-

Despite the price hike, sentiment around BOME remained bearish.

A few of the metrics and indicators hinted at a trend reversal for WIF.

As a researcher with extensive experience in the crypto market, I’ve closely followed the price trends and sentiment of various meme coins, including BOME, BONK, and WIF.

In recent developments, the cryptocurrency market has shifted to a bullish trend, resulting in positive price movements for major coins such as Bitcoin (BTC) and Ethereum (ETH).

In a similar vein to several memcoins built on the Solana blockchain, such as BOME and BONK, there has been a noticeable surge in popularity. However, Dogwifhat (WIF) appeared to have been left behind in this trend.

BOME and BONK remain on track

Based on data from CoinMarketCap, the daily and weekly charts for BOME and BONK displayed a bullish trend with green colors.

Significantly, BOME experienced a gain of over 11% and BONK saw its value increase by more than 7% within the past week. At present, BOME is priced at $0.01203 per unit, and BONK holds the same value.

As an analyst, I’ve observed that the positive price trend has kept the buzz around both meme coins, BONK included, quite vibrant. The social media chatter surrounding these assets hasn’t waned. Furthermore, a surge in BONK’s Weighted Sentiment suggests that investor confidence is strong – a promising sign for this particular meme coin.

Although BOME experienced a significant price increase with double-digit numbers, its Weighted Sentiment surprisingly decreased. This finding indicates that negative sentiment, or bearishness, held more influence over the meme coin’s market perception.

