- Dogecoin’s sentiment has fallen badly with indicators suggesting that another correction was close.

- A breakdown to $0.10 seemed possible as the coin could dump below the lower support line.

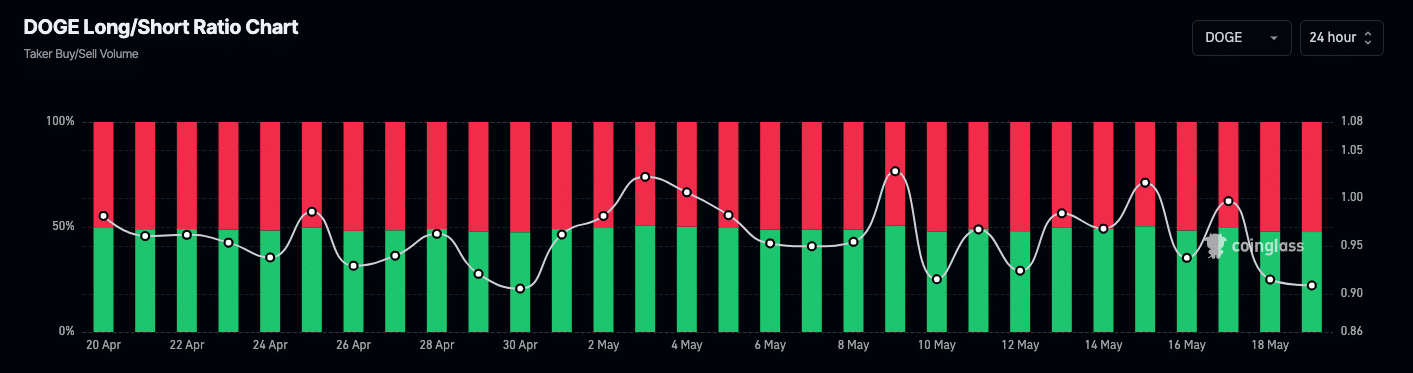

As a researcher with experience in cryptocurrency markets, I’m pessimistic about Dogecoin (DOGE) based on recent market indicators. The sentiment towards DOGE has worsened, as shown by a low Long/Short Ratio and negative funding rates. These metrics suggest that traders are bearish on the coin, which could lead to another correction.

Traders holding a pessimistic view towards Dogecoin (DOGE) were evident in the financial data. The Long/Short Ratio, as reported by Coinglass, stood at 0.90.

As an analyst, I would describe the Long/Short Ratio as a valuable indicator reflecting traders’ collective outlook on a particular asset. To calculate this ratio, I divide the count of open long positions by the number of short positions. A figure greater than one implies that more traders are betting on the asset to rise, conveying a bullish stance.

If the reading is below 1, it signifies that there are more short positions than long ones among traders. This situation is typically viewed as a bearish indicator, implying that many market participants anticipate a decline in the price of Dogecoin (DOGE).

As of now, I’ve observed Dogecoin’s price at $0.15. Over the past week, this figure signified a 6.44% upward trend. However, based on current market sentiments, it seems that bearish influences might take control, potentially leading to a decline in Dogecoin’s value.

Confidence in the coin drops

In a previous article, AMBCrypto discussed the possibility of Dogecoin’s price reaching as low as $0.12. However, whether this price point will be attained or not hinges upon various other influential factors.

