-

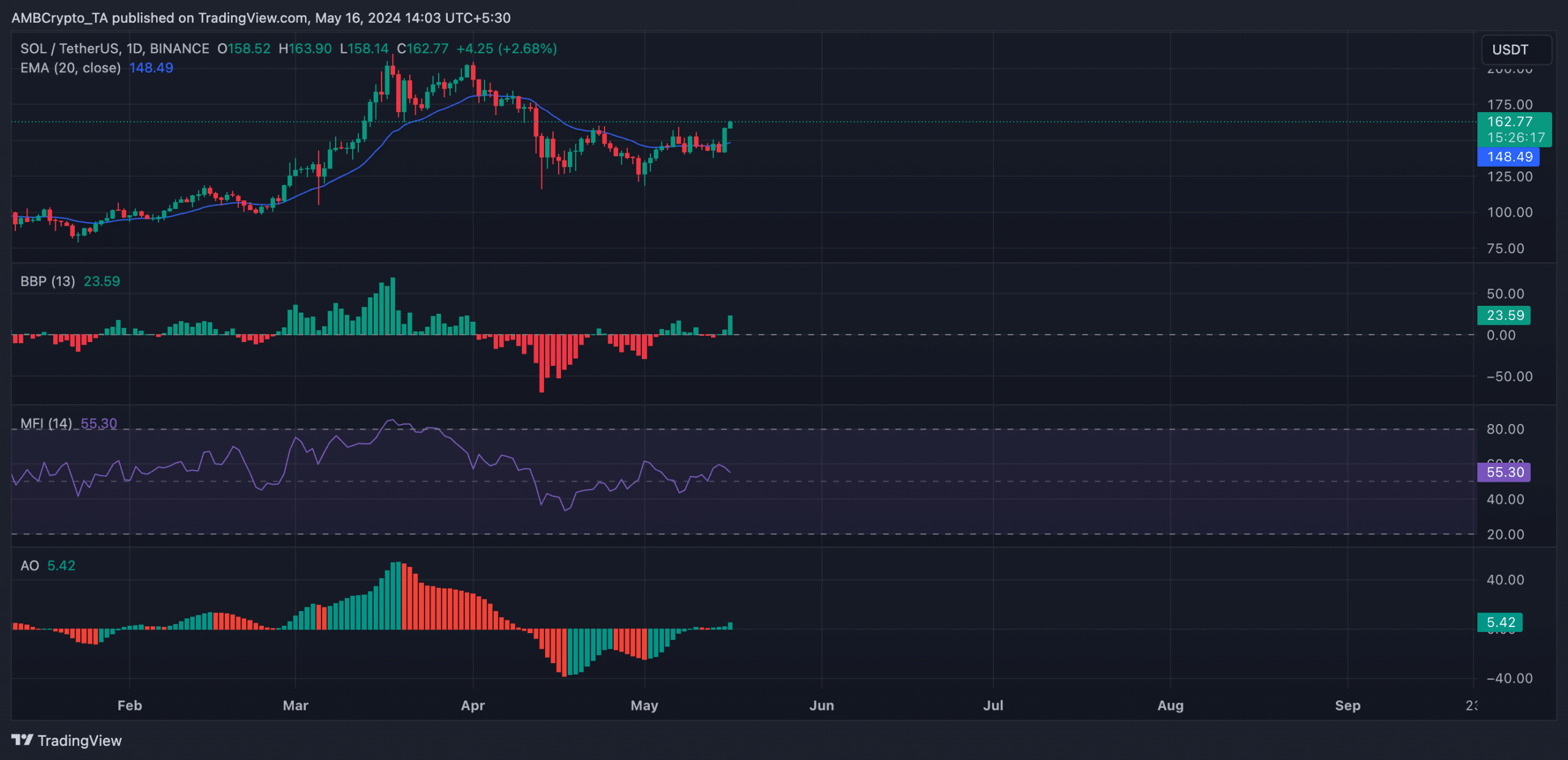

SOL’s price rallied above its 20-day EMA on the charts on 15 May

This pointed to a decline in selling pressure

As a seasoned crypto investor with a keen eye for technical analysis, I’m always on the lookout for promising trends and potential opportunities in the market. And the recent price action of Solana [SOL] has certainly piqued my interest.

On May 15, during the daily trading hours, the cost of Solana’s SOL token surpassed its 20-day Exponential Moving Average (EMA). This signified a surge in fresh interest and demand for the cryptocurrency.

This occurrence is significant as SOL‘s price surpassed its average price during the previous 20-day period. Moreover, it signaled a growing buying pressure and potentially initiated an upward trend for this altcoin.

