- Bitcoin saw a sharp rally in early May.

- The drop below the SSR oscillator bands was seen then- but will we see an extended rally hereon?

As an experienced crypto analyst, I’ve closely monitored Bitcoin’s price action and market sentiment over the past few months. The recent sharp rally in early May, where Bitcoin touched $67k at press time, was a significant development for the asset class.

At the moment of reporting, Bitcoin’s price stood at approximately $67,000, with potential for surpassing the price ceiling it had formed over the last month.

Fears around sell-offs around the halving period were losing strength.

Last week, there was a noticeable surge in investments towards Bitcoin exchange-traded funds (ETFs). This trend signifies a significant rise in demand for Bitcoin. With prices approaching resistance levels, will buyers be able to force a price breakthrough?

Gauging the ammo reserves of the bulls

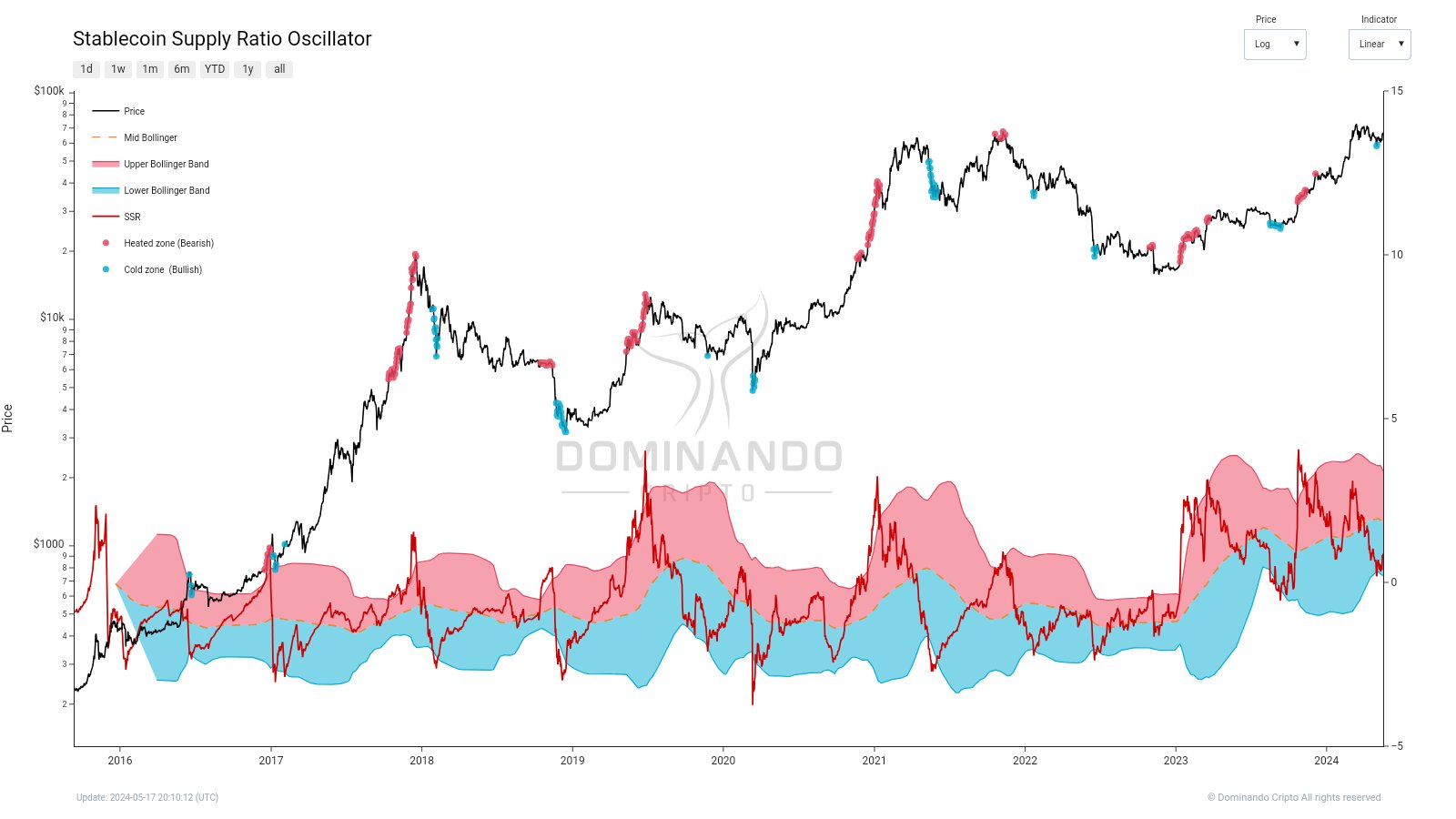

As a crypto investor, I’ve been keeping an eye on the latest analysis from respected figures in the community. Recently, a crypto analyst brought up an interesting observation on their post (previously known as Twitter). They pointed out that according to the stablecoin supply ratio oscillator, there are bullish signs emerging in the market.

