-

Fantom disclosed that Ethereum would enable the token migration.

While FTM’s price increased, reaching $1 could be challenging in the short term.

As a seasoned crypto investor with a few years under my belt, I’ve learned that blockchain projects and their communities can be unpredictable at times. With Fantom’s latest announcement regarding the Ethereum integration and the upcoming Sonic upgrade, I find myself cautiously optimistic about FTM‘s prospects.

As a blockchain analyst, I’m excited to share that Fantom’s Layer-1 network, using the token symbol FTM, is releasing fresh information in the run-up to the upcoming Sonic upgrade.

For those not in the know, Sonic upgrade represents the latest advancement in the Fantom project, promising an increase in transaction processing capacity, reaching up to 2000 transactions per second.

As a crypto investor, I’m excited about the recent upgrade that has highlighted Ethereum (ETH) as a significant contributor to the project’s progress.

Ethereum to aid the switch

Based on the memo addressed to FTM token holders, the initiative intends to introduce a fresh layer-1 and layer-2 blockchain. On both chains, the project guarantees that FTM token owners will have the ability to transfer assets to Ethereum via a bridge.

It explained,

“Sonic Chain functions as a Layer 1 network interconnected to Ethereum through a customized Layer 2 bridge. This integration grants Sonic the ability to leverage extensive liquidity, user base, and Ethereum-native protocols. The result is a cost-effective, scalable, and swift network that ensures secure access to ETH and other Ethereum assets.”

As a analyst, I’d like to share that previously, Fantom announced its intention to introduce a new token named “S” with the ticker symbol representing Sonic. Consequently, Fantom Token (FTM) holders can effortlessly transfer their FTM tokens into an equal number of S tokens using Ethereum as the facilitating platform.

As of the current moment in time, FTM cost $0.86 per token – marking a 6.22% growth during the previous 24-hour period. This surge in price might be attributed to the escalating enthusiasm surrounding the imminent upgrade and the forthcoming introduction of the token.

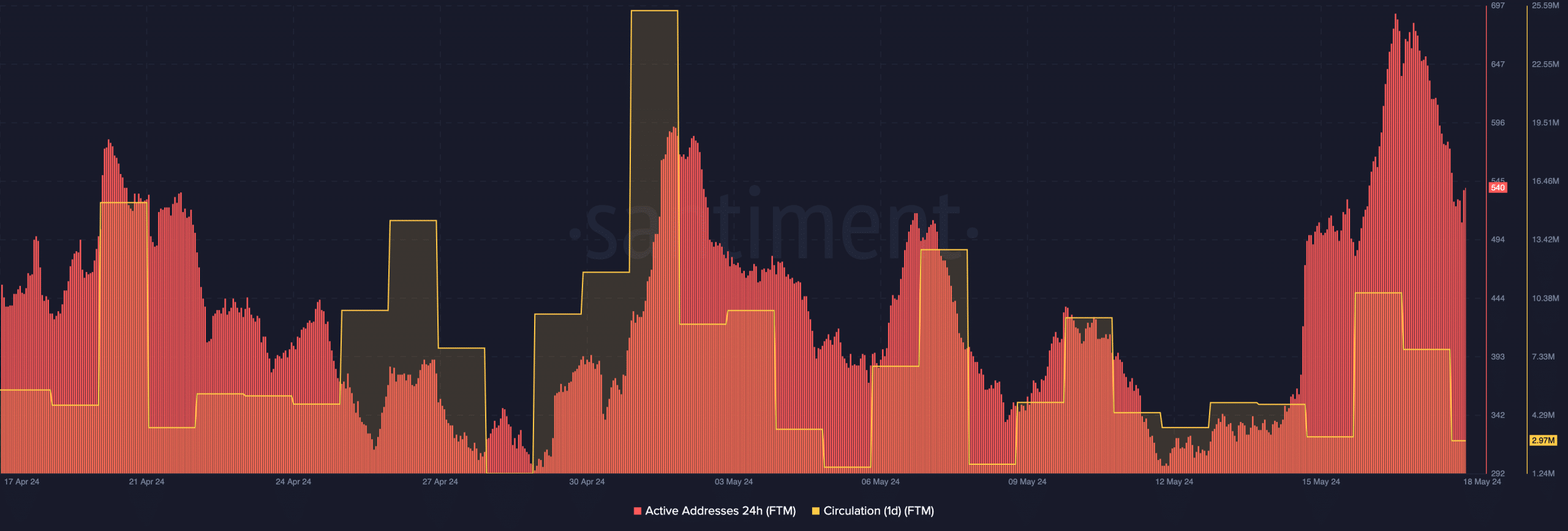

I observed an uptick in the number of active addresses on Fantom within the past 24 hours, which was evident on the 17th of May. This surge suggests an improvement in the success rate of transactions being processed through the network.

At the moment of publication, I’ve observed a decrease in the metric, indicating that the previous uptick was brief. Additionally, analysis of on-chain data reveals a decline in the one-day circulation.

Network activity struggles to hold up

From my analysis, the current Circulating Supply of FTM stands at approximately 2.97 million tokens. This figure signifies a decrease in the number of FTM tokens being transacted.

If these metrics continue to fall, it could be difficult for FTM’s price to approach $1.

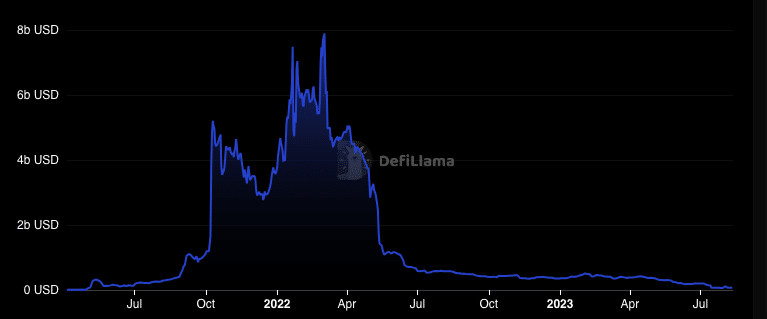

Although it doesn’t mean the value won’t rise, there’s still a possibility for a substantial decrease. Moreover, we took into account the Total Value Locked (TVL) as part of our analysis.

As a data analyst, I’ve examined the latest figures from DeFiLlama, and I can confirm that Fantom’s Total Value Locked (TVL) currently stands at approximately $133.38 million. Notably, this represents a substantial rise within the past 30 days. Such growth points to a promising improvement in the performance of the protocols functioning under the Fantom network.

Realistic or not, here’s FTM’s market cap in ETH terms

As an analyst, I’d put it this way: The current value of locked assets on Fantom is relatively low compared to the impressive $7 billion mark we witnessed in 2022. Reaching those heights once more could prove challenging for Fantom.

As a crypto investor, I’ve had my share of concerns about the chain due to the upcoming Sonic upgrade. However, once this upgrade is live, my trust in the platform may be restored. It’s possible that we might witness a significant increase in assets being deposited onto the chain post-upgrade.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- ETH Mega Pump: Will Ether Soar or Sink Like a Stone? 🚀💸

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-18 21:11