-

On-chain metrics were used to analyze the state of three AI coins.

RNDR had a slightly more bullish price action in the past month.

As a seasoned crypto investor with a keen interest in the AI sector, I’ve been closely monitoring the on-chain metrics of three promising AI coins: Render (RNDR), The Graph (GRT), and Injective (INJ). Based on the analysis of these metrics, I believe that RNDR has a more bullish outlook in the long term.

As a crypto investor, I’m excited about the potential of Artificial Intelligence (AI) cryptocurrencies in the dynamic world of digital assets. AI technology is making significant strides forward, with tools like ChatGPT, Fireflies, Midjourney, and SaneBox leading the charge. These innovations are revolutionizing workplaces by automating everyday tasks, thereby increasing efficiency and productivity. By investing in AI cryptos, I believe we can be part of this groundbreaking trend and potentially reap substantial rewards in the future.

In the emerging field of AI within crypto, there’s been much speculation among enthusiasts about the potential for discovering the next valuable asset.

As an analyst, I would rephrase that as: In the AI sector, the top five coins, as listed on CoinMarketCap, collectively hold a market capitalization of approximately $21.2 billion. Notably, Dogecoin, which is the leading memecoin, boasts a market cap of around $22.18 billion at present.

To gain insights into the attitudes of token holders and levels of user interaction for three leading artificial intelligence cryptocurrencies, AMBCrypto opted to examine the relevant on-chain statistics for Render (RNDR), The Graph (GRT), and Injective (INJ).

The big question is – Which of these AI coins has the most bullish outlook in the long term?

An introduction to the trio

Over the last week, Bitcoin (BTC) experienced a growth of 8.9%. On the other hand, RNDR recorded a decrease of 4.9% as of now. In contrast, GRT and INJ have surged by 13.9% and 18.1%, respectively. This is noteworthy since altcoins often see larger price increases when there’s strong market belief in them compared to Bitcoin.

As an analyst, I’ve examined the price trends of INJ, GRT, and another coin in the context of the past 24 hours. However, my assessment doesn’t fully encapsulate their intraday price movements. From a technical standpoint, INJ exhibited the most vulnerable position among the three coins. Both INJ and GRT displayed bearish market structures on their respective one-day charts.

Meanwhile, RNDR formed a short-term range below the $11.3 resistance level.

Regarding the function of Render Network, this decentralized platform operates on a peer-to-peer basis and employs blockchain technology for distributing GPU rendering capabilities. The objective is to promote equal access to GPU cloud rendering and enhance efficiency and adaptability in the process.

The Graph is a protocol for indexing data that enables developers to access and utilize publicly available information to create decentralized applications. Its objectives include reducing development costs through market data and enhancing server reliability, among others.

“Injective is a decentralized trading platform based on the Cosmos blockchain, offering features such as cross-margin trades, futures, and forex. It functions as a Layer 2 application and incorporates cross-chain bridges to enable traders to access assets from both Polkadot and Ethereum networks.”

After gaining a basic understanding of their functions, further exploration into the specific performance indicators of these AI cryptocurrencies would provide greater clarity.