SOL prepares for more

At the moment of publication, the value of SOL was $163.28, representing a 13% increase over the past 24 hours. Based on an analysis of its key technical indicators, there’s a strong likelihood that this upward trend could continue in the near future for the altcoin.

Initially, indicating increased demand, the Relative Strength Index (RSI) of SOL was climbing upwards and stood at 59.20 as of now. Additionally, its Money Flow Index (MFI) amounted to 55.29.

As a researcher studying the trading behavior of SOL holders, I discovered that their actions were consistent with a preference for accumulating more tokens rather than selling for profits based on the observed indicator values.

Additionally, the Awesome Oscillator indicator on the coin signaled bullish momentum with its display of green bars, aligning with the current positive trend.

As a researcher studying financial markets, I would describe this indicator as follows: This metric reflects the market momentum of an asset by signaling potential trend shifts in its pricing. When you notice green upward-pointing bars emerging after a phase of consolidation or correction, it suggests that buying power is regaining control over the market. Consequently, the price surge of the asset might persist.

The Elder-Ray Index of the coin indicated a positive value at the current moment, supporting the previously mentioned perspective. This index stood at 23.59 during our last check, suggesting that buying strength prevailed in the Solana market.

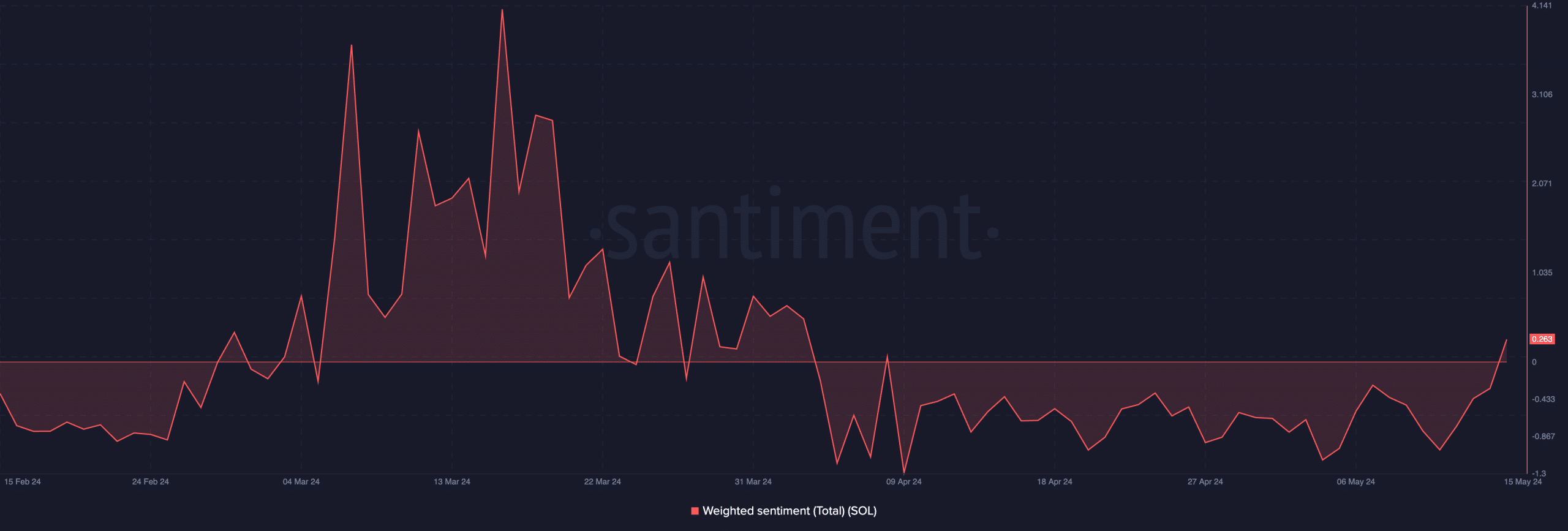

As a crypto investor, I’ve noticed an uptick in the bullish trend for Solana (SOL) since its recent crossover. Notably, the coin’s sentiment, as indicated by its weighted average, has shifted from negative to positive for the first time since 4 April. This change in sentiment is a promising sign and could potentially indicate further growth for SOL in the crypto market.

Based on the information from Santiment, I found that the coin’s weighted sentiment was 0.263 when I examined it.

Realistic or not, here’s SOL’s market cap in BTC’s terms

Do not get carried away

The unexpected surge in interest for SOL has been met with an uptick in market instability. According to the Bollinger Band analysis, the distance between the indicator’s upper and lower bands is growing larger.

As a crypto market analyst, I’ve observed that when the price difference between certain bands on the chart expands, the volatility of the crypto-asset increases significantly. Consequently, the asset’s value may experience considerable fluctuations in both upward and downward directions.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-05-17 08:07