-

BTC has stayed above $66,000.

Small BTC wallets have dumped more coins in the past week.

As a seasoned crypto investor with several years of experience in the market, I’m keeping a close eye on Bitcoin’s [BTC] price action and wallet trends. While BTC has managed to hold above $66,000 recently, I’ve noticed an intriguing development: small Bitcoin wallets have been selling off their holdings.

The price of Bitcoin [BTC] currently hovers around $66,000, as it makes an attempt to regain its previous record-breaking peak. However, smaller investors have recently been unloading their coins from their wallets.

Despite the selling activity from smaller Bitcoin (BTC) holders, the total amount of BTC in circulation has persisted in growing. This indicates that larger investors and institutions remain active buyers in the market.

Small Bitcoin wallets dump holdings

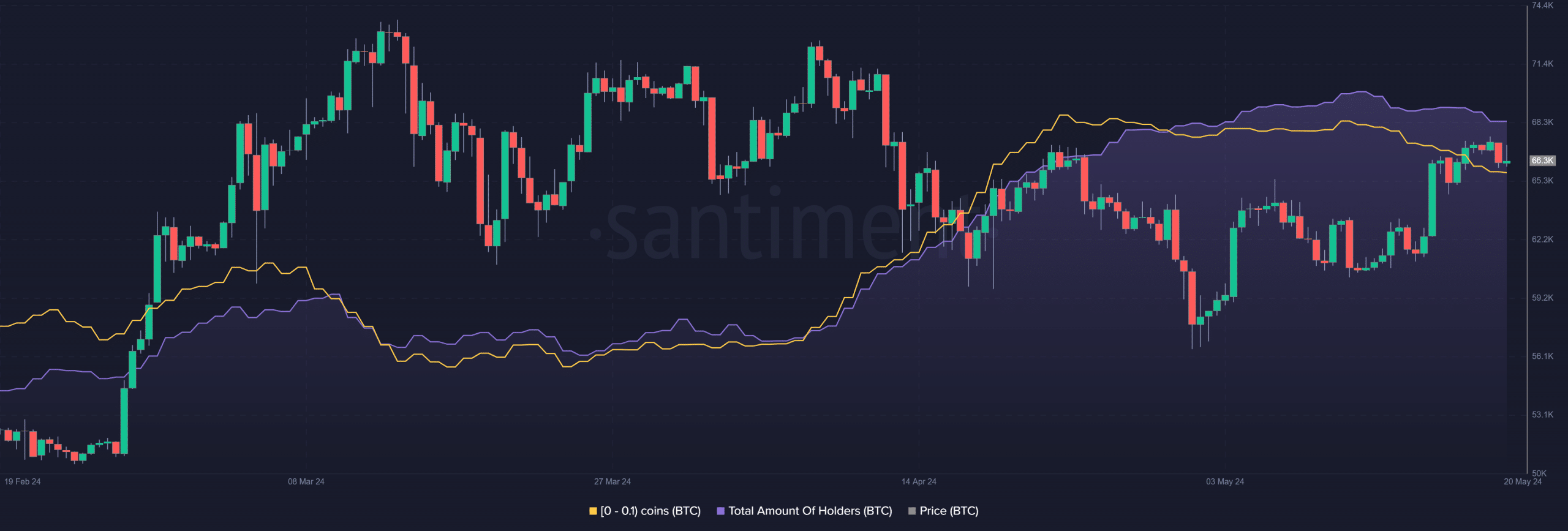

Based on recent information from Santiment, there has been a trend of smaller Bitcoin owners disposing of their coins over the past couple of weeks.

Approximately 182,000 individuals who previously owned holdings disposed of them during the previous week.

Based on the data presented in the graph, it appears that the number of Bitcoin held in wallets containing less than 0.1 BTC has decreased by 0.46% over the last week. It’s possible that these smaller wallets are trying to capitalize on short-term gains and have therefore sold off some of their Bitcoin holdings.

Despite the decrease, the trend of small wallets being sold while large wallets amass continues to be viewed as a positive indication in the market.

Examining Bitcoin wallets containing over 1,000 coins revealed a notable growth in their accumulated holdings. As of now, there were approximately 53.8 million individual Bitcoin owners.