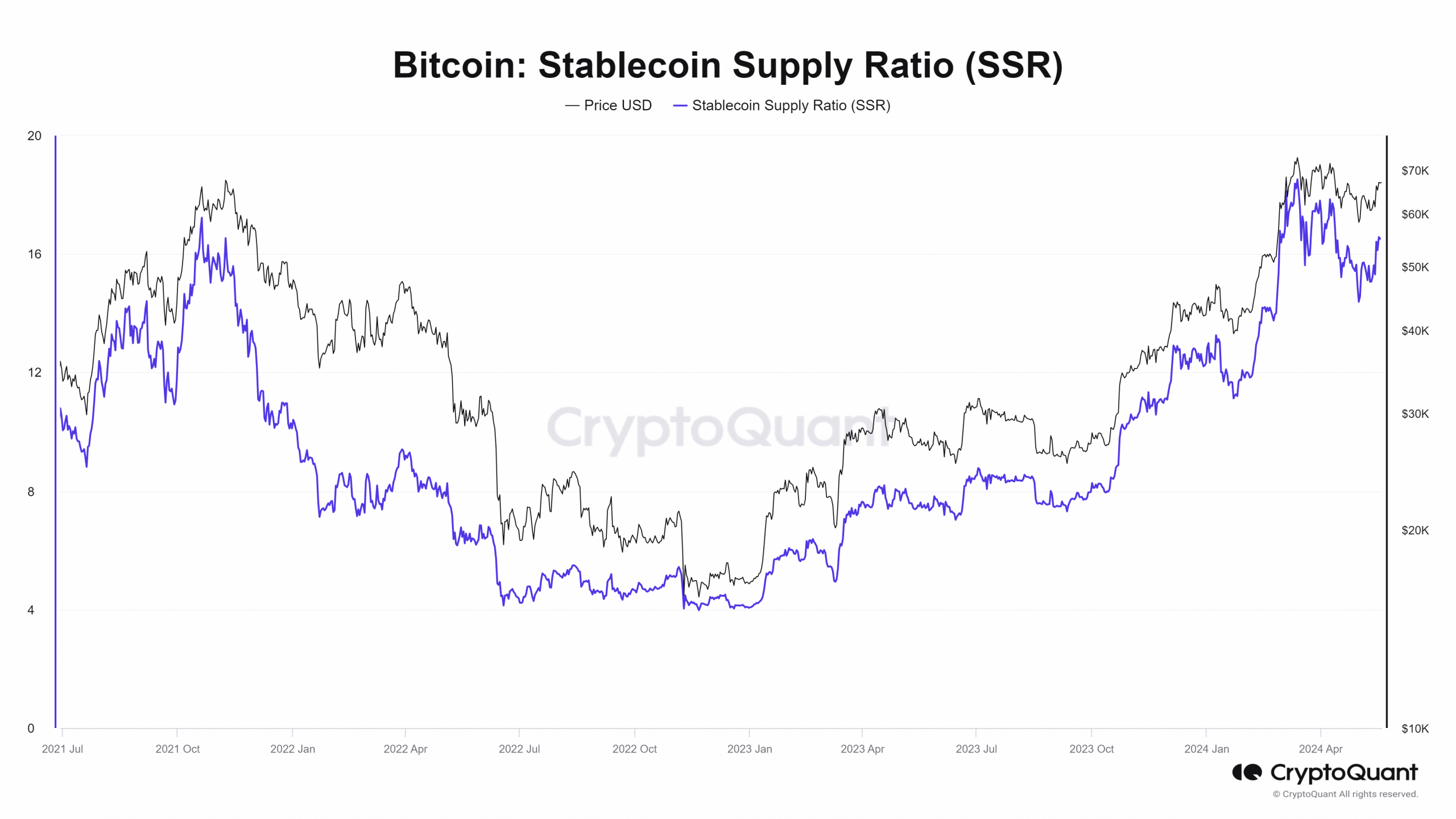

The technical indicator assesses stablecoin market sentiment relative to Bitcoin over time.

To derive Bollinger Bands, first calculate the difference between the current Simple Moving Average (SMA) of 200 periods and the current SSR (Simple Moving Average or other short-term average). Next, divide this value by the standard deviation of the prices over the same period to get the bandwidth. Finally, move each standard deviation away from the SMA to obtain the upper and lower Bollinger Bands.

As an analyst, I would represent this information by displaying the current stablecoin supply on a graph with designated bands. By observing the position of the supply within these bands, traders can glean valuable insights into the prevailing market sentiment.

When the SSR dips beneath the lower boundary of the Bollinger Band, this signifies a decreased influence of stablecoins and could suggest emerging bullish market feelings.

As an analyst, I’ve observed that the market often exhibits a corrective pullback when the oscillator indicates overheating. On the other hand, when the lower bands on the chart are broken, it typically presents a promising long-term buying opportunity.

