-

ETH now trades at a two-month high.

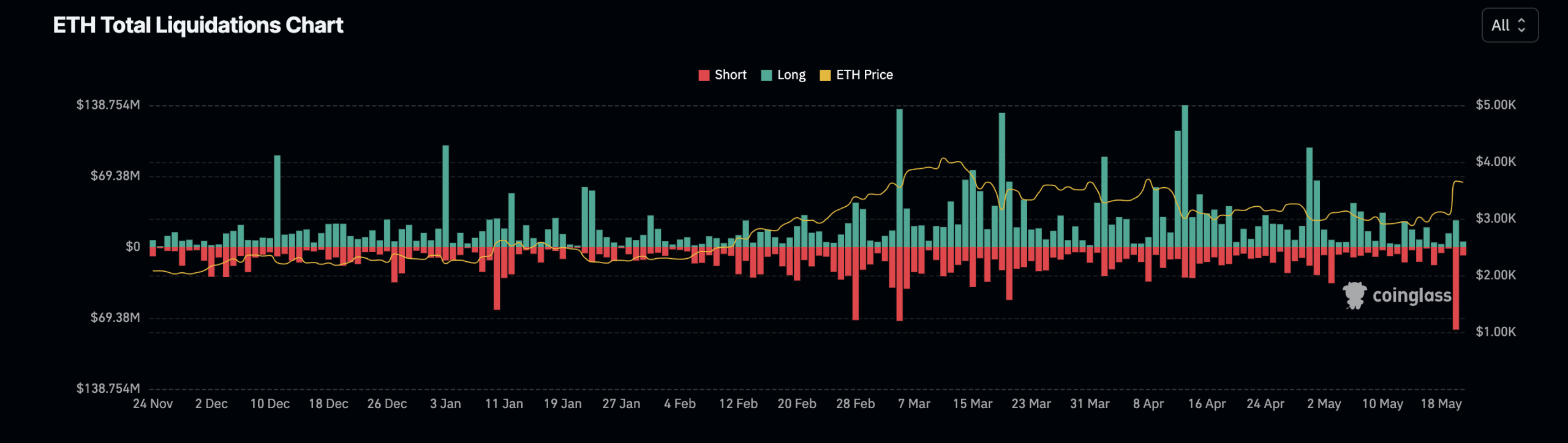

The number of short positions liquidated on 20th May represented the coin’s single-day highest since the beginning of the year.

As a researcher with extensive experience in the crypto market, I’m thrilled to see Ethereum [ETH] reaching new heights and recording impressive gains in the past 24 hours. The potential approval of an Ethereum ETF by the US Securities and Exchange Commission (SEC) has certainly fueled this rally, as indicated by Bloomberg analyst Eric Balchunas’ increased odds of success.

The price of Ethereum (ETH) has surged to its highest point in two months following Bloomberg’s analysis that boosted the likelihood of a successful debut for the Ethereum ETF.

On May 20th, in a post previously published on X (formerly Twitter), Bloomberg’s senior analyst Eric Balchunas upgraded his estimation of the Ethereum ETF’s approval chances from a quarter to three-quarters.

Following news that the SEC requested revisions from hopeful ETH ETF applicants on their 19b-4 filings before the week’s deadline, Balchunas shared his thoughts on social media.

