-

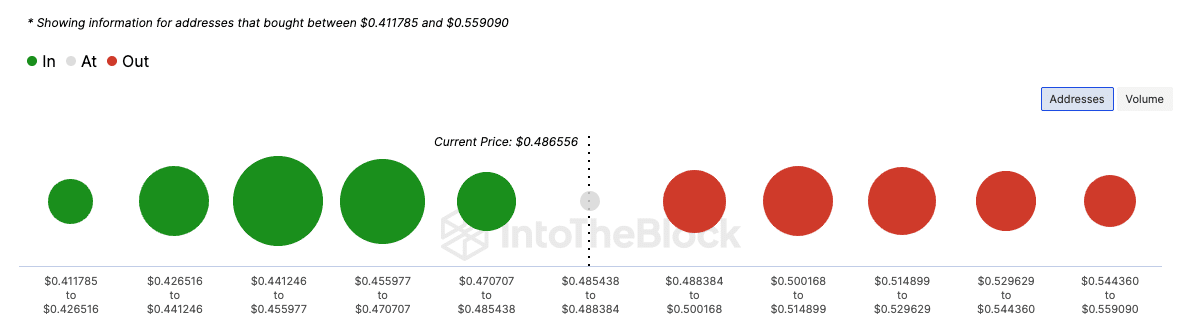

ADA’s price looked ready to hit $0.50, if achieved, the ratio of holders in loss will reduce below 55%.

Whale concentration passed 2021 levels, suggesting that the price might get close to $3 later on.

As a crypto investor with some experience under my belt, I’m keeping a close eye on Cardano (ADA) and its recent price movements. The token has been performing exceptionally well in the market, with its price looking ready to hit $0.50. This is significant because if achieved, the ratio of holders in loss will reduce below 55%.

In an unexpected turn of events, Cardano (ADA) emerged as the top gainer among the cryptocurrencies in the top ten tiers, with a price point of $0.48 at the current moment. This equates to a noteworthy 7.28% surge over the past 24 hours.

In the past, AMBCrypto announced that Cardano might drop out of the top 10 cryptocurrencies based on market capitalization. However, against all expectations, the token’s price action enabled it to maintain its position among the leading digital assets.

As a crypto investor, I’ve been closely monitoring the market performance of ADA. However, there’s one factor that could significantly impact the situation – the percentage of profitable ADA holders. According to IntoTheBlock’s latest data, just 40% of us are currently in the green.

Whereas, 55% of those holding the token were “out of the money.”

Many addresses are ready to provide support

If Cardano’s price keeps rising, the current ratio could shift. This would require an average token price of approximately $0.49.

Approximately 65,590 addresses successfully acquired a total of 792.58 million tokens during the time when their prices fluctuated between the ranges of $0.48 and $0.50.

Based on the prevailing market mood, these numerous wallet addresses could potentially act as a backstop for the token. Nonetheless, it is crucial for traders to remain vigilant.

As a crypto investor, I’ve noticed that a significant accumulation of tokens in a few hands can lead to selling pressure once the price reaches the average cost basis. In other words, if the holders decide to sell their ADA tokens when the price hits around $0.50 (their average cost), this could cause the price to drop. Consequently, the downward trend may continue until a new support level is established.

