- The meme coin was down by more than 6% in the last 24 hours.

- Market indicators and metrics hinted at a further price decline.

As a crypto investor with some experience in the market, I’m concerned about PEPE‘s recent price decline and the potential for further losses. The sharp drop of more than 6% in just 24 hours is a red flag that cannot be ignored. Furthermore, market indicators such as high profit-taking by investors and an increase in exchange inflows suggest that selling pressure is strong.

On May 18th, PEPE‘s value as a meme coin took a significant hit, with prices dropping dramatically. An analysis of its key performance indicators provided some insight into the cause of this downturn in the market.

Let’s take a look at the entire picture.

Are PEPE investors taking profits?

As an analyst, I’ve examined the market data from CoinMarketCap and noticed a significant trend with PEPE‘s price action. In just a few hours, there was a sharp decline in PEPE’s value that led to a daily loss of over 6%.

Currently, its price was at $0.000009426 and boasting a market value exceeding $3.9 billion, this cryptocurrency held the number 27 spot in terms of size.

According to AMBCrypto’s analysis ofIntoTheBlock’s figures, approximately 92% of PEPE investors have earned a profit on their investments.

As an analyst, I can suggest that my observation is that this situation could have been a factor encouraging some investors to dispose of their meme coin holdings. Consequently, the selling pressure may have contributed to the decline in the coin’s price.

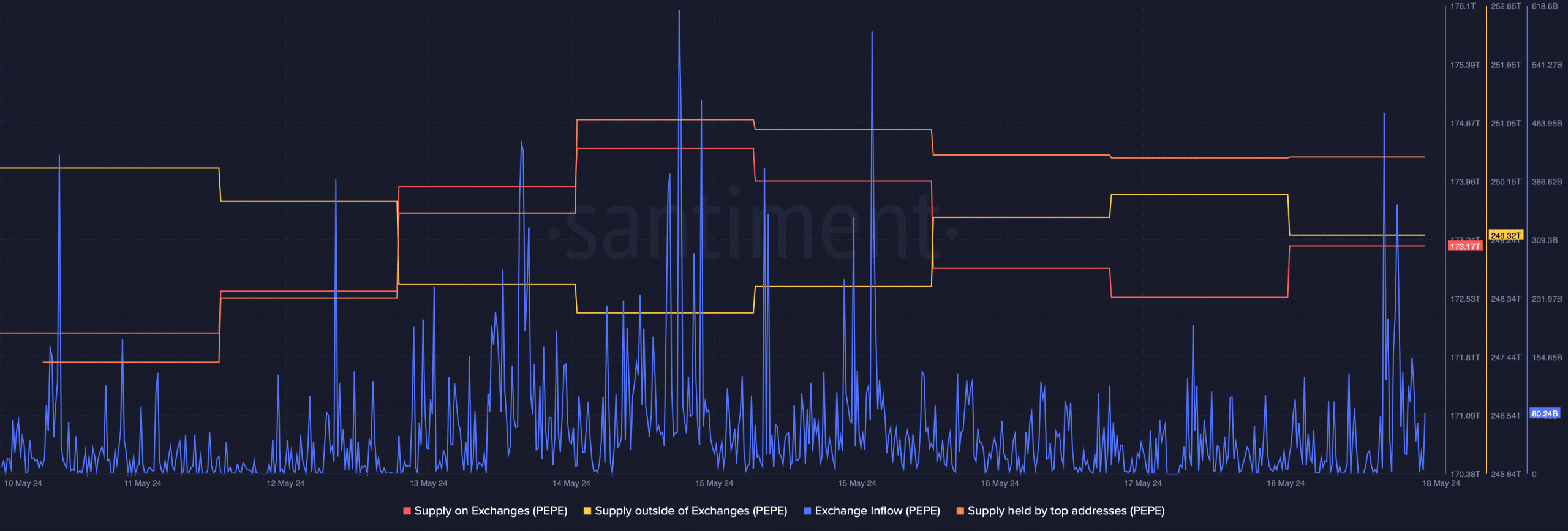

To check if this was true, AMBCrypto examined the data from Santiment. According to our assessment, the meme coin experienced several surge in exchange inflows during the previous week.

