- Bitcoin has a strong bullish bias this week.

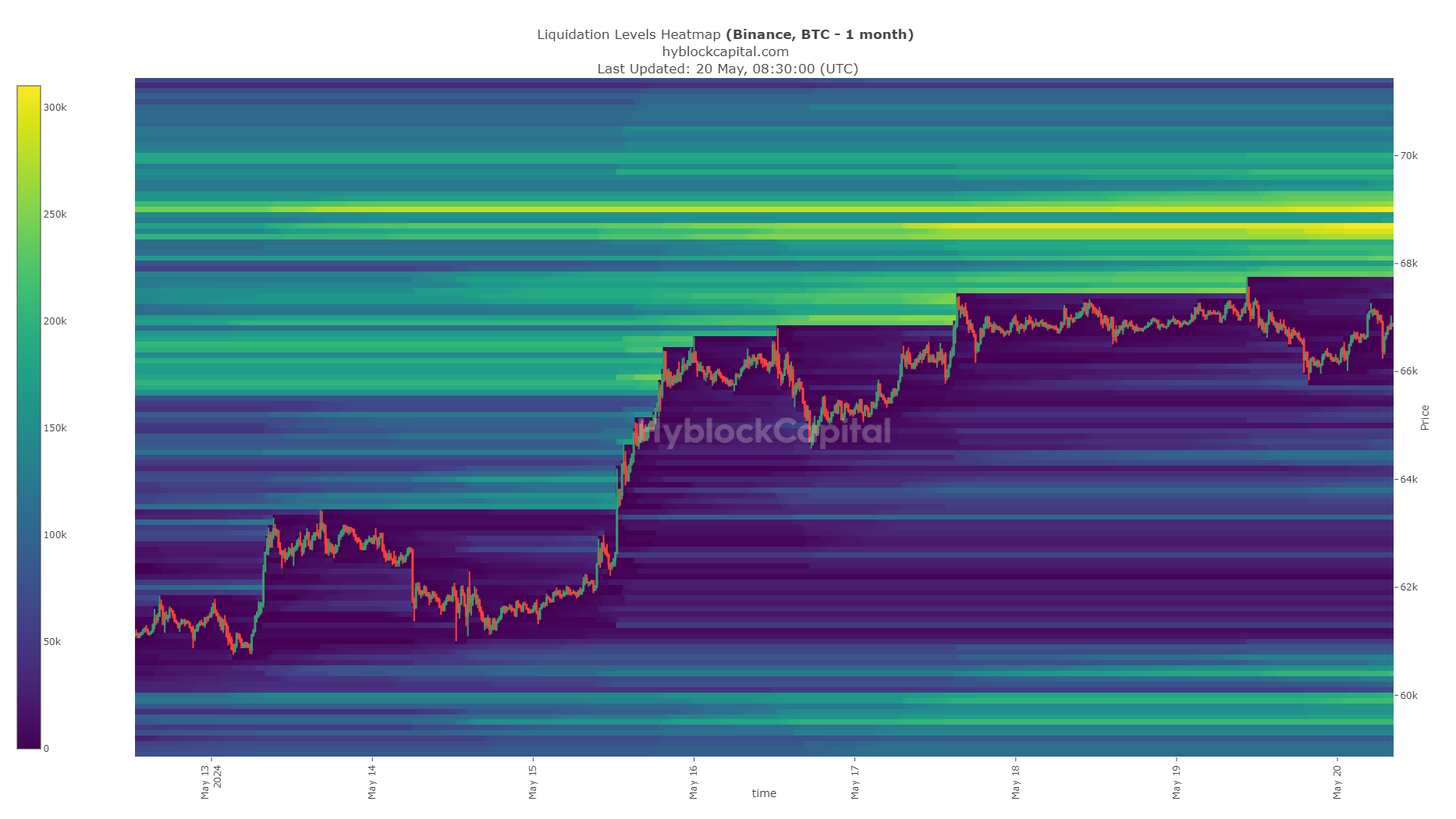

- The recent dip might be to engineer liquidity and more volatility was likely.

As a seasoned crypto investor with a few years under my belt, I’ve learned to read the market signals carefully and adapt quickly. Based on the recent developments in Bitcoin’s price action and on-chain analysis, here’s my take:

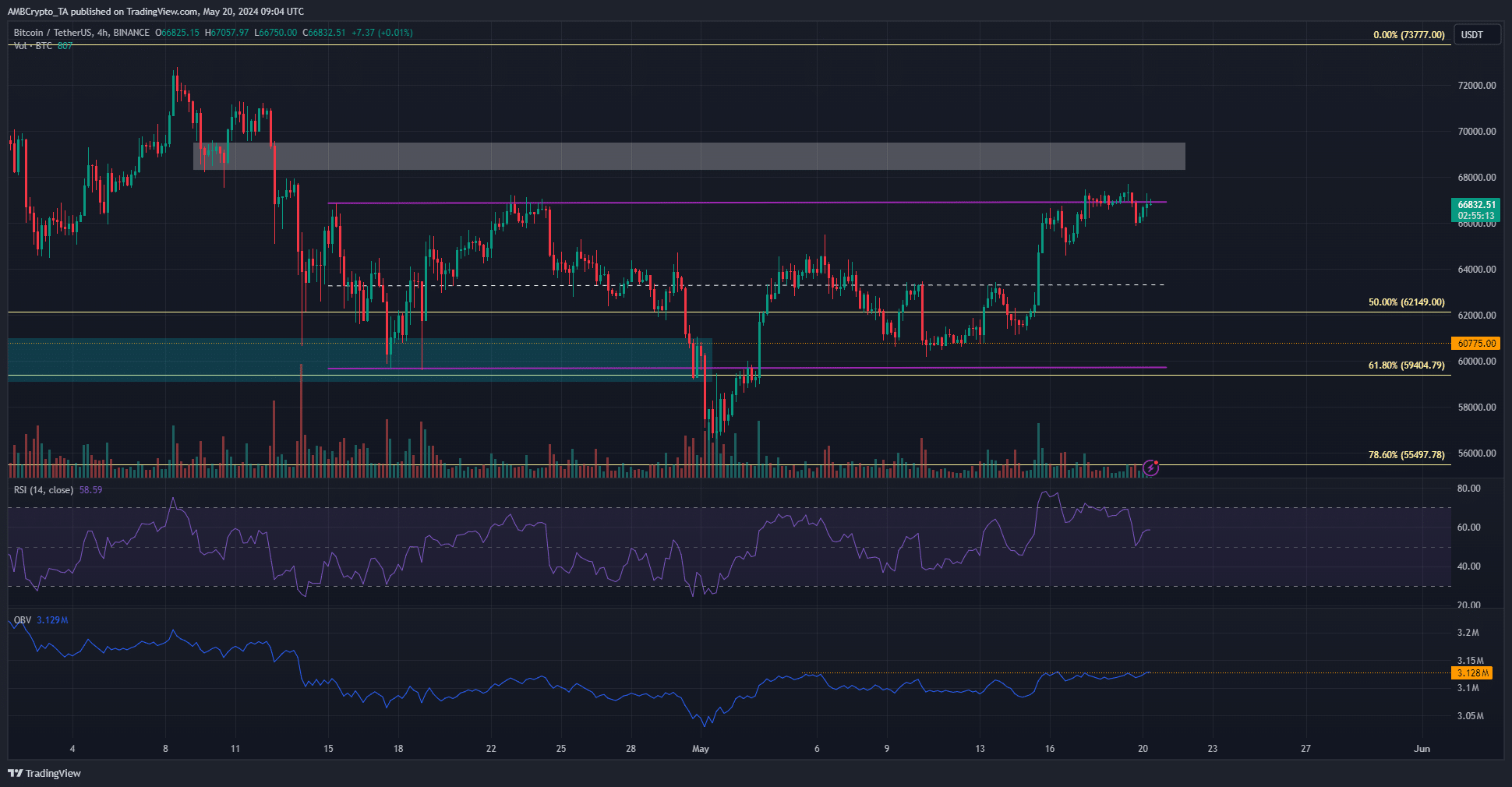

As a crypto investor, I’ve observed Bitcoin (BTC) hovering near the upper end of its current price range at around $67 as of now. This range has persisted since mid-April. The recent surge in momentum, specifically the bounce back above the $65,000 mark, has instilled confidence among bulls that higher prices are on the horizon.

In simpler terms, some indicators derived from on-chain data suggested a positive market outlook. However, the area around $68,000 to $69,000 displayed potential for a bearish turnaround. The likelihood of this occurring is uncertain.

How liquidity runs can be engineered

In a recent post on X, formerly known as Twitter, crypto analyst CrypNuevo highlighted that around $69,000, there exists a significant concentration of potential sell orders. This area might pull prices towards it in the near future; however, this event could also bring about increased price fluctuations.

Making a swift, sharp selloff just before reaching the large pool of liquidity might entice more traders to take short positions. It could also give a false sense of security to traders who are already holding short positions, leading them to add more liquidity around the $69k level.

As a crypto investor, I’ve noticed that the market can be particularly volatile at the beginning of the week. For instance, the price of Bitcoin took a significant hit and dropped below $65k on my 4-hour chart. This sharp decline might lead to increased short-selling among traders, making the 50-EMA at this level a potential support. If the price holds above this mark, it could potentially help in stemming the downward trend. However, if it breaks through, we may see even more sell-offs and a deeper correction.

As a crypto investor, I’ve been keeping a close eye on the liquidation heatmap, and it’s clear that the $68,600-$69,200 range is a significant resistance level. An analyst I follow predicts a potential drop to $65,000 this week, but after that, we might see a bounce back up towards $69,000.

What does the 4-hour timeframe technical analysis reveal?

As a researcher analyzing market trends, I’ve noticed that the H4 Relative Strength Index (RSI) of Bitcoin (BTC) has been persistently moving above the neutral threshold of 50, suggesting robust buying momentum. However, my attention was drawn to the relatively low trading volume experienced by BTC since last Friday. Despite this, I observed an intriguing development with the On-Balance Volume (OBV), which was on the brink of breaking through a local resistance level. This potential advancement could significantly amplify the bullish trend.

Is your portfolio green? Check the Bitcoin Profit Calculator

As a crypto investor, I closely examined the 4-hour chart and noticed significant resistance around the $69,000 to $69,500 range. However, I also saw an opportunity for short liquidations that could potentially propel the price above this challenging resistance zone.

Hence, traders should be prepared for some volatility but continued bullish progress this week.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- McDonald’s Japan Confirms Hatsune Miku Collab for “Miku Day”

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

2024-05-21 00:07