-

Short-term holders began to accumulate large amounts of BTC.

Whale accumulation of BTC slowed down.

As an experienced analyst, I’ve seen my fair share of market trends and price movements in the crypto world. The recent surge in Bitcoin (BTC) prices has caught my attention, not just because of its magnitude, but also due to the unique dynamics at play.

As a researcher studying the cryptocurrency market, I’ve observed an impressive price rise in Bitcoin [BTC] within the past few days. This upward trend has generated significant enthusiasm among traders, but it’s not only them who are expressing optimistic views regarding BTC.

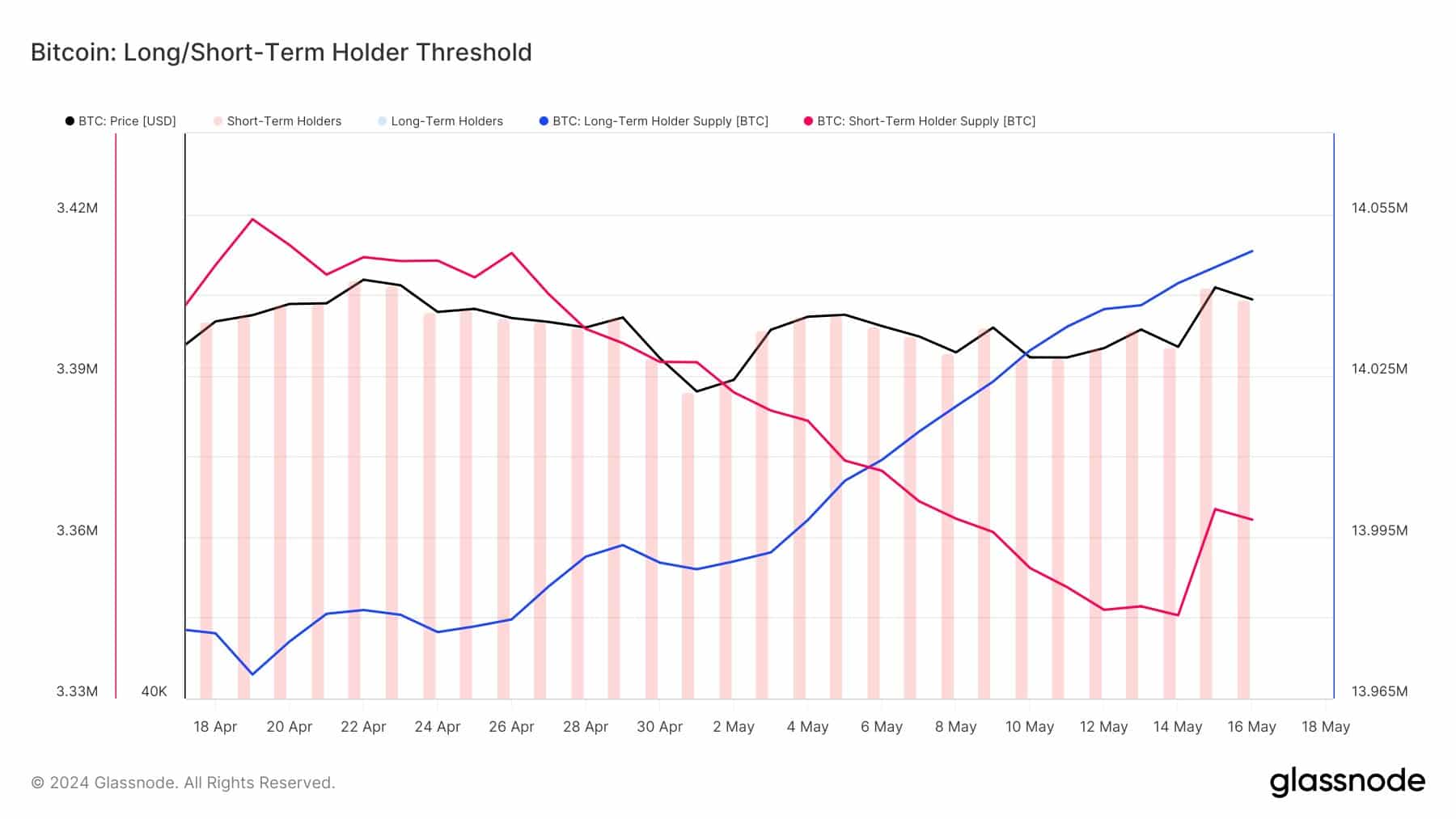

Short term holders move in

Over the past few days, there was a significant addition of more than 20,000 Bitcoins to the circulating supply held by short-term investors.