On May 18th, there was a notable trend as the amount of the meme coin held on exchanges began to rise, while the supply off the exchanges decreased. This pattern suggested that investors were selling off their coins.

Following a significant increase on May 14th, the amount of the meme coin held by major wallets experienced a minor decrease.

As a researcher examining the recent trends in the meme coin market, I discovered that a handful of whale investors may have disposed of their holdings. This action could have potentially contributed to the significant decrease in the coin’s value.

PEPE’s troubles aren’t over

The dark days might continue for the meme coin, as few other metrics gave away a bearish notion.

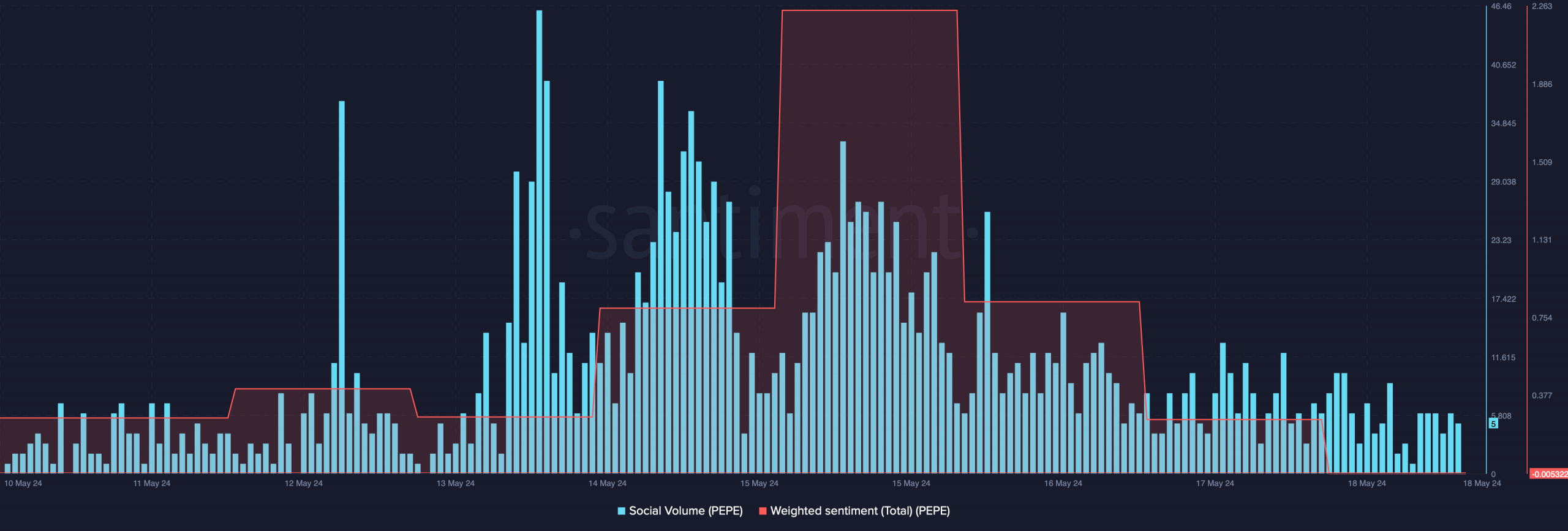

For example, PEPE‘s social media presence saw a significant decrease over the past week, indicating a drop in interest for the meme coin. Additionally, its sentiment score took a downturn within the previous few days.

With a considerable amount of pessimism surrounding the meme coin, investors anticipated its value would continue to decrease.

In similar fashion to metrics, various market signs pointed towards bearish sentiment for the meme coin. Its Relative Strength Index (RSI), which reflects the coin’s recent price action and momentum, showed a decrease. At the current moment, the RSI stood at 58.7.

Similarly, the decline in the Chaikin Money Flow (CMF) implies a strong possibility that the current bearish market trend will persist.

Realistic or not, here’s PEPE’s market cap in BTC’s terms

As per our analysis, PEPE’s price was still well above its 20-day Exponential Moving Average (EMA).

If the downward trend in the meme coin’s price persists, its value could potentially reach the level of its 20-day Exponential Moving Average (EMA), which may function as a floor.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-19 21:11