Just as with any other technical indicator, the SSR oscillator doesn’t offer infallibility, and each signal it generates doesn’t assure a price shift in the anticipated direction.

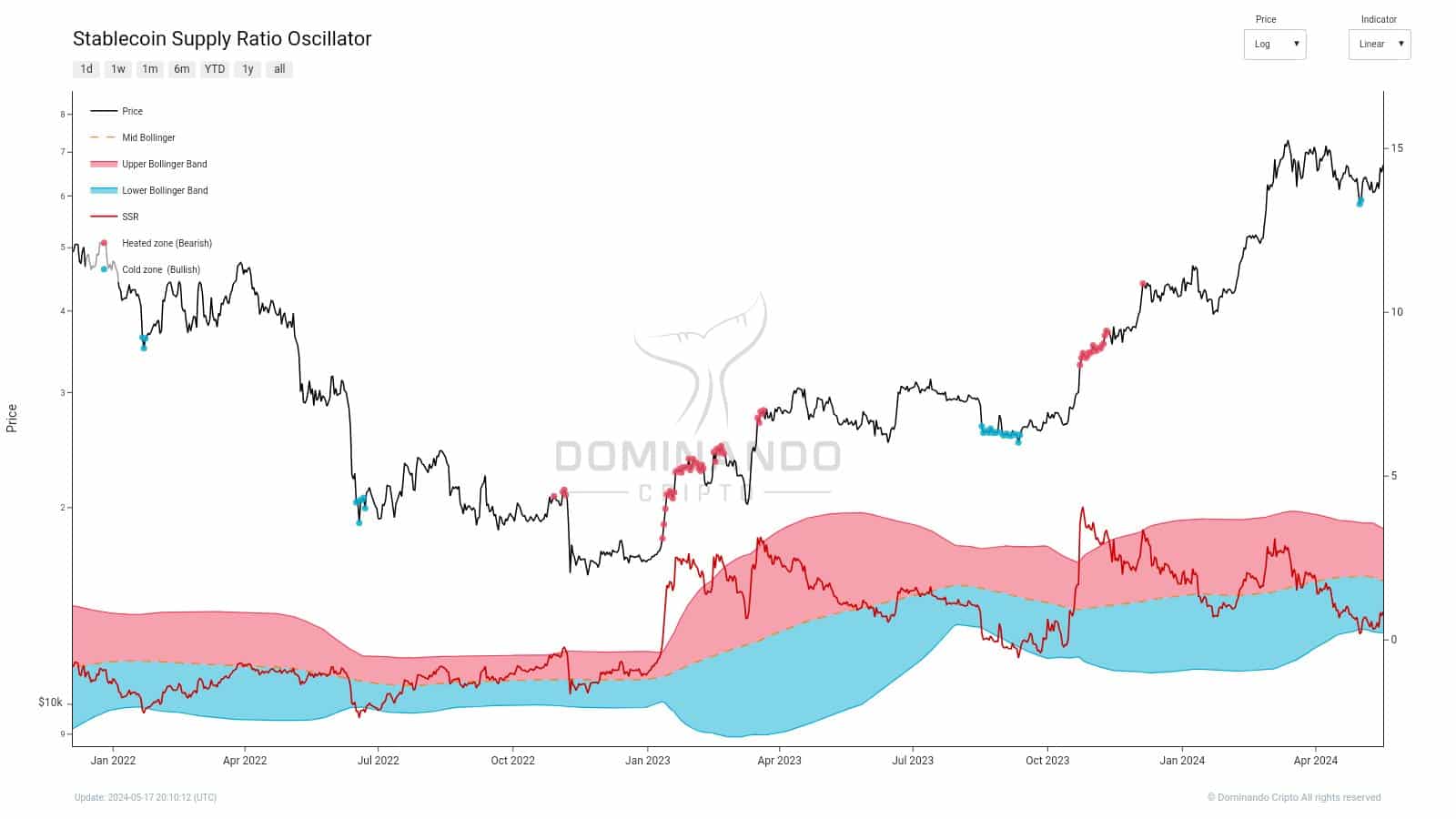

We are still within a “buy” signal

The proportion of stablecoin supply relative to its 200-day moving average was less than the figure, but it exceeded the lower boundary of the Bollinger Band. This ratio dipped beneath this threshold around early May, coinciding with Bitcoin’s price peak at $56k. Nonetheless, the price swiftly bounced back up afterwards.

“The oscillator remained within its lower band, implying that potential increases might still materialize. Meanwhile, the moving average indicator showed a descending trend during the previous month.”

As a crypto investor, I’ve noticed a robust upward trend in this metric since October 2023. However, there have been occasional pauses or dips, like the one we experienced in early January and mid-May.

About a month after Bitcoin experienced a significant drop in price in January, it surged past the $46,000 barrier without much effort. Over the next few weeks, it’s possible that Bitcoin will continue to rise and challenge the $73,000 resistance level.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

2024-05-20 04:07