-

Decreasing volume and the price increase could cause consolidation for DOT.

Search for DOT has reduced, indicating a slide in demand.

As an experienced analyst, I believe that the decreasing trading volume and the subsequent price increase could cause consolidation for Polkadot (DOT). The reduction in search volume for DOT indicates a slide in demand, which is a concern for bulls. Although the price has risen by 6.61% in the last seven days, the lack of volume growth could hinder further price increases.

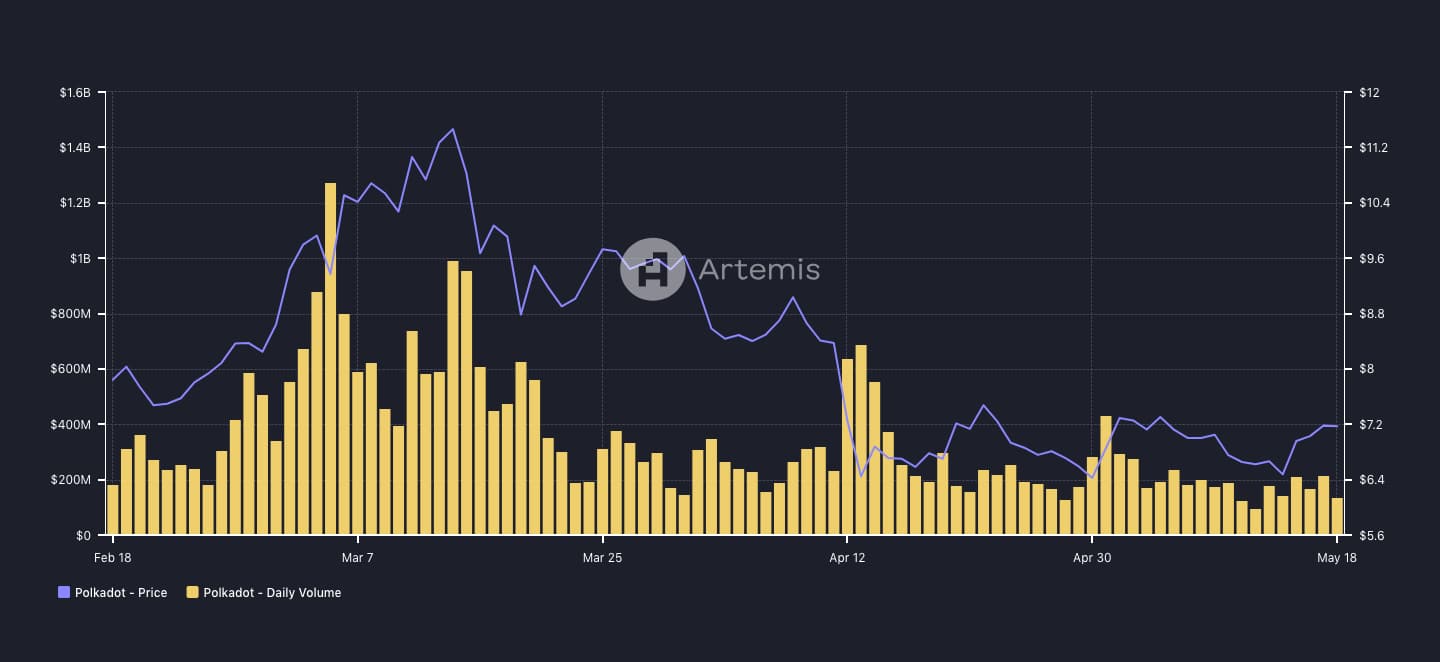

As a Polkadot (DOT) investor, I’ve noticed that the cryptocurrency’s daily trading volume has taken a substantial hit. While a drop in volume doesn’t automatically mean a price decrease, it does put DOT at risk of further declines.

As a researcher studying cryptocurrency markets, I would interpret an uptick in trading volume for a particular token as a reflection of heightened exchange activity. In simpler terms, it indicates that there is significant buying and selling happening within the token’s market. On the other hand, a decrease in trading volume implies reduced interest or exchange activity surrounding the cryptocurrency.

Excitement in the token drops

According to Artemis.xyz’s data, Polkadot had a volume of approximately $137.8 million. This was among the lowest figures recorded for the project since the beginning of the second quarter.

Although the cost of DOT has risen by 6.61% over the past week, a significant decrease in trading volume might impede this upward trend.

In the past, it was projected that DOT‘s price could rebound to hit the $10 mark. Should trading volume pick up significantly as the price rises, this projection could materialize.

