- Institutional interest in Bitcoin grows, adding liquidity despite Grayscale’s recent high-fee withdrawals.

- Retail investors accumulate Bitcoin, enhancing decentralization, while whales show less interest.

As a researcher with a background in cryptocurrencies and finance, I find the recent developments in the Bitcoin market intriguing. The institutional interest in Bitcoin is growing, as evidenced by Grayscale’s spot Bitcoin ETF (GBTC) experiencing inflows despite high fees. This trend contrasts with the decreased interest from crypto whales.

As a crypto investor, I’m relieved to see Bitcoin [BTC] bouncing back from a rough week, currently sitting at a value of $67,093, representing a 1.28% price hike over the last 24 hours.

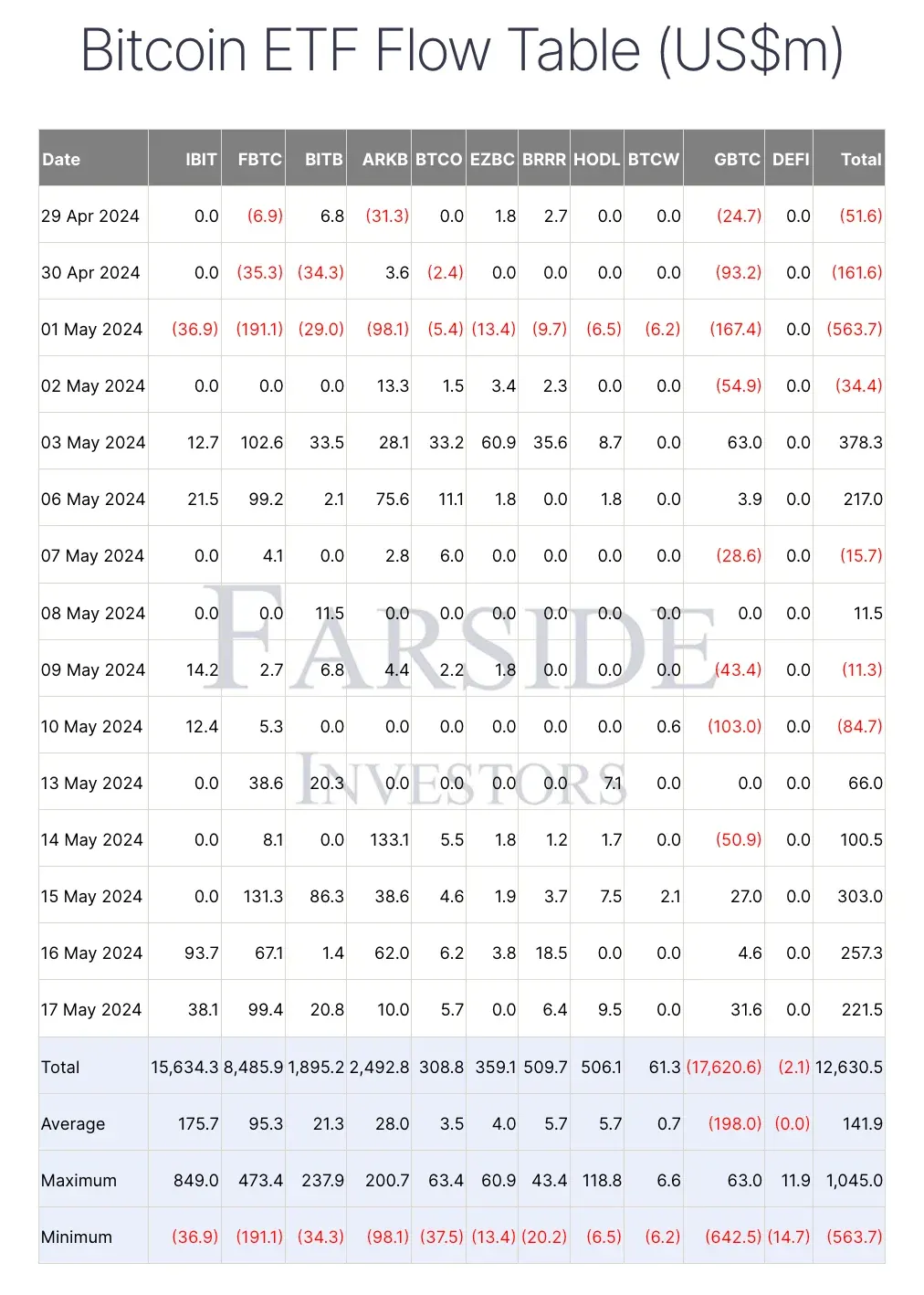

On May 17th, Farside Investors announced that Grayscale’s Bitcoin Spot ETF (GBTC) had taken in $31.6 million, and the total assets under its management exceeded $18 billion.