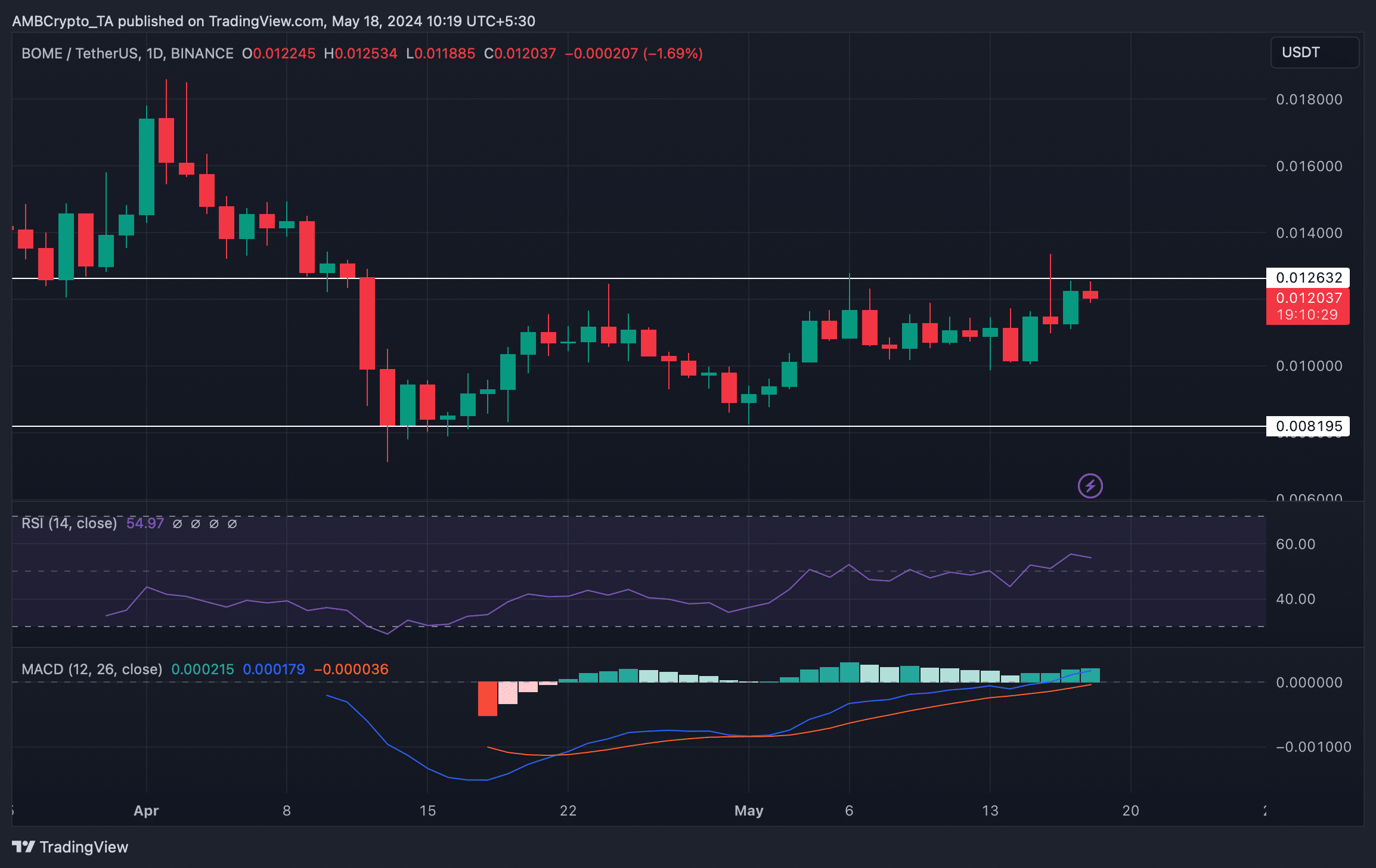

An expert analysis by AMBCrypto revealed that they examined the daily charts of BOME and BONK to determine if their bullish trend would continue. Starting with BOME, it appeared the meme coin was preparing to encounter resistance at approximately $0.0126.

In simpler terms, the MACD indicator showed that the buying force was stronger than the selling force in the market, increasing the likelihood that BOME would surpass its resistance level.

The RSI reading for BOME took a dip, implying that the stock may struggle to continue its upward trend.