As a researcher studying the Bitcoin market, I’ve discovered that U.S.-listed Exchange-Traded Funds (ETFs) amassed approximately 11,000 Bitcoins during the specified time frame. Even taking into account outflows from Hong Kong ETFs, this figure indicates robust demand originating from other sources. This demand is evidenced by the noticeable price trend in the Bitcoin market.

The heightened interest from potential buyers (STHs) instigates a self-reinforcing cycle. With each new purchase, the price rises, thereby drawing in additional buyers. This trend can lead to an expedited escalation in prices.

Keep in mind that Stop-Limit Orders (SLOs), which are used to sell securities when their price reaches a certain level, tend to be activated more frequently during market declines. This heightened activity could result in increased price fluctuations.

While the buildup of STH (Short-Term Holders) is a good indicator of Bitcoin’s near-term price momentum, it might have an impact on its potential long-term expansion.

What are holders up to?

“A decreasing long/short ratio could be another sign of an increasing number of investors holding Bitcoin for short terms. This implies that the number of long-term holders purchasing Bitcoin may be on the decline.”

As a financial analyst, I would observe that those investors who have held Bitcoin (BTC) for extended periods are generally less susceptible to selling during market volatility. However, this stability could potentially pose a risk to BTC’s price trend over the long haul if these holders do not adjust their portfolios in response to changing market conditions or if new investors are deterred by the perceived lack of liquidity.