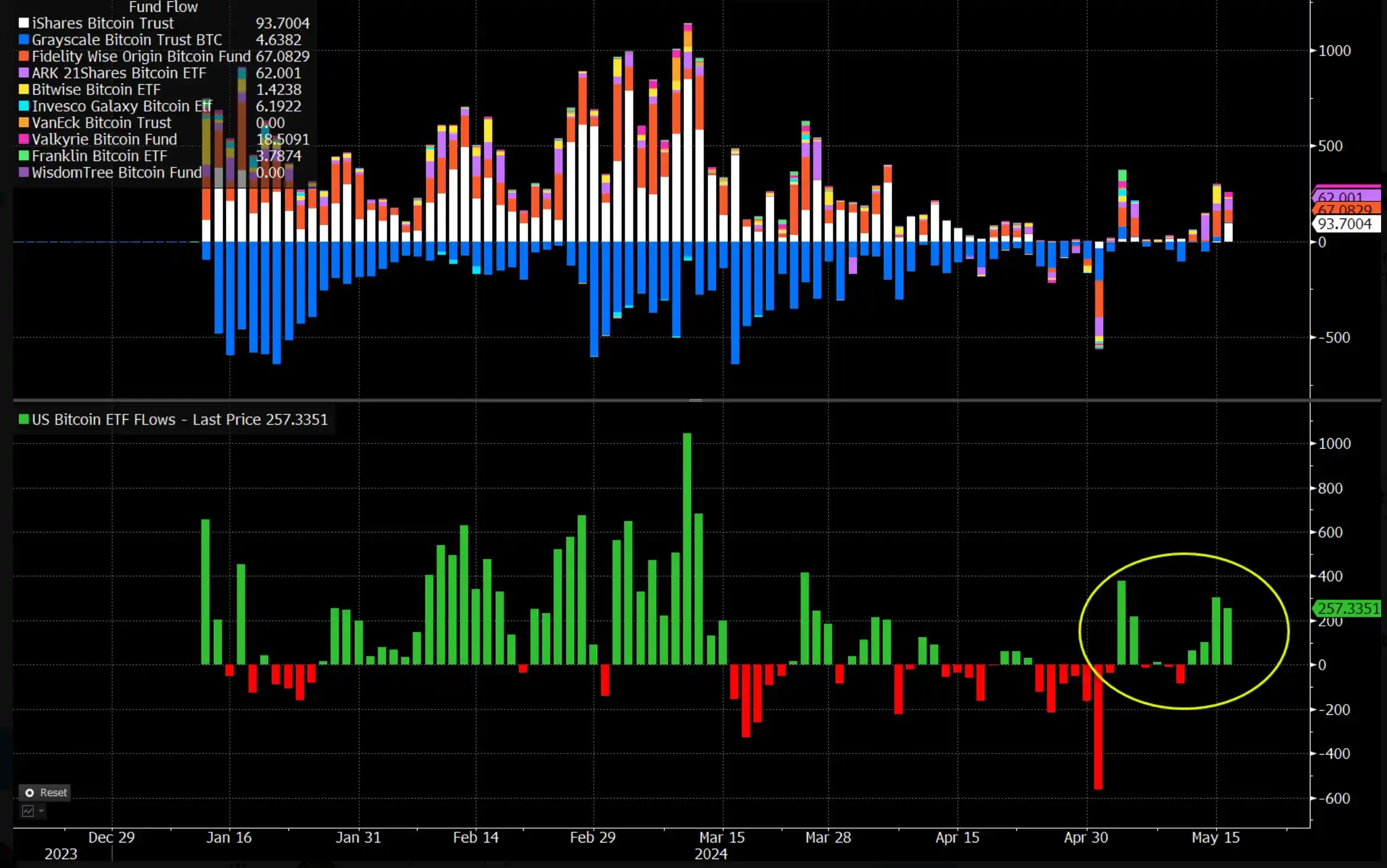

As an analyst, I’ve noticed that Grayscale Investment Trust (Grayscale) has encountered significant hurdles since its transition from a trust to a spot Bitcoin Exchange-Traded Fund (ETF) in January. Nevertheless, the recent inflows of assets for three consecutive days have brought positive momentum to Grayscale Bitcoin Trust (GBTC).