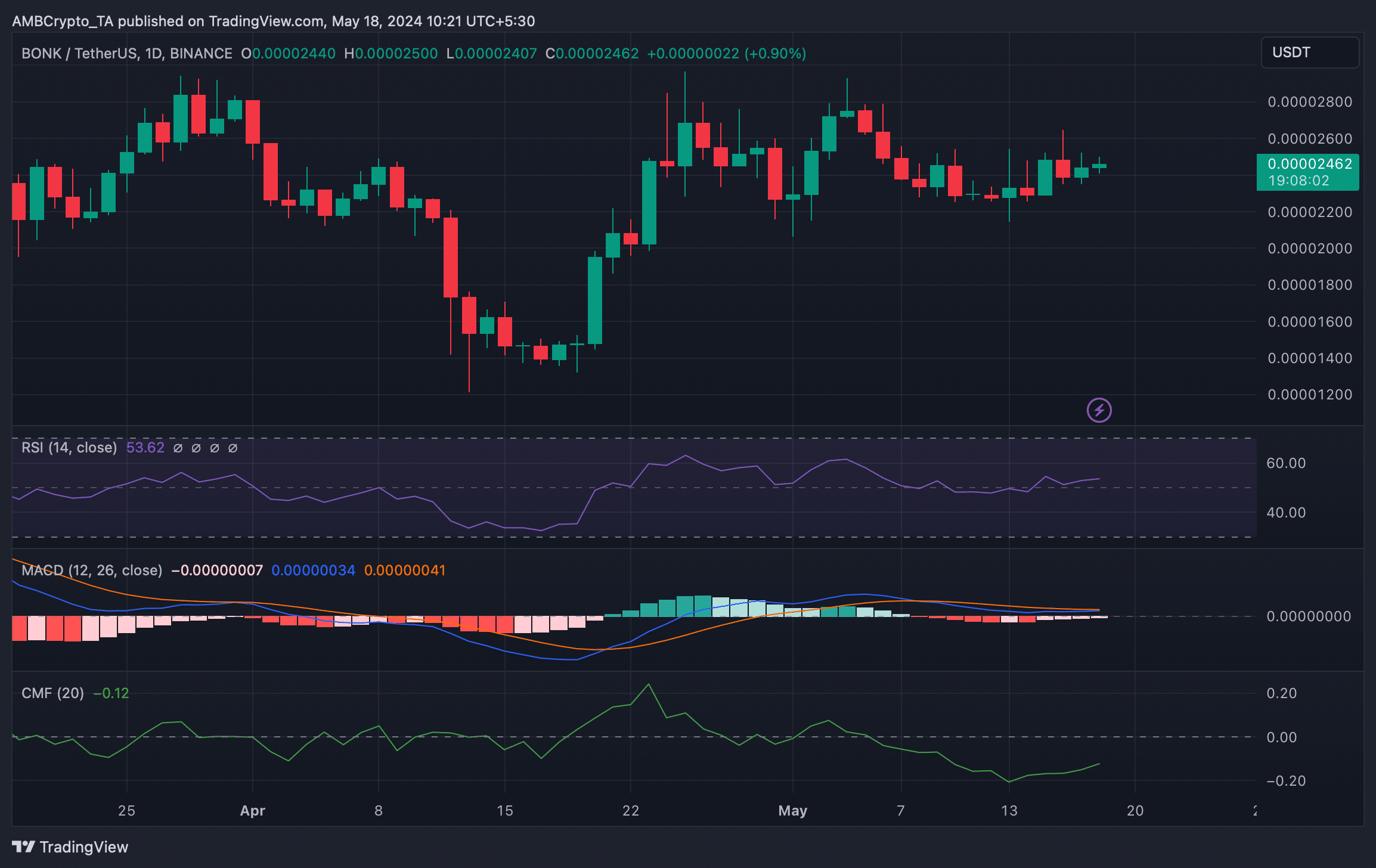

From my perspective as an analyst, I find it intriguing that while Beyond Meat (BOME) may be showing signs of a potential pullback, BONK‘s technical indicators point towards an emerging bull rally. A notable indicator is its Moving Average Convergence Divergence (MACD), which suggests the possibility of an imminent bullish crossover.

The RSI reading was at 53, indicating that it was above the threshold of 70 considered neutral, suggesting potential for further upward price movement. Furthermore, the Chaikin Money Flow (CMF) exhibited a positive trend, increasing the likelihood of continued price growth.