However, the contrary trend is evident from the increasing prices and declining volume. Therefore, it’s possible that DOT may fluctuate around the range of $7.15 to $7.60 in the near future.

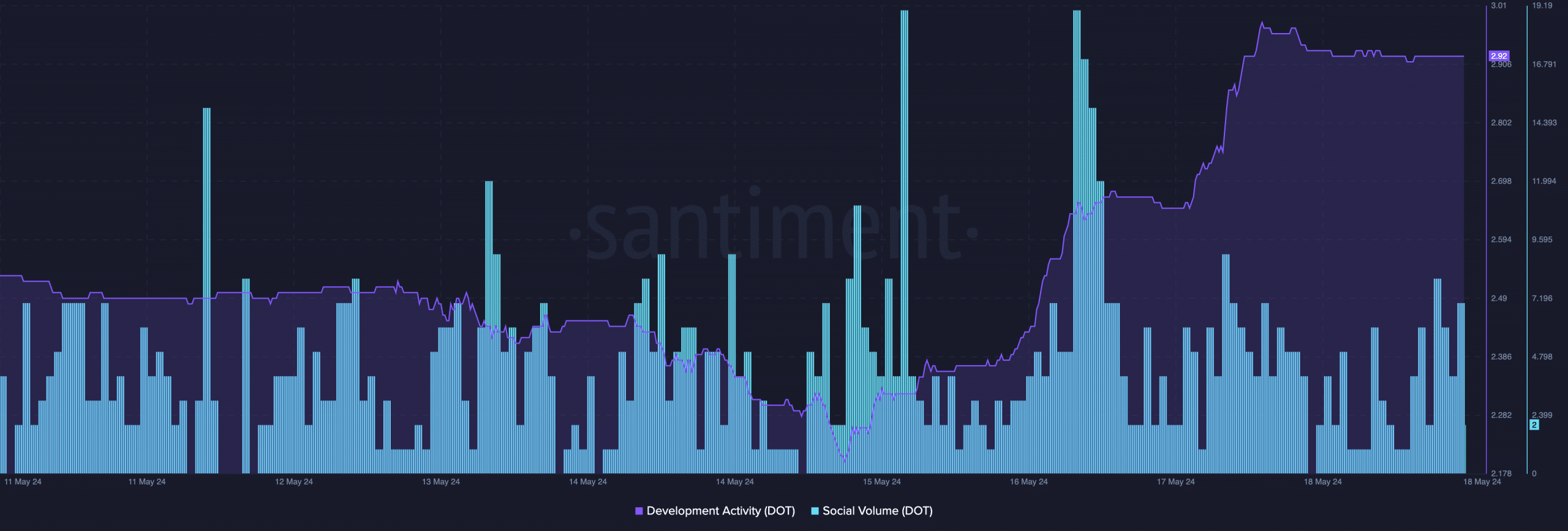

Additionally, AMBCrypto analyzed Polkadot’s development activity, which is an area where the project stands out with a score of 2.92 according to Santiment.

As an analyst, I’d put it this way: Two days ago, I observed a metric reading of 2.20. This figure suggested that developers had recently added a greater number of codes to enhance Polkadot’s functionality.

Bulls are not the kings this time

As a researcher studying the cryptocurrency market, I’ve observed that an increase in development activity often corresponds to a positive price trend for some projects. However, my analysis of DOT has revealed a more complex relationship. At times, the price of DOT rises in tandem with development metrics, while other instances show no such correlation.

This network enhancement cannot serve as the primary catalyst for boosting the token’s price. Additionally, AMBCrypto examined the social media buzz.

As a researcher observing social media trends, I’ve noticed an intriguing correlation: when social volume surges, it signifies a heightened interest in a particular project or topic related to DOT. Conversely, a decrease in social volume may indicate that the buzz surrounding arbitrary text connected to DOT is waning.

As of the 17th of May, there was a significant increase in social media buzz surrounding Polkadot. However, on the following day, the 18th, this volume decreased. A decrease in social media activity often corresponds to reduced demand for the associated asset, such as Polkadot and its token DOT.

In other words, a price hike of more than 25% may not be achievable in the near future based on the factors presented. However, it’s important to note that there are other metrics apart from those mentioned which could impact DOT‘s pricing as well.

Is your portfolio green? Check the Polkadot Profit Calculator

For a comprehensive grasp, factors such as network expansion can similarly influence the value when considering other relevant on-chain indicators.

If the expansion of the network causes a surge in demand, the price of DOT may rise. But so far, this hasn’t happened, suggesting it may be difficult for DOT to reach double-digit prices this month.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-05-19 12:07