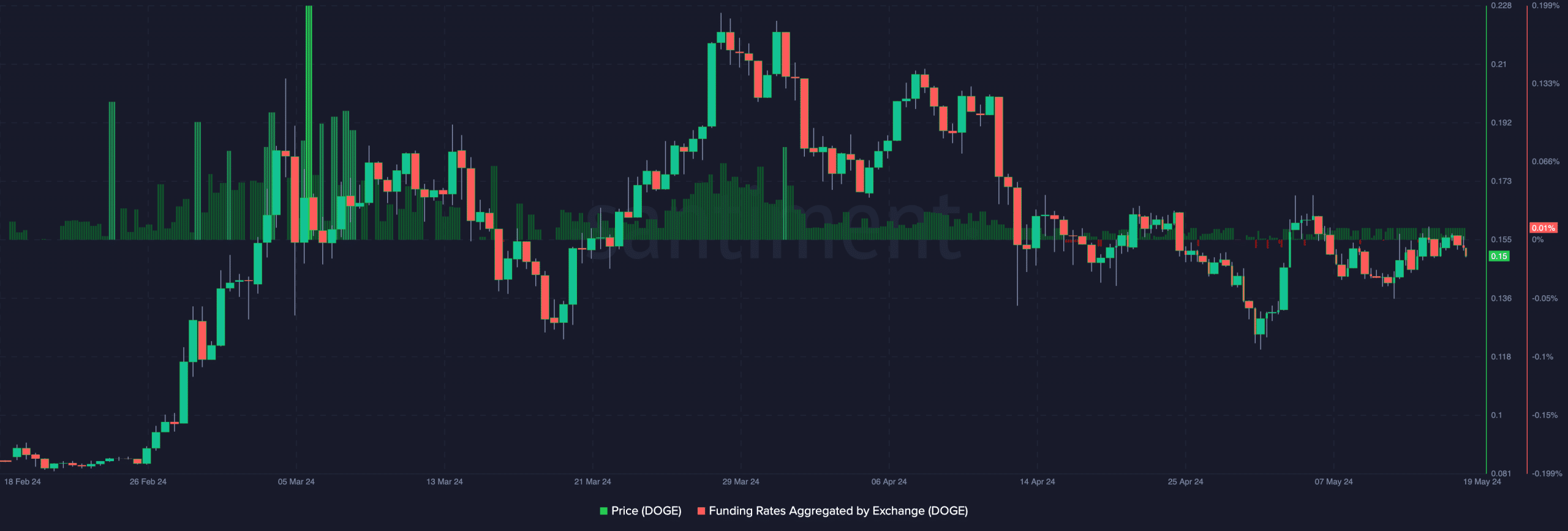

One potential factor influencing the price trend is the Funding Rate. While related to the aforementioned ratio, it holds some distinctions.

In simpler terms, funding represents the fee paid to maintain an open contract position when its value surpasses the current market price. A positive metric signifies that the contract’s price is more valuable than the prevailing market rate.

In contrast, a pessimistic interpretation implies that the perpetual price for Dogecoin is less than its index value. Based on Santiment’s data, Dogecoin had a funding rate of only 0.01%. However, as this funding level decreased, so did Dogecoin’s price over the past 24 hours.

As an analyst, I would interpret this situation as follows: If perpetual sellers are being incentivized, it could lead to them adding to their short positions. This bears a bearish outlook from a pricing standpoint and may potentially negatively impact the price trend of DOGE.

DOGE plunges traders into the deep blue sea

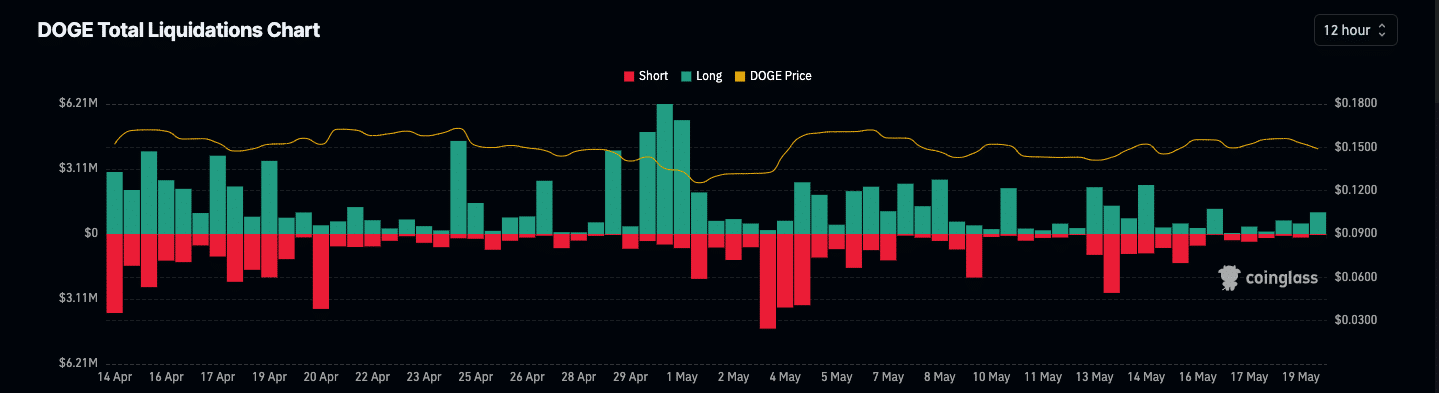

Based on its current trend, Dogecoin might drop down to the next significant level of support. Additionally, there were approximately $1.79 million in Dogecoin positions liquidated within the past day.

Among the overall amount, long positions amounted to approximately $1.54 million, whereas short positions fell below the $250,000 mark. Exchanges forcibly terminate leveraged trading positions when they are referred to as liquidations.

The cause might be due to a decrease or complete disappearance of the starting capital. It’s important to add that market movements, specifically price drops leading to liquidations, can significantly impact market trends.

As a researcher studying the trading market, I’ve observed an increase in long positions being liquidated. This could potentially signal a price rise for Dogecoin (DOGE), pushing it towards existing resistance levels. However, further analysis and consideration would be required before making any definitive conclusions.

Read Dogecoin’s [DOGE] Price Prediction 2024-2025

As a crypto investor, I’ve noticed that this time around, there have been significant sell-offs leading to long liquidations. In a particularly bearish market, there’s a possibility that DOGE‘s price may dip below the $0.12 mark.

Should selling pressure intensify from this point, DOGE could decline to $0.10.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Masters Toronto 2025: Everything You Need to Know

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-20 12:07