WIF is left behind

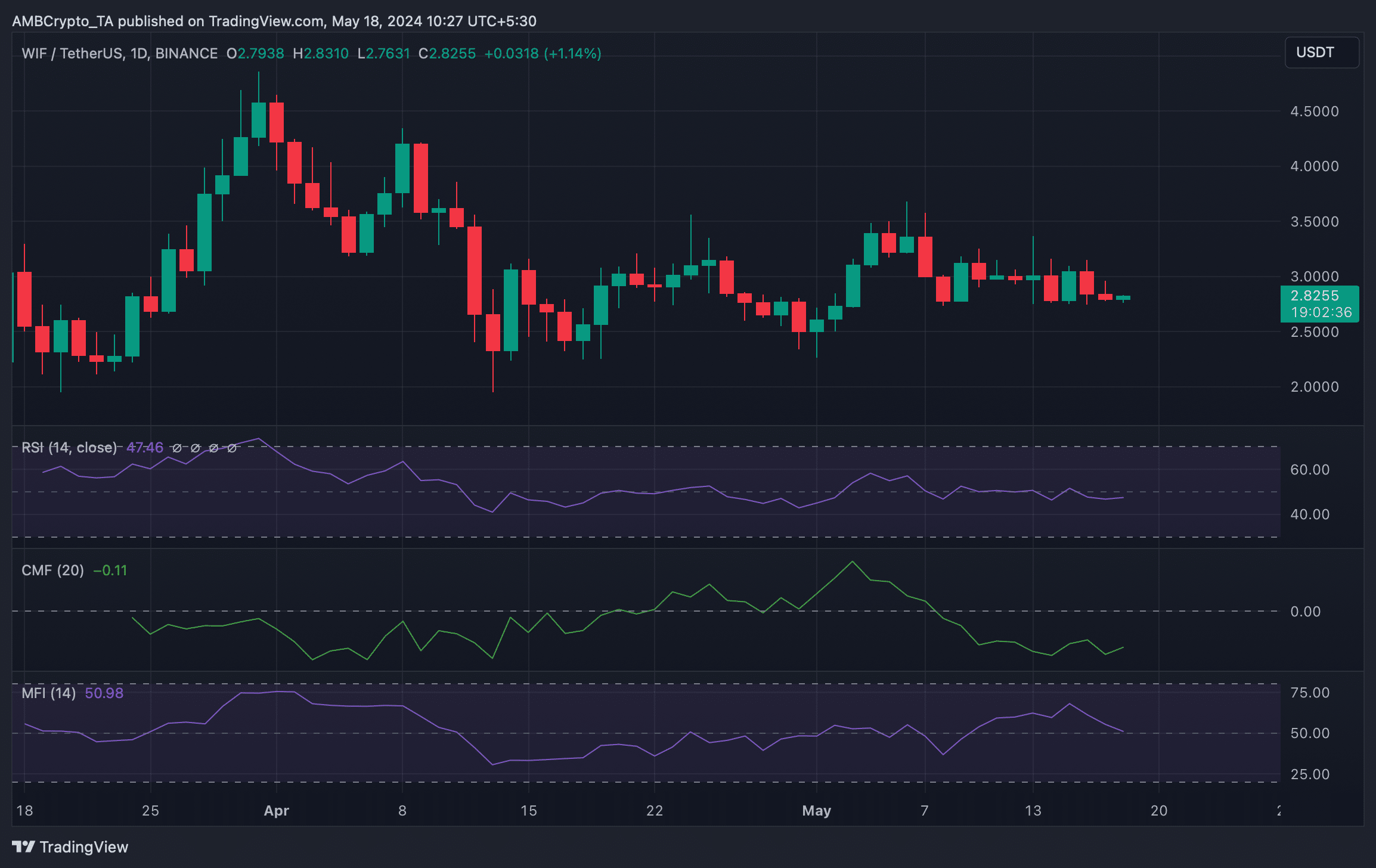

As I analyzed the performance of various meme coins recently, I noticed an upward trend for many of them, with their prices turning green on their charts. However, my focus on WIF yielded disappointing results as its price experienced a significant decline of over 6% during the past week.

According to CoinMarketCap’s current data, the price of WIF is at around $2.83 and its market capitalization exceeds $2.8 billion. Nevertheless, the downward trend may come to an end shortly.

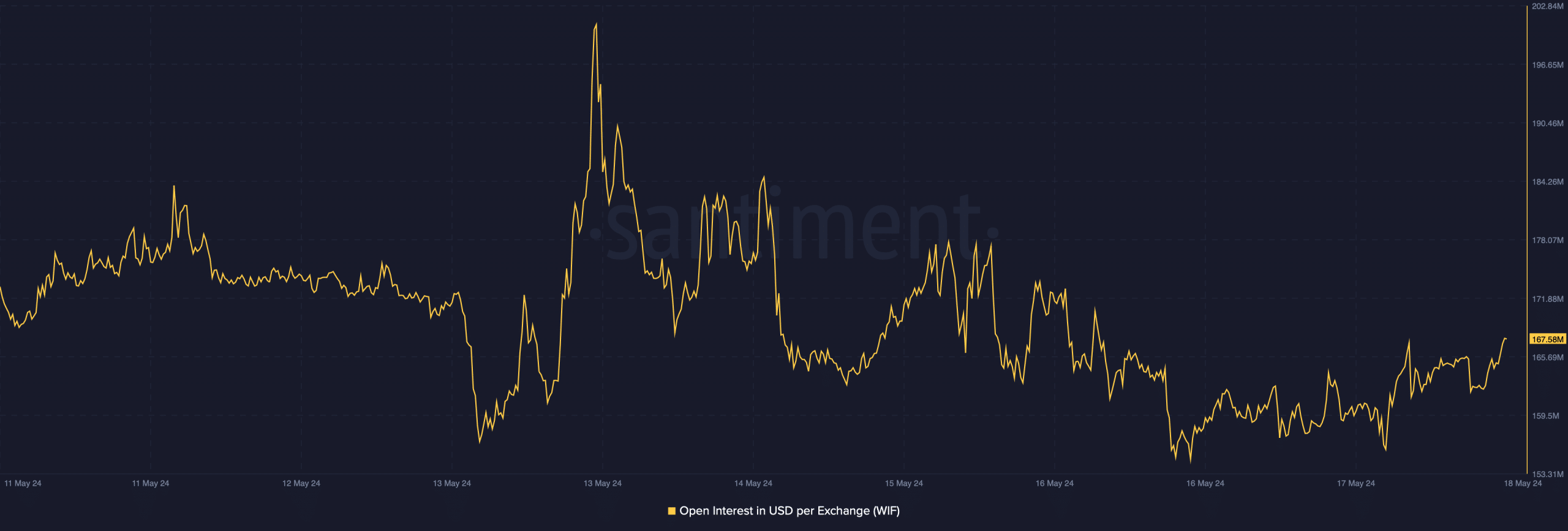

According to AMBCrypto’s interpretation of Santiment’s findings, the Open Interest of WIF experienced a significant decrease in tandem with its falling price.

Generally, a drop in the metric indicates that the ongoing price trend might change soon.

Read Bonk’s [BONK] Price Prediction 2024-25

Based on our examination of WIF‘s day-to-day price chart, we observed an increase in its Chaikin Money Flow (CMF), signaling a possible trend shift. Nevertheless, the Relative Strength Index (RSI) remained stationary below the neutral threshold.

Additionally, the Money Flow Index (MFI) experienced a significant decline, while another indicator hinted at this possibility for WIF. Consequently, it seemed unlikely that WIF would participate in the upward trend due to its potentially decreasing value.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-18 15:04