What are the execs saying?

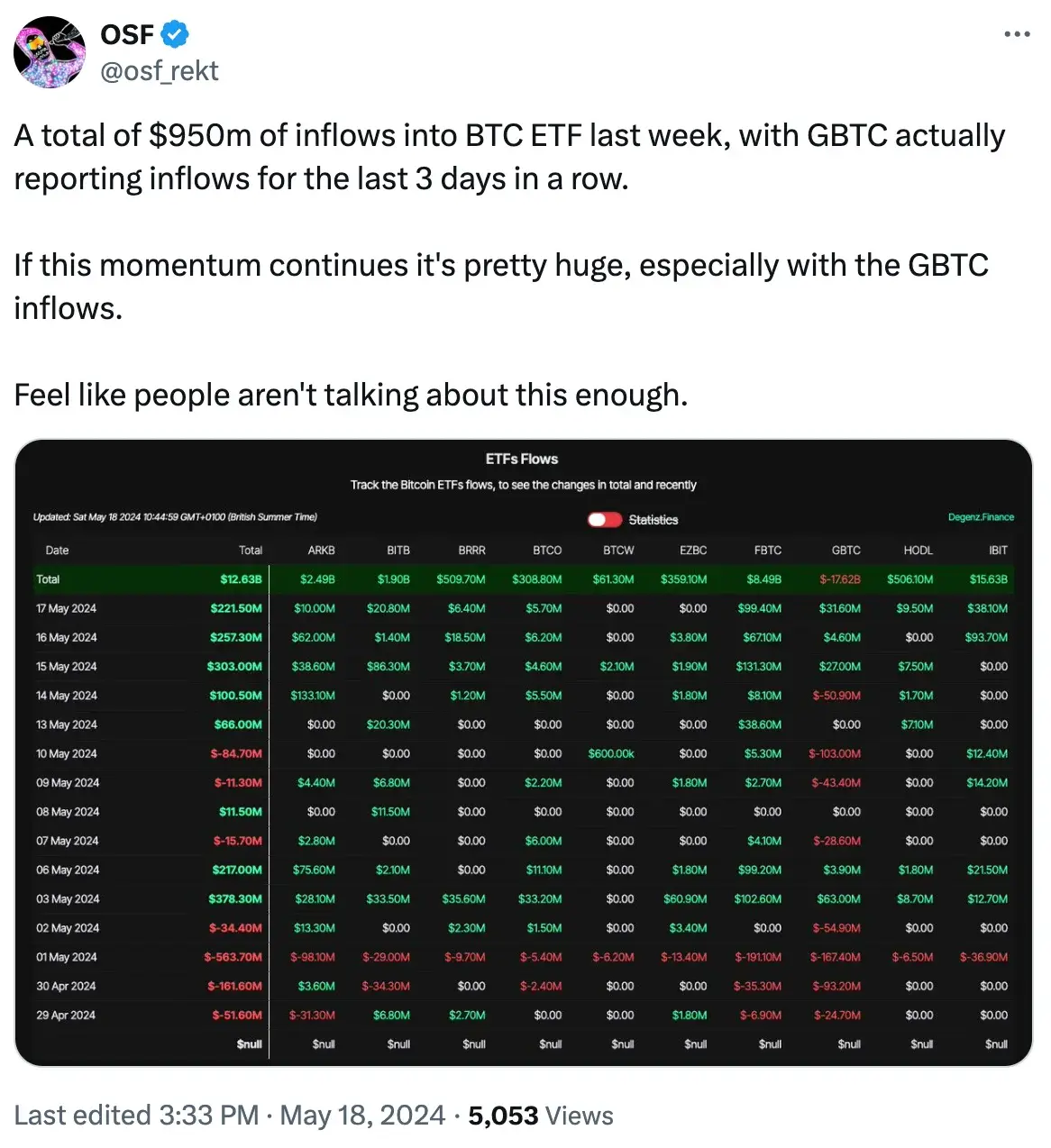

Seeing a positive outlook of GBTC among investors, an X (formerly Twitter) user, @osf_rekt said,

The shift has led to approximately $17 billion being taken out, mainly because of the elevated fees as compared to other available choices.

As a crypto investor, I’ve witnessed a troubling trend in the past two years with several cryptocurrency companies filing for bankruptcy. Consequently, these firms have had no choice but to liquidate their assets to fulfill their debts to creditors.