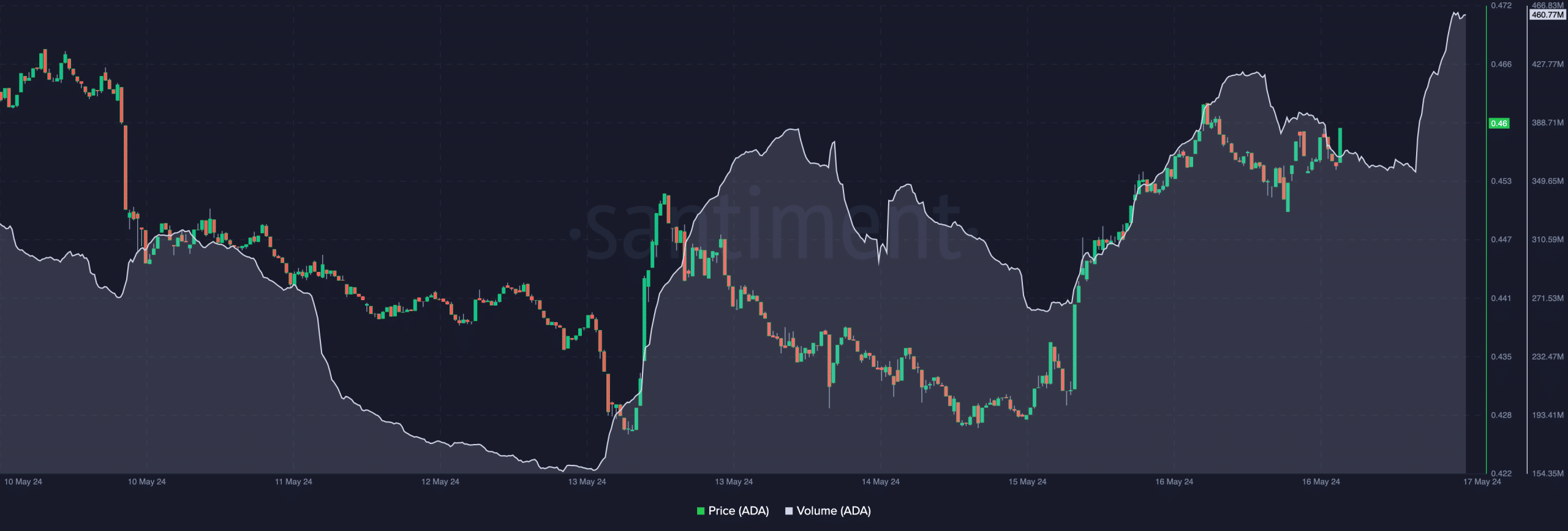

Based on current on-chain indications, it seems that the price of ADA could surpass the anticipated resistance level at $0.50. One reason for this optimistic outlook is the significant volume of Cardano transactions observed in the market.

As an analyst, I’ve observed a significant surge in Cardano’s trading volume based on AMBCrypto’s analysis using Santiment. Specifically, the volume reached a peak of $460.77 million for the week, which is indicative of heightened investor interest in ADA.

If the volume keeps rising in tandem with the price, it’s likely that the projected price of $0.50 will be reached relatively soon.

If this situation holds true, faith in the ADA token’s potential could increase. Consequently, $0.50 may serve as a fresh support level for ADA as it strives to reach greater values.

Can ADA reach $3 again?

In addition, the token’s future value holds promise. However, this may only remain true if the present market trend does not reach its peak as suggested by certain analysts.

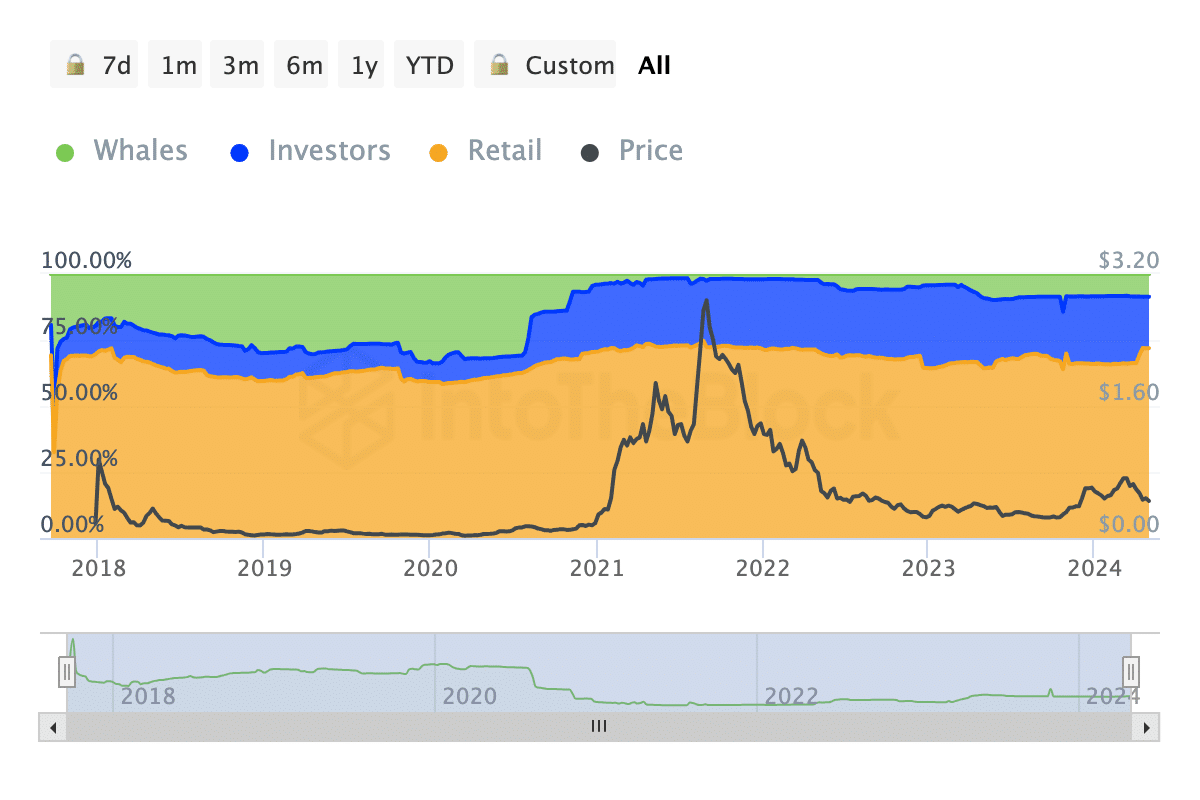

Based on historical data, retail investors currently control approximately 72% of the total Cardano supply as of now.

Approximately 19.47% of the cryptocurrency’s total supply was held by investors with an average stake, while ADA‘s large holders accounted for around 6.82%.

Read Cardano’s [ADA] Price Prediction 2024-2025

The last time whales held anything close to 8% of the total Cardano circulation was in 2021.

Around the same period, ADA‘s price reached a high of $3.09. However, due to the bear market by 2022, most of these big investors were compelled to sell their assets. Yet, with more substantial purchases taking place, ADA could make another attempt at reaching its previous peak.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

2024-05-18 10:15