- U.S. spot Bitcoin ETF inflows, Millennium Management’s holdings demonstrate growing institutional involvement

- Galaxy Digital’s income surge and increased ETF investments propelled Bitcoin’s latest hike too

As an experienced analyst, I believe that the recent surge in U.S. spot Bitcoin ETF inflows and the growing involvement of institutional investors, such as Millennium Management, are clear indicators of the increasing acceptance and legitimization of Bitcoin as a viable investment asset.

As a researcher studying the cryptocurrency market, I’ve observed that when Bitcoin surpassed the $66,000 mark on price charts, there was a significant increase in investments flowing into U.S.-listed Bitcoin spot ETFs. Specifically, these ETFs experienced inflows amounting to approximately $303 million over a two-week period.

Based on the information from Farside Investors, only BlackRock’s iShares Bitcoin Trust (IBIT) experienced outflows among all spot Bitcoin ETFs on May 15th.

Interesting data sets

As I delve into the latest data on institutional investment flows in Bitcoin (IBIT), I’m taken aback by the fact that it has remained unchanged for the third straight day, neither experiencing notable influxes nor outflows. In contrast, Fidelity’s FBTC reported a substantial inflow of $131.3 million. Furthermore, Grayscale’s GBTC marked its first positive day in a week with an inflow of $27 million.

Seeing this performance, Sunnydecree, a Bitcoin investor/analyst noted,

“$303’000’000 Bitcoin ETF inflows yesterday. We are so back!”

Adding to the excitement, another X user, ‘Bitcoin for Freedom’ said,

“That’s a Bull Market Multiple of 276! No one is ready for this bullrun. We’ve seen nothing yet!”

Millennium Management’s big move

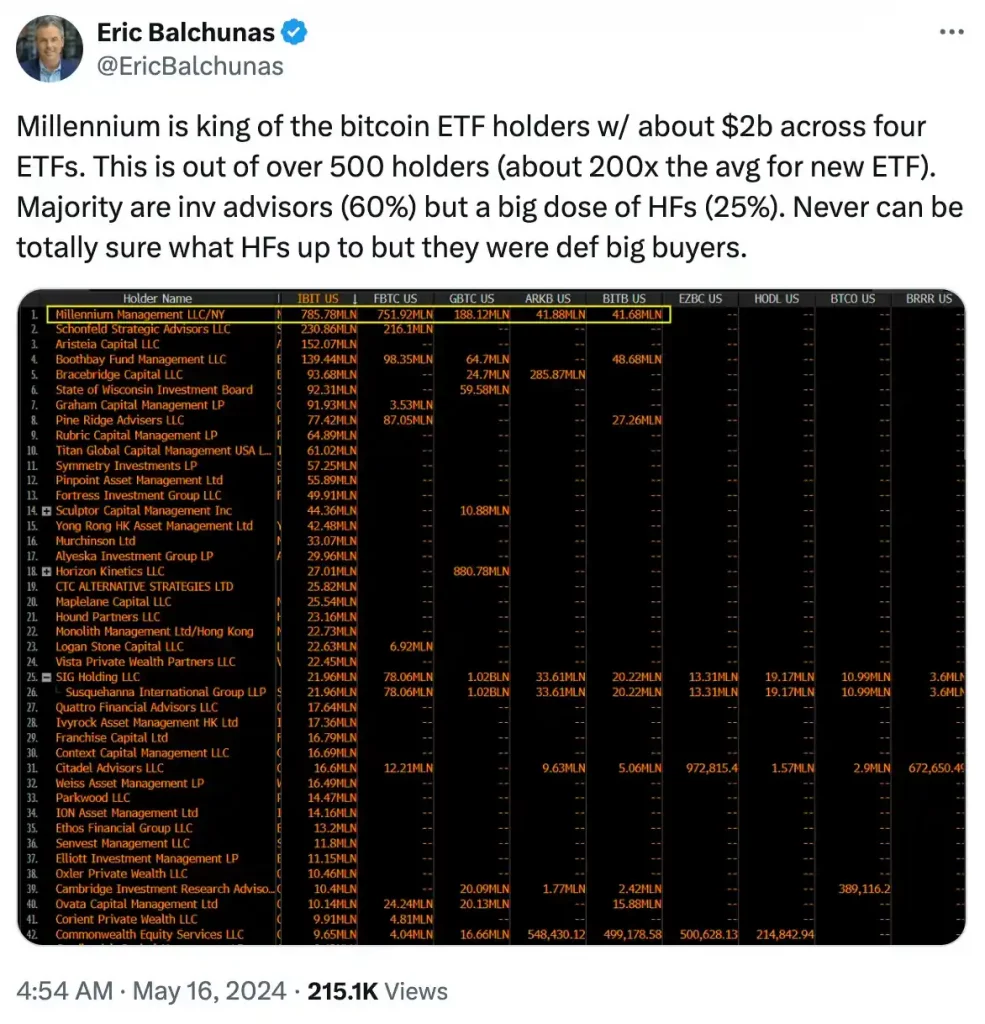

The tale doesn’t conclude there! Based on 13F filings, it has been disclosed that international hedge fund Millennium Management owns approximately $2 billion worth of shares in Bitcoin spot ETFs. As of March 31st, Millennium had invested a total of $1.94 billion across five distinct Bitcoin spot ETFs. The names of these ETFs include ARK 21Shares, Bitwise, Grayscale, iShares, and Fidelity’s offerings.

Significantly, the BlackRock Bitcoin fund stands out as the largest investment for the hedge fund, with approximately $844 million dedicated to it, while Fidelity’s fund comes in a close second with roughly $806 million worth of shares owned.

Providing further insights on the same, Bloomberg ETF analyst Eric Balchunas noted,

In response to this James Seyffart added,

“It’s only retail traders buying the #bitcoin ETFs”

In a talk with ‘Barron’s’, Salim Ramji, the new CEO of Vanguard, reaffirmed the company’s stance against creating a Bitcoin Exchange-Traded Fund (ETF) at this time.

As a researcher examining these investments, I cannot help but be struck by their distinct character and the intricate view they offer into the financial markets.

Increase in institutional investors

In spite of facing criticism, significant investors and leading financial institutions have been drawn towards making investments in Bitcoin. As per recent Securities and Exchange Commission (SEC) filings, Bracebridge Capital revealed a substantial investment of $363 million in Bitcoin spot exchange-traded funds (ETFs). Similarly, J.P. Morgan’s clients collectively contributed an amount of $731,246 towards the same.

On May 15th, Galaxy Digital Holdings Ltd. announced a significant increase of 40% in their net income, reaching $422 million. This surge can be linked to the impact of Bitcoin spot ETFs.

Based on the most recent data, the surge in Bitcoin ETF investments could be the primary reason for Bitcoin’s price increase this week.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-17 11:03