On-chain metrics reflected the price trends to an extent

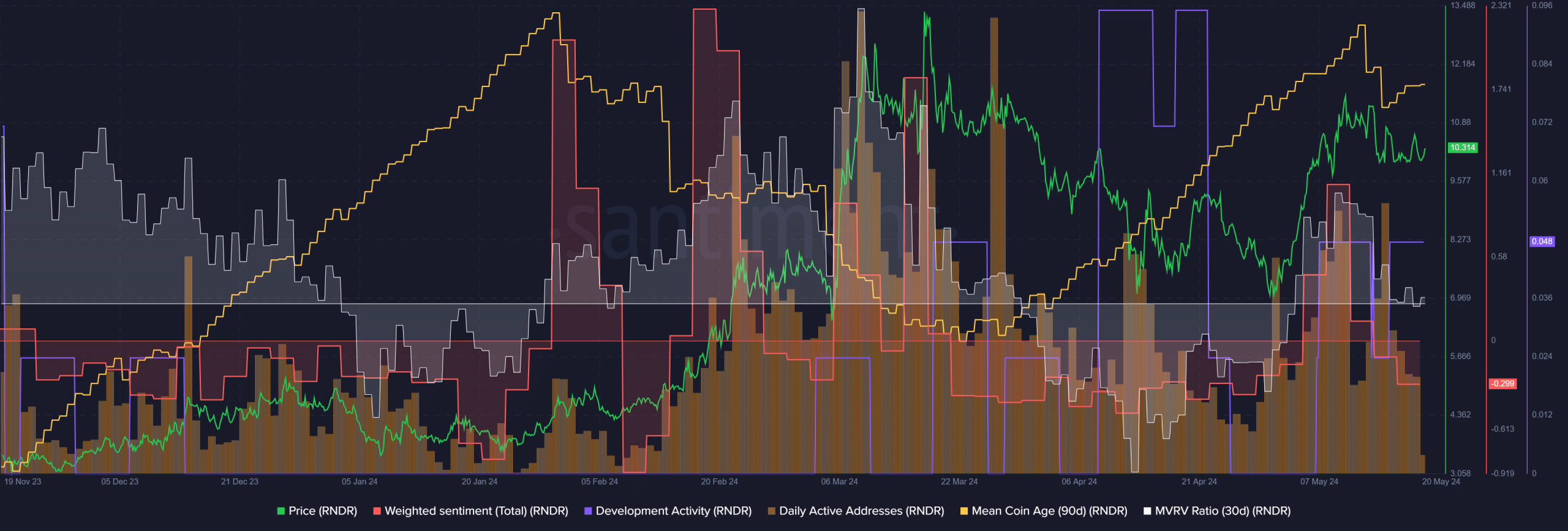

Over the last three weeks, there was a noticeable increase in the number of daily active addresses on RNDR. In contrast, RNDR’s development activity values were quite low, with a reading of 0.048. For comparison, Cardano (ADA) had a significantly higher development activity value of 94 at the current moment.

Since the 22nd of March, the overall sentiment, with its associated weights, has remained predominantly negative. Conversely, the average age of coins in circulation has been on an upward trend, suggesting a broader accumulation within the market.

The MVRV (Market Value to Realized Value) ratio hovered around the zero mark, suggesting minor gains for investors. In essence, this signified that investors had made small profits on their holdings. However, there were some noteworthy positives: accumulation and user activity remained strong. Nevertheless, development activity raised concerns.

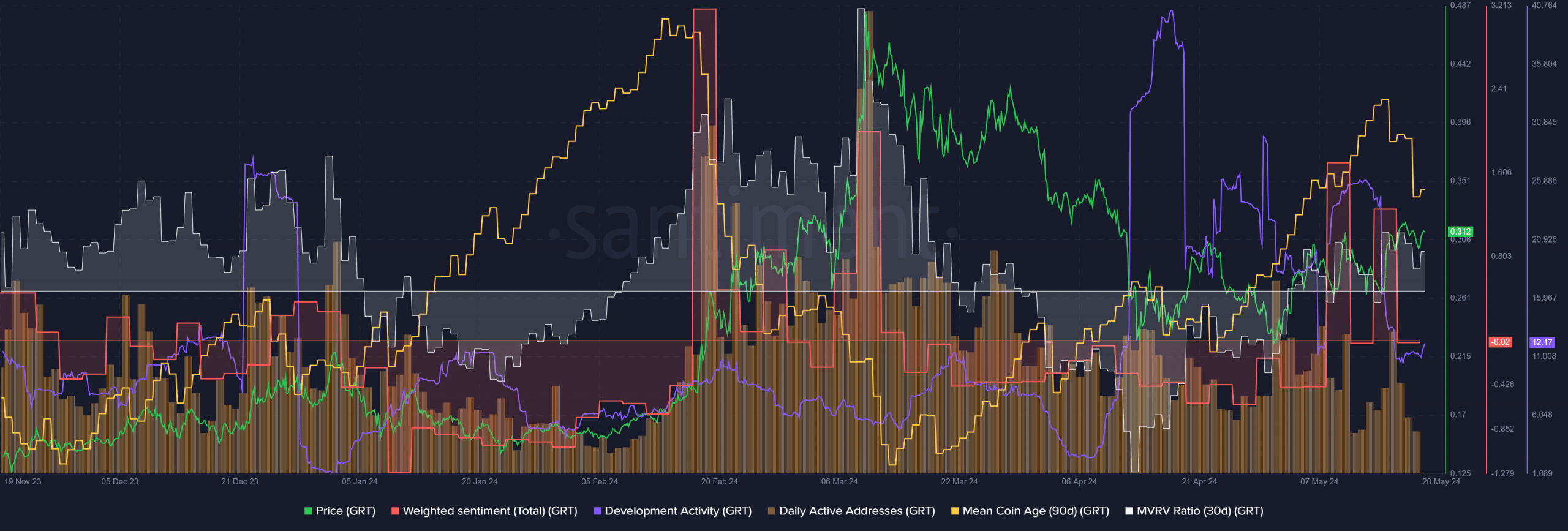

As a crypto investor, I’ve noticed that the number of daily active addresses interacting with GRT has been decreasing since early March. However, I find it encouraging that the development activity remains reasonable, currently sitting at 12.17 as we speak. This figure peaked as high as 39.4 in May.