On May 15th, with the exception of BlackRock’s iShares Bitcoin Trust (IBIT), all other bitcoin Spot ETFs recorded net inflows.

On the very same day, Grayscale’s GBTC saw its first inflows in over a week, with a total of $27 million being added to the trust.

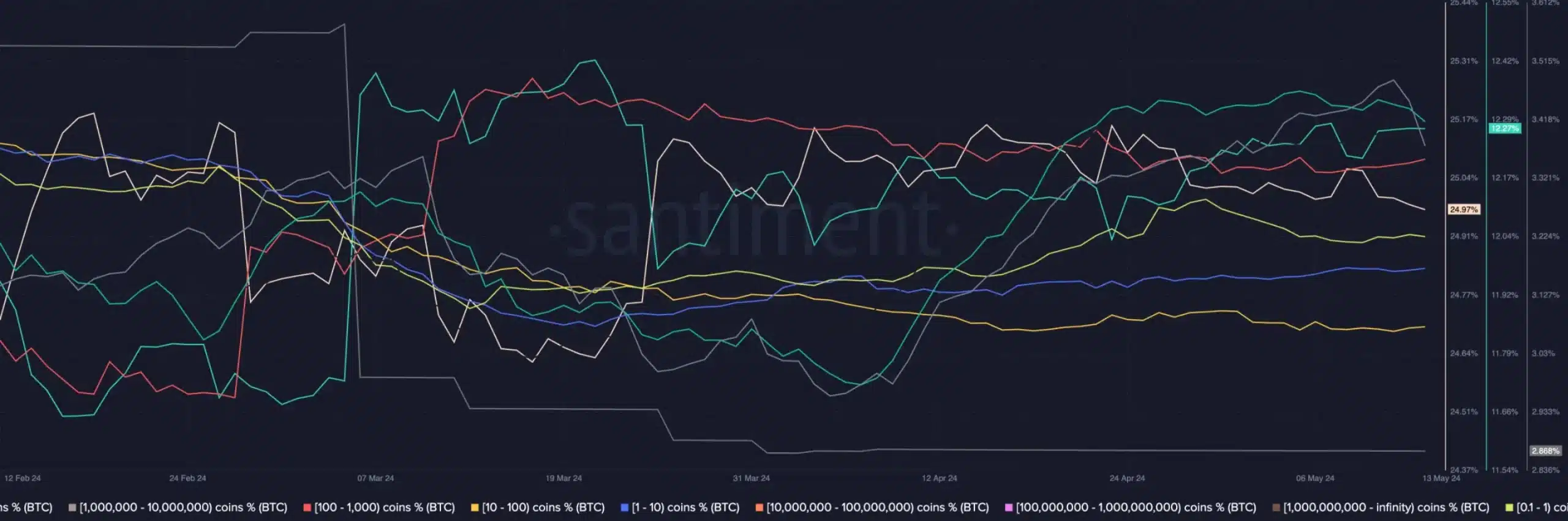

Institutional investors are increasingly expressing their appetite for Bitcoin, thereby infusing the market with significant liquidity. In contrast, major crypto players, or “whales,” have yet to display similar levels of enthusiasm.

Increased in retail investors

According to the data examined by AMBCrypto from Santiment, there has been a decrease in the rate at which large investors or “whales” have been acquiring cryptocurrency. Conversely, smaller individual investors, often referred to as “retail investors,” have been increasing their purchases. This trend toward greater participation by retail investors is believed to be promoting a more decentralized network.

The continued growth of retail adoption for Bitcoin may contribute positively to its long-term success by enhancing the network’s decentralization.

As a senior analyst at Bloomberg, I’ve taken note of Theresa May’s optimistic stance towards potential bitcoin exchange-traded funds (ETFs).

Over the past two weeks, Bitcoin ETFs have recorded substantial inflows totaling $1.3 billion, effectively counterbalancing the losses incurred during April. Consequently, their net assets now stand at approximately $12.3 billion since their launch – a crucial figure as it represents the sum of all deposits and withdrawals.

Offering advice to investors, he further commented,

“The last two months have highlighted the importance of staying calm during market fluctuations that are inherent to ETF investing. While I believe these movements will ultimately result in positive returns, it’s essential to keep in mind that the volumes involved represent only a small fraction (around 1-2%) of the total assets under management. Therefore, it’s neither a cause for excessive concern nor a reason to become overly optimistic.”

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- WCT PREDICTION. WCT cryptocurrency

2024-05-19 10:15