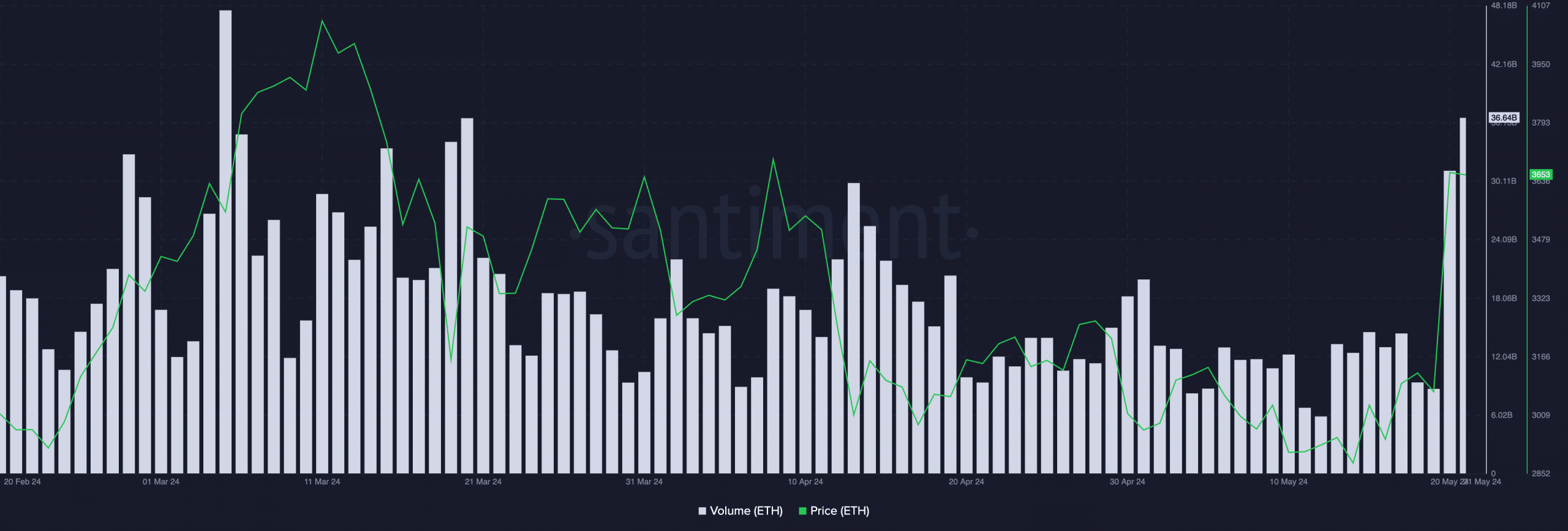

ETH in the last 24 hours

As of now, Ethereum is being traded at a price of $3,648 based on the latest data from CoinMarketCap, representing a significant 17% increase in value within the last 24 hours. The heightened trading activity surrounding Ethereum during this timeframe has led to an impressive over twofold (200%) expansion in its trading volume.

Based on Santiment’s data, Ethereum’s trading volume has reached a total of $37 billion – the highest it has been since March 5th.

On May 20th, the value of Ethereum (ETH) momentarily surpassed $3700 during daytime trading, triggering the termination of various short positions in its futures market as a result.

Based on Coingecko statistics, the value of Ethereum’s short positions being liquidated reached a yearly peak of $81 million on that particular day. Contrastingly, only $26 million worth of long positions were terminated during the same timeframe.

Additionally, ETH large investors, or “whales,” have seized the opportunity presented by the recent price surge. Notable increases in their trading activities have been observed within the last day based on on-chain data.

As a crypto investor keeping a close eye on Ethereum (ETH) prices, I noticed an intriguing correlation between the surging ETH price trend approaching $3700 on May 20th and the growing number of Ethereum transactions worth over $1 million. According to AMBCrypto’s findings, this pattern is not uncommon in the crypto market.

According to Santiment’s data, a total of 1393 transactions of this kind occurred on that particular day, which marked the greatest number since the 14th of April.

On May 20th, the number of transactions exceeding $100,000 reached a total of 11,827. This figure had last been attained on April 15th.

Is your portfolio green? Check the Ethereum Profit Calculator

In the past 24 hours, Ethereum (ETH) has garnered significant focus, leading to a surge in social engagement. Currently, ETH holds a social prominence score of 2.28, which is its peak since February.

Approximately 2.28 out of every 100 discussions about the leading 100 cryptocurrencies revolve around Ethereum, placing it slightly above the average for major digital currencies in terms of conversation frequency.

Read More

2024-05-21 10:15