Weighted sentiment has picked up over the past week but was negative at press time.

As a crypto investor, I’ve observed some encouraging signs with GRT. The average age of coins in circulation (mean coin age) has been on the rise, and the MVRV ratio has turned positive. These indicators suggest that there has been accumulation of coins by long-term investors and that short-term holders are currently in profit. This information implies that there might be more room for price appreciation in the near future.

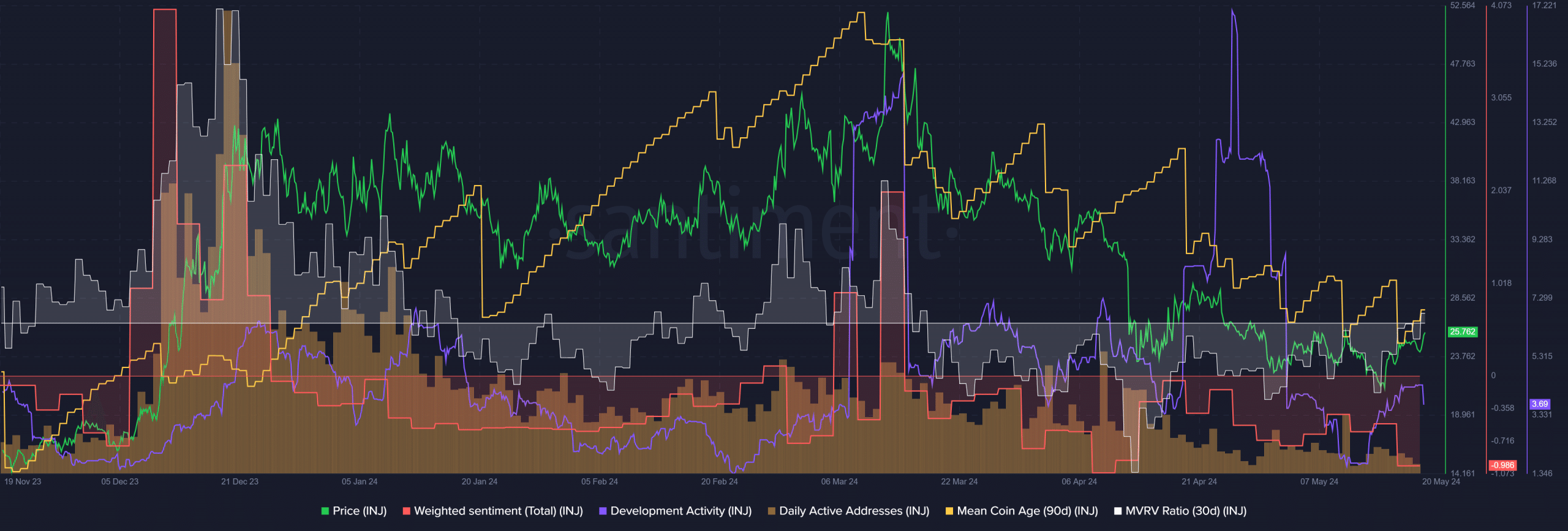

Among the three options, Injective experienced a steeper decline in active users, noticeably more so than during the December highs. Furthermore, its development activity was relatively low at 3.69 as of the present moment, and there was a persistent negative tone in public sentiment towards the project.

The mean coin age was also in a steady downtrend and highlighted selling pressure.

Read Render’s [RNDR] Price Prediction 2024-25

Over the last three weeks, the price has remained above $20 and rallied, leading to higher short-term gains for holders. However, among the three, it exhibited the least promising bullish perspective.

As a crypto investor, I believe Render Network’s strong user activity, consistent buying patterns, and price growth since the recent lows make it a promising candidate for superior returns over the next few weeks compared to the other two investments I’m considering.

Read More

2024-05-21 09:12