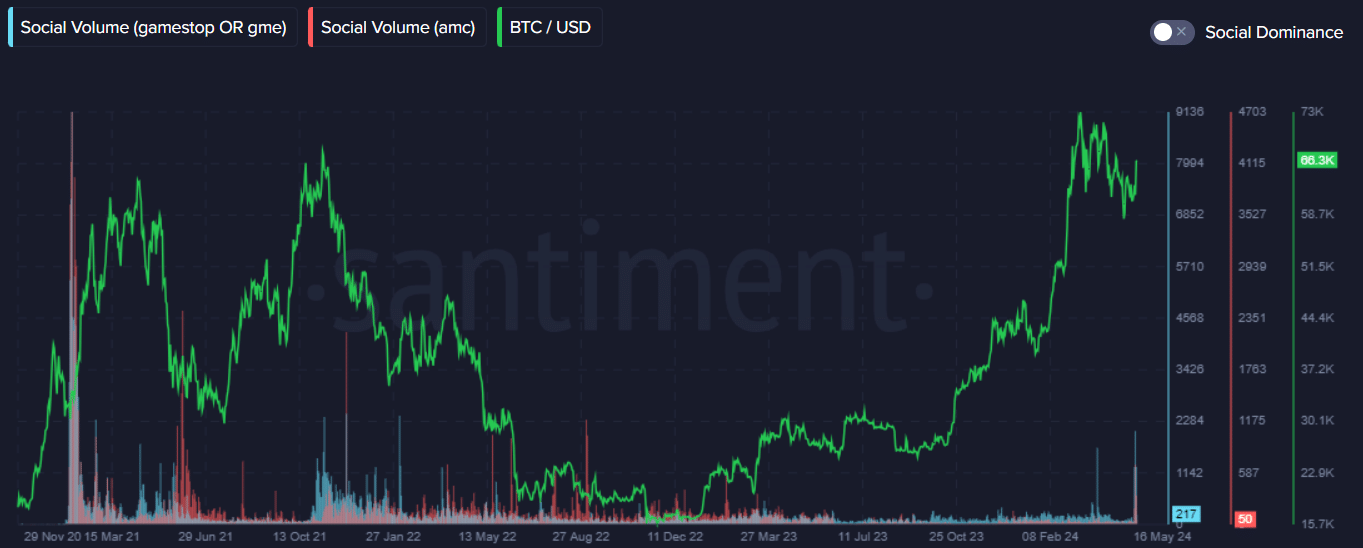

How much correlation does GME’s rally and its social volume have with Bitcoin’s price trends?

Impact of the same was seen on the higher timeframes during the previous cycle

As a seasoned crypto investor with several years of experience under my belt, I’ve witnessed firsthand how interconnected various markets can be, especially during times of high volatility and social media hype. The recent correlation between GameStop (GME) and Bitcoin (BTC) price trends has been intriguing, to say the least.

Bitcoin’s price broke through its short-term resistance at $64,500 around May 15, following closely behind GameStop’s remarkable 284% surge from last week’s prices. As per a recent post on X (previously Twitter), Santiment suggested that the frenzy surrounding GameStop may have spilled over into the crypto market.

In light of the unpredictable character of the cryptocurrency market, particularly within the memecoin niche, this correlation is not unexpected. AMBCrypto explored potential additional correlations to ascertain if public opinion can signify market peaks and valleys.

Short-term top and bottom coincided with increased social activity

As an analyst, I’ve observed that over the past three days, there have been significant mentions of GME and AMC on social media platforms, which seemed to correspond with Bitcoin’s price peaks and valleys. However, it’s essential to note that these social trends might not have signaled a change in Bitcoin’s trend. Instead, they may have merely occurred concurrently with the price movements.

On the Monday, May 13th, following the weekend, Roaring Kitty emerged from a three-year long hiatus and posted a memorable message on X, which was previously known as Twitter. A few days later, on May 15th, important economic data was released: the Consumer Price Index and inflation figures came out lower than expected. As a result, investors became more willing to take risks.

The social media buzz around GameStop significantly escalated in January and November of the year 2021. In particular, January witnessed an increase due to the rebound of Bitcoin prices from a steep drop to approximately $31,000, leading to another surge in its value.

From my perspective as an analyst, while the social volume surge in November 2021 reached a peak for cryptocurrencies, Bitcoin prices subsequently started to decline. Despite the recent correlation having a valid explanation, Santiment’s recent observations might hold some merit.

Traders and investors might want to keep an eye on these metrics in the future.

What about the altcoin market’s capitalization?

During January and November 2021, there were significant increases in social volume on the GME forum that weren’t only connected to Bitcoin’s surge and peaks but also to the growth of the altcoin market’s total value. However, this wasn’t the case for the May 2024 spike. Instead, since October 2023, the value of the altcoin market has been steadily increasing.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a researcher studying the dynamics of the crypto-market, I have observed a noticeable increase in social media activity surrounding GameStop (GME) stocks. This surge in conversation seems to be bolstering the existing bullish sentiment in the market. However, it does not guarantee that this trend will definitely materialize into a full-blown bull market.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-05-17 03:03