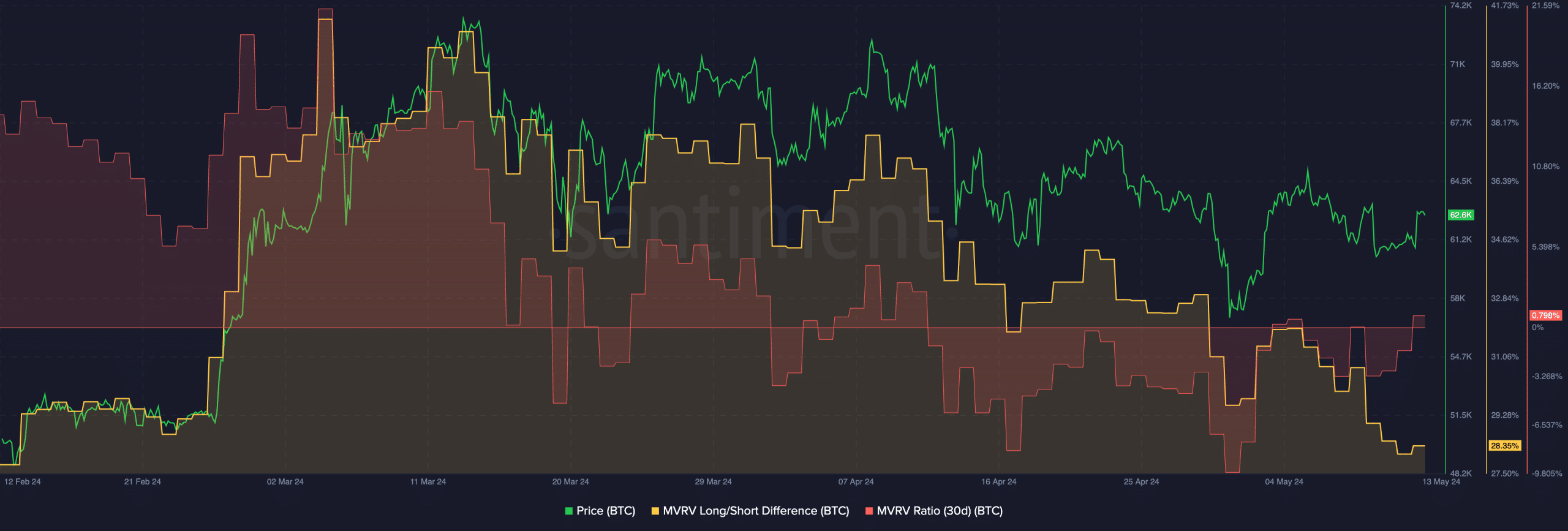

As a researcher studying Bitcoin’s market trends, I’ve noticed an intriguing development regarding the MVRV (Moving Average Value) ratio for this cryptocurrency. Over the past few days, there has been a significant increase in this ratio. This surge suggests that a considerable number of Bitcoin addresses have recently experienced profits, as the current market price is now higher than their previous purchase costs.

As a crypto investor holding Bitcoin (BTC), I might feel compelled to sell some of my coins if I’m a Strategic Token Holder (STH) and notice significant gains in their value. This selling pressure could potentially push down the price of BTC in the market.

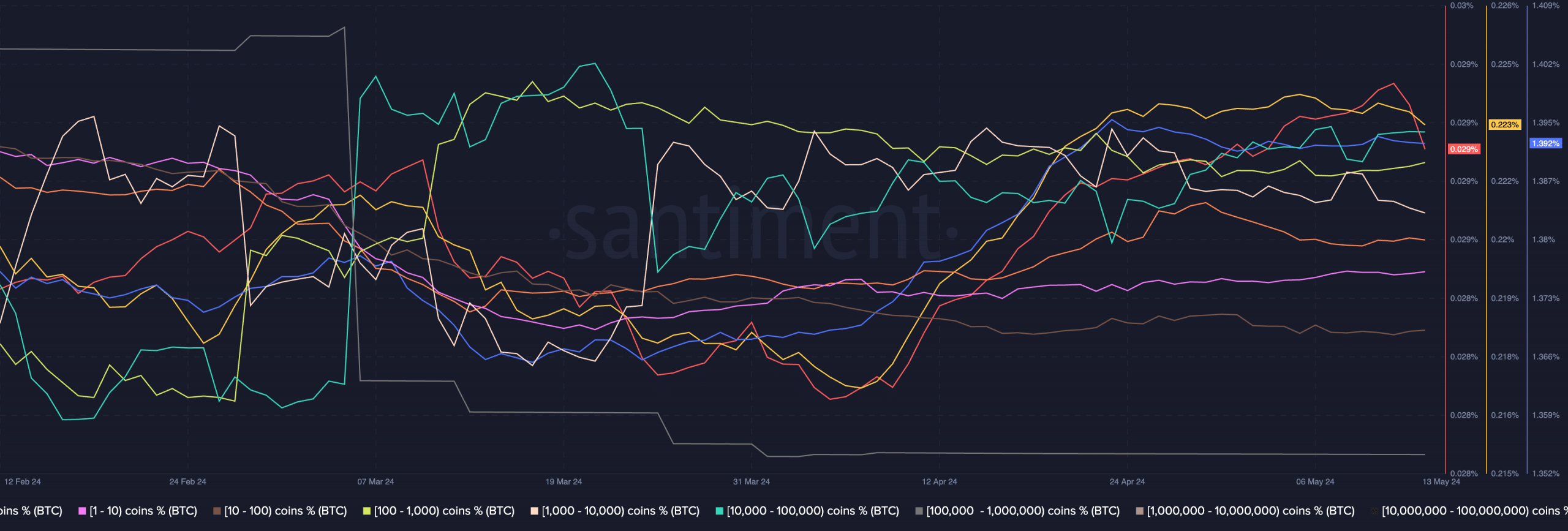

The actions of whale investors could significantly influence the value of Bitcoin moving forward. Recently, these large-scale investors have shown little activity in acquiring more Bitcoin.

At the current price, they haven’t bought any more Bitcoin, and they’ve also remained hesitant to sell their existing stash.

Instead of “Retail traders, on the other hand, have been observed to buying Bitcoin in large quantities, which may have also played a role in the recent increase in Bitcoin’s price,” you could say:

Currently, Bitcoin was priced at $67,110.39 during my composition of this text, representing a 1.17% increase over the previous 24-hour period.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-19 08:07