Bitcoin continues to see negative netflow

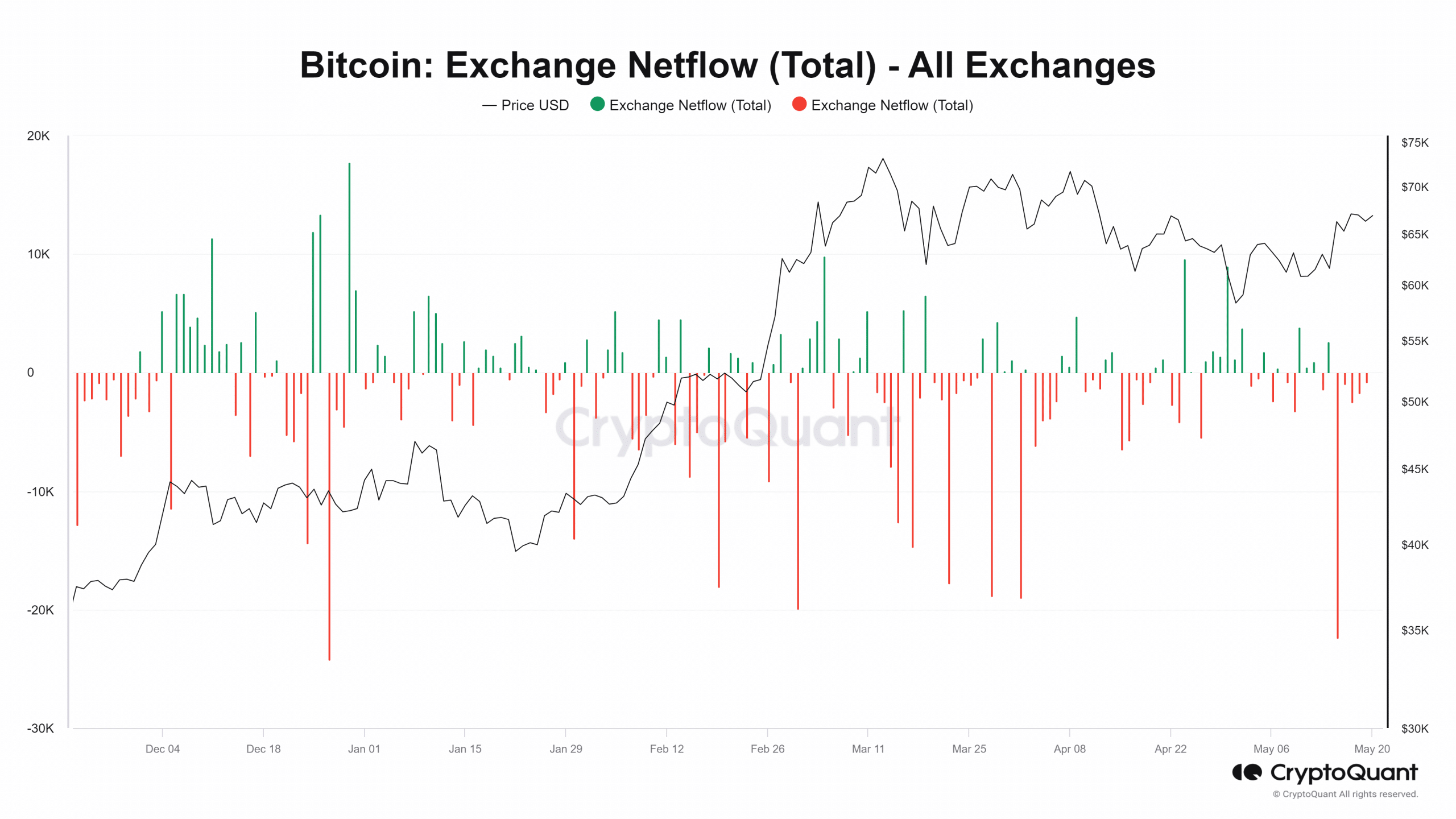

The flow of Bitcoin between exchanges indicated a record high in outgoing transactions, suggesting a significant amount was taken off the market recently.

Fifteen days ago, on May 15th, the net outflow of Bitcoin amounted to a staggering -22,359 coins, marking the largest such figure since late 2023. The diagram revealed that this negative trend has persisted ever since, implying that more Bitcoin is being taken off exchanges than added.

As a crypto investor, I’ve noticed that even though smaller Bitcoin wallets have been selling off their holdings, there are still substantial amounts being accumulated.

As a crypto investor, I’ve observed that when larger holders exhibit confidence and begin accumulating more cryptocurrencies, it’s often a bullish sign. This trend reduces the amount of crypto available on exchanges for trading, which in turn could lead to an uptick in price due to the increased demand resulting from this accumulation.

BTC struggles to stay above $66,000

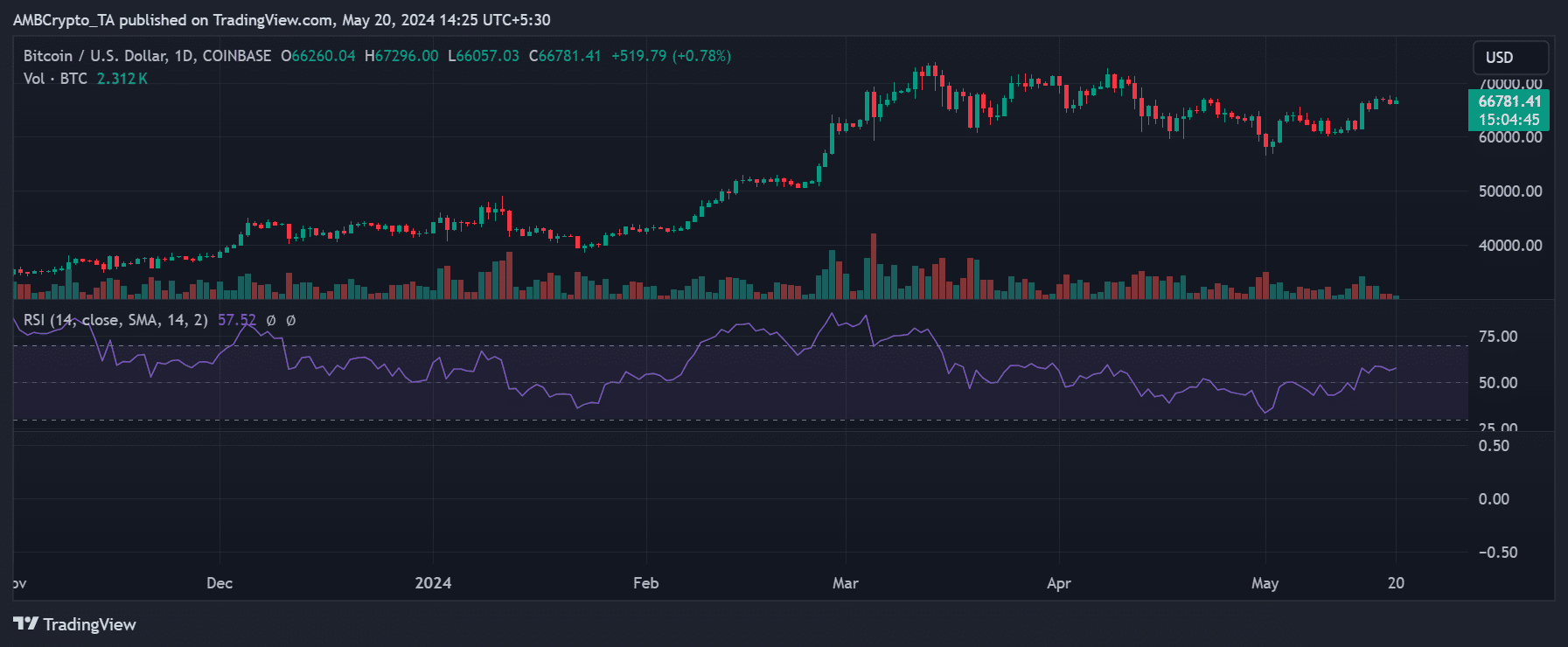

Observing Bitcoin’s daily chart reveals that it has recently reached and is currently battling to hold its ground above the $66,000 mark.

As a researcher analyzing the cryptocurrency market, I’ve observed that Bitcoin was currently priced at roughly $66,700 based on AMBCrypto’s latest assessment, representing a modest gain of approximately 0.7% in value.

Read Bitcoin (BTC) Price Prediction 2024-25

I’ve analyzed the Bitcoin chart and noticed an intriguing development: the yellow short moving average line, which had historically functioned as a resistance level, has now been flipped. This means that instead of preventing price increases, it is currently providing support to the Bitcoin price.

The immediate support level was around $64,000 at the time of this writing.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- SOL PREDICTION. SOL cryptocurrency

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-05-21 05:11